- Johns Lyng Group has a business model that fits a world beset by climate related property disasters.

- The company has been in business for 70 years, listing on the ASX in 2017.

- The share price is up 440.5% since listing.

Johns Lyng’s operating groups of Insurance Building and Restoration, Commercial Building Services, and Commercial Construction feature sixteen branded service providers.

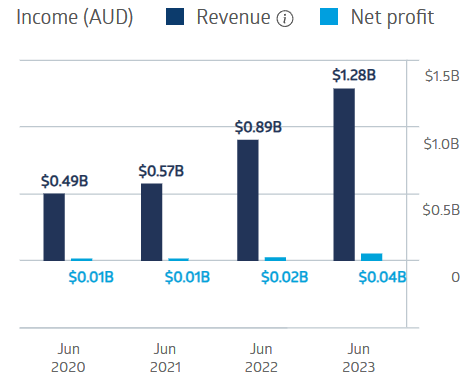

The fact the company maintained profitability in the face of COVID lockdowns is admirable as is the company’s doubling of net profit after tax in FY 2022 and again in FY 2023.

Johns Lyng Group Financial Performance

Source: ASX

In addition to the solid revenue and net profit growth, the company added five acquisitions in FY 2023 and another three since the start of FY 2024. The company is now operating in the US market, with four brands active in the US.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Over five years, the share price is up 553.2%.

Source: ASX

The company began paying dividends in FY 2018 and has averaged dividend payments of $0.05 per share over five years with a five year average dividend yield of 1.23%. FY 2023’s full year dividend of $0.09 per share – up from $0.06 in FY 2022 – was fully franked.

An analyst at Medallion Financial Securities has a BUY recommendation on Johns Lyng Group shares, pointing to the company’s “history of exceeding expectations, with FY 2023 net profit after tax $12.8 million dollars above the analyst consensus forecast.”

Marketscreener.com has an analyst consensus rating of BUY with seven of the analysts reporting at BUY, two at OUTPERFORM, and three at HOLD.

The Wall Street Journal has an OVERWEIGHT consensus rating, with three analysts at BUY, one at OVERWEIGHT, and two at HOLD.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2024.

We’re giving away this valuable research for FREE.

Click below to secure your copy