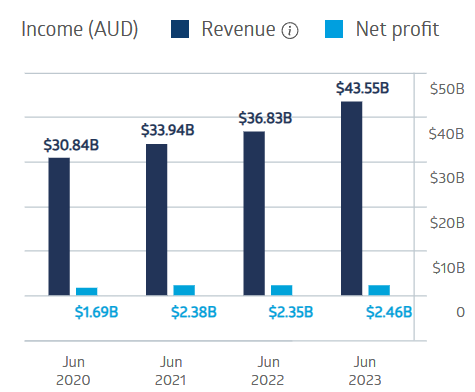

- Diversified conglomerate Wesfarmers generates most of its revenues from four consumer retail operations.

- The company continued to increase revenue and remained profitable throughout the COVID pandemic.

- Wesfarmers has continued to perform well in the face of inflationary pressures and high interest rates.

Wesfarmers is Australia’s largest conglomerate with market leading Bunnings Hardware and Officeworks along with Kmart and Target discount stores.

The company has managed to maintain growth in revenue and profit in the last four fiscal years in the face of both the COVID 19 pandemic and an inflationary/higher interest rate environment.

Wesfarmers Financial Performance

Source: ASX

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. Other fees apply. See PDS and TMD

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Half Year 2024 results continued the trend with a 0.3% increase in revenues, a 3% rise in net profit after tax and a 3.4% increase in dividend payments.

In FY 2023 Wesfarmers paid out $1.91 per share in dividends. The company’s average dividend yield over five years is 3.63%.

An analyst at Medallion Financial Group has a SELL recommendation, suggesting investors might want to take profits as the company’s trading near all-time highs suggests better value alternatives elsewhere.

Marketscreener.com has an analyst consensus HOLD recommendation on Wesfarmers shares, with one of the fifteen analysts reporting at BUY, one at OUTPERFORM, nine at HOLD, two at UNDERPERFORM, and two at SELL.

The Wall Street Journal also has an analyst consensus rating at HOLD, with two of the seventeen analysts reporting at BUY, ten at HOLD, two at UNDERWEIGHT, and three at SELL.

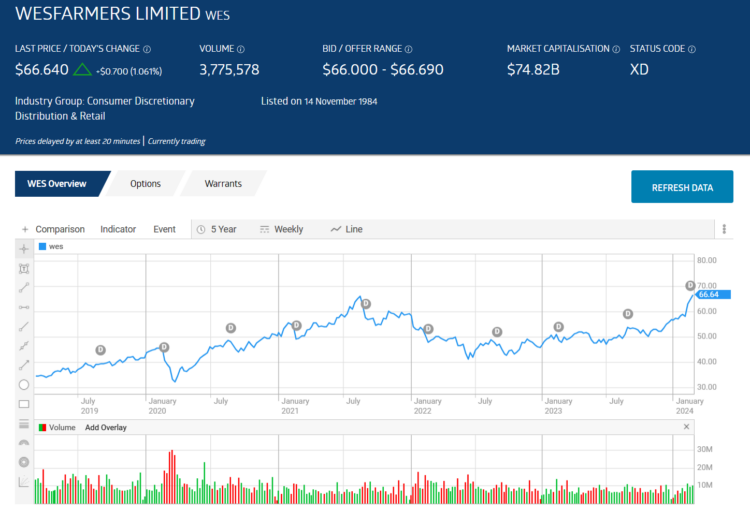

Over five years WES shares are up 106.8%. The price chart shows interested investors with a “wait and see” posture had multiple opportunities to buy on the dips.

Source: ASX

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. Other fees apply. See PDS and TMD

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2024.

We’re giving away this valuable research for FREE.

Click below to secure your copy