Aussie investors who may wish to restrict their portfolio to the safety of “homegrown” Australian companies have limited choices. The world’s largest economy – the United States – offers a virtually unlimited cornucopia of companies of all sizes and sectors from which to choose.

Behind the US economy stands China – not only the world’s second-largest economy now, but the economy once considered likely to overtake the US. How to buy Chinese stocks in Australia is a question many investors looking for global exposure might ask.

Australian investors accustomed to the ease of trading and the transparency of company information for ASX and US stocks on the NYSE (New York Stock Exchange), the S&P 500, the NASDAQ, and other minor exchanges can expect challenges in navigating the Chinese Stock Market.

The first is the difference between Chinese A shares and B shares. The A shares trade in the Chinese renminbi and are restricted to domestic investors; B shares settle in US dollars when purchased at either of two main Chinese exchanges – the Shanghai or the Shenzhen. B shares traded on the Hong Kong Exchange settle in Hong Kong dollars.

How to Buy Chinese Stocks

Beginning in 2003, the Chinese government started offering programs allowing institutional investors in Chinese A shares. In 2014, a “Stock Connect” program linking the Hong Kong Exchange to the Shanghai and Shenzhen exchanges opened the trading door for retail investors via qualified brokerage houses.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Australian investors seeking to avoid the risk of investing in individual stocks have a variety of Chinese exchange-traded funds (ETFs) from which to choose to diversify an investment. Now there are two options for how to buy Chinese shares in Australia – individual stocks via a brokerage house with access to one of the Stock Connect programs or exchange traded funds.

Chinese Stocks on US Exchanges

Australian brokerage accounts with access to US exchanges make buying popular Chinese stocks as easy as buying US stocks. Chinese tech stocks may have slipped since the government cracked down on the sector beginning in 2020, but most have rebounded with the government easing the pressure. Among the hardest hit were Tencent, JD.com, and Baidu.

Source: CNBC.com

Chinese Stock ETFs on the ASX

Aussie investors do not need to turn to brokerage houses with access to US-listed ETFs. While some brokerage houses may not charge commissions for trading US stocks, other fees can eat into the final return on investment, making ASX-listed China ETFs potentially a more cost-effective choice. Four major China-related ETFs are trading on the ASX:

- iShares China Large-Cap (ASX: IZZ)

- VanEck FTSE China A50 (ASX: CETF)

- VanEck China New Economy (ASX: CNEW)

- Betashares Asia Technology Tigers (ASX: ASIA)

iShares China Large-Cap (ASX: IZZ)

IZZ mirrors the US-listed iShares China Large-Cap ( NYSE: FXI), with 97.97% of its holdings matching the FXI. Both track the performance of 50 of the largest companies in China’s FTSE 50 (Financial Times Stock Exchange), drawing from both the Shanghai and the Shenzhen exchanges, while trading on the Hong Kong exchange.

The top ten holdings include consumer discretionary stocks Alibaba, Meitun, and JD.com; communication stocks Tencent Holdings, NetEase, and Badu; financial stocks China Construction Bank, Industrial and Commercial Bank of China, the Bank of China; and the final Top Ten holding technology stock Xiaomi Corporation.

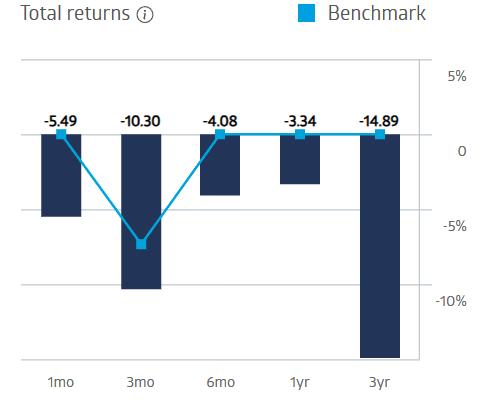

Total returns for ETFs include the share price, dividends, and distributions to shareholders. When the share price does not keep up with dividends and distributions, the total return to investors is negative.

IZZ Total Returns Performance

Source: ASX

VanEck FTSE China A50 (ASX:CETF)

The VanEck China A50 is the doorway for Aussie investors to gain exposure to China’s top 50 A shares. Given that Chinese A shares are available individually to Chinese investors, the holdings are most likely to be unfamiliar to Australian investors, including companies like top holding Kweichow Moutai Co Ltd. Financial holdings like China Merchant Bank, Agricultural Bank of China, and Industrial and Commercial Bank of China might be vaguely familiar.

The sector weightings for CETF are led by consumer staples at 30.6%, followed by financial at 29.3% and industrials at 10.6%.

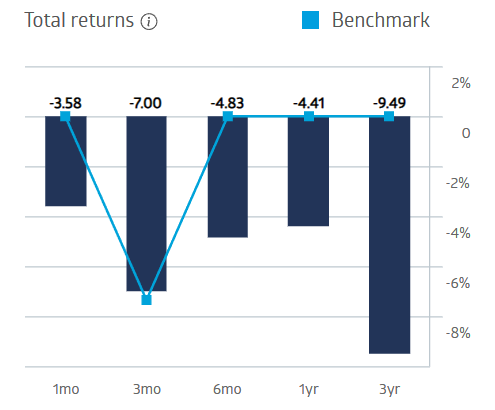

VanEck FTSE China A50 Total Returns Performance

Source: ASX

VanEck China New Economy (ASX: CNEW)

China is reportedly in the process of migrating towards a “New Economy,” promoting growth in the services sectors. CNEW has assembled a portfolio of companies targeted for growth in the technology, healthcare, consumer staples, and consumer discretionary sectors.

The portfolio of holdings was drawn from Shanghai and Shenzhen A Shares without posting losses over the past two years, along with a MarketGrader grade based on 24 fundamental indicators.

In addition, portfolio holdings must have a minimum market cap of $500 million USD and a liquidity measure of a minimum three-month daily traded value of $5 million USD.

Sector weightings are heaviest on pharmaceuticals and biotechnology stocks (21.2%), food and beverage stocks (19.8%) and technology hardware and equipment stocks (10.9%).

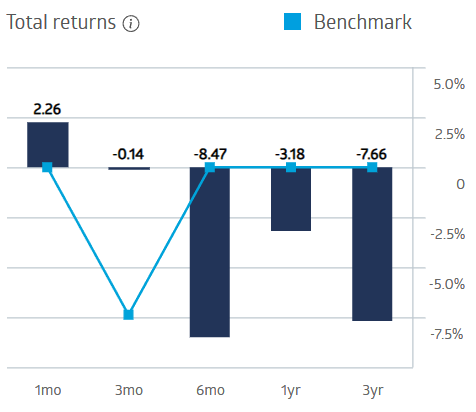

CNEW Total Return Performance

Source: ASX

Betashares Asia Technology Tigers (ASX: ASIA)

Betashares Asia Technology Tigers’ portfolio includes the largest of the top 50 technology and online retail companies in Asia, outside Japan.

In addition to Chinese companies Baidu, Tencent, JD.com, NetEase, and Alibaba, the portfolio’s two largest holdings are Samsung Electronics (11.4%) and Taiwan Semiconductor (10.8%).

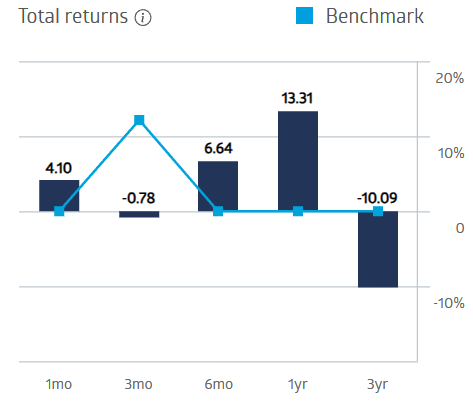

Betashares Asia Technology Tigers Total Return Performance

Source: ASX

The Pros and Cons of Trading Chinese Stocks

The Chinese economy has underperformed since COVID-19, yet two of the four ASX China ETFs have seen positive share price appreciation over the past five years.

Source: ASX

However, the Chinese rise to the top of the heap of global economies is waning. It is struggling and facing significant structural headwinds; among them is an economic growth model mainly based on abundant cheap labour to fill low-paying manufacturing jobs.

Cheap labour turned China into the “world’s factory”. Now, those manufacturers that flocked to China are bailing in search of even cheaper labour. The once booming Chinese economy has led to higher wages, accentuated by fewer workers entering the labour force, partially due to China’s past “one child” policy.

Although accurate statistics on various issues are hard to come by out of China, a decade ago, research from Bank of America/Merrill Lynch claimed the labour wage rate in Mexico had dropped from three times the rate in China ten years before to one-fifth lower.

Wages in China had reportedly risen to around $6.00 per hour by 2020, compared to about $2.00 per hour in Mexico. Financial news in recent years is replete with stories of companies seeking cheaper labour in Vietnam, India, and elsewhere.

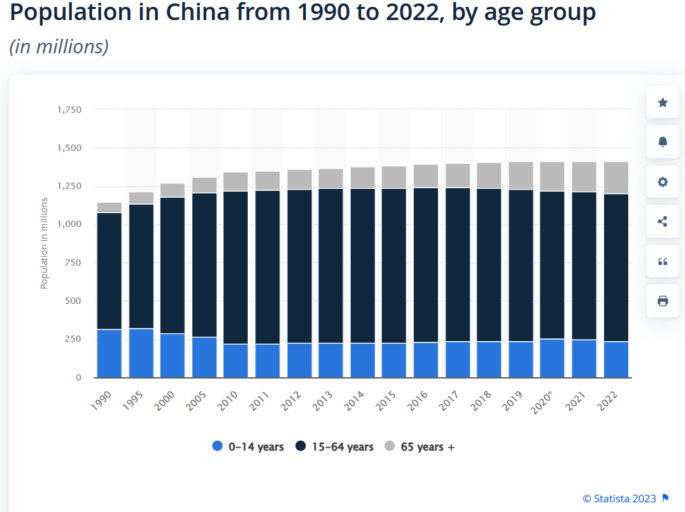

The Chinese demographics that once seemed to guarantee an endless source of labour face major headwinds. China is an aging country with population growth in the wrong age groups.

Source: Statista

The only demographic group showing growth over the last three years is the 65+ group. China’s total population in 2022 saw its first decline since 1961, with the birth rate dropping to a record low.

Although there is no lack of “doomsayers” flocking around what appears to be China in irreversible decline, the country still has advantages to attract investors. While China’s status as the world’s factory is declining, the sheer size of the country’s population could see its transition from “factory for the world” to “marketplace for the world.”

Popular Chinese Stocks

Some of China’s most popular stocks are available as individual investments and in Chinese ETFs like IZZ, CETF, and ASIA.

Baidu, one of the largest internet companies in the world, is moving into Artificial Intelligence (AI).

Alibaba and JD.com are two of the largest eCommerce companies in the world.

Tencent Holdings is the world’s largest video game company and a major multimedia and technology business.

The share price of all four has languished in 2023.

Source: CNBC.com

Trade Chinese Stocks with Top Australian Brokers

Both IG Markets and Interactive Brokers are reputable sites for how to buy Chinese A shares in Australia. They offer ETF trading and cutting-edge trading platforms to aid the buying and trading of Chinese shares.

Conclusion

Given the relatively small size of the ASX compared to US and Chinese stock exchanges, Australian investors seeking global equity exposure need to look outside the ASX. Investing in US stocks may be more costly than investing domestically, but it can be done easily.

In sharp contrast, how to buy Chinese stocks in Australia can be a complicated matter, especially for “stock pickers” – investors who choose to build their own portfolios.

Some Chinese shares are restricted to Chinese investors, but Aussies can get access, with ETFs being the most straightforward answer to the issue of how to buy Chinese stocks in Australia.

Popular Chinese stocks Baidu, Tencent, Alibaba, and JD.com are included in the portfolios of most China ETFs on the ASX:

- iShares China Large-Cap (ASX: IZZ)

- VanEck FTSE China A50 (ASX: CETF)

- VanEck China New Economy (ASX: CNEW)

- Betashares Asia Technology Tigers (ASX: ASIA)