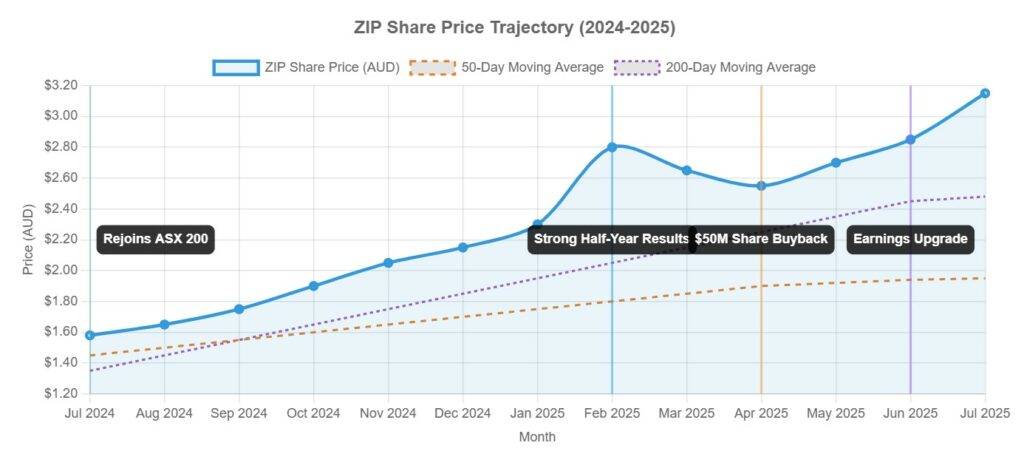

Zip Co Limited (ASX:ZIP) had been showing signs of a potential breakout, leading into today, before bumping into some resistance to the move at A$3.21 and making an about turn. As of today’s close, ZIP shares are trading at A$3.03, marking a 5.61% decrease on the day, with a retest of A$3.00. Despite today’s drop, the shares have gained 56.19% over the past month of trading, moving the stock into overbought territory.

ZIP’s recent success is underpinned by several key factors. A full-year earnings upgrade announced on June 11, 2025, projecting cash earnings before tax, depreciation, and amortization (EBTDA) of at least $160 million for FY 2025, aided a 19% jump in the share price.

This revision was largely attributed to strong performance in the U.S. market, where Total Transaction Volume (TTV) growth exceeded 40% year-on-year. Furthermore, the company’s strategic $50 million share buyback program, initiated in April 2025, boosted investor sentiment, resulting in a 20% share price increase. These initiatives reflect Zip’s commitment to enhancing shareholder value and signal a strong financial position.

Technically, ZIP’s current price is well above its 50-day (1.95 AUD) and 200-day (2.48 AUD) moving averages, indicating strong recent momentum. However, the Relative Strength Index (RSI) of 75.93 suggests the stock is currently overbought, which could trigger a short-term correction.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Despite these positive signs, Zip remains unprofitable, reporting a net loss of 46.37 million AUD over the last 12 months, with a loss per share of -0.04 AUD. While revenue for the last 12 months reached 951.74 million AUD, the path to sustained profitability remains a key focus for investors.

Zip Co had been displaying strong momentum and technical indicators that suggest a breakout was the target, with shares up 114.89% in 12 months. However, today’s move could be indicative of some near term profit taking, resistance being found, overbought conditions, and the company’s current lack of profitability.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2025.

We’re giving away this valuable research for FREE.

Click below to secure your copy