- Integrated port to door and contract logistics services provider listed on the ASX in 2015.

- The share price hit an all-time high in February of 2023 but has been in decline since.

- Silk now has a P/E and a P/EG attractive for bargain hunters.

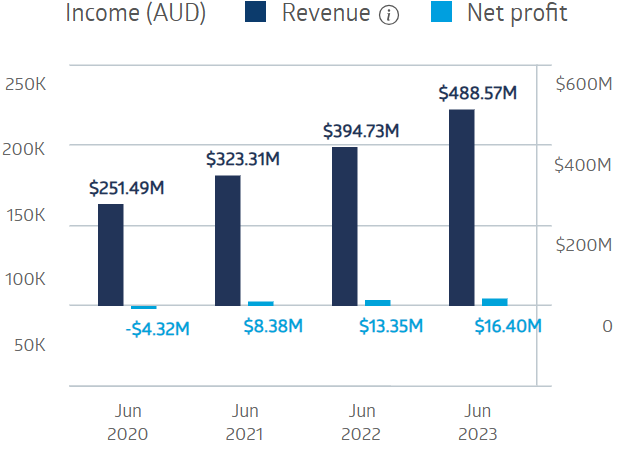

Silk was incorporated in 2013 and has become a major player in the Australian logistics sector, with its port-to-door services providing most of the company’s revenue. In its first year of financial reporting on the ASX the company reported a loss. Silk rebounded quickly, with growing revenues and profit in FY 2021, 2022, and 2023.

Silk Logistics Financial Performance

Source: ASX

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. Other fees apply. See PDS and TMD

Challenging economic conditions caught up with the company, as seen in the Half Year 2024 financial results. Revenues did rise 9%, but underlying net profit fell 22.4%. The company maintained moderately positive guidance for the full year 2024 but cautioned that “trading conditions would remain challenging for the remainder of 2024.”

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Silk listed on the ASX in July of 2021, with the share price now down 40.5%, with a steep drop following the disappointing Half Year 2024 results.

Source: ASX

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. Other fees apply. See PDS and TMD

Silk has a current price to earnings ratio (P/E) of 8.43, well below the index average of 19.37. The price to earnings growth (P/EG) ratio includes forecasted growth, an improvement over the P/E which reports historical growth. Silk’s current P/EG is 0.43. P/EG ratios under 1.0 are considered a signal the stock is undervalued.

An analyst at Auburn Capital has a BUY recommendation on Silk Logistics shares, citing positive Half Year 2024 financials and forecast and a new revenue stream, concluding that “SLH is trading at a substantial discount for a company offering upside potential.”

Marketscreener.com has an analyst consensus rating of BUY on SLH shares, with the three analysts reporting at BUY.

Yahoo Finance Australia has an analyst consensus rating of STRONG BUY on Silk Logistics shares.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2024.

We’re giving away this valuable research for FREE.

Click below to secure your copy