The ASX financial sector has much to offer investors of all backgrounds. Risk adverse investors with long term horizons have only to look at Australia’s globally renowned “Big Four” banks, along with a smattering of smaller regional banks and an internationally acclaimed investment bank. The Big Four are considered the best in the world based on the difference between the bank’s assets and its liabilities — capitalisation.

Although some younger investors may find banks supremely boring, they hold an unparalleled advantage – the demand for the services both traditional and investment banks provide will never fade away.

The insurance companies within the best ASX banking and financial stocks share the same advantage of virtually guaranteed demand over time. The public cannot go without home, auto, and health insurance. Both banks and insurance companies take in cash that can be held by the financial institution for decades before payout. Yet many investors find insurance stocks equally boring.

The newer subsector in financials – the financial technology providers — had earned the admiration and loyalty of risk tolerant investors looking for outsized returns from financial companies using technology to disrupt traditional ways of conducting financial business.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

The BNPL (buy now pay later sector) achieved red hot market darling status with the rise of a member of the group of ASX tech stocks known as WAAAX stocks – Afterpay – in what seemed to be never-ending upward movement until it stopped. The BNPL sector has fallen into disfavor, spurred on by collapse of Openpay Group (ASX: OPY, and others.

In times of economic uncertainty it seems the best ASX financial and banking stocks to buy remain financially stable and low risk.

At the close of the first quarter of FY 2024 we looked at five of the best ASX financial and banking stocks. Here is how the five finished calendar year 2024 and started the 2025 trading year.

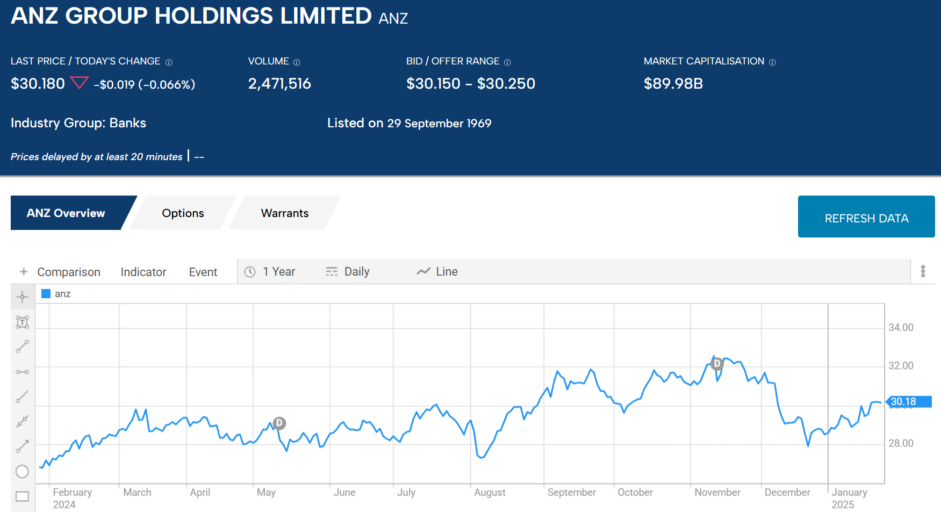

ANZ Group Holdings (ASX: ANZ)

Over a decade or more Commonwealth Bank had the best track record but for the best ASX financial and banking stocks to buy nowsome analysts favor ANZ and Westpac.

For investors looking for bargain stocks ANZ is a surprising target. The P/E ratio of 12.16 is well below the index average of 19.17. The P/EG ratio – which adds forecasted growth to the calculation – is 0.56. Stocks with P/EG ratios well under 1.0 are considered undervalued. The ANZ P/B ratio of 1.10 converts to shares valued at $23.17, about $6.65 below the 8 March closing price,

Year over year, the ANZ share price is up 13.6%, following a weak performance at year’s end and small recovery so far in 2025.

Source: ASX Website

ANZ has introduced a fully digital banking platform that includes a mobile app called ANZ Plus and has acquired Suncorp Group.

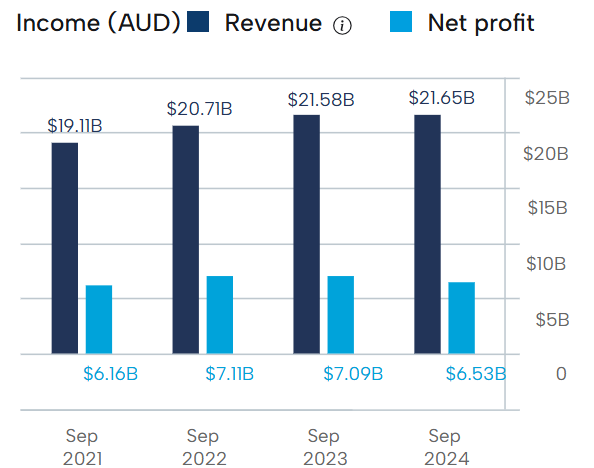

ANZ’s financials have fully recovered from the early stages of the COVID 19 Pandemic.

Australia and New Zealand Bank Financials

Source: ASX Website

Analyst outlook on the Big Four Australian Banks has soured a bit, with a consensus rating on marketcreener.com of HOLD, with 3 analysts at BUY, 7 at HOLD, and 3 at SELL.

Westpac Banking Corporation (ASX: WBC)

Like ANZ, Westpac Bank weathered the high interest rate environment but avoided a did in share price at the close of calendar year 2024, now up 39.3% year over year.

Westpac’s valuation metrics place the bank behind ANZ with a a forward P/E of 15.6 versus 12.15 for ANZ. of 14.93.

Year over year the share price is up 39.2%, with an impressive year to date rise of 20.96%.

Source: ASX Website

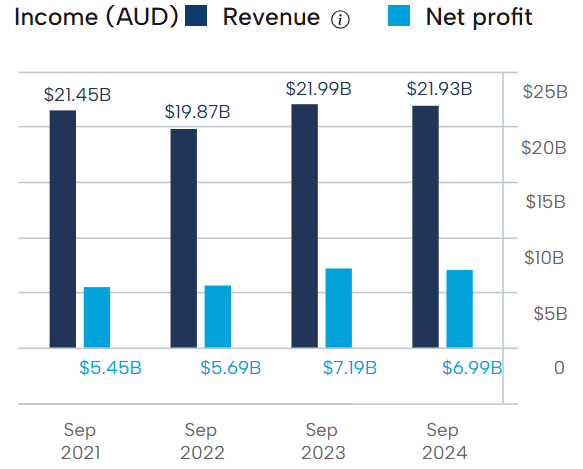

Westpac’s financials have remained stable over the last four fiscal years.

Financials Westpac Banking

Source: ASX Website

Westpac also trails Australia and New Zealand Bank in dividend yields, with a five year average of 4.11% compared to ANZ’s 4. 95%..

Marketscreener.com has a consensus UNDERPERFORM rating on Westpac shares, with 1 analyst at BUY, 4 at HOLD, 3 at UNDERPERFORM, and 5 at SELL.

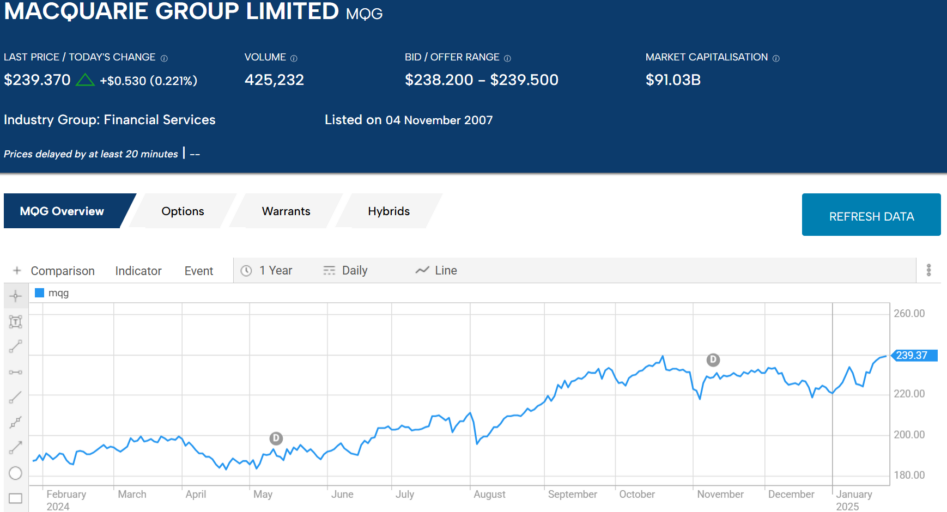

Macquarie Group Limited (ASX: MQG)

Macquarie Group has the distinction of being Australia’s sole investment bank with an international presence, operating in 34markets. Macquarie has four operating business units – banking and financial services, asset management, commodities andrenewable investments. Macquarie targets the infrastructure, energy, technology, and commodities sectors. oOne of Macquarie’s principal reasons for considering the company as a potential best financial and banking stock to buy is the company’s geographical and operational diversification.

Troubles in the banking sector appear to be a thing of the past at Macquarie, finishing the second half of calendar year 2024 with a strong upward trend, now up 28.2% year over year.

Source: ASX Website

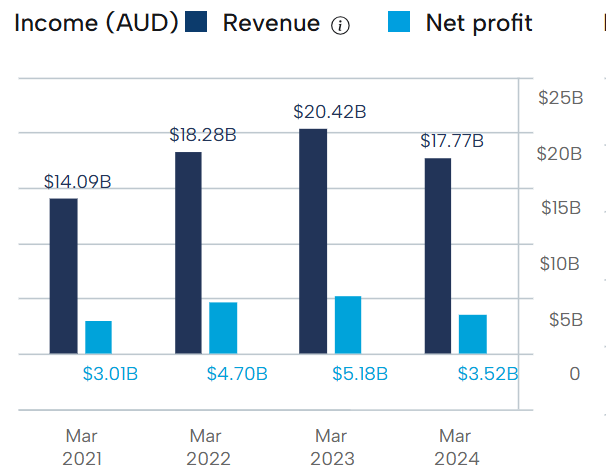

The company’s financial performance took a slight dip in FY 2024 following a strong recovery from the impact of the COVID 19 Pandemic.

Macquarie Group Financials

Source: ASX Website

Half Year 2025 financial results continued the positive trend, with revenues up 3.8% and net profit up 14.7%.

The consensus analys estimate from marketscreener.com is OUTPERFORM, with 4 analysts at BUY, 1 at OUTPERFORM, 4 at HOLD, 1 at UNDERPERFORM, and 1 at SELL.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2025.

We’re giving away this valuable research for FREE.

Click below to secure your copy

Medibank Private Limited (ASX: MPL)

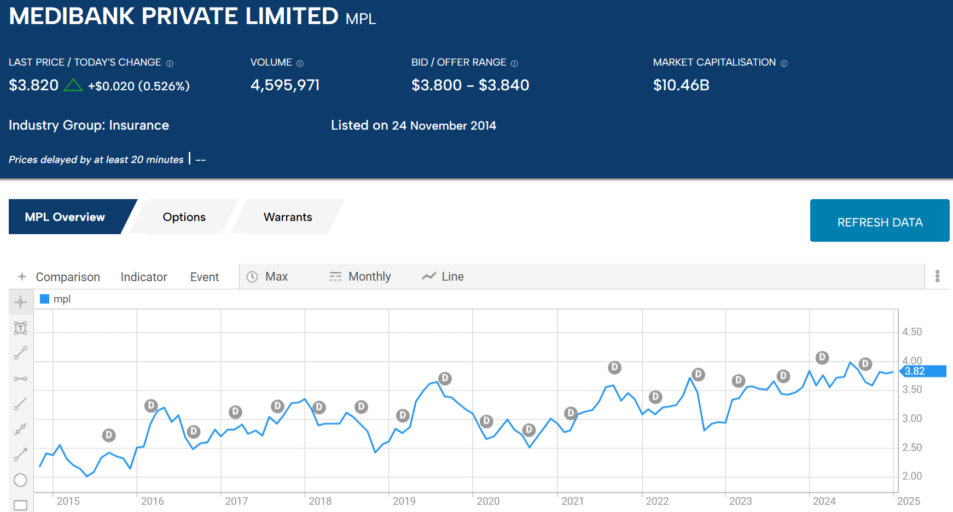

The federal government privatized Medibank in 2014 and the share price of the now publicly traded health insurance and treatment provider is up 76%% since listing, making dividend payments every year. The five-year average dividend yield is 4.12%.

Source: ASX Website

In addition to its insurance for hospitalisations and ancillary medical issues from dental to optical to physical therapy, the company offers a variety of healthcare treatments and healthcare management services.as well as temporary insurance for overseas students and visitors.

Medibank has two operating segments – Health Insurance and Medibank Health. The company adds pet, travel, and life insurance to its range of offerings.

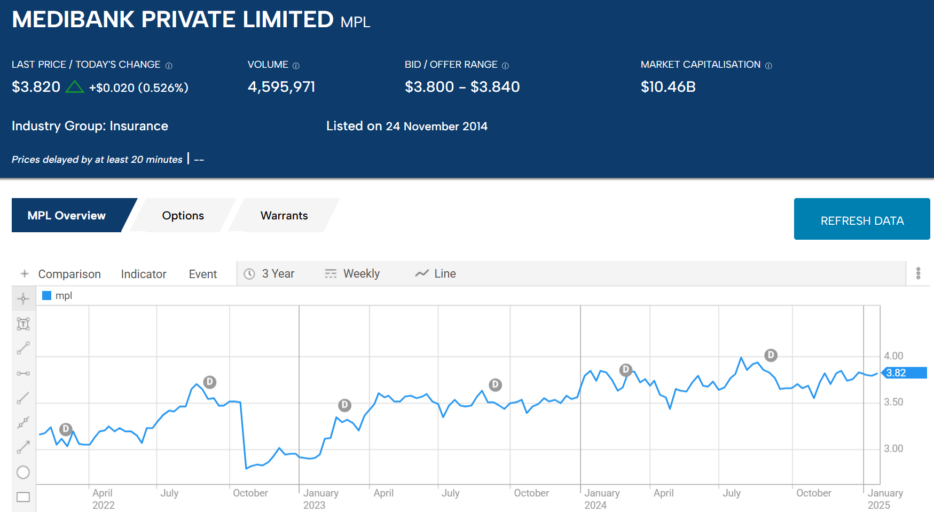

By the end of October of 2022, a series of announcements from the company regarding a hack of its data bases ended in the unwelcome news that hackers had accessed all of the personal data of Medibank Private health insurance customers and “significant” amounts of health claims data.

The stock price plunged, but despite the company’s warning of the potential negative impact on upcoming financial performance, by mid-April of 2023 MPL shares had returned to pre-announcement levels.

Source: ASX Website

Over the last four fiscal years, the company has a solid track record of financial performance.

Medibank Private Financial Performance

Source: ASX Website

Marketscreener.com has a consensus OUTPEERFORM rating on MPL shares, with 3 analysts at BUY, 1 at OUTPERFORM, and 7 at HOLD.

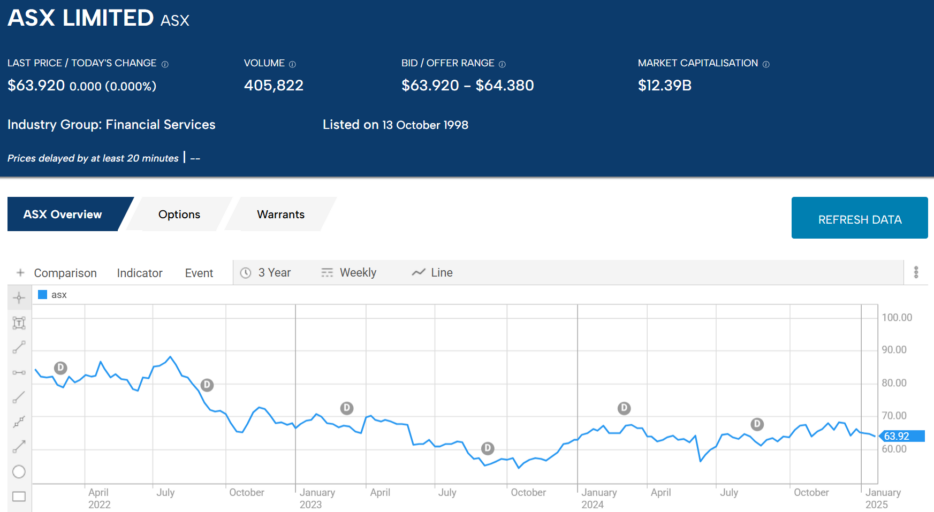

ASX Limited (ASX: ASX)

Given the volatility in markets,, how could ASX stock possibly be seen as a potentially best financial stock to buy?

The ASX operates and manages the only major stock exchange in Australia, with an international reputation. ResMed Inc (ASX: RMD) Is one of man blue-chip US companies who have chosen to list on the ASX. Demand for stock trading has never and never will evaporate, even during the hardest of economic times. Investors may sell more than they buy, but trading goes on.

The ASX has minimal competition and the massive “barriers to entry” virtually assure it never will, but the ASX is at moderate risk from regulators seeking to break its virtual monopoly on the clearing and settlement functions. . ASX manages all aspects of equites, debt securities, derivatives, and investment funds.

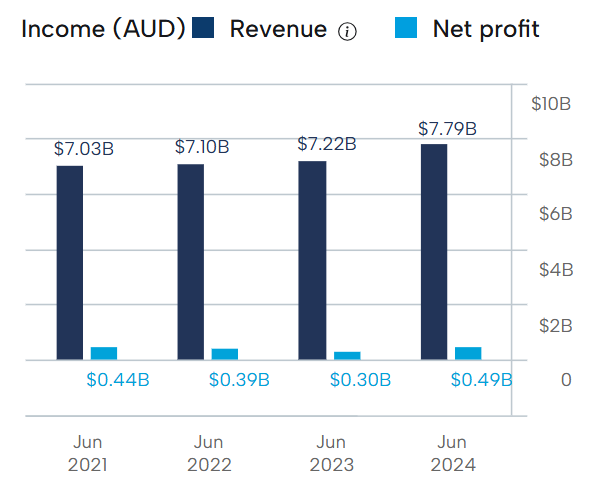

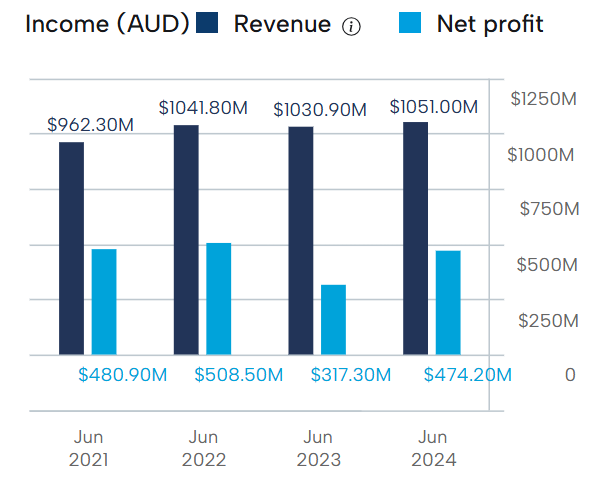

FY 2023 net profit suffered from one-off charges related to the CHESS (Clearing House Electronic Subregister System) replacement program, but performance rebounded strongly in FY 2024.

ASX Financial Performance

Source: ASX Website

The share price began a gradual climb at the end of November of 2023 on the news the company had a vendor in place to restart work on the revised CHESS system, but remains down 23.3% over three years. Year over year, the share price is down 3.4%.

Source: ASX Website

For traders looking to invest in Australian financial and banking stocks the ASX offers four of the largest and safest banks in the world, along with major international and domestic insurance companies and a host of financial technology companies.

Both the banks and the insurance companies have a major advantage over many stocks in other sectors – the demand for banking services and home, auto, health, and other forms of insurance will never go away.

This is not the case with the financial technology sub-sector making these stocks less suitable to buy in challenging economic conditions.. Stick with the financially stable, low risk big banks and insurance companies.

FAQs

What Are Financial Stocks?

Financial stocks are shares in companies that offer financial services such as banking, insurance, loans, credit cards, payment services and more. The financial sector is a core part of the global economy so financial stocks should play a key part in any portfolio.

How Do I Buy Financial Stocks?

To buy financial stocks you will first need to open an account with a regulated australian broker . The majority will offer a wide range of financial stocks. You will then need to do your own research to determine which are the best for you to invest in.

Are Financial Stocks a Good Investment?

Any investment involves some degree of risk – prices can go down as well as up. However the financial sector is at the core of the global economy and is seen by many as a safer investment that other sectors. The financial sector is heavily regulated and has performed well over the past 30 years.