It would appear that auto manufacturers were among the many who underestimated the timing of the EV (electric vehicle) revolution. What else could explain the mad frenzy in the sector as car makers scurry about in a desperate search for adequate supply of the minerals and metals needed to produce the batteries to power their new product lines.

Governments have produced lists of “critical minerals” for the battery revolution in multiple markets – EVs, energy storage, consumer electronics, and industrial and defense.

With the EV market virtually monopolising the investing and finance news outlets, it is little wonder so many retail investors are fixated on the mineral that appears in the description of virtually all EV batteries in use today – lithium.

Others follow a practice common in the manufacturing sector – reverse engineering. Reverse engineering in its simplest form is the process of taking apart a product to determine its component parts. In the early days of the iPhone boom, many investors were desperately trying to identify the component parts in order to invest in those parts manufacturers.

It doesn’t take much research to learn investing possibilities lie in the metals/minerals used in the cathodes and anodes of batteries. Similarly, it quickly becomes evident to all investors looking for information to learn it is in the cathode where researchers and manufacturers are looking for improved battery performance by developing new metals/minerals composition.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Thus, the early leader in li-ion batteries – the Lithium-nickel/cobalt/manganese, or NCM composition, now has competition from LFP batteries – lithium-iron phosphate. Lithium is still a critical component of all battery technologies in use today.

In the early days of the exploding interest in battery metals/minerals, some investors ignored the other mineral with no current substitute in battery technology. While researchers and manufacturers scramble to replace or reduce cobalt, nickel, and manganese in lithium-ion batteries, few are looking for an alternative to the mineral critical for the battery anode –graphite. Silicon is being assessed as an alternative, but commercialisation remains in the distant future, given the challenges researchers are facing.

In theory, this should mean graphite investments are as attractive to investors as lithium itself, as these are the two components that are common to all current battery technologies and are likely to remain so for some time. The path to a green energy future requires both lithium and graphite.

Average daily trading volume can be seen as a rough gauge of investor interest. One of the top ten lithium producers in the world trades on the ASX – Pilbara Minerals (PLS). The shares last traded at $3.09 per share with a market cap of $9.2 billion dollars. With a market cap of $1.4 million dollars and a last closing share price of $3.20, ASX listed graphite producer Novonix (NVX) provides such a comparison. The 30 day average trading volume for Novonix is 5.1 million shares per day while the average for Pilbara is 18 million shares – more than double.

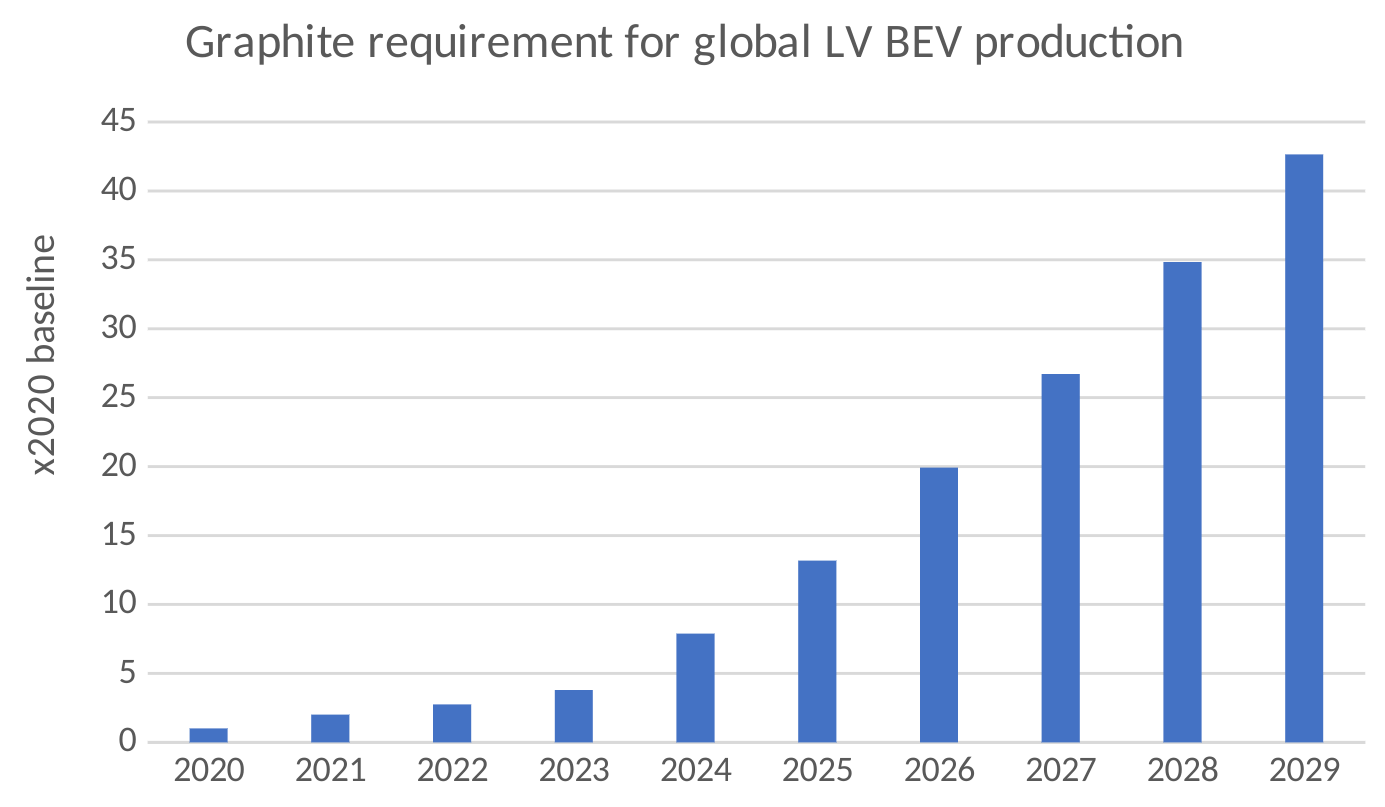

The following graph depicting the outlook in the medium term for graphite use in Low Voltage Battery Electric Vehicles (LV BEV) comes from the website of global automotive marketing research firm LMC Automotive:

The following table includes relevant metrics for six of the top ASX listed companies with market caps in excess of $100 million dollars working in the graphite space:

|

Company (Code) Market Cap |

Current Share Price |

Share Price 52 Week High 52 Week Low |

Year over Year % Change Year to Date % Change |

Total Shareholder Return 3 Year 5 Year 10 Year |

|

Novonix Limited (NVX) $1.5b |

$2.99 |

$12.47 $1.94 |

-27.07% -67.42% |

+96.2% +28.6% N/A |

|

Syrah Resources (SYR) $1.0b |

$1.56 |

$2.13 $0.98 |

+4.18% -12.23% |

+33% -11.2% -4.7% |

|

Renascor Resources (RNU) $485m |

$0.21 |

$0.38 $0.08 |

+95.45% +43.33% |

+137.6% +60.8% +15.6% |

|

Talga Group (TLG) $415m |

$1.36 |

$2.23 $1.00 |

-4.9% -16.56% |

+47.9% +14.5% +20.7% |

|

EcoGraf Limited (EGR) $221m |

$0.49 |

$1.02 $0.22 |

-46.74% -27.41% |

+64.5% +25.9% -2.2% |

|

Black Rock Mining (BKT) $181m |

$0.18 |

$0.33 $0.13 |

+13.85% -22.92% |

+37.5% +32.1% +16.8% |

Renascor Resources is the only graphite mining stock in positive territory both year over year and year to date. While still the leader of the pack over three years, the remaining companies have posted impressive gains as well. From the ASX website:

Although Renascor has both gold and copper assets in development, the company now bills itself as “Powering Clean Energy Green Battery Anode Material.” Renascor is focusing its resources on its wholly owned Siviour Graphite Project in South Australia.

The company touts the Siviour Project’s proven reserves as the largest outside of the graphite mining regions of Africa and the second largest in the world. Renascor has a Battery Anode Material study underway to vertically integrate the Siviour with a mine, concentrator, and a PSG production facility. Purified Spherical Graphite (PSG) is processed specifically for use in battery anodes, with demand forecasted to increase tenfold over the next decade.

The project has a DFS (definitive feasibility study) in place showing a 40 year mine life with the latest drilling results showing production capacity for graphite concentrates of up to 150k tonnes per year. Renascor is expanding its drilling campaign with the intent of increasing the production capacity of the project. The company has a non-binding offtake agreement in place with South Korean steel maker Posco. Graphite is needed for a new process for steel manufacturing using Electric Arc Furnaces.

Novonix is a technology company with a process for producing synthetic graphite, along with the manufacture of battery testing equipment. The company is expanding an existing synthetic graphite facility in Tennessee to industrial scale, making Novonix the first of its kind “made in the USA” producer of synthetic graphite.

Historically battery manufacturers have leaned towards synthetic graphite over natural graphite due to its superior life cycle and safety. However, the pendulum is shifting the other way as the processing costs of creating a synthetic product lose cost effectiveness in high demand conditions. In addition, the synthetic manufacturing process has a higher carbon footprint than natural graphite mining. Natural graphite is forecasted to dominate the market by 2030, up from 42% market share in 2020.

Syrah Resources has an operational graphite mining operation in Mozambique at the Balama Graphite Project. The company also has a US operation in Vidalia Louisiana for the processing of natural graphite from Balama into purified spherical graphite – an Active Anode Material (AAM).

Syrah has a four year offtake agreement in place with US based EV manufacturer Tesla for AAM from Vidalia. On 22 July the company signed a non-binding memorandum of understanding for a potential offtake agreement for AAM from the Vidalia operation to supply the planned Blue Oval Battery Park, a joint venture manufacturing facility built by JV partners Ford Motor Company and South Korean company SK Innovation.

On 28 July Syrah announced the US Department of Energy had loaned the company $146 million dollars for the expansion of its Vidalia facility. Syrah is the only company in the table generating significant revenue and the only one with a positive two year earnings growth forecast. In FY 2021 the company posted an earnings per share loss of $0.156, expected to reduce by more than half to a loss of $0.072 in FY 2022 before turning positive in FY 2023 with a gain of $0.019 per share.

Talga Group manufactures battery anodes “mined and refined” from the company’s mine and processing plants in Sweden. The company has multiple graphite projects, with the Vittangi project as Talga’s flagship. All the companies mining assets are located close to existing and planned battery “mega factories” and well-positioned with existing electricity and road, rail, and port transport.

Talga’s operational Electric Vehicle Anode (EVA) is producing its flagship Li-ion battery anode product Talnode®-C from the Vittangi trial mine. More than 20 battery manufacturers and automotive customers are to receive product samples for customer qualification.

EcoGraf is developing the Epanko Graphite Mine in Tanzania to provided natural flake graphite as feedstock for its spherical graphite processing operation in Australia using the company’s HFfree processing technology (patent application in process.)

The company is also developing a Battery Recycling Facility, working with customer provided used batteries with the intent of building a containerised pilot plant, with the mobility enabling recycling at disposal sites. HFfree processing will be used in recycling as well.

Regulatory approvals for the Australia based processing facility should be in place by the end of the year. The company has a variety of potential funding sources to bring these early stage development projects to commercialisation.

Black Rock Mining has a single asset – the wholly owned Mahenge Project in Tanzania, reportedly yet another of the biggest natural graphite deposits in the world. On 13 December of 2021 Black Rock signed a framework agreement with the government of Tanzania to form a Joint Venture company – the Faru Graphite Corporation – to develop the Mahenge Graphite Mine in collaboration. Black Rock will own 84% of the JV.

Black Rock’s Definitive Feasibility Study (DFS) for the Mahenge project envisions construction in four stages and production of up to 340,000 tonnes of 98.5% pure graphite concentrate per year with a projected mine life of 26 years.

Investors interested in “two for one” exposure might consider the smaller (market cap of $79 million dollars) – Lithium Energy Limited (LEL). The company is developing a flagship project – the Solaroz Lithium Brine Project in Argentina, as well as the Burke Graphite Project in Queensland.

Lithium Energy is well under the radar of most investors, trading only 136k shares per day with a last closing price of $1.12. The company listed on the ASX on 31 May of 2021 with a first trading day opening price of $0.38 per share, an increase of 194.7%.