Humans have been gambling since we began gathering in groups, with hard evidence of gambling in China as far back as 200BC. In addition, there is ample evidence of strict regulations in an attempt to curtail gambling in ancient Rome, China, and in the Jewish Talmud.

The ASX gambling and gaming sector today includes solid companies trolling different paths towards capitalising on one of humankind’s oldest forms of entertainment. There are the haunts of the extraordinarily rich filled with games of chance of the mechanical and non-mechanical variety – the casinos. Local clubs and pubs today offer their patrons some of those same mechanical gambling machines.

Then there are the companies that design, manufacture, sell, and service those machines, many augmented by sophisticated software characteristic of the digital age. Some have jumped into what may be one the fastest growing business opportunities in the world today – video gaming.

Finally there are the traditional betting companies – from keno to lottery to horse racing.

Both risk tolerant and risk averse investors need to remind themselves when looking for the best that gambling in Australia is licensed and constantly under the watchful eye of federal, state, and local government officials.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Not even the game makers escape the scrutiny, with a government approved license to operate and manufacturing standards to maintain.

However, the game makers are not likely to run afoul of the regulators as have big name casinos, so the game makers may be the least risky in this high-risk sector.

Aristocrat Leisure (ASX: ALL)

Aristocrat Leisure (ASX: ALL) is the largest and most diversified game maker on the ASX. The company was listed in 1996 and has grown into a global leader in the game making industry, evolving to include software platforms, state-of the art game machines, and interactive mobile video games.

Aristocrat has turned its eye to the future, first moving into the red-hot video game industry and now with the formation of Aristocrat Interactive, a new operational unit combining two recent acquisitions – NeoGames and Anaxi. Aristocrat has a line of interactive games developed for a new category – “Real Money Gaming” which is exactly what it sounds like – the opportunity to win real money in an interactive game.

Aristocrat already has a deal in place with Caesar’s Sportsbook & Casino to offer Aristocrat’s RMG games on the Caesar’s Sportsbook platform. As of 7 May the company had a market cap of $ 25.4 billion dollars.

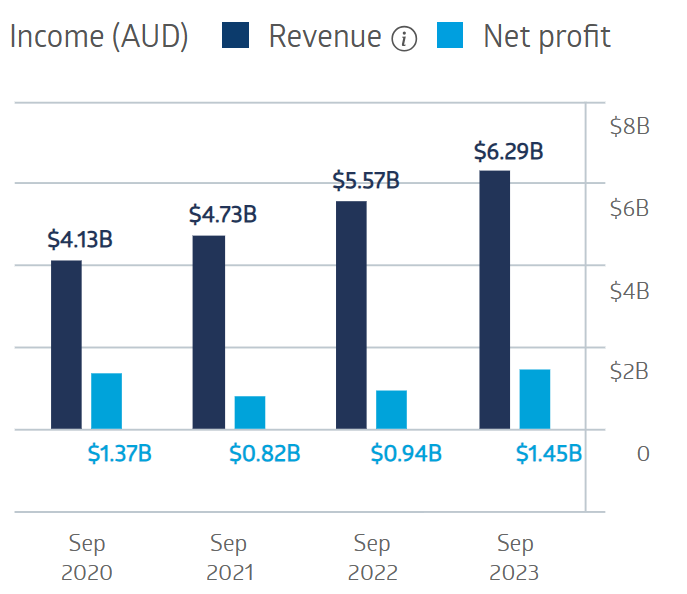

Aristocrat’s profits remained positive but slipped during COVID before rebounding in FY 2023 to eclipse pre-COVID profit.

Aristocrat Leisure Financial Performance

Source: ASX

Revenues were up 13% with net profit after tax up 53.3%. Dividend payments increased from $0.26 per share in FY 2022 to $0.34 per share. Aristocrat has a stellar record of share price appreciation and dividend payments over ten years.

Source: ASX

Aristocrat is nearing the end of a $1.5 billion dollar share buyback.

Light and Wonder (ASX: LNW)

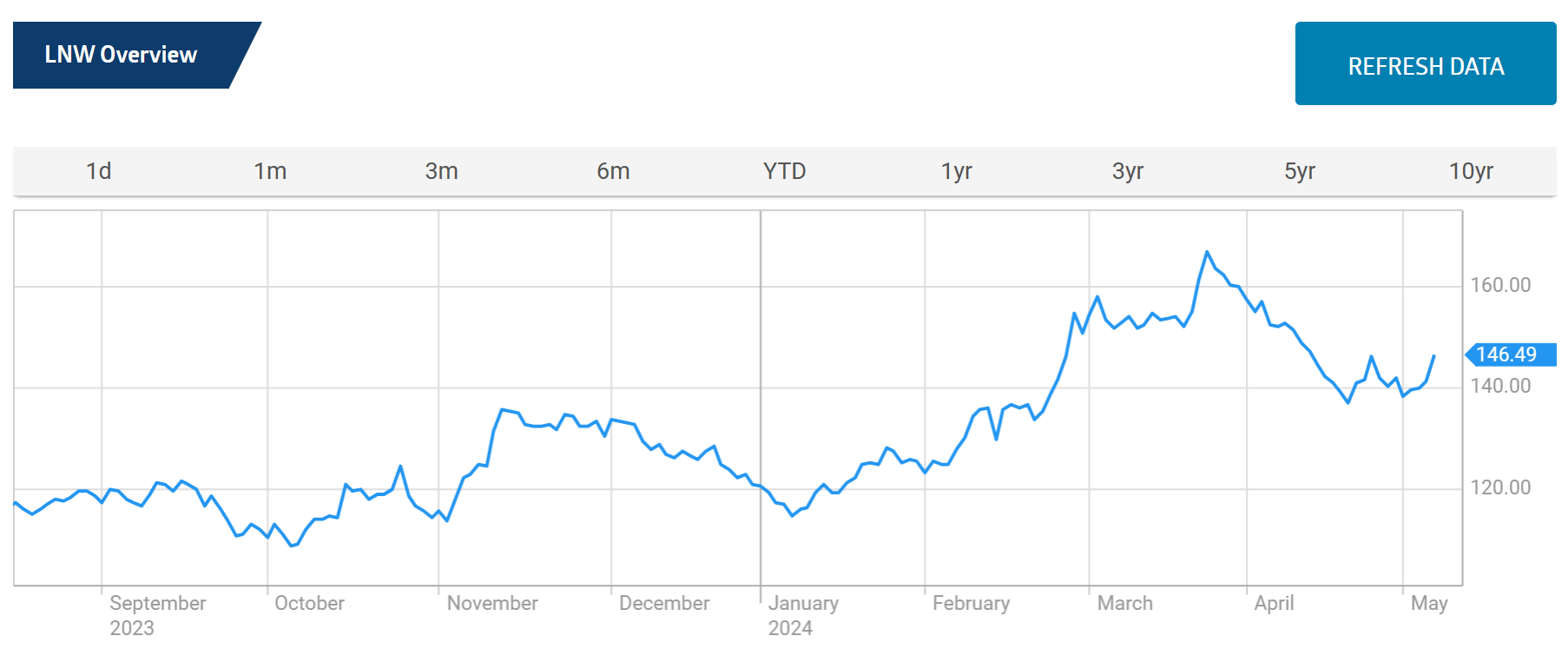

Light and Wonder (ASX: LNW) is a US-based company headquartered in gambling mecca Las Vegas, Nevada that opted to augment its US NASDAQ listing with a dual listing on the ASX. The company listed on 31 May of 2023, with the share price appreciating 60.9% as of 7 May of 2024. LNW’s market capitalisation is $13.2 billion dollars.

Source: ASX

Light and Wonder is a direct competitor of Aristocrat in the manufacturing of electronic gaming machines for casinos, clubs, and pubs. The company operates globally and along with Aristocrat is one of the top game makers in the world. Light and Wonder claims to be the world’s leader in internet gaming, or iGaming, dedicating an entire operating division to providing a wide range of fantasy franchises like Rainbow Frenzy and Into the Storm. SciPlay is the company’s third operating segment, providing web and mobile based social games.

For its fiscal year ending in December Light and Wonder reported revenues rising from $2.5 billion dollars in FY 2022 to $2.9 billion in FY 2023. Net profit swung up from a $176 million dollar loss in FY 2022 to profit of $180 million dollars in FY 2023.

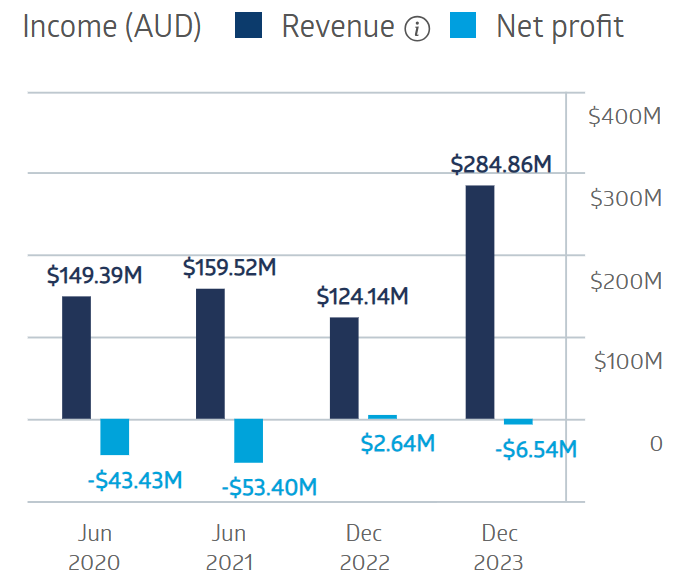

Ainsworth Game Technology (ASX: AGI)

Ainsworth Game Technology remains one of the world’s leading game makers, but its operations remains in the kind of big, high-tech electronic gaming machines found in casinos, clubs, and pubs. Lack of revenue from other gaming formats is reflected in the company’s financial results compared to rival Aristocrat.

Ainsworth Gaming Technology Financial Performance

Source: ASX

Light and Wonder, like Aristocrat, is looking to the future, expanding their operations into gaming formats not confined to physical space as is Ainsworth.

Analysts are equally bullish on Light and Wonder and Aristocrat. With eighteen analysts reporting the Wall Street Journal has an analyst consensus OVERWEIGHT rating on LNW, with twelve of the eighteen analysts reporting at BUY, five at HOLD, and one at UNDERWEIGHT.

The Journal also has an OVERWEIGHT rating on Aristocrat, with seven of the eleven analysts reporting at BUY, two at OVERWEIGHT, one at HOLD, and one at SELL.

Light and Wonder has yet to excite the appetites of Aussie investors, with a ninety-day average trading volume of 92,375 shares per day compared to Aristocrat’s 1,219,813 shares per day.

Tabcorp Holdings (ASX: TAH)

While conventional wisdom might suggest Tabcorp Holdings (ASX: TAH) as a candidate for a spot on your best gambling stock list due to its size and scope of involvement in a variety of betting opportunities, but the company’s recent financial and stock price performance suggests otherwise, at least in the short term.

Tabcorp Holdings Financial Performance

Source: ASX

The ASX website reports statutory net profit after tax, not underlying or net profit from operations. The FY 2022 profit reflected the proceeds from the company’s demerger of its lotto and keno businesses.

Year over year the TAH share price is down 35.6% and down 21.9% over five years.

Source: ASX

The Wall Street Journal has an analyst consensus rating of OVERWEIGHT on Tabcorp shares, with seven of the thirteen analysts reporting at BUY, two at OVERWEIGHT, two at HOLD, one at UNDERWEIGHT, and one at SELL.

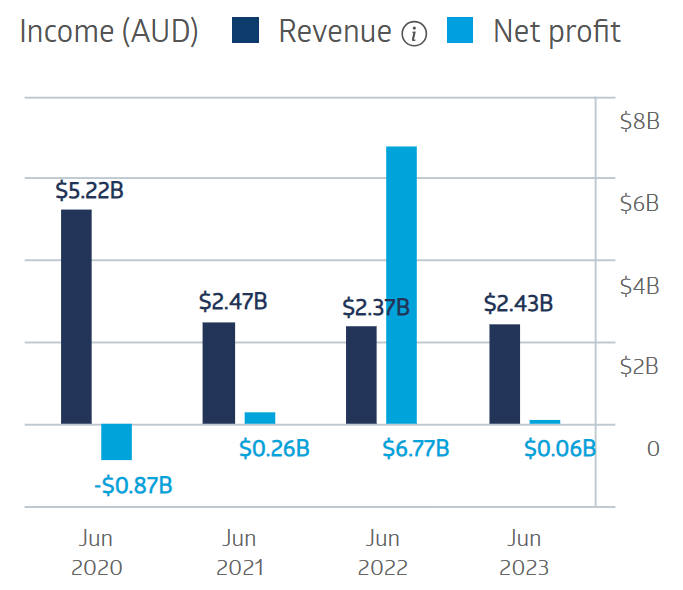

The Lottery Corporation (ASX: TLC)

Tabcorp shed its lottery and keno business into The Lottery Corporation (ASX: TLC), listing on the ASX on 23 May in 2022. TLC is the largest provider of lottery, Keno, and instant scratch products in Australia boasting exclusive and long-term licenses in all Australian states with the exception of Western Australia.

For the Half Year 2024 the company reported a 1.8% fall in revenue coupled with a 25.7% increase in net profit after tax. The company began paying dividends in FY 2023 with a 2.78% yield.

Source: ASX

The Wall Street Journal has an OVERWEIGHT rating on TLC shares with four of the sixteen analysts reporting at BUY, three at OVERWEIGHT, and nine at HOLD.

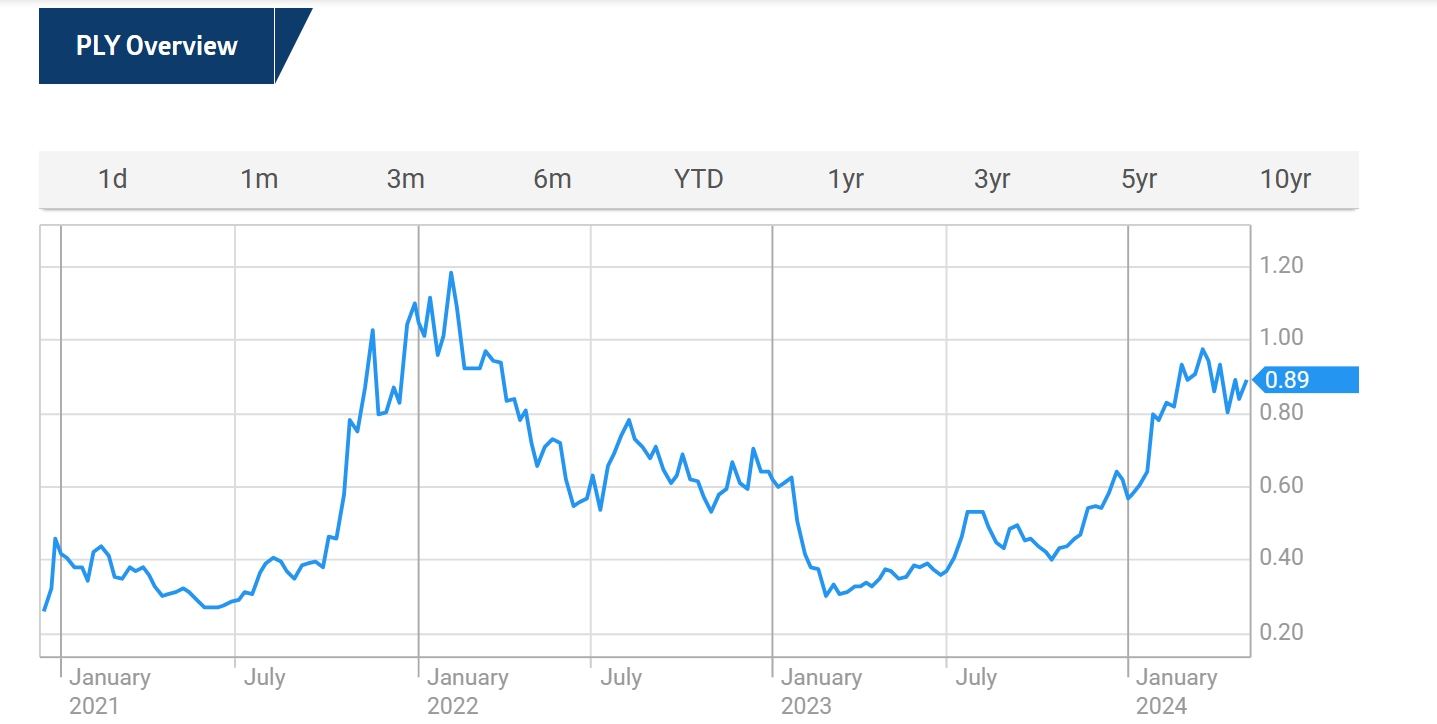

Listing in December of 2020, pure play video game developer PlaySide Studios (ASX: PLY) reported stellar Half Year 2024 results following a down year in FY 2023.

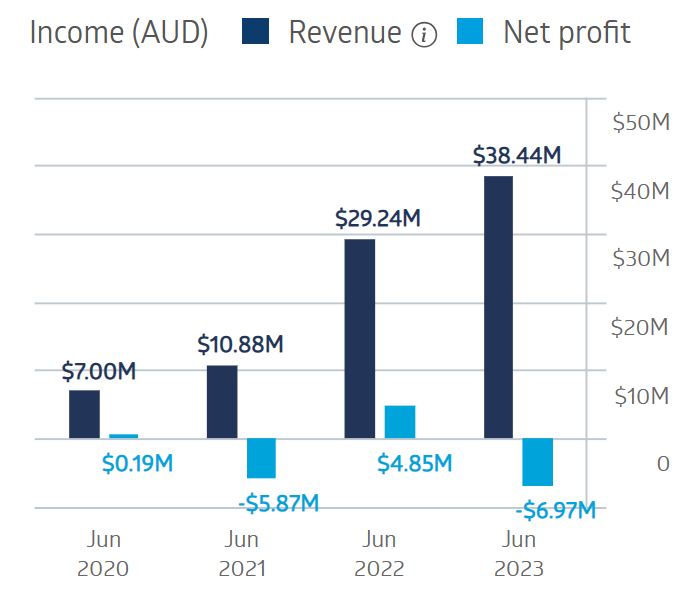

PlaySide Studios Financial Performance

Source: ASX

For the Half Year 2024 revenues rose 119% while profit from ordinary activities after tax increased 263%, following a posted loss of $5.4 million dollars in the Half Year 2023. Management attributed the results to its Dumb Ways to Die game going viral.

The company’s games span four platforms – Mobile, Virtual Reality, Augmented Reality, and PC. Marketscreener.com has a BUY rating reported by three analysts. Since listing on 31 December in 2020 the share price is up 93.4%.

Source: ASX

The history of gambling goes back to ancient empires and even beyond. Gambling is risky, as is investing in gambling and gaming stocks, as today there is a growing trend towards video games where money can be won. The risk for the purveyors of electronic gambling machines and some forms of video games is regulation.

Evidence suggests that both the Chinese and Roman empire enforced strict regulations on gambling in an effort to reduce the practice. Today the watchful eye of regulators at all levels of government are watching the gaming and gambling companies.