Using Equal Weight Investing Strategies

For investors looking for long term growth in their investments portfolio, diversification is universally lauded as one of the most fundamental approaches to achieving that goal. The idea is to build of portfolio of assets that adhere to the old adage – ‘Don’t put all your eggs in one basket.”

Trouble in one basket can spoils all the eggs, while separate baskets lower the risk of universal failure. Risk averse investors are generally willing to lower their potential investment return by including fixed income investments that lower the overall risk. However, the returns from these safer fixed income investments pale in comparison to the potential returns of an investment portfolio of diversified stocks, prompting many investors to opt for diversified portfolios of equity investments in companies — stocks.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

What Does Equal Weight Investing Mean?

Market indices like the ASX 200 here in Australia and the S&P 500 in the US weight their entries in the index by market capitalisation, with the large blue chips at the top of the index exerting the greatest influence on the movement of the index. Other indices like the US DJIA (Dow Jones Industrial Average) are weighted by stock price, with the same result – stocks at the top of the index have the most impact on the index.

For the investing community, this means when an index like the ASX 200 is rising, it is likely the movement reflects price increases in mining or financial sectors than dominate the index

When an index like the ASX 200 is rising, it is likely the movement reflects price increases in mining or financial sectors than dominate the index

Both mutual funds and exchange traded funds also weight entries on criteria unique to the fund. The fund will hold more stocks of favored companies with declining holdings in less favored companies.

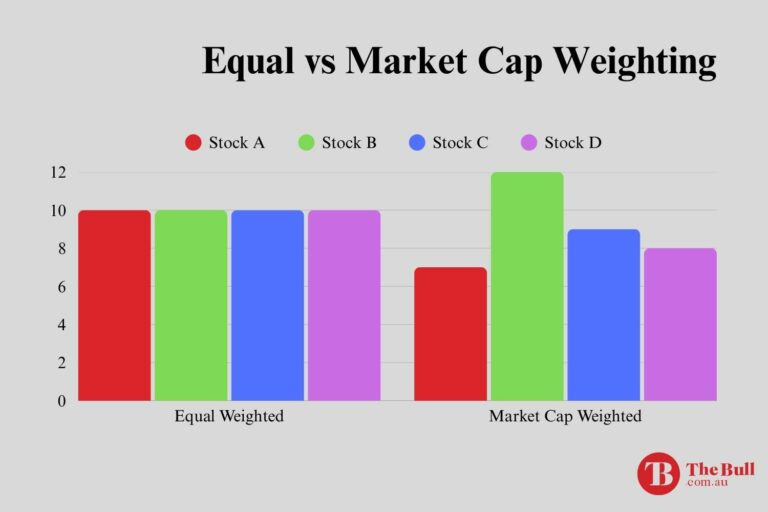

Equal weight investing turns this approach on its head, investing the same amount of money in each of the stocks in the index. The result is that the price performance of each stock in the portfolio exerts the same impact on the index performance, in sharp contrast to the dominance of large cap stocks influence in market capitalisation indices and funds holding more shares of favored blue chip companies.

Following the adage that a picture is worth a thousand words, the following graphic is a perfect representation of the basic difference between equal weighting and market capitalisation weighting.

The Benefits of Equal Weight Investing

Legendary US investor Peter Lynch once made the comment “big companies don’t make big moves.” This comment pre-dated the rise of the influence of big tech stocks, whose collective big downward moves in the tech sell off dominated markets.

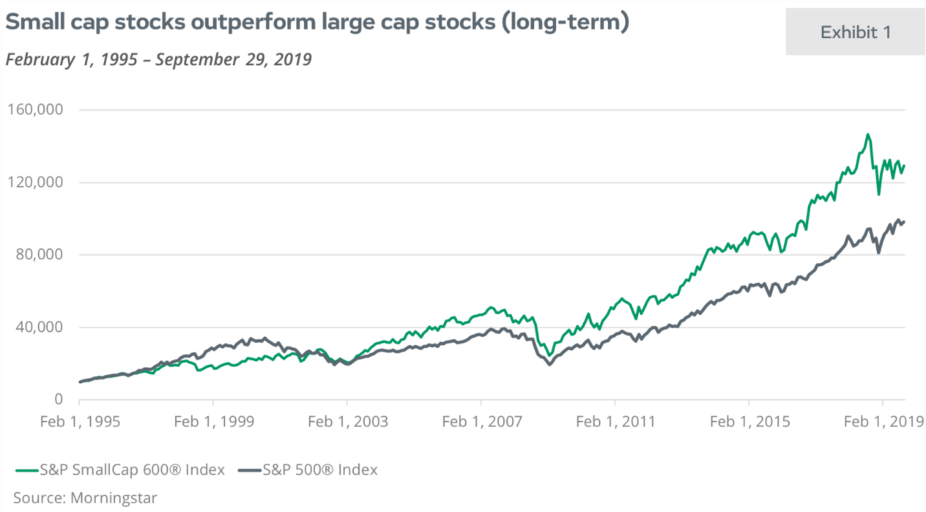

However, it is true that small cap stocks on the whole do outperform big cap stocks over time and equal weight investing opens the door for small cap and mid-cap performance to have an equal impact as the large cap stocks dominating market capitalisation and price weighting indices.

Most research shows small caps outperforming over time, as seen in the following graph.

The same pattern holds true in longer time frames as seen in the following graph.

Including mid-cap stocks which receive the same attention as large caps in an equal weighted investing strategy strengthen the picture. Research from Yahoo Finance claims that in the period from February of 1989 to February of 2024 large cap stock returns to investors grew by 1,664%. Small caps returns were 2,062% and mid-caps returned 3.176%.

Equal weight funds came into being to counter the outsized impact of favored stocks in market capitalisation based indices. Most of the global investing community looks to the US S&P 500 as the gold standard of the US economy. Although there are 500 companies in the index, the top ten stocks make up in excess of 20% of the entire index.

The Drawbacks of Equal Weight Investing

Regardless of whether an investor opts to build his or her own equal weighted portfolio or chooses an equal weighted index or sector fund, keeping the portfolio balanced requires more management. When one stock rises in equal weighting mangers or independent investors need to re-balance the portfolio by selling shares of stocks with higher prices and buying shares of stocks with share prices in decline.

Fees for equal weighted funds are higher to cover management time. For investors, the buying and selling trading required to keep the portfolio balanced also increase costs.

Equal weighted indices perform best with non-technology groupings. The volatility inherent in these indices make them more susceptible to crashes during severe economic downturns.

How do Equal Weight Funds Perform?

Historically equal weighted indices and funds perform best in times of upward moving markets when the impact of small-cap and mid-cap stock price movements contribute more to index or fund performance.

When markets are struggling, large cap stocks gain prominence in the eyes of investors arguably due to their perceived safety and stability, with the more volatile small-cap and mid-cap stocks waning in popularity with the investing community.

The key benefit to equal weight investing is spreading diversification across entire markets and sectors. In good market conditions small-caps and mid-caps are more attractive to investors due to their higher growth potential than large caps. This strategy avoids the risk of a portfolio laden with less risky, tried and true large cap stocks.

The key benefit to equal weight investing is spreading diversification across entire markets and sectors.

In the US, the Invesco S&P 500 Equal Weighted Index (RSP) is one of the most popular equal weighed funds. A 2025 year to date comparison with one of the most popular market capitalisation based ETFs – the SPDR S&P 500 ETF Trust (SPY) sees RSP outperforming SPY although both are down on the year. RSP has fallen 0.34% while SPY is down 3.77%.

Equal weighted funds are growing in popularity in the US, with seven funds repeatedly making top fun lists appearing on financial websites. In Australia, we have one equal weighted fund – the Van Eck Australian Equal Weight ETF (ASX: MVW).

Over ten years MVW has outperformed the ASX 200, up 60% versus a rise of 34.6% for the ASX 200. Over the same period, the market capitalisation based SPDR S&P ASX 200 ETF (ASX: STW) is up 30%. In a five year comparison MVW outperformed STW, up 71.2% versus 58.3%

Market indices and exchange traded funds use proportional representation in constructing the index of the fund. Large cap or favored stocks represent a greater percentage of the total portfolio. The end result is an outsized impact of large cap or favored stocks at the top of the portfolio dominating index and fund performance.

Equal weight investing allocates the same investment in each stock in the index or fund, allowing the performance of small-cap and mid-cap stocks to exert greater influence. Historically, small-caps have outperformed large caps.