- Sigma is a wholesale drug distributor with a network of branded franchised pharmacies.

- Chemist Warehouse has a network of more than five hundred discount drug stores.

- The proposed merger of the two companies is likely to face regulatory hurdles.

On 10 December of 2023 Sigma Healthcare emerged from a trading halt with the two-fold blockbuster announcement of a proposed merger with Chemist Warehouse and an institutional and retail capital raise to fund the deal. The share price got a bump as investors responded positively to expert analysis of the benefits of the merger.

Source: ASX

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. Other fees apply. See PDS and TMD

Year over year the share price is up 57% cooling off a bit after the large jump, but remaining stable, offering investors a chance to get in before a likely boost when the deal is approved.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

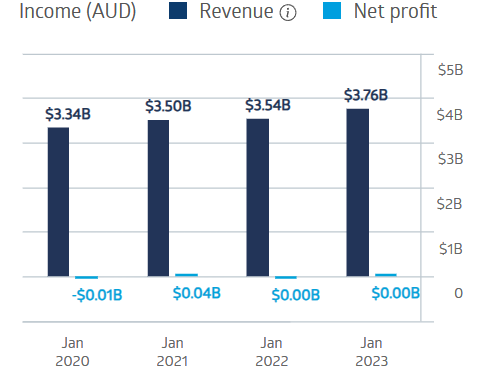

The company’s financial performance prior to the merger has been solid, if not spectacular. Sigma’s wholesale distribution of regulated drugs limited financial performance. The large network of pharmacies offers the combined company the opportunity to benefit from the sale of non-regulated items.

Sigma Healthcare Financial Performance

Source: ASX

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. Other fees apply. See PDS and TMD

Sigma cut its dividend payment at the height of COVID and returned with lower dividends in the aftermath, with a five year average dividend payment of $0.02 per share and a five year average yield of 3.04%.

An analyst at Morgans has a BUY recommendation on Sigma Healthcare shares, commenting that the merger “will create a healthcare wholesaler, distributor and retail pharmacy franchisor. The proposed merger may unlock significant efficiencies and generate cost synergies.”

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2024.

We’re giving away this valuable research for FREE.

Click below to secure your copy