Is It Time to Get Defensive?

Economic downturns can be a scourge for investor stock portfolios with full-blown recessions wiping out gains en masse. Although recession fears fueled by the trio of inflation, high interest rates, and wars has ebbed somewhat, few would argue that current economic conditions are good, much less excellent.

Market analysts and experts tell investors there are some stocks with business models resistant to challenging and even devastating economic winds – the defensive stocks. Some point to an investor stampede into defensive stocks as a signal a recession may be right around the corner, if not already in place. But what are defensive shares?

What Are Defensive Shares?

Some experts tell us defensive shares are those with a track record of income generation, low debt, strong budgets, consistent dividend payments, and low volatility which will remain sustainable in stormy weather, as contrasted with shares focusing on capital growth. Other experts prefer to look to business models resistant to economic downturns. Stocks of companies that provide goods and services consumers can do without for a time – consumer discretionary stocks – have no defense when consumers are strapped for current income and concerned about future income. Stocks of companies that provide goods and services consumers cannot do without are defensive in character.

Who Should Invest in Defensive Shares

Turning again to market experts, most recommend investors balance their portfolios with defensive stocks even during booming economic growth worldwide. Investors with high risk tolerance may wait until doom is upon them before giving up their favorite high-flying growth stocks.

One category of investor spans both ends of the spectrum. Those who follow the advice to “go to cash.” Recessions do not last forever. Even defensive stocks that “tread water” during tough times will yield better returns than cash stashed under the proverbial mattress.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Some of the Best Defensive Shares on the ASX

Business sectors like electrical utilities, insurance, smartphone and television service are often pointed out as defensive stocks. However, common sense suggests that in the worst of times, lights can be turned off, thermostats reduced, insurance policies cancelled, non-life threatening medical procedures postponed, and even smartphone services limited. Common sense further suggests there is one business sector that provides the one thing no one can do without regardless of even depression-like conditions – food. What is more, economic downturns turn consumers away from fast food outlets and restaurants and into their own kitchens.

For the ultra-cautious investor, the ASX offers a variety of agricultural stocks from “pure play” food producers to providers of services to agricultural producers.

Food Providers

Two of the best food producers on the ASX right now are Bega Cheese (ASX: BGA) and Cobram Estate Olives (ASX:CBO). These two stocks may already be benefitting from some investors going defensive as the share price of both has been in a sustained upward movement since December of 2023.

Source: ASX 18 June 2024

Cobram Estate was listed on the ASX in 2021. Cobram produces and markets two branded extra virgin olive oil products here in Australia and in the US – Cobram Estate and Red Island. The company has producing groves in both Australia and the US state of California, with its own milling, bottling, and storage facilities, along with the Modern Olive Nursery and Laboratory. As of 2022 the company had 49% of Australian supermarket olive oil sales and was ranked 10th nationally in the US.

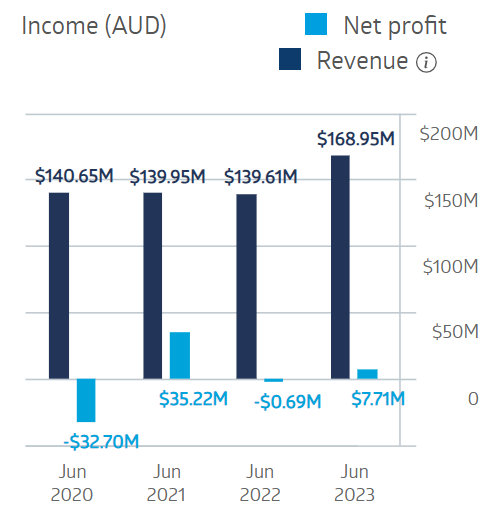

The company began paying dividends in 2023 – $0.03 per share with a current yield of 1.81% and payments remaining at $0.03 per share. While Cobram’s revenues over the last four fiscal years have remained solid, profits have shown volatility.

Cobram Estate Financial Performance

Source: ASX 18 June 2024

The posted loss in FY 2022 was attributed to lower crop volumes in Australia along with declines in packaged goods sales in the US and higher costs in both countries.

Half Year 2024 results showed revenues up 59% and a 29% improvement in the posted loss, down to $7.2 million from $9.9 million in the first half of FY 2023. Packaged goods sales rose 41% in Australia and 100% in the US, with Cobram brands rising to 9th place ranking in US supermarkets. During the year, the company invested $32 million dollars in growth projects. Water input costs during the period more than tripled. Cobram acquired an additional 182 hectares of grove land in California during the period for planting over the next twelve months.

Marketscreener.com has a BUY rating on CBO shares, with 2 analysts at BUY, and 1 at HOLD.

Dairy processor and food manufacturer Bega Cheese operates in two segments – Branded and Bulk. The Branded segment produces a wide range of consumer dairy products from cheeses of all types to peanut butter, sold in supermarkets, while the Bulk segment markets commodity dairy ingredients via the B2B channel (Business to Business.) Bega exports its products to more than forty countries from the Asia Pacific Region to the Middle East to Central and South America and the Pacific islands.

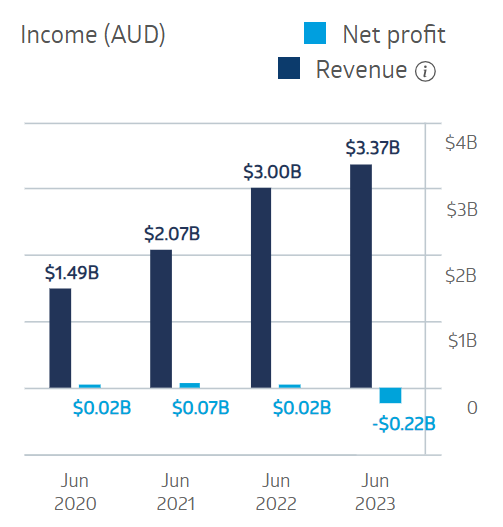

Bega’s revenues have seen robust growth but FY 2023 saw the company post a loss following three successive profitable years spanning the COVID pandemic.

Bega Cheese Financial Performance

Source: ASX 18 June 2024

Bega management attributed much of the profit decline to declines in milk production leading to a disconnect between global commodity prices and the price farmers receive (the farmgate price.)

While management speculated the challenging pricing conditions would continue into 2024, the company’s Half Year 2024 saw milk production stabilising, ushering in a dramatic increase in profit – statutory net profit rose 283% while revenues rose 3%.

In FY 2023 the company paid a dividend of $0.07 per share with a five year average dividend yield of 2.21%

Marketscreener.com has an OUTPERFORM rating on BGA shares, with 3 analysts at BUY, 1 at OUTPERFORM, six at HOLD, and 1 at UNDERPERFORM.

Yahoo finance Australia has a moderate BUY on Bega shares, with 1 analyst at STONG BUY, 2 at BUY, and 2 at HOLD.

Agricultural Services Providers

Aussie investors have two solid choices of companies providing services to agricultural producers – Elders Limited (ASX: ELD) and Rural Funds Group (ASX: RFF).

Rural Funds Group offers Australian food producers a single service – land for rent. The company is a REIT (real estate investment trust) that owns land leased to growers of multiple agricultural commodities – almonds, macadamia nuts, cotton, vineyards, poultry, and cattle. Notable clients include ASX listed almond grower Select Harvests (ASX: SHV) and wine producer Treasury Wine Estates (ASX: TWE).

The company’s properties are not only diversified by crop but also by location, giving the stock some level of protection against localised agricultural weather risks.

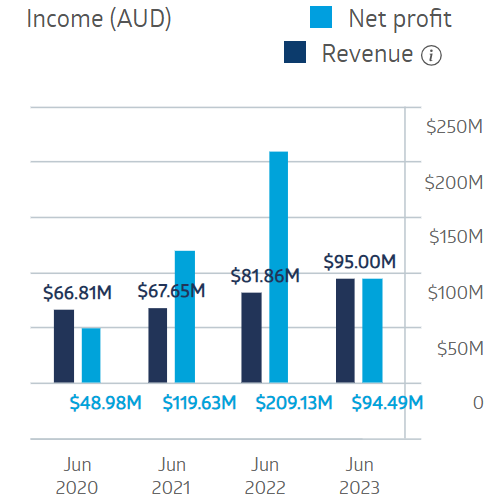

Rural Funds Group was growing both revenue and profit before hitting the inflation/high interest rate conditions in FY 2023.

Rural Funds Group Financial Performance

Source: ASX 18 June 2024

Half Year 2024 results showed revenue up 21%, net profit after tax down 20%, and dividends up 30%. Analysts have hailed RFF as a stellar passive income stock. FY 2023 dividend payments were $0.12 per share, with a yield of 5.88%. Over five years the dividend yield is 4.92%.

Rural Funds Group also has attractive valuation metrics, with a P/E (price to earnings ) of 9.21 and “gold standard” price to book (P/B) ratio of 0.74 and a price to earnings growth(P/EG) ratio of 0.87. Values under 1.0 suggest bargain stock status.

Marketscreener.com has an OUTPERFORM rating on RFF shares, with 2 analysts at HOLD, and 1 at UNDERPERFORM.

Yahoo finance Australia has a HOLD rating on Rural Funds shares, with 1 analyst at STONG BUY, 2 at BUY, and 2 at HOLD.

On share price appreciation Rural Funds Group trails Elders year over year, with both recovering from downturns in 2023.

Source: ASX 18 June 2024

Elders operates as a diversified agribusiness, providing rural real estate and financial services along with farm supplies, and assistance in livestock, wool, and crops production. The company has a network of store across Australia along with multiple subsidiaries. The range of products and services is exhaustive, with eleven unique service offerings listed on the company website.

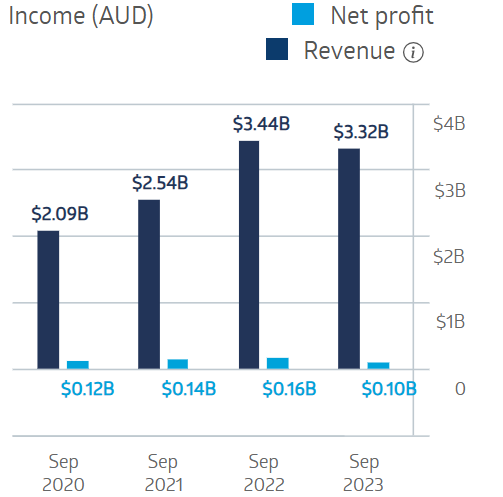

Like Rural Funds Group, FY 2023 was a down year for Elders.

Elders Financial Performance

Source: ASX 18 June 2024

Half Year 2024 results accelerated the downward trend, with management attributing much of the decline to “poor client sentiment following an El Niño declaration and below 10-year median livestock prices.”

Revenues fell 19% with underlying net profit after tax down 72%. The company also cut dividends by 22%. Elders management expressed confidence for the remainder of 2024 with average seasonal conditions returning and client sentiment improving as El Niño ends. The company reaffirmed its prior guidance for the full year 2024.

Current dividend payments are $0.36 per share with a five-year average dividend yield of 3.92%.

Marketscreener.com has an OUTPERFORM rating on Elder shares, with 5 analysts at BUY, 1 at OUTPERFORM, and 5 at HOLD.

Yahoo finance Australia has a moderate BUY on Elder shares, with 3 analysts at BUY, and 2 at HOLD.

Challenging economic conditions drive investors into defensive shares, although many market experts advise investors to diversify investment portfolios with defensive shares at all times. Defensive shares are those companies with the financial stability to weather downturns, or business models that remain in demand.

Of the many categories of defensive companies cited by experts, food is the one without which consumers cannot survive. The ASX has many agricultural stocks listed, with some food producers and agricultural service providers riding above the crowd.