There are more than 2,000 individual stocks listed on the ASX, including Australia’s best blue-chip stocks. Selecting the best ASX stocks from such a large pool can be a formidable challenge. ‘Best’ is a subjective term, but all investors can agree that there is one standard that makes an ASX stock a potential best buy: profit growth.

Investing is all about generating return on the investment dollar. For traders looking to invest in Australian stocks, we have picked out some of the best ASX stocks to buy based on positive opinions from the ASX analyst community.

STRONG BUY, BUY, OVERWEIGHT, OUTPERFORM, and even HOLD recommendations are virtually always reflective of analyst research indicating that the stock has future growth potential.

Here, then, are five of the best ASX stocks to buy now.

- CSL Limited (ASX: CSL)

- ResMed Inc (ASX: RMD)

- WiseTech Global (ASX: WTC)

- NextDC Limited (ASX: NXT)

- Altium Limited (ASX: ALU)

CSL Limited (ASX: CSL)

CSL Limited continues to grow, despite the wisdom quoted from legendary investor Peter Lynch that big companies don’t make big moves.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

The market for CSL’s blood plasma treatments and influenza vaccines has multiple tailwinds propelling the stock that other large cap stocks can only dream of. The largest generation that the US had ever seen – the baby boomers – continues to retire. The boomers and the Millennials – the newly anointed largest generation as of 2011 – and all the generations to follow are living longer lives, extending the time during which they could benefit from CSL products.

The company invests heavily in R&D (research and development), with multiple non-plasma products in its pipeline to promote growth.

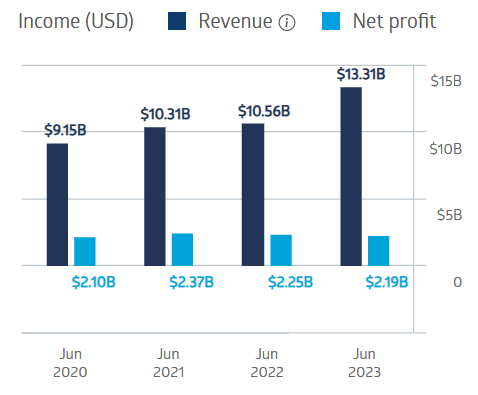

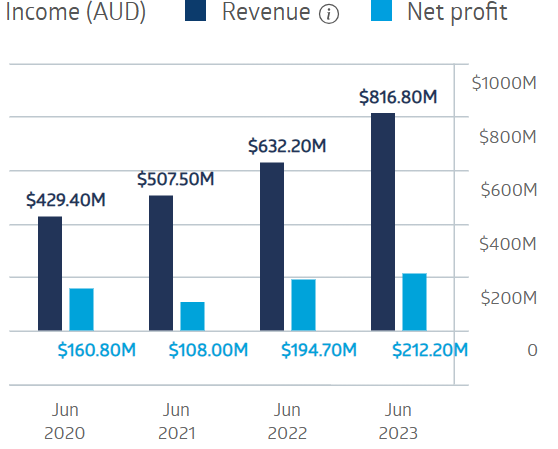

CSL’s financial performance throughout the COVID-19 pandemic did not go unscathed, as hospitals worldwide put elective treatments on hold. However, the company did manage to grow revenue, with net profit showing a decline between FY 2021 and FY 2022 and again in FY 2023

Half-year 2023 financial results began a modest recovery, with revenues up 19% and net profit after tax and amortisation (NPATA) up 10%. Full Year 2023 results saw revenues rise 31% and NPATA rise 20%. By FY 2023 the company’s financials eclipsed pre-COVID revenue and net profit.

CSL Limited Financials

Source: ASX 19 March 2024

Half Year 2024 showed revenues up 11% and NPATA up 17%. The company’s newest operating segment – kidney and iron deficiency treatment CSL Vifor – has yet to contribute significant revenue but does have treatments in the CSL product pipeline.

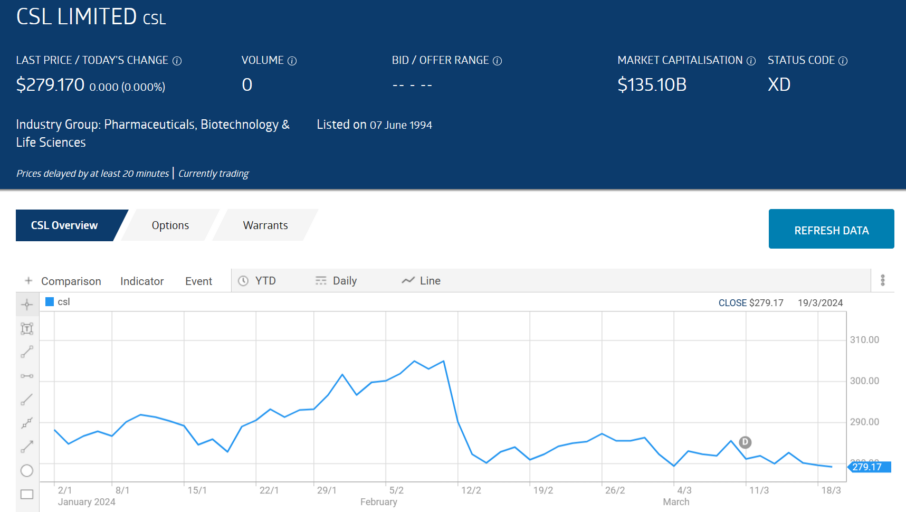

Year to date the share price has dropped 2.61%, driven by investor disappointment over the release of the results of a Phase III clinical trial that did not meet its primary endpoint.

Source: ASX 19 March 2024

Analyst coverage of CSL places the company as a strong contender for a spot on any best ASX shares to buy list. At marketscrener.com seven analysts of sixteen reporting have a BUY recommendation, three are at OUTPERFORM, five are at HOLD, and one is at SELL.

Yahoo finance Australia has two of eleven analysts reporting at STRONG BUY, seven at BUY, one at HOLD, and one at UNDERPERFORM.

ResMed Inc (ASX: RMD)

This US-based provider of high-tech solutions for two of life’s essential functions – breathing and sleeping – has an additional tailwind at its back beyond an ageing, obese and long-life population.

Its flagship products are for the treatment of sleep apnoea. The distinguished British journal The Lancet Respiratory Medicine reported the startling estimate of one billion people between the ages of 30 and 69 affected by obstructive sleep apnoea, suggesting that the condition is both “under-recognised and underdiagnosed”.

To add to this, ResMed’s primary competitor – Philips Respironics – is in the midst of a product recall. ResMed produces a line of sophisticated, digitally connected sleep apnoea treatment products and other devices for respiratory conditions.

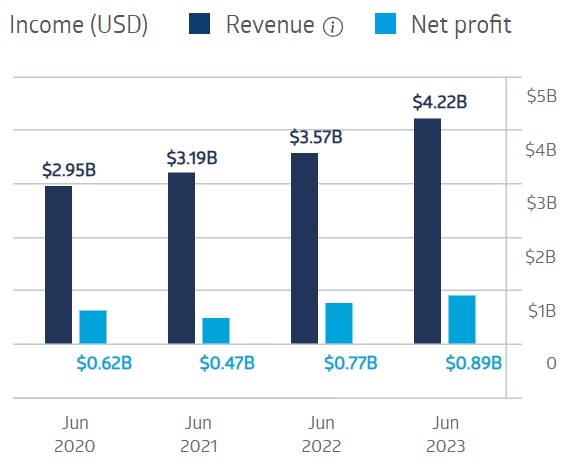

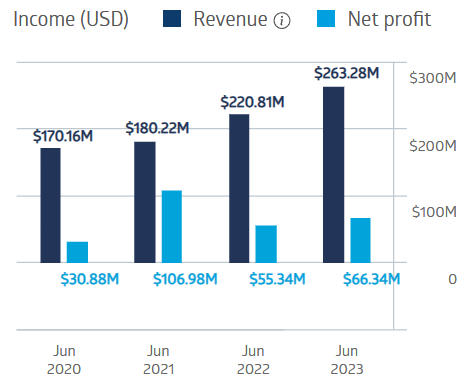

While the company makes respirators, the COVID-19 pandemic shut down the sleep centre labs where clients undergo testing for sleep apnoea. Despite these headwinds, the company managed to grow revenues from FY 2020 to FY 2022, with net income slipping from $621m USD in FY 2020 to $474m in FY 2021 before rebounding strongly in FY 2022 with a net profit of $779m. By FY 2023, the company’s financials appeared to have fully recovered, with revenues up 21% and net income up 15%. From the ASX website:

ResMed Financial Performance

Source: ASX

The Full Year 2023 results included a decline in the company’s gross margins, leading to a sell-off in RMD shares. The sell-off was accelerated by concerns over the prospect of new obesity drugs impacting ResMed revenues. The analyst community largely thinks investor concerns are overblown. The share price rose following the dip but has yet to get back to levels seen prior to the FY 2023 results release. Year over year the share price is down 7.2%.

Source: ASX 19 March 2024

Like CSL, some analysts see ResMed as a best Australian stock to buy.Marketscreener.com is reporting seven analysts with a BUY recommendation, three at OUTPERFORM, five at HOLD, and one at UNDERPERFORM.

Yahoo finance Australia is reporting one analyst with a STRONG BUY recommendation, three at BUY, three at HOLD and one at UNDERPERFORM.

The Wall Street Journal is reporting twelve analysts at BUY, five at OVERWEIGHT, seven at HOLD, and one at UNDERPERFORM.

Risk-averse investors should consider both ResMed and CSL as best ASX stocks right now, if for no other reason than that these two companies are as ‘inflation proof’ as is possible. Both have high-demand products with the power to raise prices without cutting into demand, as Medicare and private insurance are the payers, not the end consumer.

WiseTech Global (ASX: WTC)

WiseTech Global is a provider of software services offering door-to-door solutions for the logistics sector. The company’s flagship product is CargoWise, a complex analytical and control software platform for managing every facet of supply chains unique to each of the company’s customers.

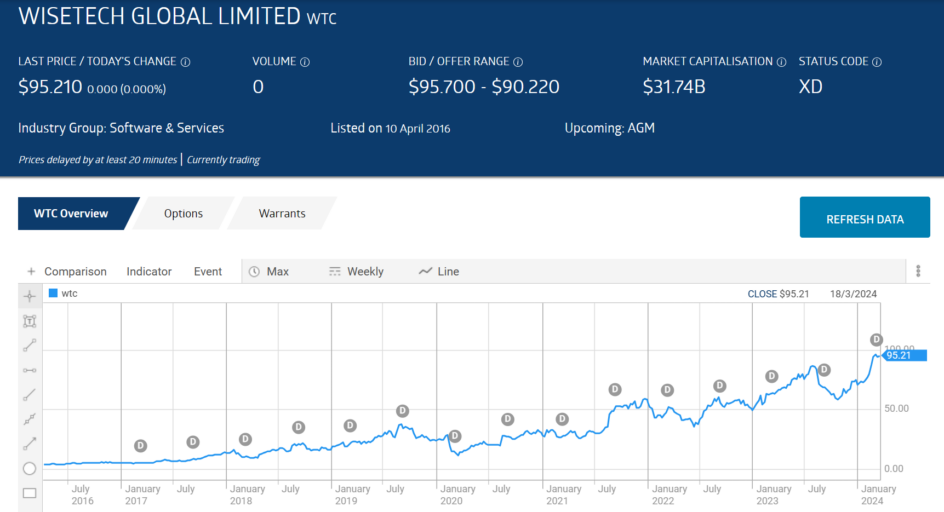

Listing on the ASX in April 2016 with a first day closing price of $5.37 AUD per share, WTC shares have risen 2,256.6%to a close of $95.21 om 19 March of 2024.. The share price is at all-time highs.

Source: ASX 19 March 2024

The company began paying dividends in its full year of operation and has maintained dividend payments even in the face of massive challenges as the COVID-19 pandemic wreaked havoc on global supply chains.

The share price fared worse than the company’s financials in 2022 as tech shares around the world were pummelled by rising interest rates. WiseTech grew revenue in each of the last three fiscal years, with net income dropping from $160.8m AUD in FY 2020 to $108m AUD in FY 2021 before eclipsing pre-pandemic income with a reported $194.7m AUD in FY 2022. FY 2023 Financials were strong, with revenues up 29% and underlying net profit up 30%.

WiseTech Global Financial Performance

Source: ASX 19 March 2024

Half Year 2024 financial results showed revenues increasing 32% while underlying net profit was up 5%. Dividend payments increased 17%.

Analysts are lukewarm on Wisetech’s status as an ASX best stock to buy with marketscreener.com, the Wall Street Journal, and yahoo finance Australia all with analyst consensus recommendations at Hold.

NextDC Limited (ASX: NXT)

NextDC Limited owns and operates 11 independent data centres across Australia designed and developed by the company. Client servers can be ‘colocated’ or stored at a NextDC data centre, eliminating the need for expansion at the client site. NextDC offers a full range of connectivity services with other enterprises, information communications technology (ICT) providers, and telecommunication providers via the cloud.

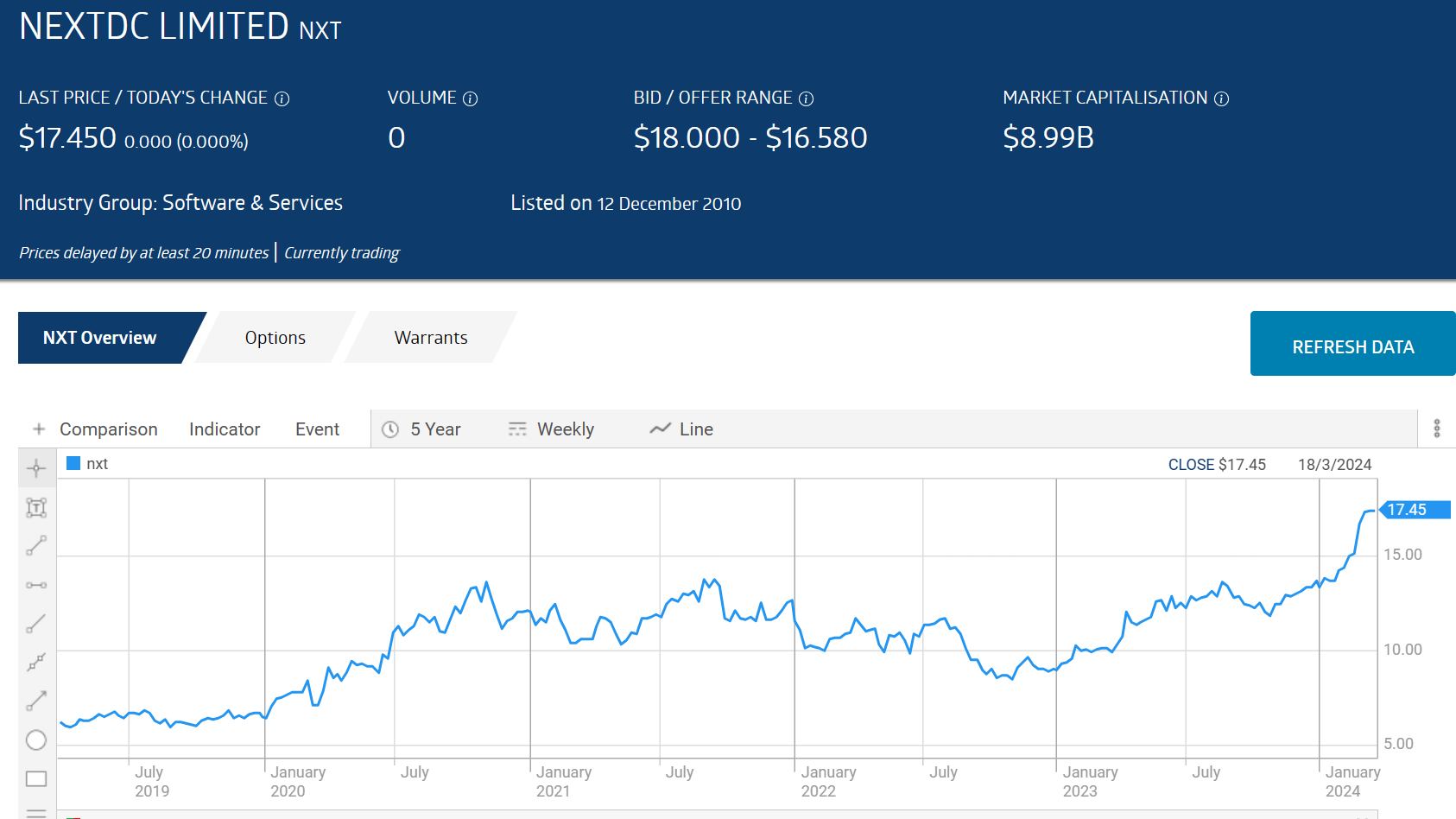

NextDC clients have cloud access to Australia’s leading ICT partners, value-added service providers, and managed and professional services providers. The share price did not escape the global tech stock meltdown, but the share price is up 182.2% over five years and 72.5% year over year, now at all-time highs.

Source: ASX 19 March 2024

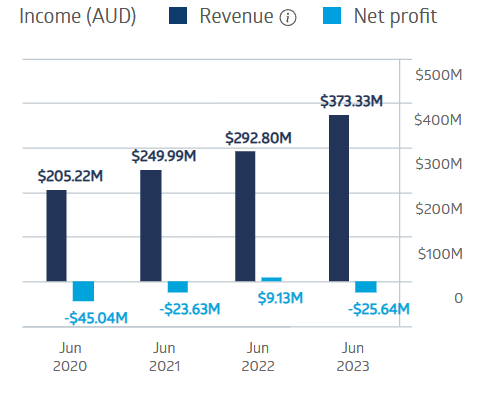

The company posted losses in FY 2019, FY 2020 and FY 2021 before turning profitable in FY 2022, while increasing revenue in each year. FY 2023 saw profit again slipping into the red. From the ASX website:

NextDC Financials

Source: ASX

Half Year 2024 results showed total revenue up 31% and net revenue up 8% with underlying EBITDA (earnings before interest taxes depreciation and amortisation) up 5%. The share price hit an all-time high following the release of the results.

The analyst community strongly concurs that NXT is an ASX best stock to buy right now. Marletscreener.com has an analyst consensus rating on NXT at BUY, with eleven of the sixteen analysts reporting at BUY, four at OUTPERFORM, and one at UNDERPERFORM.

Yahoo finance Australia also has a consensus analyst BUY rating, with four of ten analysts reporting at STRONG BUY, and six at BUY.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2024.

We’re giving away this valuable research for FREE.

Click below to secure your copy

Altium Limited (ASX: ALU)

Altium Limited creates software platforms used by professional designers of printed circuit boards (PCBs). In today’s digital world, the PCB has virtually eliminated point-to-point wiring in electrical devices of all types. The market for PCBs seems limited only by the capacity of humans to reduce their reliance on electronic devices.

Altium 365 is the company’s latest addition to its line of software design tools, allowing connection and collaboration between all stakeholders in the PCB design process via the cloud. According to the company, the core Altium Designer platform is used by more than 100,000 PCB designers around the world. Altium also has a platform called Octopart to search for parts for PCBs.

Most investors know that one sign of a best ASX stock to buy is confident management. In July 2021, Altium’s management expressed the ultimate confidence in the future growth potential of the company when they turned down an unsolicited takeover offer from US rival Autodesk Software for $40 AUD per share. At that time, Altium stock price was trading at $34 AUD. The $5.25bn AUD deal undervalued the company in the eyes of Altium’s management.

The company has consistently grown revenue over the last three fiscal years but saw a net profit dip in FY 2020 and again in FY 2022. Profit growth returned in FY 2023, with profits up 19.6% and revenues up 19.2%.

Altium Financials

Source: ASX 19 March 2024

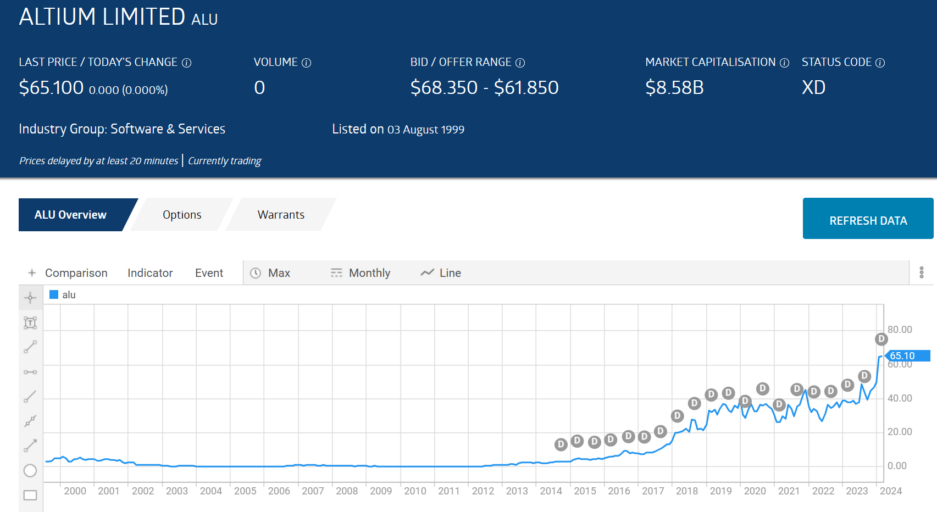

Half Year 2024 financial results saw revenues rise 15.9% and net profit up 11.4%. Altium listed on the ASX in 1999. The share price is up 1,666% since listing and 71.1% year over year. Like NXT Altium has hit an all-time high.

Source: ASX 19 March 2024

Both marketsreender.com and yahoo finance Australia have analyst consensus ratings at HOLD. Altium management, however, believes that strong industry tailwinds could propel the company’s revenue \to $500m by FY 2026.

For investors looking for the best Australian shares to buy, profit is the ‘holy grail’. Profitable companies over time generate higher share prices, which generate higher returns on an investor’s initial investment in the stock.

Profit growth in the future, not in the past, is one measure of the best shares on the ASX. Professional analysts thoroughly research a company’s business operations, opportunities and competition, reserving STRONG BUY and BUY recommendations for stocks likely to grow profit, and HOLD recommendations with stable profit outlooks.

FAQs

How Many Stocks are on the ASX?

The ASX has more than 2000 companies listed. The exact number changes from month to month, but it was reported as 2,121 in April 2023.

How do you Short ASX Stocks?

To short ASX stocks, you first borrow a stock from a broker and sell it at the current price. You then buy it back at a later date once, hopefully, the price has moved in your favour. This method of short selling is usually only available to institutional investors. Retail investors instead use CFDs and take a sell position, as CFDs don’t involve the underlying asset.

How do you Research ASX Stocks?

To research ASX stocks you need to gather data from several sources to identify ASX stocks that meet your investment needs. Stock screening tools allow you to search for ASX stocks that meet your criteria and create a shortlist of potential stocks to invest in. These companies will then need to be researched to find out if they are a good investment. Australian companies are required to produce annual reports providing information to investors. These reports contain a wealth of information that will help you decide if you should buy shares in the company.