Regular followers of market news know that one of the unanticipated outcomes of the COVID 19 Pandemic was a stunning increase in the number of people investing in share markets in much of the world, particularly among the young.

Professional financial services providers noted the need for educating the newcomers with companies like CBA’s (Commonwealth Bank of Australia) stepping up with stock trading education through their online investing platform, CommSec. Investors can go to commsec.com.au, click the EDUCATION button to find a comprehensive introduction to market investing at CommSec Learn.

Couple this kind of educational exposure with daily following of rising and falling stock prices leads novice investors to learn news drives share prices, both up and down.

And within the broad category of news, the “wheat” remains financial reporting announcements, not to be conflated with the “chaff” announcements of newcomers to a company’s boards.

Financial reporting includes the annual and bi-annual revelations of company revenues, profits, expenses, and a host of other measures. From time to time companies will issue trading updates about conditions that might impact future earnings reports, usually in the form of revising upward or downward financial guidance previously issued by the company.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

The first exposure for newcomers to either a trading update or a formal financial report can be a revelation. One would assume that positive results drive share price upward and negative results drive share price downward. From time to time, earnings “surprise” the market when analyst expectations are not met, with the company performing better or worse than expectations. The assumption is the same, in spite of the surprise – positive earnings announcements will result in positive share price appreciation.

As newcomers learn this is not always the case. Pre-announcement coverage of expectations can influence post announcement investor behavior more than the results themselves.

On 9 February, two ASX listed stocks that were highly impacted by the pandemic reported earnings.

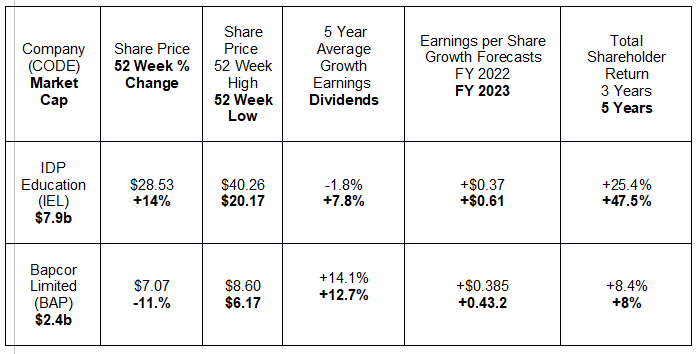

International education services provider IDP Education (IEL) and automotive parts, supplies, and services retailer Bapcor (BAP) both reported earnings on 9 February of 2022. COVID related travel restrictions and lockdowns impacted earnings for both companies in FY 2021.

IDP’s revenues declined from $587 million dollars in FY 2020 to $527 million dollars while net profit dropped from $67 million to $39 million.

In sharp contrast Bapcor increased both revenue and profit but cautioned on forward guidance, stating financial performance in FY 2022 would “at least match FY 2021 results.

The caution now appears to have been well-founded as restrictions and lockdowns caught up with the retailer in the first half of FY 2022. The February announcement showed revenue growth shrinking to an increase of 1.9%, with Bapcor management citing COVID lockdowns. Net profit after tax (NPAT) dropped 13.7% compared to the first half of FY 2021.

IDP’s results were another study in contrast. Revenues increased 47% while NPAT rose 70%. The surprise for newcomers expecting Bapcor’s share price to decline while IDP’s rose? A picture is worth a thousand words. From the ASX website:

Trying to make sense of investor reaction to financial news is at best sheer speculation, but there are some factors that could come into play.

In IDP’s case, some analysts expected more from the company, as IDP’s international operations were dramatically improving in countries in the Northern Hemisphere where the pandemic was beginning to show signs of easing. Student placements in IDP’s “multi-destination” category were up 73% in the period compared to the same period last year, while in Australia placements declined 5.7%.

Both companies reported strong performance from segments of their business operations and both made significant acquisitions. Both companies have revenue generating assets outside their core businesses.

IDP owns the world’s most used test of English language proficiency – IELTS (International English Language Testing System.) To gain entry into any university or college anywhere in the world where English is the language of instruction, prospective students must take a test like IELTS.

In addition to retailing and wholesaling automotive parts here in Australia and throughout the Asia Pacific Region, Bapcor operates more than two hundred branded automobile service centres here in Australia and in New Zealand.

The following table includes price movement information as well as historical earnings and dividend performance and future growth estimates for the two companies.

IDP’s historical performance bests that of Bapcor and has the future benefit of removal of travel restrictions added to the removal of lockdowns which will benefit both companies.

The IDP website is already posting “Welcome Back” notices for international students who can return to study at an Australian University.

Investors who have been in the game for awhile are less likely to be surprised by seemingly contradictory share price moves than newcomers. Two companies recently reporting earnings and one announcing revised guidance provide examples.

Tech stock Megaport (MP1) flipped the switch on the traditional SaaS (software as a service) business model, creating software driven networking as a service. The brainchild of noted Aussie tech innovator Bevan Slattery, the Megaport SDN (software defined network) makes use of “cloud base models” to create what the company calls “elastic interconnection services for their customers.

For the Half Year 2022 the company reported a 42% increase in revenue, with all of the company’s markets served – Asia Pacific, North America, and Europe – showing positive revenue increases. Megaport reduced its net loss from $38 million dollars in the Half Year 2021 to $18 million this year, a 47% improvement. Profit after direct costs rose 69%.

The share price shot up, only to drop the day after the release as major analyst firms began to weigh in. One was lukewarm, at best, while the other was bullish.

The following price movement chart shows the immediate “before and after” for Megaport and a big name in stocks, both here and in the US – James Hardie Industries (JHX).

James Hardie makes fibre cement backboards and siding, with operations in North America, Europe, and in the Asia Pacific Region, primarily here in Australia, New Zealand, and the Philippines. The pandemic hit the company hard, with revenues declining from $4.2 billion in FY 2020 to $3.8 billion in FY 2021, while profit fell from $391 million to $345 million.

Hardie reported its financial results for Q3 of FY 2022, with global net sales rising 22% over the same period in FY 2021. Adjusted net income rose 25% and earnings before interest and taxes (EBIT) were up 22%.

Hardie chose to raise its guidance for the Full Year 2022, ending on 31 March of 2022. Prior guidance called for adjusted net income coming in between USD$605 million dollars and $625 million. The upward revisions to the guidance now expects adjusted net income of USD$620 million and $630 million.

Hardie was confident enough that growth in its operating markets was sustainable for management to raise guidance for FY 2023 as well. The forecast for adjusted net income in FY 2023 is between USD$740 million and $840 million.

Given the hesitancy of so many companies around the world to issue guidance, extending its forecast to 2023 speaks to the confidence this management team has in its operations.

Management did caution that unanticipated changes to the COVID 19 pandemic could alter the guidance.

Since guidance looks to what newcomers to investing read that the market is all about – the future not the past – some might expect this kind of revision would send the stock price into an upward trajectory. The price movement chart above reinforces what experienced investors know to be true – nothing in share market investing is certain. The JHX share price has fallen below its pre-announcement level.

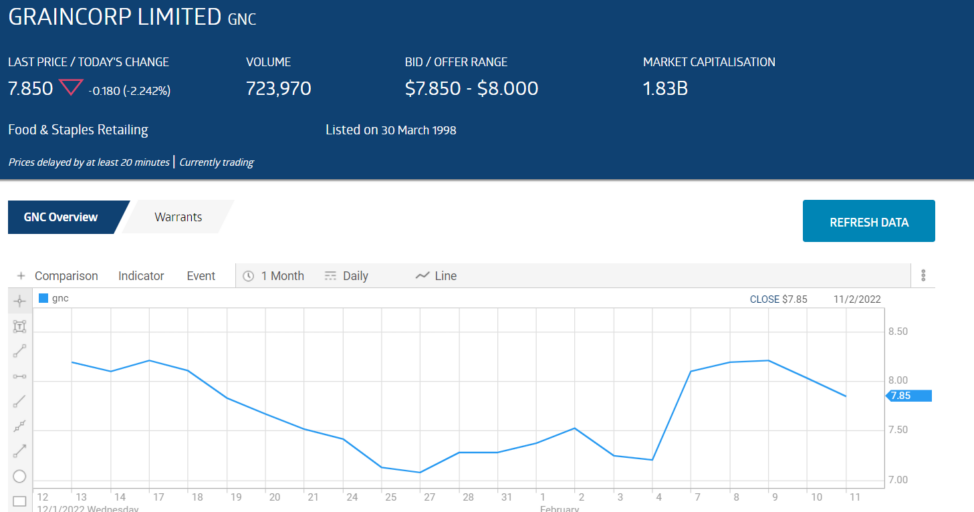

One final announcement can reinforce that case. On 6 February GrainCorp Limited (GNC) revised its guidance. The company has been in business for more than a century, providing a global supply chain to process, store, and manage the distribution of grains and edible oils produced by its customers. GrainCorp manages wheat, barley, sorghum, corn, oilseeds, pulses, and organics.

Given the coverage of supply chain disruptions in the business press, upward revisions might have come as a surprise to some investors expecting the company to revise its guidance downward. However, GrainCorp effectively managed its own supply chain and revised its FY 2022 guidance upward. In FY 2021 the company reported NPAT of $139 million dollars. GrainCorp is now forecasting NPAT between $235 million and $280 million dollars, potential gains of 69% to 101%.

Global share markets are stuttering a bit, with the tech sector in steep decline. What GrainCorp does is make the building blocks of food available, yet the share price followed the lead set by James Hardie, and after a momentary uptick, is now trading below the pre-announcement price. Surprise, surprise!