It is hard to imagine any retail investor anywhere in the world not paying attention to the news out of United States markets about a battle between hedge funds and ordinary investors on the social media platform reddit.com over the strategy of short selling.

Retail investors are cautioned again and again to leave short selling to the professionals due to the infinite loss risk. Investing “long” means buying and holding a stock until it returns a profit, or the investor loses faith in the stock when the price goes down. The risk is limited to the initial investment, should the company go out of business.

Short selling involves “borrowing” shares of stock at a given price in the belief the stock price will fall. The investor could reap the difference between the “borrowed” price and the “cover” price when the investor closes the position by buying the shares. When a shorted stock starts rising above the initial “borrow” price the risk remains until the investor chooses to take the loss and covers the position. In theory, the loss could extend indefinitely.

Short selling has been practiced for the most part by large institutional investors like hedge funds who can weather a prolonged wait for the stock price to fall. Some hedge funds specialise in shorting stocks and sometimes go after a company in what has come to be known as a “bear attack” or a “bear raid.” Long term investors in Wisetech Global (WGC) watched helplessly while the share price cratered twice in the last two years following bear attacks.

There are currently about 3 million members of a forum on reddit.com called Wall Street Bets who are fighting back, first buying shares of one of the favorites of short sellers – GameStop (NYSE: GME) – and have branched out to nine other highly shorted stocks, prompting the one thing in shorting that can benefit long term investors of a shorted stock – the short squeeze. The mounting losses can prompt even the largest of hedge funds to cover their positions, with the frenzied round of buying to cover driving up the price.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Regular followers of events in US markets have seen a whirlwind of opinions, from extolling the “David’s” on reddit.com slaying the “Goliath” hedge funds to dire warnings for the reddit crowd when the bubble bursts, to trading platforms limiting trades of the affected stocks.

Greedy retail investors who hang on too long will likely suffer, but those with the discipline to sell once they are comfortable with the profit they have made will benefit. The moral for all investors is that it is possible for long investors to profit from investing in shorted stocks.

No ASX stock better supports this truth than JB Hi Fi (JBH), a stock that has graced the ASX Top Thirty Short List multiple times over the last decade. From the ASX website here is how JBH has beaten the short sellers, again and again.

Right now there are four healthcare stocks on the ASX Top Thirty Short List, with two in the top ten and two in the bottom ten. JB Hi Fi is once again on the list, coming in at 27.

The share prices of all four were impacted by the COVID 19 Pandemic. The following table lists relevant performance metrics for the two stocks in the top ten – Mesoblast (MSB) and Avita Health (AVH).

Both companies operate in the promising field of regenerative medicine. Understanding the details of how regenerative medicine works and what it is can be challenging. In the simplest terms possible, regenerative medicine uses cells existing in humans to treat a variety of ailments. Cells come from different sources in both adults and human embryos – including the brain, bone marrow, blood and blood vessels, skeletal muscles, skin, the liver – and have different methods of harvesting cells for use in human treatments. Stem cells can also be harvested post-partum from umbilical cord blood.

Ethical issues with embryonic stem cells have been mitigated somewhat with the use of embryos donated by couples undergoing fertility treatment where the embryos are no longer needed.

Mesoblast has a proprietary technology for harvesting adult mesenchymal stem cells, primarily from tissue surrounding blood vessels and from bone marrow. Mesenchymal dells can develop into “connective tissue, blood vessels, and lymphatic tissue.”

Stocks in the regenerative medicine sector aroused intense investor interest going into the last decade, but the performance of therapeutic treatments has not yet lived up to its promise.

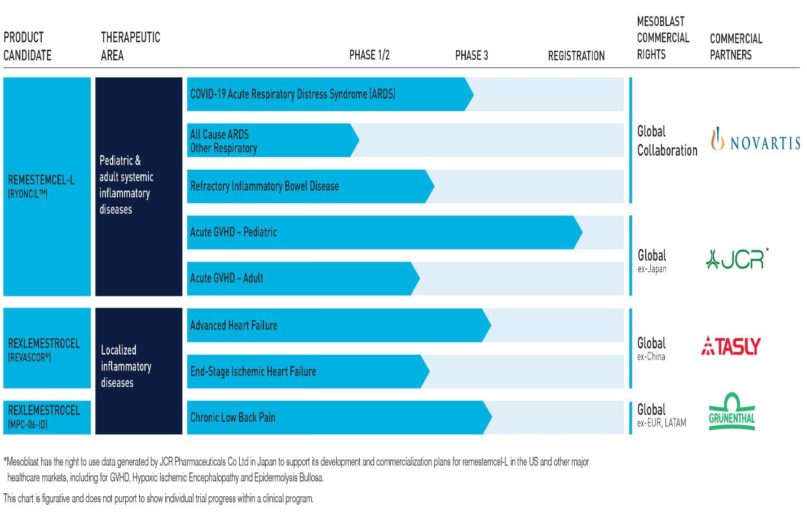

However, Mesoblast still has an impressive list of product candidates and partnering organisations. From the company website:

Earlier in the year investor interest in MSB was rekindled when the US FDA (Food and Drug Administration) approved an investigatory application for the potential use of one of Mesoblast’s product candidates – the remestemcel-L treatment – for use with acute respiratory disorder (ARD) associated with COVID 19.

After an on again off again series of FDA announcements, at year end Mesoblast announced the trial did not meet FDA standards, with the company attempting to soothe investors with its intentions to continue exploring the use of the treatment for non-COVID related ARD while not yet giving up on the use of remestemcel-L in COVID patients.

In early January, the company announced another of its product candidates – rexlemestrocel-L – showed a ”60% reduction in incidence of heart attacks or strokes and 60% reduction in death from cardiac causes when treated at an earlier stage in the progressive disease process.” Mesoblast plans to seek FDA approval for the treatment.

Long suffering Mesoblast investors would welcome the positive FDA response.

Avita Medical has a narrower focus, using a patient’s own skin cells to produce a treatment for burns, scalds, and wounds – RECELL® – delivered as a spray on.

The company is exploring the use of RECELL® in other applications, including vitiligo (loss of skin pigmentation), and scar reconstruction. RECELL® is approved for use in the US, where the company generates most of its revenue. For that reason, Avita has moved its headquarters to the US, listing on the NASDAQ while maintaining its ASX listing.

Avita has a clinical trial for using RECELL® in vitiligo underway. The stock price is off to a hot start in 2021, following the release of its unaudited financial results for the three months ending 30 December of 2020. US RECELL® revenues were up 51% over the same quarter in the prior year while total global revenue rose 67%. The company has two additional clinical trials underway in addition to the vitiligo study – a trial for soft tissue reconstruction and another for early intervention for pediatric scalds.

Avita’s RECELL® burn treatment is not considered an elective procedure, but the protective “stay at home” orders reduced the incidence of accident related burn injuries, affecting the company’s results.

The two healthcare companies in the bottom ten of the Top Thirty List – medical imaging provider Pro Medicus Limited (PME) and skin protective provider Clinuvel Pharmaceutical (CUV) – both were impacted by COVID 19 but Pro Medicus rebounded at lighting speed.

In its Full Year 2020 Financial Results release, Pro Medicus management noted use of all of its extensive global suite of imaging solutions fell prey to curtailment of elective procedures, with volumes dropping by 75% in March through early April. A recovery began in mid-April with volumes back to 90% to 100% by late August.

For the year, Pro Medicus saw underlying revenues grow by 23.9% while net profit after tax (NPAT) was up 20.7%.

The company is much more than a provider of enterprise level, cloud based imaging software and hardware products branded under the Visage name. It provides a complete set of integrated information technology solutions for hospitals, imaging centres, and healthcare groups across Australia, the United States, and Europe.

Pro Medicus is a solid dividend payer, doubling its FY 2018 dividend payment of $0.06 per share to the current $0.12 per share with a two year dividend growth forecast of 19.8% and a 27.1% earnings growth forecast.

In mid-December of 2020, the company announced a new contract signing valued at $18 million dollars, with the signing of a $40 million dollar contract coming in mid-January of 2021, both with US based healthcare organisations.

The following table includes performance metrics for Pro Medicus and for the last healthcare stock in the Top Thirty List, Clinuvel Pharmaceuticals.

Clinuvel Pharmaceuticals has generated both revenue and profit in each of the last three fiscal years from its lead treatment – SCENESSE® – approved for use in Australia, Europe, and the US. SCENESSE® is used both for protecting skin against the UV rays of the sun and as a treatment for a genetic disease that attacks the skin through exposure to the sun. To date there have been 15 clinical trials on the use of SCENESSE® to treat the genetic disease, with results appearing in published research in respected journals.

Commercial distribution of SCENESSE® began in Europe in 2016 with the US coming in April of 2020 and Australian approval coming in late October. Clinuvel’s success has come out of the EU with revenues from the US just beginning and Australia on the horizon. The company is now turning its attention to use its use of the hormone melanocortin produced by the pituitary gland in the brain to treat “genetic, metabolic, and life-threatening disorders, as well as healthcare solutions for the general population.”

The company has clinical trials in the works to test the effectiveness of afamelanotide, a melanocortin molecule used in SCENESSE®, for restoring blood flow and oxygen supply to the brains of patients following an arterial ischemic stroke (AIS.

UV rays can damage to the DNA in skin cells. On 30 November Clinuvel announced a clinical study to evaluate the use of SCENESSE® in DNA repair.