Australia is known the world over as a premier mining country. ASX mining stocks are in the top tier of the world’s producers of lithium, nickel, copper, gold, silver, and other metals and minerals.

The world runs on hard commodities that come from the earth. Australian investors are blessed with a wealth of stellar miners from which to choose, in virtually all commodity categories. Australian mining stocks are the subject of a cornucopia of investment analysis from industry experts and stock market analysts, enabling investor research.

There is no such thing as a “best” stock that meets the needs of all Australian investors. The choice depends on the individual investor’s strategy. Some are attracted to bargain, or value stocks, while others prefer stocks with high growth potential.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Market capitalisation is measure of how market participants perceive the value of the stock. Demand for commodities rises and falls and large cap stocks are more likely to have the financial resources to weather the storm. Large market caps provide some safety for the risk averse.

For traders looking to invest in Australian mining stocks, in the first half of the trading year 2024 we selected some of the best buys in 2024, by market cap. Now we look at how these stocks ended the year.

The Best ASX Lithium Stocks

Not long ago Lithium was on fire with the perception demand driven by our insatiable appetite for battery-powered electronic devices and the anticipated shift from ICE (internal combustion engine) powered vehicles to battery powered vehicles, from cars and buses and trucks up to airplanes. Oversupply conditions and a slow fall of electric vehicle sales in the midst of high interest rates put the lithium price in a downward trend.

Here were two of the best lithium stocks on the ASX in early 2024.:

Allkem Limited (ASX:AKE)

In 2021, a leading hard rock producer on the ASX – Galaxy Resources Limited (ASX:GXY) merged with lithium from brine producer – Orocobre Limited (ASX:ORE).

The new company began trading on the ASX in late August of 2021 under the name and code – Allkem Limited (ASX:AKE) with a market cap of $7.8b. Two years later the company has merged again, this time with US-based lithium chemicals producer Livent Corporation. The new company trades on the ASX as Arcadium Lithium (ASX: LTM) and in the US as ALTM. Combining mining and refining resources should give the newly christened company a competitive advantage over time.

The newly formed entity listed in the midst of a global meltdown of lithium stocks following sliding lithium prices. The company has now been acquired by Rio Tinto (ASX: RIO), with the deal expected to be finalized in mid-2025. The announcement on 9 October propelled the share price into an upward jump before levelling off.

Source: ASX Website

Pilbara Minerals (ASX:PLS)

Pilbara claims its wholly owned Pilgangoora Lithium-Tantalum Project is the largest independently owned hard-rock lithium operation in the world, with two mines in production. The company also holds a 70% in the Mt Francisco joint venture.

Pilbara is looking to expand into the entire lithium supply chain and has another joint venture in place, with South Korea’s POSCO – the POSCO-Pilbara JV Company to build a lithium hydroxide chemical processing facility to be located in South Korea.

Pilbara’s Full Year 2023 Financial Results showed a 647% increase in revenue and a 989% increase net profit, but collapsing lithium prices crushed the company’s financials in FY 2024, with revenues dropping from $4.06 billion dollars to $1.25 billion and net profit sliding from 2.39 billion dollars to 0.25 billion in FY 2024.

The share price is down 36.39% year over year, as of 15 January following a brutal performance in the second half of 2024.

Source: ASX Website

The Best ASX Nickel Stocks

Demand for nickel has broken out of its traditional use in stainless steels, vaulting into the latest holy grail of investing – critical battery minerals. The commodity is now in high demand for its use in batteries for electronic devices and electric vehicles.

IGO Limited (ASX:IGO)

IGO’s mission statement is to mine the metals needed for a clean energy future. IGO’s primary focus is its three Australia-based nickel mining operations. The company also holds a 49% interest in a lithium joint venture project with privately held Tianqi Lithium, as well as a 25% interest in another joint venture with ASX listed lithium miner, St. George Mining Limited (ASX:SGQ).

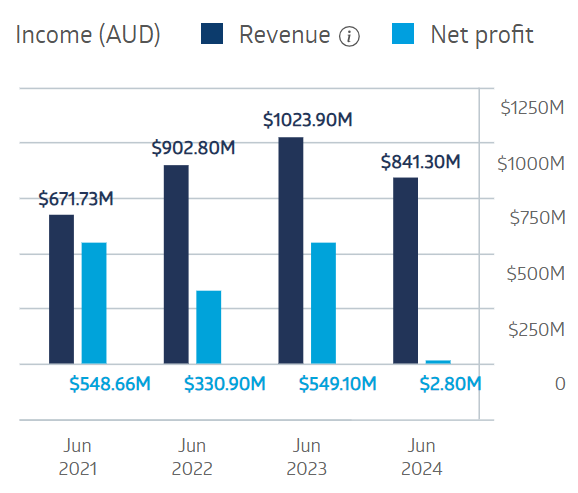

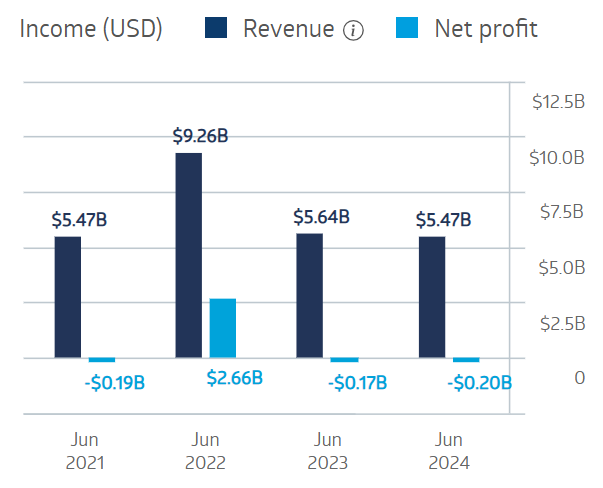

Full Year 2022 Financial Results showed a 34% revenue increase with a 40% profit decline due to a one-off charge from an asset divestment. Full Year 2023 financials were markedly improved, but the global slowdown in commodity pricing hit IGO hard in FY 2024.

IGO Limited Financial Performance

Source: ASX Website

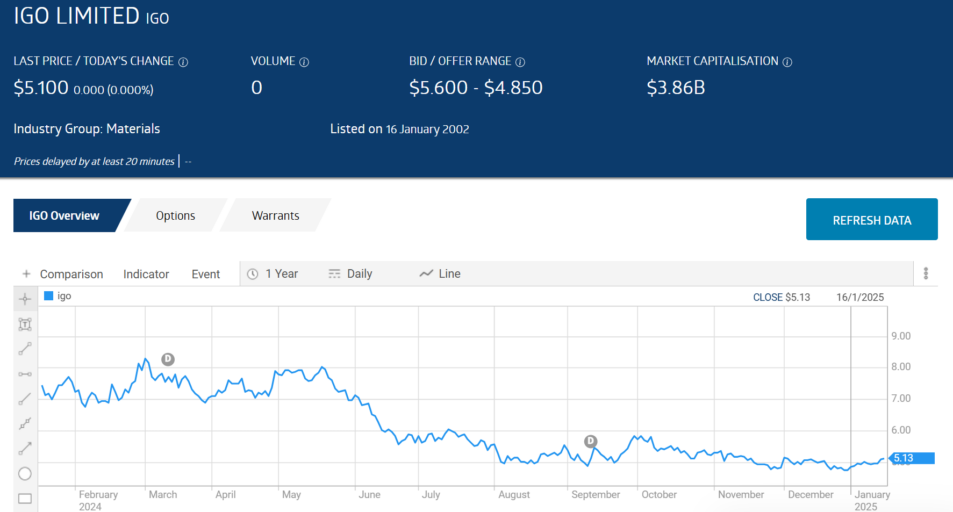

The share price began 2024 with a rising stock price that began to collapse in mid-May, now down 31.14% year over year, as of 15 January of 2025. A note from global investment bank Goldman Sachs predicting lithium prices would not hit bottom until 2025.

Source: ASX Website

On 16 December of 2024 IGO announced it had entered into a joint venture arrangement with Encounter Resources for exploration at the Yeneena Copper Project in Western Australia.

Nickel Industries (ASX:NIC)

Nickel Industries holds interests of between 70% and 80% in four different nickel mining operations in Indonesia. Although the price of nickel escaped the downturn experienced with lithium, an oversupply of nickel and weakening demand in China kept pricing in check in volatile trading.

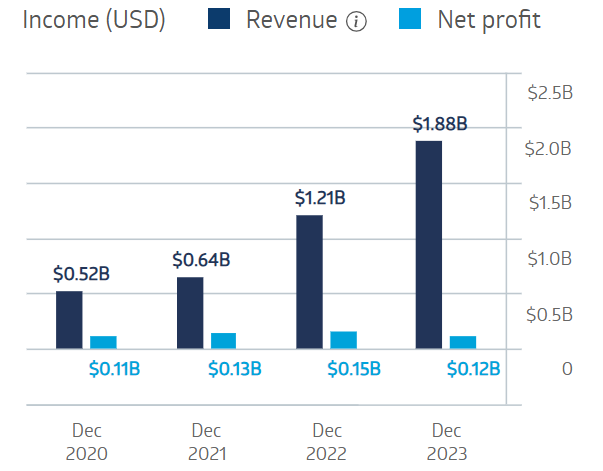

The company posted rising revenues and stable profits through FY 2023.

Nickel Industries Financial Performance

Source: ASX Website

Half-Year 2024 results caught up with the company, with revenues dropping 9.5% and net profit falling 81.1%. The analyst community and investors remain bullish on the company with the 29 August report announcement failing to send the stock price into a downward trend.

Year over year the stock price is up 39.75%, as of 16 January of 2025.

Source: ASX Website

The Best ASX Copper Stocks

Copper has long been considered a bellwether for the economy, given its use in so many industrial applications. While not uniformly classified as a critical battery mineral, copper’s role has long past evolved beyond electrical wiring and plumbing into use in electronic components of all types as well as the electrical grid itself, electric vehicles, and renewable energy delivery systems.

Australian investors have two of the world’s largest copper mining companies listed on the ASX – BHP and Rio Tinto.

BHP Group (ASX:BHP)

With a market cap of $201.8 billion dollars, BHP is the second largest stock on the ASX and the largest mining company in the world by market capitalisation.. The company bills itself not as a mining company, but as a provider of the essential resources needed for global growth and a transition to cleaner energy.

The company has operations in virtually every corner of the world, producing copper, iron ore, nickel, metallurgical coal, and potash. BHP is a prolific dividend payer and has bounced back from challenging times repeatedly over the last decade, rising 68.5% over the decade. :

Source: ASX Website

Year over year the share price has dropped 14%, as of 16 January of 2025. BHP’s net profit has dropped in the last two fiscal years, following a 13% increase in revenue from operations and a 173% increase in profit in FY 2022. BHP has completed the acquisition of Oz Minerals, an ASX listed pure play copper producer.

BHP Group Financial Performance

Source: ASX Website

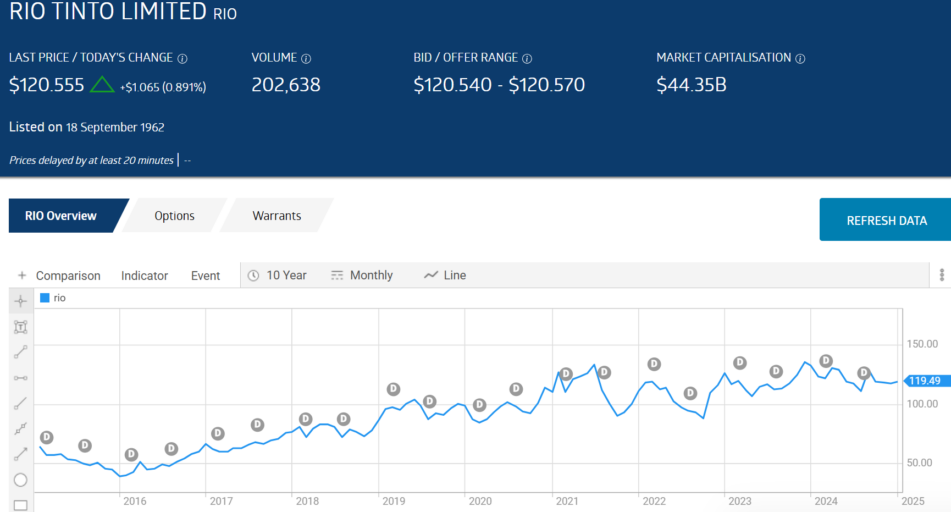

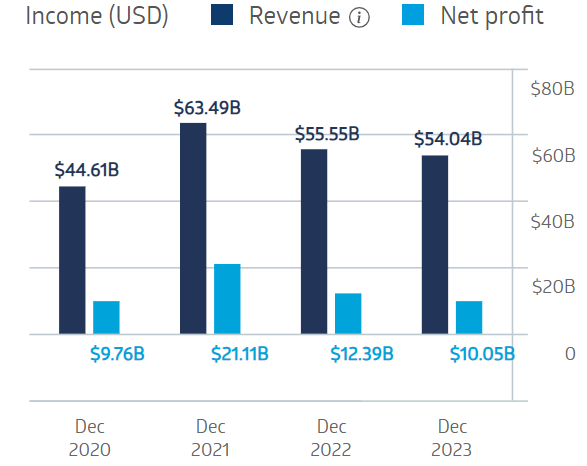

Rio Tinto Group (ASX:RIO)

Rio’s mission statement is to find better ways to produce what the world needs. The company has operations in eight countries around the world, producing iron ore, aluminum, copper, lithium, borates, diamonds, and salts.

While BHP has decided to stay out of the lithium market, Rio has a demonstration plant in the US state of California to recover lithium from waste rock, along with projects in Argentina, Canada and a project on hold in Serbia. Rio recently acquired Arcadium Lithium, with assets in both hard rock and lithium from brine operations along with chemical refining of lithium.

Like BHP, Rio’s share price performance over the last decade shows the company’s resilience in recovering from troubled times, up 107.5% over the decade.

Source: ASX Website

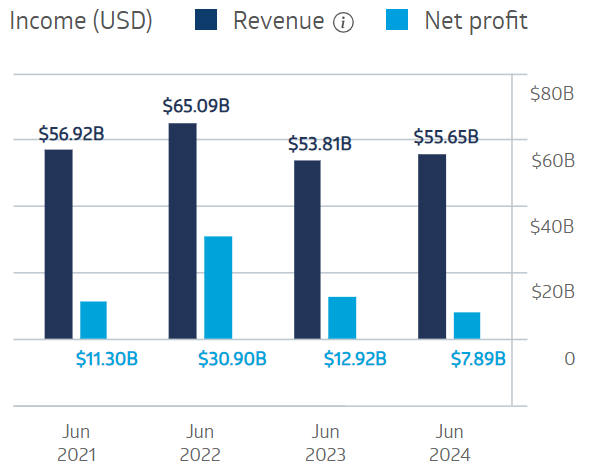

Year over the year the stock price is down about 4.7%, as of 16 January of 2025. Rio’s Full Year 2022 Financial Results reflected the challenging conditions of the year. Net cash from operations fell 36% while net profit after tax dropped 41%. By contrast, the full year 2021 results showed a 60% increase in net cash from operations and a 116% rise in profit after tax. Revenues and profit dropped again in both FY 2022 and FY 2023.

Rio Tinto Group Financial Performance

Source: ASX Website

Half-Year 2024 results improved with a 1% increase in revenues and a 14% increase in net profit.

The Best ASX Gold Stocks

Historically, gold has attracted investor interest as a safe haven in troubled times. Interest rates are still rising to combat inflation, and the prospect of an imminent recession looms large in the eyes of some experts, but the supposed recession appears to be on hold at the moment.

Acquisition activity is generally a welcome sight for investors in a specific sector, so the recent attempt by the world’s largest gold miner – Newmont Mining (NYSE:NEM) – to acquire the largest gold producer on the ASX by market cap – Newcrest Mining (ASX:NCM) should have piqued investor interest in investing in the best ASX gold stocks.

Newcrest Mining (ASX:NCM)

Newmont came back with a second offer to buy Newcrest, the largest gold producer on the ASX by market cap — $20.77b as of 09/03/2023. Newcrest has three operating gold mines in Australia; two in Canada; and two in Papua New Guinea. The company has development projects in advanced stages in both Australia and Papua New Guinea. Newmont sealed the deal in mid-May of 2023, to become the largest producer of gold bullion in the world.

While Newcrest lags behind other large cap ASX gold mining stocks, the company has an admirable history of dividend payments. From the ASX website:

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2025.

We’re giving away this valuable research for FREE.

Click below to secure your copy

Northern Star Resources (ASX:NST)

With a market cap of $19.7 billion dollars, Northern Star now ranks at the top of the heap of ASX gold miners, with a stunning share price performance history over the last decade – up 863%^.

Source: ASX Website

The company’s revenues have increased in each of the last four fiscal years, but net profit , although increasing in the last three, has yet to match its net profit performance in FY 2021.

Northen Star Resources Financial Performance

Source: ASX Website

Unlike Newcrest, Northern Star has managed significant growth while still paying dividends. The company began its climb in the ranks of ASX gold miners in 2010, with its first major acquisition – the Paulsen mine in Western Australia. Northern Star continued its aggressive acquisition strategy, with the company maintaining its pledge to pursue attractive acquisitions to this day.

The company has three operational gold mining centres – two here in Australia and one in Canada. Year over year the share price is up 40.2%, as of 26 January of 2025. .

The Best ASX Silver Stocks

Silver is also considered a safe haven investment but does not match the allure of gold. The result of investor preference for gold is lower liquidity for silver investors. Silver is thinly traded but it is cheaper for retailers to buy and has industrial applications in a variety of green technologies, including electric vehicles and devices as well as solar panels.

Silver Mines Limited (ASX:SVL)

Silver Mines does not meet the large market cap standard at its current market cap of $129.9 million dollars, but it is the only pure play silver miner listed on the ASX.

The company is the sole owner of the Bowden Silver Project in New South Wales, reportedly the largest undeveloped silver deposit in Australia, with a feasibility study in place. Silver Mines is seeking financing for the project. The share price took a big hit on the announcement on 16 August that the company had lost an appeal of a legal challenge of Development Consent agreement for the Bowden project.

Source: ASX Website

On 5 December, the company announced amended legislation providing a path forward for the development of the Bowden Project. The company has a$25 million dollar capital raise underway, targeting “sophisticated or professional” investors.

On 20 December, the company upgraded its resource estimate for the project following additional drilling in the project.

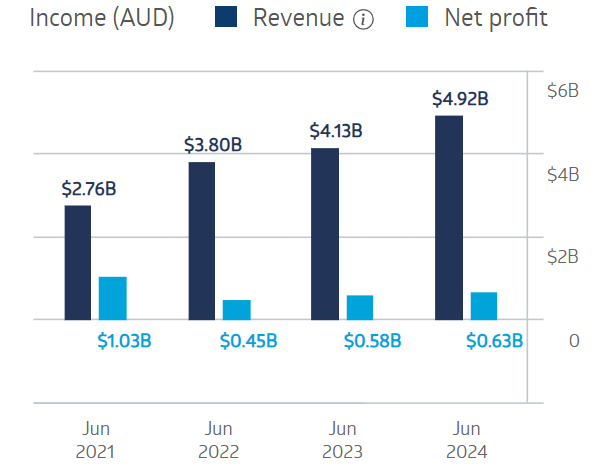

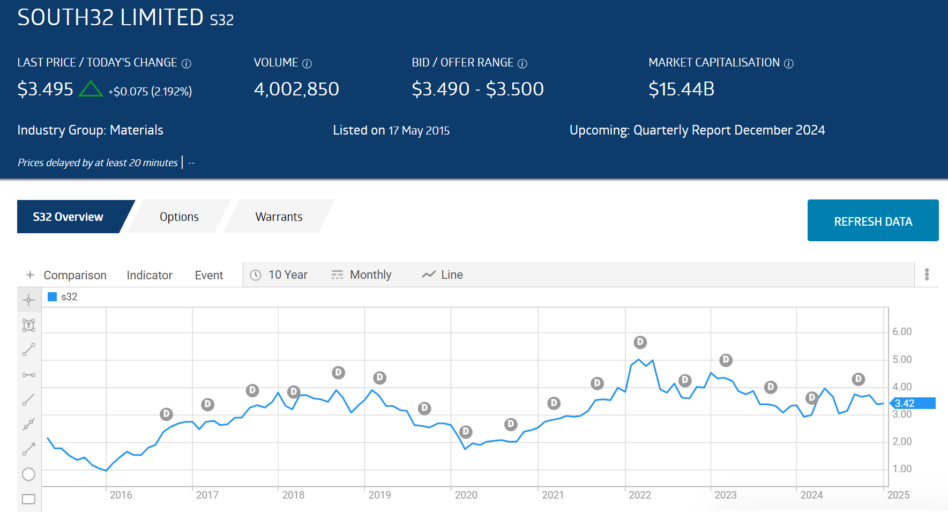

South32 Limited (S32)

South32 ‘s mid-year market cap $20.7 billion dollars is down to $15.4 billion as of 16 January of 2025. The company spun off from BHP and began trading on the ASX in May of 2015, rising a respectable 56.6% over the decade.

Source: ASX Website

South 32 operates in Australia, South Africa, and South America with a highly diversified asset base. The company’s Cannington Mine in Queensland is one of the largest silver and zinc mines in the world.

The South32 Full Year 2022 Financial Results saw a 69% revenue increase and a 4325 rise in underlying earnings, but the company has seen hard times since, with declining revenues and profits turned into losses in both FY 2023 and FY 2024.

South 32 Financial Performance

Source: ASX Website

The stock price is up a modest 5.9% year over year, with analysts at global investment banks Goldman Sachs and Morgan Stanley bullish on the stock for 2025, despite poor financial performance in the last two fiscal years.

Market Capitalisation provides a measure of safety when seeking best stocks. A large market cap tells the potential investor other market participants regard the stock highly. While ASX mining stocks are among the best in the world, junior miners face the gauntlet of expense after expense bring a mining prospect into production.

FAQs

How do you Invest in Junior Mining Stocks?

You can invest in Junior mining stocks by purchasing shares through a regulated broker. Junior mining stocks are new or smaller companies looking to develop a natural resource deposit. They are riskier than investing in major mining companies as they tend to have lower amounts of capital and shorter histories. Their popularity with Australian investors comes from the fact that their value can increase dramatically if they hit upon a large deposit of the resource they are mining. However there is no way to know how much of the natural resource is contained in the deposit, so their value can easily drop should the deposit not live up to expectation. Investors should always do their due diligence and have a risk management plan in place.

Which Companies are Mining Lithium?

Lithium is a commodity that is used in the manufacture of batteries. Demand for lithium has grown in recent years due to increasing sales of electric vehicles. Australian companies that mine lithium include Allkem Limited and Pilbara Minerals.

When is the Best Time to Buy Gold Stocks?

Gold stocks are companies whose value is closely tied to the price of gold, though their stock price is affected by other factors as well. Gold is an asset that is traditionally seen as a safe haven in times of uncertainty. Typically the price of gold rises in periods of high inflation and recession. On average the price of gold tends to climb during January and February before dropping off during the Spring and Summer months and climbing again in the Autumn. You should always do your own research before deciding to invest and never risk more than you can afford to lose.