- Lendlease Group is a global real estate organisation creating large-scale integrated projects.

- The stock price collapsed in the early stages of the COVID-19 Pandemic and has not recovered.

- Lendlease management has initiated a strategy of asset sales and debt management improvements.

Lendlease Group has been responsible for some of the world’s most notable real estate developments, including the Sydney Opera House, the Petronas Towers in Kuala Lumpur, and the September 11 Memorial and Museum in New York City.

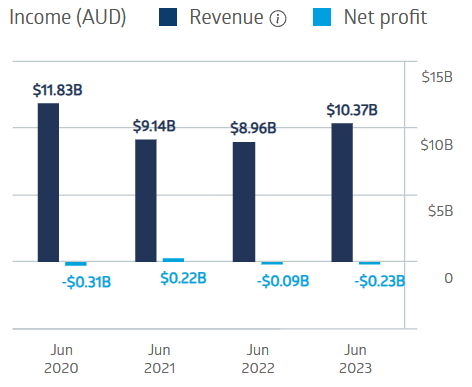

The company managed to post a profit in FY 2021 before reverting to losses in FY 2022 and 2023.

Lendlease Group Financial Performance

Source: ASX

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

The stock price fell early in the COVID-19 Pandemic. At the end of February 2020, the stock was trading around $17.64 per share. On 2 January 2024, the price has fallen to $7.46.

Source: ASX

Lendlease has paid dividends each year for the past decade, with a five-year average payment of $0.31 per share and a five-year average yield of 2.69%.

A $1.3 billion asset sale announced on 18 December 2023 will contribute between $130 million and $160 million dollars to the company’s core operating profit after tax in FY 2024.

An analyst at Baker Young believes Lendlease is “an attractive recovery play in 2024.”

Other analysts agree.

Marketscreener.com has an OUTPERFORM rating on Lendlease shares, with three of the nine analysts reporting at BUY, one at OUTPERFORM, four at HOLD, and one at UNDERPERFORM.

The Wall Street Journal has an OVERWEIGHT rating on Lendlease shares, with three analysts at BUY and two at HOLD.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2023.

We’re giving away this valuable research for FREE.

Click below to secure your copy