- Pure play copper miner Sandfire Resources posted near disastrous financial results for both the full year 2023 and the half year 2024.

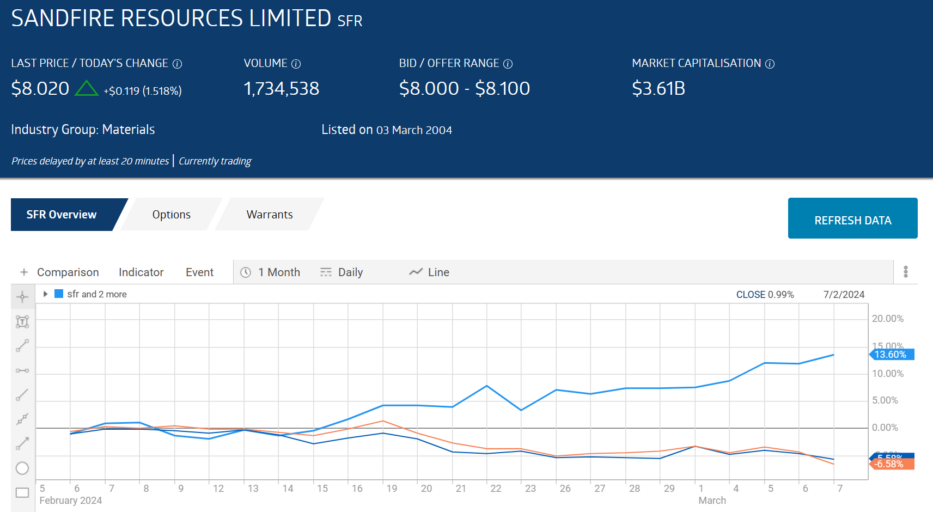

- The share price is still rising, outperforming rival diversified copper producers BHP and RIO.

- Most analysts agree copper demand will rise.

Pure play copper miner Sandfire Resource’s DeGrussa copper/gold mine is in operation in Australia. The company also has assets in development in the US, Spain, and Africa.

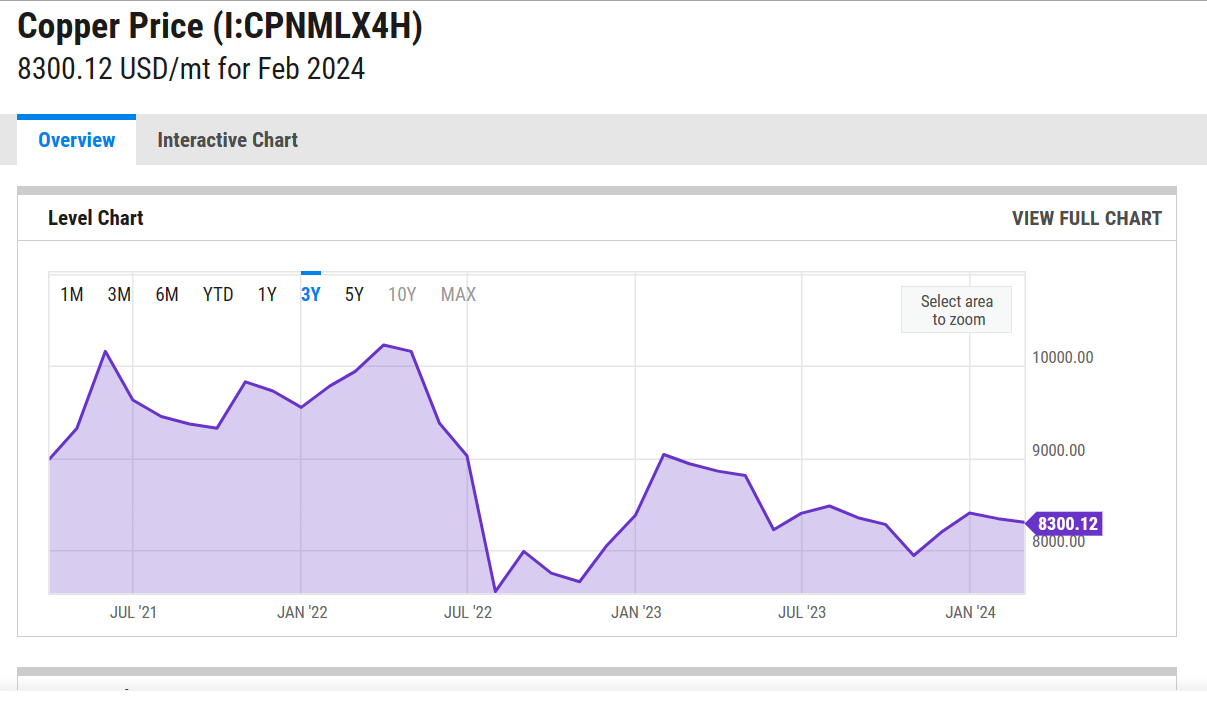

The price of copper has turned volatile since 2022, as have most commodities mined in Australia.

Source: https://ycharts.com/indicators/copper_price

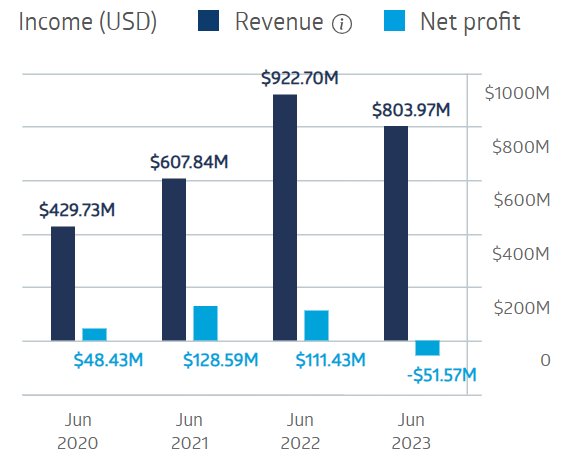

The tailwinds from the copper price coupled with global economic uncertainty fueled by inflation, high interest rates, and war completed the challenging environment. Sandfire’s financial metrics saw both revenues and net profit decline in FY 2023.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Sandfire Financial Performance

Source: ASX

The bad news for investors continued into the first half of FY 2024, with Sandfire reporting revenue decline of 3% and a 96% loss after tax attributable to members. Despite the loss, investors drove up the share price following an initial dip on the 16 February announcement.

Source: (ASX)

Some analysts point to a possible 75% rise in the price of copper to 2025 fueled by rising demand in the face of the green energy transition and mining supply disruptions.

An analyst at Fairmont Equities has a BUY recommendation on Sandfire Resources shares, telling investors the firm is “positive about the prospects for copper with the expectation lower supplies and sustained global demand twill result in higher prices during the next few years”

Marketsreener.com has an analyst consensus rating of OUTPERFORM on Sandfire shares, with six of the sixteen analysts reporting at BUY, at four OUPPERFORM, five at HOLD, and one at SELL.

The Wall Street Journal has a consensus analyst rating of OVERWEIGHT with six of the eighteen analysts reporting at BUY, four at OVERWEIGHT, seven at HOLD, and one at SELL.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2024.

We’re giving away this valuable research for FREE.

Click below to secure your copy