Risk averse investors in share markets in many cases rely on mutual or exchange traded funds managed by experts. The assumption behind this strategy seems obvious – experts have the training and the time to thoroughly research both macro and micro economic conditions and the markets in which the stocks they add and subtract from their manage portfolios operate as well as the fundamentals of the stock under consideration.

This is not to suggest investors with higher levels of risk tolerance do not ignore expert opinion from market and industry analysts when picking stocks for their self-managed portfolios.

Forecasting is a critical component of most economists and stock market and industry sector analysts. Cynics who scoff at the value of forecasts point to the multiple sources of quotes along the following lines , with the first credited to Nobel Laureate physicist Niels Bohr:

- Prediction is very difficult, especially if it’s about the future.

US author Mark Twain and American baseball icons Casey Stengel and Yogi Berra reportedly made similar comments.

Add to that the following observation from one of the most influential economists of the twentieth century – John Kenneth Galbraith, who said:

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

- There are two kinds of forecasters: those who don’t know, and those who don’t know they don’t know.

Yet these oft repeated bromides do little if anything to dampen the enthusiasm of so many investors for expert forecasts. Investors flock to sectors and individual stocks on the rise, backed by a boatload of positive expert opinion. When the experts are right, the search for some semblance of certainty is reinforced, and social scientists are now telling us humans have an innate craving for certainty. When experts get it wrong, many investors rationalise the misleading forecast with a multitude of reasons, most of them relating to events beyond the control of the forecasters.

On 16 December of 2022, an article appearing on forbes.com entitled “Why Market Predictions Are So Often Wrong” took an interesting turn on the right/wrong debate.

The article’s author cites the work of behavioral psychologist and management expert Philip Tetlock’s twenty years studying the predictive ability of experts in a variety of fields. In his 2005 book “Expert Political Judgment” Tetlock provided this startling metaphor by way of explanation:

- …imagine a bunch of chimpanzees throwing darts at a board full of predictions, with the hits beating the accuracy of the experts.

Sounds preposterous? A study comparing the predictive ability of laboratory rats with Yale undergraduates was conducted in the 1970’s. The rats predicted the side of a maze where a treat rested 60% of the time, while the students accuracy predictive rate was 52%.

Metaphors are not literally true, suggesting instead a comparison to explain an idea. In this case, “dart-throwing chimps” suggests the low probability of predictive success, particularly in situations where a complicated maze of factors can affect the outcome.

In reality, predictive forecasts from man or machine combine historical patterns with possible future outcomes, also involving a maze of factors. History is history, but even there, speculation about why what happened is needed and sometimes wrong.

Much of the future outcome analysis fails from totally unexpected events, like a pandemic or a war, and the natural predilection of humans for confirmation bias.

Confirmation bias is the human tendency to focus heavily on events that confirm existing beliefs and place little value on evidence that runs against those prevailing beliefs.

Actual market outcomes of many analyst predictions often raise the question of how experts could have gotten things so wrong, while others get it right. Investors and experts alike look for certainty in markets, forgetting that market activity has little certainly, with many situations arising when experts disagree. However, understanding that stock prices are not based in reality but rather in market perception of reality means that sentiment drives prices. Once negative sentiment gains a foothold, the outcome should be evident, but often isn’t.

The answer frequently lies in evidence experts undervalue or ignore in their analysis.

History is replete with examples. On the ASX, one of the most glaring is the fall and rise again of hearing implant provider Cochlear Limited (COH).

Experts piled on the stock with downgrades and negative predictions about Cochlear’s future following the company’s voluntary recall of a promising product, pointing to losing market share. The prediction proved dead wrong in short order, as the company was able to regain lost market share and has continued to outperform to this day.

At the time there were some who cautioned investors interested in rolling the dice on Cochlear shares to consider the company’s capacity to rebound. Some experts got it wrong and others got it right, predicting a recovery in the near term.

Investors taking the time to research what happened in hindsight can point to the failure of most experts to understand that physicians’ were and remain the gatekeeper for the company’s products. Cochlear had earned the loyalty of the Doctors who recommend the proper hearing implant to their patients. Patients rarely go to their physicians and ask for a specific implant. The Doctors choose.

In addition, Cochlear was still the market leader with a reputation for continuous innovation. It took time, but investors who bought in during the declining period were rewarded.

Right now investors have an opportunity to benefit from a wave of analyst predictions that history suggests could go wrong. Forecasting the mining sector outcomes is arguably more fraught with risk than other sectors because of the delicate balance between resource supply and demand.

The classic example is the much ballyhooed “death of the mining boom” predicted more than a decade ago. The story seemed simple enough – exploding Chinese demand for Australian iron ore to meet China’s seemingly insatiable demand for steel faded away. Without the very demand that led to the boom it seemed logical that the boom would go on life support. While the supply/demand balance over time improved enough to resuscitate iron ore mining stocks, it remains volatile.

Today a new opportunity for investors willing to learn from the iron ore predictions has arisen with lithium miners

In 2018 experts en masse predicted dire days ahead for the much touted rising demand for lithium, as evidenced by declines in the price of lithium.

They were spectacularly wrong as through the end of 2022 the price exploded. Experts are again predicting declines in lithium price, impacting many once star lithium miners on the ASX. The culprit often mentioned for the negative coverage was the situation in China, where the reemergence of COVID was lowering demand for lithium. China remains the world’s largest producer of Electric Vehicles (EVs) and lithium batteries.

In the iron ore situation, some analysts downplayed the significant difference in the impact on big cap iron ore miners and their much smaller brethren.

It seems history may be repeating itself. Led by Goldman Sachs, analysts and mining industry experts are predicting continued declines in lithium pricing, and lithium mining stocks. Reasons for the drop in mining providers range from excessive valuation in the lithium price run up to expected oversupply conditions stemming from China’s latest COVID spread crushing lithium demand. This despite the fact others claim that lithium has room to run.

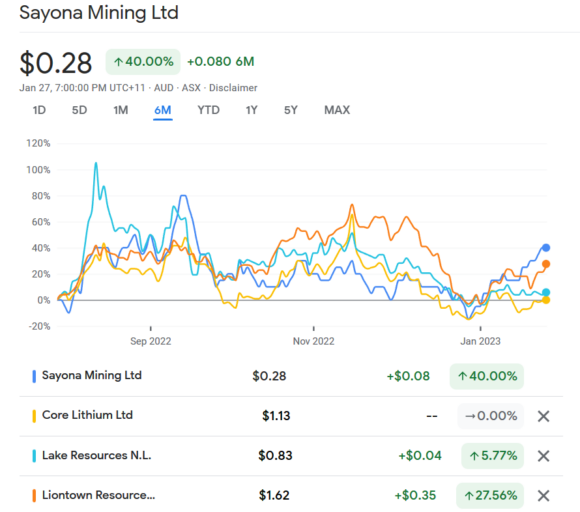

On 27 January, moneymorning.com.au published its list of the most shorted stocks on the ASX, with development-stage lithium miners taking four of the top ten spots:

- Sayona Mining (SYA)

- Core Lithium (CXO)

- Lake Resources (LKE)

- Liontown Resources (LTR)

From Google finance, here is a six month year price movement chart for the four prospective miners, reflecting the time line when lithium miners began their decline.

The share price of three of the four has begun to rebound in the first month of trading in 2023. The five year price movement of the two biggest lithium miners on the ASX – Pilbara Minerals (PLS) and Allkem Limited (AKE) , along with the world’s largest lithium miner Albemarle Limited (NYSE: ALB) shows the full pattern, from the declines starting in 2018 to the rebound starting in 2021.

As is often the case with mining stocks, the play for the risk averse is not the gleaming prospect of the commencement of production from a development stage miner, but a miner already producing.

Pilbara and Allkem meet that standard, ready to profit from the optimistic outlook out of Albemarle in the company’s quarterly update for September, raising its estimate of global lithium consumption of 1.8 million tonnes by 2025 to 3.7 million tonnes by 2030.

Lithium comes from two sources – hard rock mining and evaporating salt brine ponds. Allkem came into being through the merger of two ASX listed producers that combined their production sources into the single entity. Galaxy Resources had hard rock assets in Australia while Orocobre had lithium brine assets in Argentina’s area of the South American “lithium triangle.”

While Goldman Sachs remains the principal Bear on the price of lithium in 2023, the bank is bullish on Allkem shares, buoyed by Allkem’s latest quarterly update highlighting record lithium carbonate production from the company’s Olaroz operations in Argentina. Olaroz led the company to record revenues. In a sign supporting the merger move, the Olaroz revenue was high enough to make up for the revenue decline in the Australian hard rock operation at Mt. Cattlin.

Management outlook for the remainder of FY 2023 and beyond remains positive. At the close of the year Allkem successfully completed the sale of its boron mining subsidiary company Borax Argentina and acquired lithium producer Maria Victoria. In addition, Allkem announced the first production of lithium hydroxide at the company’s Naraha Lithium Hydroxide Plant, a JV with a subsidiary of Toyota Motors, located in Japan with Allkem holding the majority 75% interest in the JV.

Despite the remaining specter of COVID 19 early in FY2022. Allkem turned in astounding full year results, with revenues rising 808% and net profit after tax (NPAT) up 1,000%.

Pilbara Minerals in FY 2022 saw a 574% increase in revenue and a profit turnaround from a FY 2021 loss of $51.4 million dollars to a profit of $561.8 million dollars in FY 2022.

The company’s claim to fame is its 100% ownership of the world’s largest independent hard rock lithium mining operation – the Pilgangoora Project, consisting of lithium and tantalum mining along with two processing plants. Tantalum is a rare mineral used in electronic components.

Pilbara’s growth trajectory includes expanding mining operations at Pilgangoora and diversifying into the refining segment of the lithium supply chain. Pilbara has a JV project in place with South Korean steelmaker POSCO – the POSCO Pilbara Lithium Solution. For an 18% interest in the JV and the potential to increase its stake to 30%, Pilbara will supply 315,000 tons of hard rock lithium ore annually, which will be refined at the JV plant in South Korea to supply 40,000 tons of lithium hydroxide for end-use in lithium batteries for Electric Vehicles (EVs.)

The company is also working with ASX listed clean technology company Calix Limited (CXL) to develop a demonstration plant for the refinement of raw lithium ore from Pilgangoora mines into a concentrated lithium salt product for use in lithium battery electrolytes using a new refining technology developed by Caltex.

Pilbara has six analysts covering the stock with 2 STRONG BUY recommendations; 3 BUY recommendations, and 1 HOLD recommendation.

Citi is the only brokerage house initiating coverage on Allkem since the completion of the merger completion in November of 2021. The current recommendation is BUY