What is Portfolio Diversity?

Portfolio diversity is a risk management strategy where investors spread their investments across different asset classes, industries, and geographic regions so the risk of a downturn in one investment can be offset by better performance in another asset class or geographic region.

Investing history has seen repeated collapses in notable industries like the technology sector, verifying the need for diversifying an investment portfolio.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

How to Diversify Your Portfolio

There is some debate over portfolio diversification in the modern world of stock market trading, as the theory clearly states diversification does nothing to reduce systemic or market risk, only the risk associated with specific assets.

Airline stocks are at the mercy of oil price, their number one operating cost. Diversifying your portfolio means looking for stocks or other asset classes with low or negative correlations with each other. For example, if the price of oil skyrockets, airline stocks will fall. Conversely, if the price of oil falls, airline stocks will rise.

Stocks of unionized companies are at risk from employee strikes, so finding non-unionized stocks in the same business sector would mitigate that risk. Healthcare is a sector in high demand amongst investors given the strong tailwinds for the sector from older populations living longer and requiring more healthcare along the way.

Healthcare operates in a highly regulated environment so looking for stocks with less risk of regulation diversifies a portfolio. The US market is the gold standard for healthcare, with approval from the FDA (Food and Drug Administration) a major hurdle for startups in the sector. FDA requirements are less stringent for medical devices than for medical treatments. Balancing a portfolio with medical device and medical treatment stocks provides diversification.

Diversifying across business sectors also provides diversification, emphasizing stocks that react differently to economic conditions, like consumer staple stocks versus consumer discretionary stocks.

A well-diversified investment portfolio should include growth and value stocks, large-cap, mid-cap, and small-cap stocks along with startups.

A well-diversified investment portfolio should include growth and value stocks, large-cap, mid-cap, and small-cap stocks along with startups.

Stocks are arguably the most glamorous and exciting of all asset classes, so many investors concentrate their time and effort in building a diversified investment portfolio, paying less attention to other asset classes.

The digital world has enabled investing in a broad array of asset classes from precious metals like gold and silver, to commodities, to real estate to a wide range of financial instruments.

Financial instruments should have a place in a well-balanced portfolio, mixing short-term and long-term bonds and certificates of deposit. In the bond market diversify by issuer, investing in both government and corporate bonds.

For investors without the time and patience to build a well-diversified investment, there are diversified mutual and exchange traded funds available. These funds also serve as alternatives to paying for the services of a professional portfolio investment manager.

Passive income funds that track an entire index like the US S&P 500 are well diversified at the top but miss smaller stocks not in the index.

iShares has a fund tracking the top five hundred US companies —iShares S&P 500 ETF (ASX: IVV), while BetaShares has a fund that tracks the 100 top companies on the US Nasdaq Index, excluding financial stocks, the BetaShares NASDAQ 100 ETF (ASX: NDQ).

iShares has a fund tracking the ASX 200 index, the iShares Core S&P/ASX 200 ETF (ASX: IOZ) while Vanguard has two funds tracking international shares, the Vanguard MSCI Index International Shares ETF (ASX: VGS) , excluding Australian stocks and the Vanguard All-World ex-U.S. Shares Index ETF (ASX: VEU), excluding US companies.

The Dangers of Over-Diversifying

It is possible to have too much of a good thing. Overdiversifying an investment portfolio may spread investing resources too thin. Portfolio diversification is a long term strategy designed to smooth out the bumps of short-term volatility to produce higher returns over time.

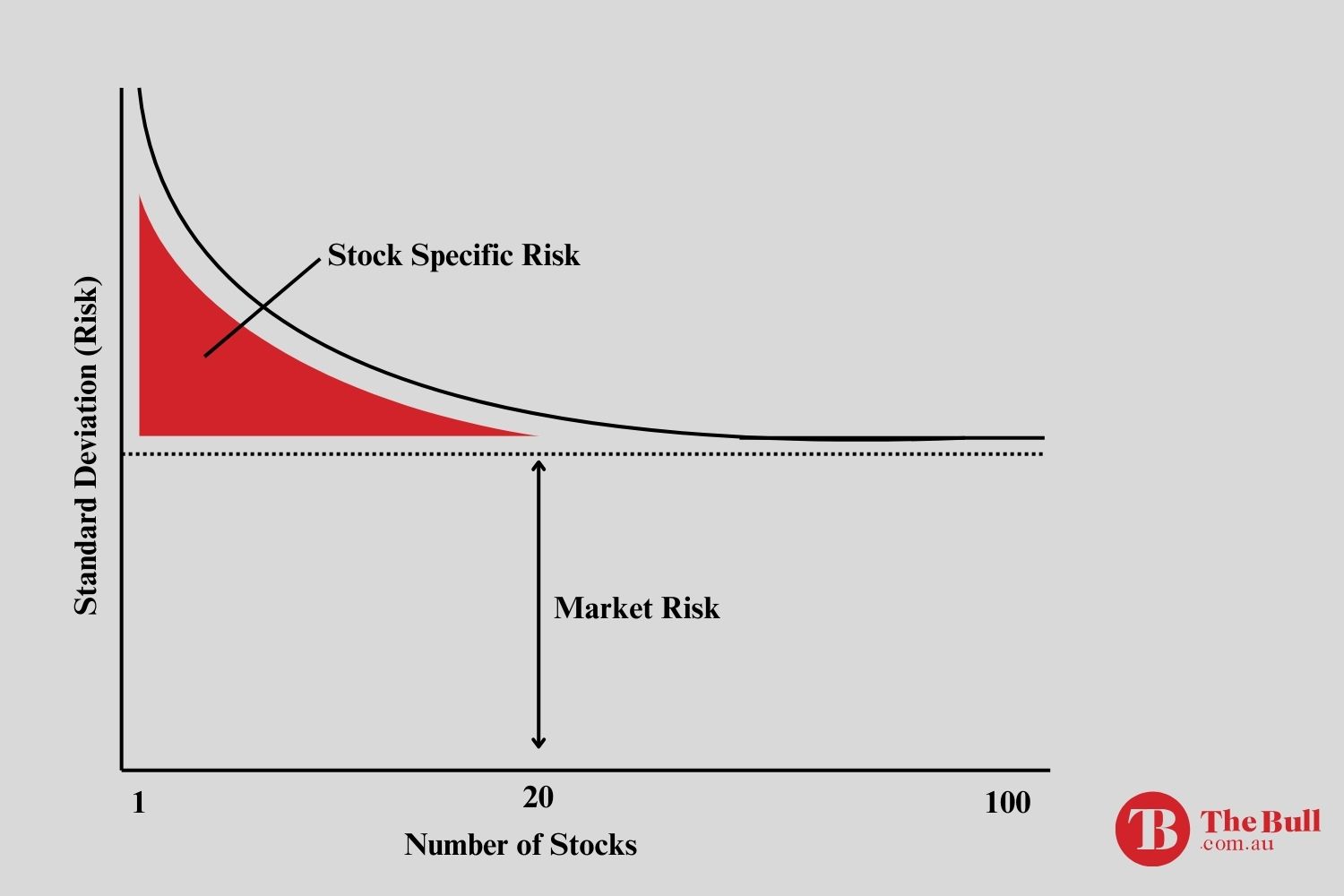

Portfolio diversification is one of the most researched investment strategies today under the banner of Modern Portfolio Theory. While some investors think adding more stocks to their portfolio will keep reducing risk, research has shown this not to be true.

Standard deviations measure market volatility and risk volatility equals risk. While some experts portfolio managers claim a portfolio of 15 to 20 stocks is ideal, others maintain 30 stocks is the minimum. Research shows little reduction in risk beyond the 20th stock in a well-diversified portfolio.

The key to successful diversification according to Modern Portfolio Theory is not the number of stocks in the portfolio, but their relationship. Stocks should have no correlation ideally, which simply means they can move in different directions under different circumstances.

Investors that are stock lovers should not ignore the need to add other asset classes to a well-diversified portfolio.

There are “build your own diversified portfolio” software programs for purchase and a dizzying array of funds offering multiple levels of diversification. However, care should be taken when investing in multiple funds as the major holdings tend to show up in many funds.

The problem with overdiversifying is having more eggs in the basket than it is reasonable to manage. Also, overdiversification will lower returns in the short term. American industrialist Andrew Carnegie had a retort to the bromide abought not keeping all your eggs in the same basket.

Andrew Carnegie reportedly said, “Keep all your eggs in one basket but watch that basket closely.”

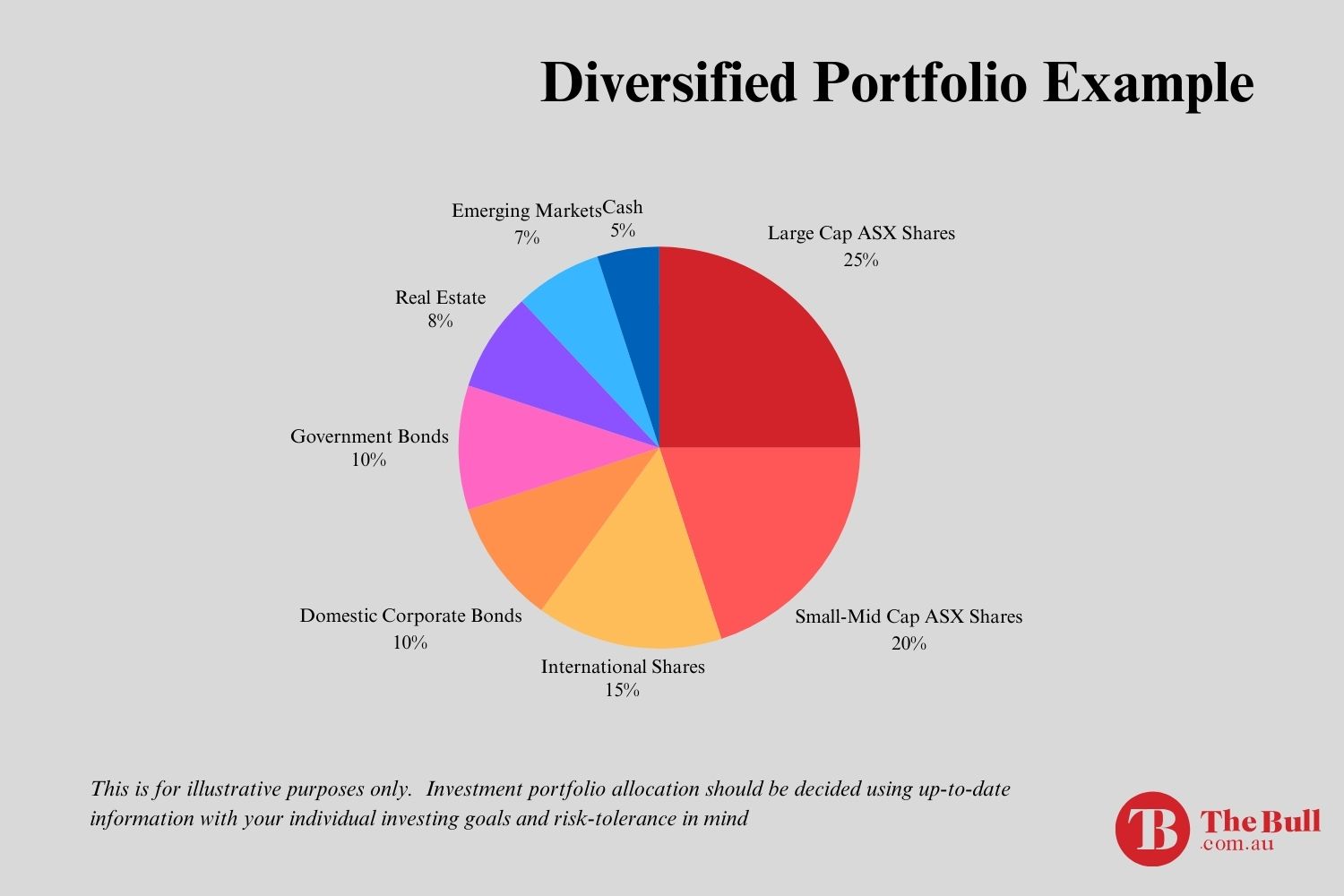

To support that view, consider the following breakdown of a well-diversified portfolio.

The contrarian view to modern portfolio theory is the time it takes to manage the far-flung and disconnected assets in contrast to the eager enthusiasm in closely following the fortunes of a basket of stocks of great interest.

Diversifying an investment portfolio with unrelated asset classes is a risk mitigation strategy that may sacrifice short-term gains for long-term stability. Asset classes include stocks, bonds, certificates of deposit, real estate, commodities, and precious metals. Diversification comes across business sectors, asset size, and geographic locations.