- Cobram Estates Olives began business in 1998, listing on the ASX in 2021.

- The company produces 71% of the olive oil crop in Australia.

- Cobram Estates now has growing and milling operations in the United States.

Cobram Estates grows and processes olives into five branded products using the company’s proprietary growing system – Oliv.iQ®. The company dominates the Australian market and is investing in growing its US operations.

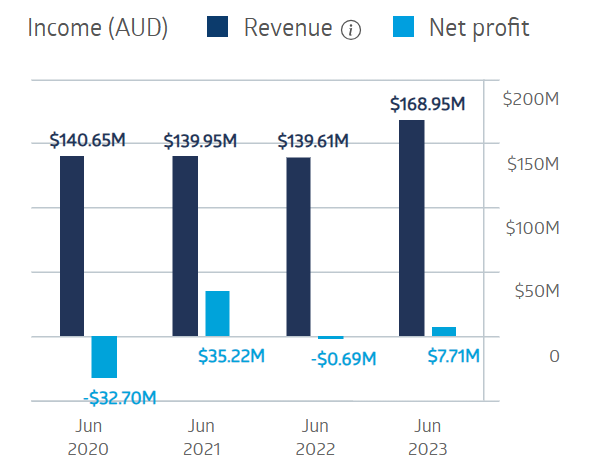

The company’s financial performance over the last four fiscal years is decidedly mixed.

Cobram Estates Olives Financial Performance

Source: ASX

The company’s Half Year 2024 financial results showed strong revenue growth – up 42.3% – and a posted loss of $7.2 million dollars, improving on the half year 2023 result of a $9.9 million dollar loss. Management expressed confidence in the company’s outlook, citing “robust demand for olive oil and strong trading conditions.”

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Cobram Estates Olives’ ninety-day trading volume is 176,098 shares traded per day. The company’s market cap is $709 million. In comparison, ASX listed almond grower Select Harvest (ASX: SHV) with a market cap of $529 million has a ninety-day average of 537,021 shares per day.

The share price is down 12.75% since listing but year over year the price is up 36.3%, outperforming Select Harvest’s 6.2% increase.

Source: ASX

Cobram began paying dividends in FY 2023 – $0.03 per share for a yield of 1.89%.

An analyst at Tradethestructure has a BUY recommendation on Cobram Estate Olives, citing the company’s Half Year 2024 financial results, concluding “the company appears poised to test $2 before potentially moving higher.”

Marketscreener.com has an analyst consensus recommendation of BUY on CBO shares, with three of the four analysts reporting at BUY, and one at HOLD.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2024.

We’re giving away this valuable research for FREE.

Click below to secure your copy

Related Articles:

- Eight Top ASX Stocks for 2024

- 18 Share Tips: 11th March 2024

- Can the ARB Corporation (ASX: ARB) Continue Climbing Higher

- eToro Stock : Australia Regulated Trading App Considering IPO in US or London

- Australian Stocks Marginally Higher with Tech and Gold Leading the Charge

- Iron Ore Slump Tests Mettle of Mining Giants BHP, Rio Tinto, and Fortescue