- Awaiting data, investors are relying on rumours.

- The hope of a China lockdown reversal sent the Hang Seng higher.

- The Fed requires more inflation and wage data before outlining its roadmap. Investors are turning to rumours over the wait.

Rumours fuelling energy markets

After rumours circulated on Thursday of a mainland China exit from COVID restrictions, the Hang Seng shot up over 5%. The rumour didn’t materialise into fact, and Friday gave up some of the previous day’s gains.

Beijing has officially refuted the immediate reopening and is sticking to the lockdown strategy to manage the virus over the winter.

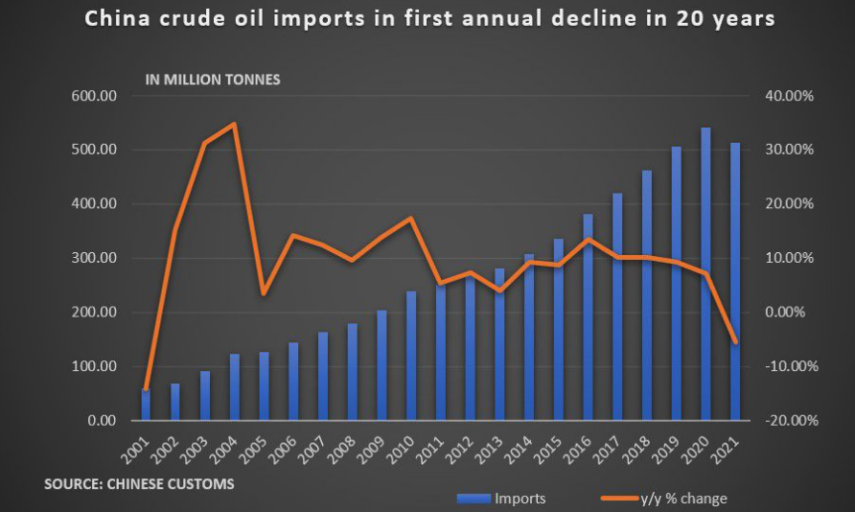

Under lockdown, Chinese oil import growth has lagged compared with previous years. The same rumours that elevated the Hang Seng were powering the oil market nearly 4% higher on Thursday.

Beijing’s clarification of policy on Monday is dragging the oil futures market 1% lower.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Gas markets are still firing

The gas markets are shrugging off an extended Chinese lockdown.

Despite an expected warmer-than-average European winter and recent storms providing ample wind-power generation across the continent, gas prices are higher on Monday.

Asian winter restocking continues apace, and the benchmark North Asian gas price of JKM is up by 4% on Monday.

This month’s anticipated restart in the Freeport LNG export facility has the US gas price rising on an expected spike in demand for piped gas intended for liquefaction.

The oft-referred gas price benchmark of Henry Hub gapped higher by almost 9% from the Friday close, narrowing at $7 USD /MMBTU.

The strong gas and LNG export market is sending shares in Woodside Energy Group ASX:WDS (WDS) higher at the ASX open, up by 2.3%.

Avoiding the chill

Since Europe was able to fill the tanks before winter, and the current weather forecast has the outlook reading as mild, it is unlikely there will be a disastrous stock-out of gas in the UK and Europe this winter.

Attention is now turning to the following winter and an anticipated shortfall in gas injection over the latter part of 2023.

The continued ramp-up in LNG export facilities from the US Gulf of Mexico will leave the US gas market playing catch up to stretched European and North Asia supply over the next 12 to 24 months.

Fed balancing act

Wording from the US Federal Reserve last week suggests that some progress is being made toward meeting monetary policy objectives by raising interest rates: the committee is currently searching for an off-ramp. However, the door is still open for further hikes in interest rates (0.5% to 0.75%), but it is all contingent on whether inflation can be brought to heel.

Rallying oil and gas prices will do little to assuage central bankers’ nerves.

The week ahead

The US inflation data is published on Thursday morning US time. That will provide an insight into the likely direction of near-term interest rates.

If inflation cannot be controlled quickly, sharper intervention from the Fed is very likely. That will create pressure on Australian and international stock markets.