What Are Share Buybacks?

Share Buybacks, or Share Repurchases, are one of two ways publicly traded companies can achieve one of their primary goals – to maximise shareholder value. Companies have two methods for potentially increasing the value of their stock and returning cash directly to their shareholders – dividend payments and share buybacks.

Both methods grow out of an admirable condition – excess cash remaining from generated revenues after the company has paid all its bills, including taxes and debt obligations.

Rather than let the cash accumulate, the company can increase its existing dividend payment, declare a special dividend, or buy back its own shares.

Share buy backs need approval of a company’s Board of Directors. Essentially, the company is investing in itself by buying its shares on the open market over an extended period of time. Typically, the company will announce the buyback and the time intervals when purchases will take place.

Another method is a fixed price tender offer to existing shareholders, giving them the option to “tender” all or some of their shares within a specified time frame at a premium to the current share price at the time of the tender offer.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Both methods reduce the number of shares outstanding, a figure used to calculate the EPS (earnings per share) metric. Fewer outstanding shares will result in a higher EPS, giving the company at least the appearance of superior performance. A higher EPS can produce a higher Price to Earnings Ratio (P/E).

Why Do Companies Buy Back Shares?

Stock prices rise when buyer demand for the stock exceeds the supply of investors willing to sell. By entering the marketplace as a buyer of its own stock, the share price should rise.

However, the aim of increasing shareholder value does not answer the question of why the company chooses to do it.

Historically, companies consider share buybacks when blessed with excess cash on hand. Share buybacks involve less risk to the company than returning excess cash to shareholders in the form of dividends. If conditions for the company change for the worse, cutting the dividend payment or eliminating it entirely is highly likely to cause the share price to drop.

In contrast, given share buybacks extend over time, they can be modified with less risk of a declining share price to the company.

In recent market conditions of historically low interest rates, many companies began financing share buybacks by taking on debt rather than relying on excess cash.

Perhaps the major reason companies initiate share buybacks to increase shareholder value is a deep seated belief that the market is undervaluing the company, in some cases through no direct fault on the company’s part. A sector sell off more often than not drags down the “best of breed” along with the sector laggards.

The P/E and EPS are not the only financial metrics market participants follow that benefit from reducing outstanding shares via a share buyback. The company’s total assets will go down as well, increasing its Return on Assets (ROA) and Return on Equity (ROE)

A final reason why companies buy back shares that draws criticism is reducing the impact of executive stock options on the share price. Buying back shares can obscure the number of shares issued to company employees.

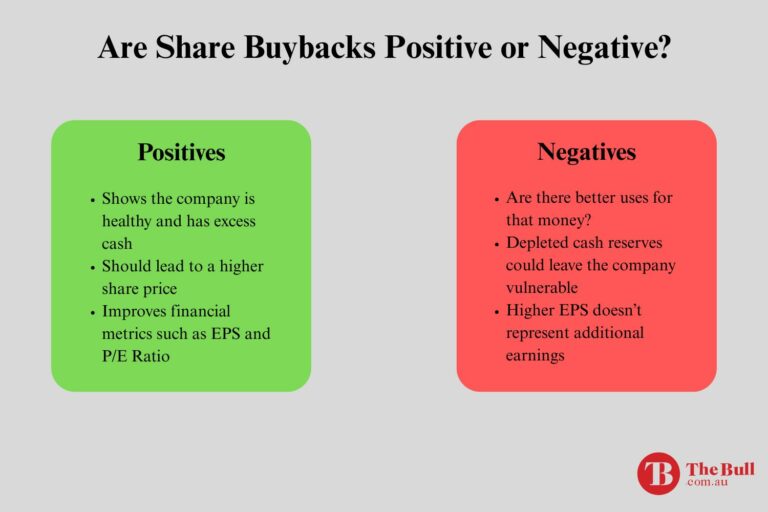

Are Share Buybacks a Positive or Negative Sign?

The answer to the question of whether share buybacks are a negative or positive sign depends in reality on who is asking the question.

Regardless of whether the share buybacks came from excess cash or added debt, shareholders and company executives receiving stock options would see share buybacks as positive. Why wouldn’t they when they stand to reap the benefits?

Long-term thinkers might view debt financed share buybacks as negative since the debt must be repaid over time subject to worsening economic conditions.

Share buybacks backed by excess cash should be universally hailed as a positive sign the company is healthy and thriving enough to amass the excess cash. But like the proverbial double-edged sword, there is another view of those share buybacks.

What else could the company do with the money, and at the core of that question rests the view that share buybacks are a negative sign.

In theory, no matter the point in the life cycle of a company, efforts to expand and grow organically should never go away. In practice, companies flush with cash choose to restrict growth opportunities to acquiring other companies with similar, complementary, or identical products and services and market.

The view of share buybacks as negative considers what companies flush with cash could use the money to increase their share value by growing from within. In the decade between 2010 and 2020 companies on the US S&P 500 invested USD$1.3 trillion dollars in share buybacks.

The money could have gone to more acquisitions that may not be organic but have the potential to grow a company if managed properly.

The money could have gone to building new factories or investing in expanding whatever infrastructure the company needs to operate.

The money could have gone into new equipment, new technologies and new markets for the company’s products and services.

The money could have gone to an intensive R&D research and development campaign in search of new and innovative products and services to the world.

The money could have gone to pay higher wages to attract the best possible talent to grow the company.

Shareholders themselves can see share buybacks as negative. The higher EPS coming after a buyback does not represent even one dollar in additional earnings, only a reduction in shares outstanding.

Some shareholders view buybacks as a sign that the company cannot find profitable growth opportunities anywhere at any time.

Some shareholders are concerned that depleting cash reserves for share buybacks leaves the company in precarious condition in the event of severe economic downturns.

In some cases, the share price actually drops following buybacks as remaining investors view the company as not healthy enough to grow from within.

One of the main points raised by those who see share buybacks as positive is that the money made by shareholders is reinvested elsewhere in the economy.

Share buybacks are one method companies can use to distribute excess cash to their shareholders. Once a Board of Directors approves a share buyback program, the company jumps into the market at prescribed intervals and buys back its own shares.

The reduction in shares outstanding improves several of the financial metrics used to assess companies – EPS, the P/E, the ROA, and the ROE.

The downside to share buybacks is the cash spent leaves the company vulnerable to downturns in economic conditions. In addition, critics of buybacks point to growth opportunities the company is missing by spending on buybacks.

Unlike dividend payments which can crash a stock price if the dividend is reduced or eliminated, share buybacks can be extended with the amount of shares purchased reduced.