- Unemployment is at record lows and inflation is at record highs

- Credit growth is outstripping wage growth

- What is the outlook for these three luxury spend ASX companies?

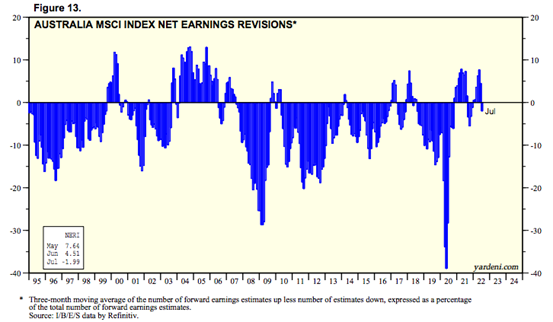

Net earnings revisions have slipped into the negative for July, but Australian companies are holding up relatively well in the face of record inflation and a tight labour market.

With unemployment still low, mining companies are finding healthy bids on international markets for their minerals. With downstream services able to win customers flush with cash, Australia’s economic wheels keep turning.

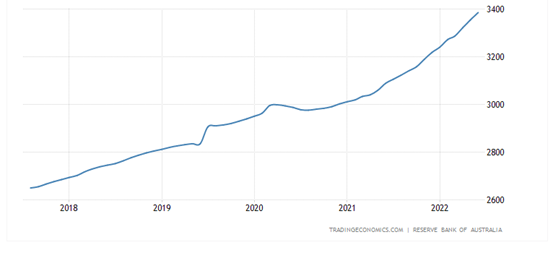

The robustness of the current situation has the Reserve Bank of Australia (RBA) concerned that Australians are burning the candle at both ends. The RBA response of raising rates is, in one regard, designed to incentivise saving over spending.

Consumer Credit in Australia increased to $3,386b AUD in June from $3,355b AUD in May 2022. A rise over the last two years on an annualised basis of 6.5%.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Meanwhile, the average salary has only risen 3% annually.

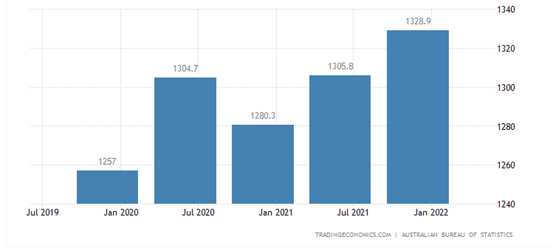

Wages in Australia increased to $1,329 AUD per week in the fourth quarter of 2021 from $1,306 AUD per week in the second quarter of 2021.

With the growth in consumer credit outstripping wage increases, there is potential for the average Australian to become financially stretched, causing a headache for Australian companies in the future.

The dual prong of record employment levels and climbing credit levels of the average consumer is creating unprecedented spending leverage for Australians.

Companies that capture excess spending on travel and luxury items are feeling the pressure of inflation squeezing margins. At the same time, the strong position of the Australian consumer is supporting the near-term outlook as sales remain resilient.

Qantas Airways Limited ASX:QAN (QAN) stock price is unsure which will win out between inflation and the consumer and has been trading sideways for several weeks.

Harvey Norman Holdings Ltd ASX:HVN (HVN) provides a similar picture to that of QAN, pressured by inflation and at the same time welcoming the short-term outlook for the Australian consumer.

Trips abroad are generally taken when some extra money is available in consumers’ bank accounts. Flight Centre Travel Group Ltd ASX:FTC (FTC) has been balancing the impact of demand from home against rising costs to their business operation and services.

FTC shares trading range for the last 12 months is similar to QAN.

Outlook

Inflation is showing signs of topping out in some sectors. International oil prices have been hovering around their current levels for weeks. There is the potential for core consumer prices and wage inflation to start to follow suit.

Companies created to capture the spare dollars of the Australian consumer are treading a precarious line between runaway costs to their products, services, and business operations and, until now, resilient demand.

A fallback in the credit conditions in the broader retail market may have the potential to weigh heavily on these stocks. On the other side of the coin, a rolling back of inflation will unlock their share prices from the current bands and send them higher.