- Software as a Service provider to education, workforce, and government entities listed on the ASX in 2019.

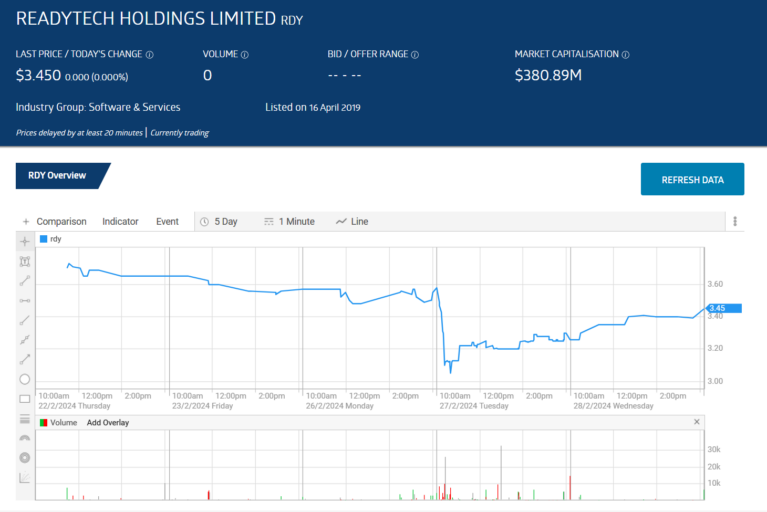

- Since listing the share price has risen more than 100%.

- Delayed revenue from enterprise contracts sent investors heading for the exit doors.

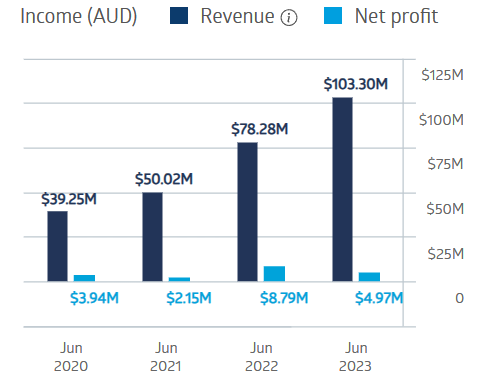

The company serves enterprise level customers in education and workforce pathways, workforce solutions, and government and justice. In the last four fiscal years ReadyTech Holdings has increased revenue and posted a profit.

ReadyTech Holdings Financial Performance

Source: ASX

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. Other fees apply. See PDS and TMD

Since listing the RDY share price has risen 109%, but disappointed investors drove the share price down from an opening price of $3.50 on 27 February, the day of the Half Year 2024 Results announcement, to $3.26 at the close, with an intraday low of $3.05 along the way.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

The actual results were uniformly positive, with 15.5% reduction in total expenses, a 14.2% increase in total revenue, and a 5.2% rise in underlying net profit after tax. The company also reported 11 new enterprise contracts during the period, but it was “a number of the company’s high conviction contracts shifting to FY 2025” that panicked investors. Based on the shift, management lowered its expectations for the second half of 2024.

Source: ASX

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. Other fees apply. See PDS and TMD

An analyst at Medallion Financial Group has a BUY recommendation on ReadyTech Holdings shares, citing “robust growth, recurring revenues, and a reasonable valuation,” concluding at recent price levels, RDY offers value.

Marketscreener.com has an analyst consensus BUY recommendation on RDY shares, with four of the six analysts reporting at BUY and two at OUTPERFORM.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2024.

We’re giving away this valuable research for FREE.

Click below to secure your copy