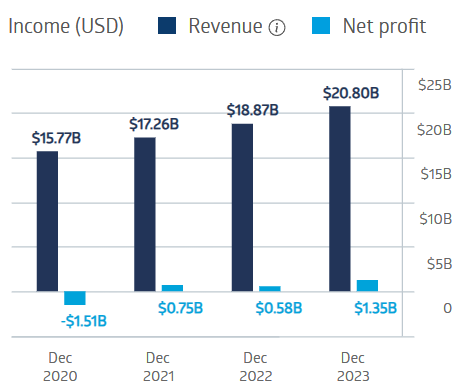

- International property and casualty insurance provider QBE Insurance Group reverses an FY 2020 loss with profit gains in the next three years.

- As of 1 March 2024 the company was moved into the S&P/ASX 20 Index, Australia’s top 20 companies by market cap.

- The share price is up both year over year and year to date.

Although QBE grew revenue in each of the last four fiscal years, the profit picture has been mixed.

QBE Insurance Group Financial Performance

Source: ASX

Full Year 2023 financial results were outstanding, perhaps benefiting from higher interest rates. Net profit in FY 2023, more than doubled, rising 105%, along with a 10% increase in gross written premium and a 60% increase in dividend payments.

The share price dipped in intraday trade, but by the close it had resumed an upward trajectory in place since mid-December of 2023. Year over year the share price is up 14.5% and 16.4% year to date.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Source: ASX

In FY 2023 QBE paid investors a dividend of $0.44 per share for a yield of 2.55%. The five year average dividend yield is 1.81%.

An analyst at Marcus Today has a BUY recommendation on QBE Insurance Group shares, pointing to the company’s “significant increase in FY 2023 statutory net profit, rise in gross written premiums and renewal rate increases, and targeted new business growth.”

Marketscreener.com has an analyst consensus BUY recommendation on QBE shares, with nine of fourteen analysts at BUY, four at OUTPERFORM, and one at UNDERPERFORM.

The Wall Street Journal has an analyst consensus BUY rating on QBE Insurance Group shares, with eleven of fourteen analysts reporting at BUY, two at OVERWEIGHT, and one at UNDERWEIGHT.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2024.

We’re giving away this valuable research for FREE.

Click below to secure your copy