In a move poised to ripple through the Australian economy, the Fair Work Commission (FWC) has mandated a 3.5% increase to the national minimum wage, effective July 1st. This adjustment, raising the hourly rate to A$24.94, translates to an extra A$1,670 annually for the approximately 2.6 million Australians relying on the national minimum wage or award minimums. While the decision offers a much-needed boost to low-income earners, it also presents a complex challenge for businesses navigating a landscape of fluctuating inflation and evolving consumer behaviour.

The FWC’s decision arrives against a backdrop of moderating inflation, which clocked in at 2.4% for the year to the March quarter of 2025. This allows the 3.5% wage increase to represent a real salary gain of 1.1%; a welcome reprieve for workers who have endured a prolonged period of wage stagnation and erosion of purchasing power since July 2021. Proponents of the increase argue that it is a crucial step towards addressing the real wage losses of recent years and preventing the entrenchment of low-wage standards within Australian society. This decision was fuelled by the fact that inflation is coming down, this was a golden opportunity for wage reform. If this were not taken now, low standards could become entrenched in our society.

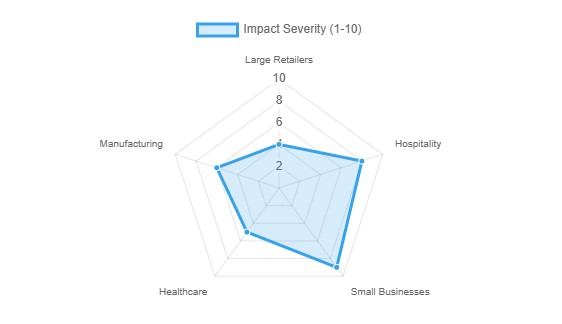

Winners and Losers from July’s Minimum Wage Increase

However, the wage hike is not without its potential pitfalls. The immediate concern for many businesses is the prospect of increased labour costs. While larger corporations, particularly in the retail sector, such as Woolworths (ASX: WOW), Wesfarmers (ASX: WES), and Coles (ASX: COL), may possess the capacity to absorb these costs or pass them on to consumers through carefully calibrated price adjustments, the situation is far more precarious for smaller enterprises and those operating within the hospitality sector.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

The hospitality industry, already struggling with rising operational expenses and supply chain disruptions, faces a significant test. Companies like Qantas (ASX: QAN) and Flight Centre (ASX: FLT), while not solely reliant on minimum wage employees, will still feel the impact across various roles. The fear is that these businesses may be forced to reduce staff, curb investment, or increase prices, potentially dampening consumer demand and hindering economic recovery.

Small and Medium Enterprises (SMEs), the backbone of the Australian economy, are perhaps the most vulnerable. With tighter margins and less flexibility than their larger counterparts, SMEs may find it exceedingly difficult to absorb the increased labor costs. This could lead to a cascade of negative consequences, including reduced hiring, increased prices that could alienate price-sensitive customers, and, in the worst-case scenario, business closures.

The Stock Market’s Reaction

The Australian stock market‘s initial reaction has been mixed, reflecting the uncertainty surrounding the wage increase’s long-term impact. While some retail giants have seen modest gains, buoyed by the expectation of increased consumer spending, companies in the hospitality sector have experienced a slight dip, signaling investor apprehension about potential profitability challenges.

The coming months will be critical. Businesses will need to adopt innovative strategies to manage costs, improve efficiency, and maintain competitiveness. The government, too, must play a role by implementing supportive policies that encourage investment, reduce regulatory burdens, and promote sustainable economic growth. The 3.5% minimum wage increase is a double-edged sword: a necessary step towards addressing wage inequality, but also a potential threat to businesses struggling to navigate a complex and uncertain economic environment. Success will depend on a collaborative effort from businesses, workers, and policymakers to ensure that the benefits of this wage increase are shared broadly and sustainably.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2025.

We’re giving away this valuable research for FREE.

Click below to secure your copy