What to Look for in Company Earnings Reports

The “Do Your Due Diligence” mantra luring Aussie investors to spend time digging into the earnings reports ASX listed companies are required to report for the Full Year and the Half Year. US investors are faced with the task of deciphering US listed stocks financial reports released every quarter.

In theory, an earnings report is the place to go to learn what the company has been doing in the past and its plans for the future. In practice, an earnings report is akin to a product marketing description of most of what we buy. Investors typically go to earnings reports for one of three reasons:

- To Buy the stock

- To Hold stock they own

- To Sell some or all of the stock they own.

The first thing for Aussie investors to bear in mind about earnings reports is company management is well aware that solid reports can boost their share price, so management has a vested interest in putting their best foot forward. Investors are protected from untruths, but a bit of spruiking is not illegal.

Decoding spruiking is part of the process of using what you learn from earnings reports to make better investment decisions. While reports are released on a pre-scheduled date twice a year, earnings reports have a continuous life cycle.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

What is an Earnings Report?

At its core, an earnings report is about disclosure. Regulatory watchdogs require publicly traded companies to disclose any information that an average person would expect to have a material effect on the price or value of the stocks they are considering buying, holding, or selling.

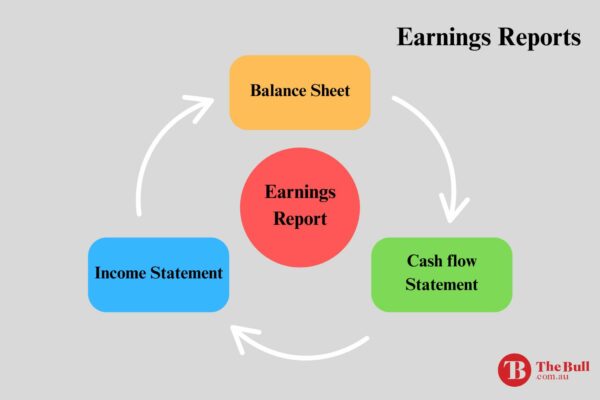

The ASX does not have a standard format companies must follow beyond the inclusion of the following financial statements, audited by independent accounting firms prior to their release to the public.

Source: fourweekmba.com/earnings-reports

The life cycle of an earnings report begins with most, but not all, reports ending with a statement of financial guidance a company expects to achieve by the next reporting period. Some cynics would see the absence of guidance as “spruiking” since some companies will explain why they are not providing guidance.

Financial analysts review the earnings report and post their findings for their clients and in some cases to the public. If things change during the reporting period, management might step in and revise guidance downward or upward. As the reporting date approaches 0financial analysts will post their expectations for what the company is likely to report.

What Does an Earnings Report Contain?

The ASX website is a place to go to find out when an earnings report will be released and then choose the reporting to review. Many ASX companies release both a Results Announcement and an Investor Presentation on the same day. Some companies include the Statutory Accounts for the period. Any of the three include Financial Statement overviews cutting out the critical parts of the three core financial statements and report them in summary form. This is useful with companies with multiple products sold in multiple markets as the report can provide product by product and market by market financial summaries.

Some reports begin with a Letter to Shareholders” while others include a Management Discussion following the Financial Review Statement. The Financial Review takes many forms, depending on the company’s business model, but everything there comes from the Income Statement, Balance Sheet, and Statement of Cash Flow. Management can tailor the Financial Review Statement to meet their needs but the three cornerstone documents are the product of professional accountants.

The Income Statement, Balance Sheet, and Statement of Cash Flows typically appear at the end of an earnings report, followed by a section of Appendices.

Watch for a favorite spruiking opportunity company management might take to make things look better when discussing sales – records. Record sales do not by themselves lead to profits of any kind, let alone record profits.

Sometimes when companies tout record revenues of record EBITDA (earnings before interest, taxes, depreciation, and amortisation) they are obscuring the fact that the company does not have a profit to report. The key word in EBITDA is before leaving open the question of how much of what the company earned is left in profit after all expenses have been paid. Arguably the greatest investor on the planet today – Warren Buffet – points out interest payments, taxes, and depreciation all represent costs the company’s must bear.

The Holy Grail of earnings reports is NPAT – net profit after tax, and you may not find it in the Financial Review or Summary at the beginning of the report, when management takes a ‘best foot forward” approach.. NPAT appears as Net Income at the bottom of the company’s Income Statement.

How Do Earnings Report Move Markets

Common sense suggests a positive earnings report would boost the stock price and a negative report would send the stock price downward. Common sense is wrong. Investors need to remember, the stock price is a function of market sentiment, not the fundamentals of the stock.

The reaction to an earnings report depends on the market expectations and sentiment regarding the stock. In times of economic trouble, a mediocre or even outright negative report cam see the stock price rise if the market expected worse results than those reported.

Positive reports can also send the stock price plunging if the results missed market expectations.

How to Analyse Earnings Reports

Given the fact the overview Financial Highlights summary varies from company, skipping to what is arguably the most important of the three reports makes sense – the Income Statement.

The first line item in the statement is Revenue. Taken alone the figure is relatively meaningless, but in comparison with revenues reported in prior periods spots trends. Some reports only compare two periods while others cite three periods.

Following the revenues entry, a series of expense entries are subtracted from revenues. Again, what is important is the trend – are expenses going up or down?

Next comes EBIT, or earnings before interest and taxes. Once interest and taxes are deducted the report ends with Net Income (or loss). This analysis shows how rising expenses across the board can eat up revenue to end with a loss.

Net Income carries over to the first line item on the Statement of Cash Flows. The statement ends with the Cash Balance for the year, after adding Cash from Investing and Cash from Financing. Again, what is relevant is the trend over successive reporting periods.

The Cash Balance becomes the first line item of the Balance Sheet, followed by additions of other assets like Accounts Receivable, and ending with subtracting Liabilities like Accounts Payable and Long Term Debt to end with a company’s Total Assets against Total Liabilities. Once again, the relevance is in the trend, especially in the Long Term Debt entry.

Some financial websites offer an expanded time line of key metrics like revenue, net income, and debt. Investors can also use the announcements section to go back to earlier earnings reports to deepen their understanding of financial trends in the company under analysis.

Investors interested in buying a new stock or deciding whether to hold or sell existing stock need to understand and analyse the published Earnings Report Announcements of the companies of interest.

In Australia, Earnings Reports are released for the Half-Year, the Full-Year, and Quarterly for some dual-listed stocks. The information in the reports is primarily financial along with management discussions of the results and future outlooks. The financial information is derived from the three corporate financial statements – the Income Statement, the Statement of Cash Flows, and the Balance Sheet.

The three statements typically appear at the end of he report, with a Financial Summary or Review appearing at the beginning of the report. This summary review can take different forms by company, depending on the company’s product line and market presence.