Due Diligence for Retail Investors

With global stock markets in turmoil the recent influx of new, primarily young people looking to the markets as a place to get solid returns on their investment dollars may be ebbing. The challenge facing these investors is now more challenging – how do you pick a stock in which to invest?

In a world increasingly dominated by social media, the “hot stock tips” once reserved for the hallways and elevators of the workplace and the neighborhood cocktail party have moved online.

Potential investors seek and find social media posts that reflect the market knowledge of the poster. This approach flies in the face of the advice from seasoned investors and professional market experts and analysts – do your “due diligence” before investing. But what is due diligence?

What is Due Diligence?

A simplified definition of due diligence explains the process as a comprehensive appraisal of a business undertaken by a prospective buyer, especially to establish its assets and liabilities and evaluate its commercial potential.”

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

The added factor in this definition is the research needed for a comprehensive appraisal, as opposed to relying solely on the opinions of others. The process of researching a potential investment can trace its origins as far back as the mid-fifteenth century, but in modern times due diligence as reasonable investigation was codified in the US Securities Act of 1933.

The Act required institutions selling securities to “fully disclose” material information about the investment products they were selling. This material information provided the fodder for the horde of lawyers, professional financial analysts, equity research analysts, fund managers, and broker-dealers, to assess the viability of an investment.

At the time, due diligence research was seen as the purview of professional finance experts evaluating potential real estate transactions, mergers, or acquisitions. Today, the term is part of virtually every primer on investing in the stock market. Retail investors are not required but are universally encouraged to do their “due diligence” on a stock before investing.

Types of Due Diligence

The targets of a full-scale due diligence process include an investigation of the target’s commercial operations, its legal and tax situation, and its financial situation.

The sheer complexity of the process and the required expertise of those executing the process may give pause to the average retail investor. Yet would a retail investor with a large inheritance trust unproven opinions to buy a business. Or would they make every effort to learn everything possible about the business by researching it?

Soft versus Hard Due Diligence

Broadly speaking due diligence can be broken down into two categories – hard due diligence and soft due diligence.

Hard Due Diligence

Hard due diligence is what immediately comes to mind – the numbers. If an aspect of a company’s business can be expressed numerically, it is subject to hard due diligence. Aspects of the business that cannot be expressed in numbers require soft due diligence. Revenue, profit, debt, cash flow, earnings, accounts payable and receivable, capital expenditures, dividend history, intellectual property, legal and regulatory issues, taxation, and information technology are all hard aspects of a business.

Soft Due Diligence

Soft due diligence aspects include corporate leadership and culture, brand recognition, customer loyalty, competitive position, product pipeline, and R&D (research and development) activities. Some aspects that fall between hard and soft include products and services the company offers, customer base, market share, competitors, demand growth, and technological developments.

How to Perform Due Diligence

Many “How To” guides found on internet financial websites mix hard and soft elements. Given the potentially subjective nature of soft due diligence business aspects, beginning research with readily available hard data appeals to common sense investors, following some introductory issues.

Like any research, due diligence must have a starting point – an individual stock. Stock tips from friends are valid targets provided the tip is on a stock that fits your portfolio, in an industry in which you have an interest. Depending on risk tolerance, large cap stocks that tend to be more stable might be a good starting point. In addition, sticking with a business sector with which you have familiarity might be a better fit.

Before jumping into the numbers, a check of the company website to assess the fit of its business model – what does the company make, how is it distributed, and how is it sold — opens the door for the process.

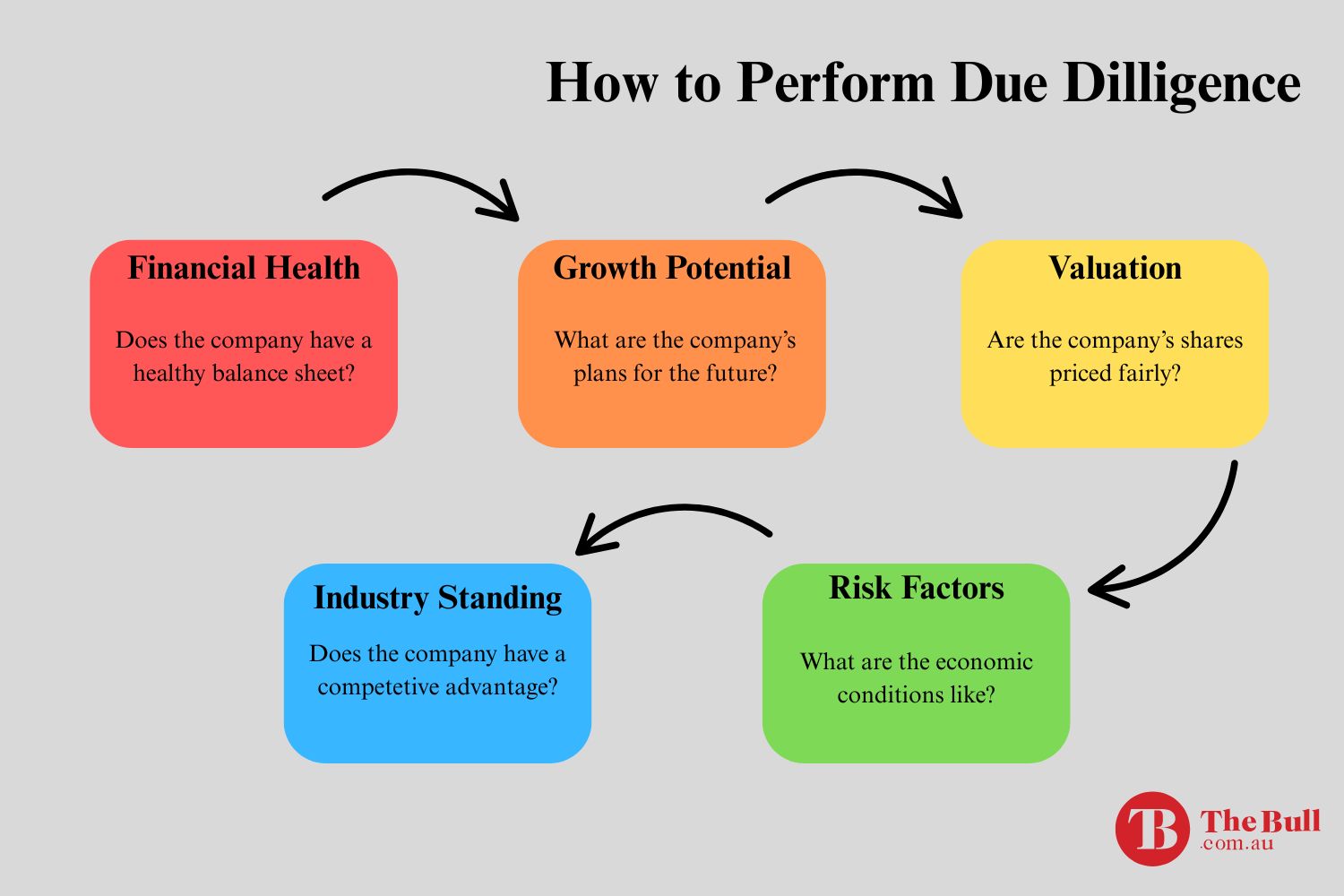

The following diagram is an example of the mixing of hard and soft elements of the due diligence process.

Financial Health is the starting point. Retail stock investors need not comb through multiple years of a company’s three financial statements – the Balance Sheet, the Income Statement, and the Statement of Cash Flows. A bevy of financial ratios calculated by market analysts from those financial statements offer all retail investors a solid due diligence road map.

There are four broad categories of financial ratios relevant to the due diligence process:

- Liquidity Ratios

- Leverage Ratios

- Efficiency Ratios

- Profitability Ratios

Missing from the list is the category where many retail investors begin the process – the Valuation Ratios. While they have their place, it is not at the front end of the analysis. Valuation ratios rely on the current share price of the stock in their calculation. Experienced retail investors know share price represents market sentiment about the stock, often with little if any consideration of the hard fundamentals of the business.

Newcomers need to take the time to learn what the ratios tell us and then search the financial websites or a trading platform with the most available ratios. In addition, some sites will track ratios over time. Historical performance is an important part of due diligence.

Financial health and operating performance of a given stock need to be compared with peer companies and with average performance of the business sector in which it operates.

Growth potential, Risk Factors, and Industry Standing will require multiple visits to sites like the ASX website where the Announcements section will include Investor Presentations and other announcements to the market covering these and other relevant issues.

The Valuation metrics enter the picture as the final decision point. Due diligence research on financial health, growth potential, and industry standing should answer the question is the investment in the stock worth the price to be paid.

Although the kind of comprehensive and exhaustive due diligence performed by legal and financial experts in assessing potential mergers and acquisitions may seem daunting to the average retail investor, would any investor buy a house without first assessing the structure and operational components like plumbing, electrical and heating?

Due diligence on stocks is an assessment of the financial health and historical and future performance of the company. Financial websites provide ample tools for the assessment, including financial ratios, company presentations, analyst research and opinions, and other relevant announcements made to the market to inform the investing public on company activities.