While coal has lost its grip on the title of “King of Commodities”, it has defied the oddsmakers predicting its ultimate demise. Numerous “King Coal is Dead” articles and contrarian views touting coal’s resilience litter the financial news. Yet the King stubbornly hangs on, defying the skeptics and delighting the contrarians.

The “king coal is here to stay” view is supported by its abundance as a natural resource, especially here in Australia, and the growing demand for electricity in countries like China and India. In much of the developed world, coal as a fuel for the generation of electricity is losing its historical cost advantage over renewable energy sources. The early calls for the displacement of coal came from the falling price of natural gas, replacing coal as the cheapest fuel for electricity generation in countries with abundant supplies of natural gas.

However, there is a stark difference between declining and disappearing.

Despite the rising number of coal companies declaring bankruptcy, the shuttering of high maintenance older coal-fired electrical generation facilities; and dwindling construction of new coal-fired plants, the death of coal is not likely in the near future.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

While both countries are plagued by debilitating levels of air pollution and have committed to increasing the use of alternative energy sources, China and India account for about 60% of the global electricity generated using coal.

China and India remain in the grip of coal as the two countries remain the largest producers, consumers, and importers of coal on the planet.

On 15 January a new variable entered the equation on the life cycle of thermal coal when the world’s largest investment manager – BlackRock (NYSE:BLK) – announced to the investing world via a letter to its investors that the company will shed its investments in the thermal coal sector – amounting to USD$500 billion dollars, AUD$725 billion. Here is the company’s statement to its clients:

- “Thermal coal is significantly carbon intensive, becoming less and less economically viable, and highly exposed to regulation because of its environmental impacts. With the acceleration of the global energy transition, we do not believe that the long-term economic or investment rationale justifies continued investment in this sector.”

- “As a result, we are in the process of removing from our discretionary active investment portfolios the public securities (both debt and equity) of companies that generate more than 25% of their revenues from thermal coal production, which we aim to accomplish by the middle of 2020.

- “As part of our process of evaluating sectors with high ESG risk, we will also closely scrutinize other businesses that are heavily reliant on thermal coal as an input, in order to understand whether they are effectively transitioning away from this reliance.”

With about USD$7 trillion (AUD$10.15 trillion) assets under management, the BlackRock decision is an acknowledgement from a global powerhouse that thermal coal should see its role in global energy production significantly reduced. In a world where the existence of climate change and its causes remain hotly debated, the CEO of BlackRock characterised the company’s decision as a move to protect the investment community. In a separate letter to BlackRock clients, Larry Fink said the company views climate change as an investment risk and that companies should expect investors to transform the way they engage with companies and issued a threat to use BlackRock’s substantial shareholdings to dumb directors who fail to respond to the climate threat.

Eighty percent of the coal produced around the world is thermal or steaming coal used to produce electricity. The remaining 20% is metallurgical or coking coal used to produce steel, unaffected by the BlackRock decision, as are companies generating less than 25% of their revenues from thermal coal.

The immediate financial impact on major ASX coal mining stocks could be minimal as BlackRock’s investment in Australia’s leading coal miners – Yancoal Australia (YAL), Whitehaven Coal (WHL), and New Hope Corporation (NHC) is minimal. The firm holds no shares in Yancoal, and investments in Whitehaven and New Hope amount to around $80 million dollars. However, according to Bloomberg, investments in both had increased substantially over the past year, doubling in New Hope and quadrupling in Whitehaven. This at a time when the share price was in decline, a clear indication of the need for more buyers and fewer sellers.

Two-year growth forecasts for WHC and NHC are bleak, with earnings per share (EPS) decline for both in excess of 30% and a 19.6% fall in dividends per share at New Hope and 54% at Whitehaven.

For investors with risk tolerance a move into ASX pure-play or near pure-play coking coal miners might be of interest. However, technology poses risks to coking coal as the sole fuel source capable of producing steel.

- Thirty percent of the world’s steel comes from scrap metals recycled in Electric Arc Furnaces.

- Monash University here in Australia has filed a patent application for a technology based on Victorian Brown Coal, a cost-effective alternative to coking coal.

- A leading German manufacturer – Thyssenkrupp – has developed a technology for operating steel furnaces on hydrogen and successfully demonstrated its capabilities.

There are three junior metallurgical coal miners in the exploration and development phase, as yet producing no revenue. Investors have flocked to these stocks with year over year share price gains ranging from 128% to 233%. The companies are Atrum Coal (ATU), Allegiance Coal (AHQ) and Bowen Coking Coal (BCB).

With a market cap of $167 million dollars, Atrum Coal is the largest of the three. The company’s exploration and development assets are in Canada, with both metallurgical coal projects and anthracite coal projects. Although the company’s Groundhog Project boasts reportedly the world’s largest high- grade anthracite assets, the cost of that kind of coal is too much for large scale use, relegating demand to residential and small business heating needs.

In 2018 the company acquired 100% ownership of the Elan hard coking coal project in Alberta, with one project now in development and more in the pipeline. The project in development – Elan South – is located in an operating mine region, bordering the Riversdale Resources’ Grassy Mountain Project with Gina Rhinehart’s Hancock Prospecting holing a minority interest in Riversdale Resources.

Initial drilling results at Elan were positive for high quality metallurgical coal and subsequent drilling has seen resource estimates increase by 170%.

Although Allegiance Coal Limited (AHQ) has thermal coal assets, it is currently fast-tracking development of the Tenas metallurgical coal project in British Columbia, Canada, one of three metallurgical coal assets in the company’s Telkwa Project.

The project is located on the western side of the Rocky Mountains, with rail access to port facilities on the BC coast. Pre-feasibility studies yielded positive results, with the company now having completed a definitive feasibility study on the Tenas Project. Japanese coal trading company Itochu has a 5% JV stake in Allegiance.

An independent research note from Bell Potter Securities rates the company a SPECULATIVE BUY.

In July of 2019, the stock price got a big boost when Allegiance announced that it had entered a terms sheet with Cline Mining Corporation to acquire that company’s moth-balled New Elk metallurgical coal mine in the US state of Colorado. The Elk mine is fully permitted with a mine in place and infrastructure access to US ports in Houston and Los Angeles. Allegiance expects to begin production from Elk in 2020.

Bowen Coking Coal (BCB) has multiple assets in Queensland’s Bowen Basin, with four wholly owned and two in joint venture arrangements with Stanmore Coal (SMR) where Bowen is the minority partner.

Bowen has successfully executed a “farm-in” agreement with Japanese trading and investment company Sumitomo to fund $2.5m for the first phase of the exploration program for Bowen’s Hillalong North and Hillalong South projects. The agreement grants Sumitomo an initial 10% interest in Hillalong, with the right to acquire an additional 10% following an additional $5 million in funding.

Reactions to the BlackRock decision were predictable, with the Morrison Government backing coal and the Labor opposition leader supporting coal exports while at the same time seeing the BlackRock move as “reality.”

In 2018 a summary of academic research papers on the outlook for coal in Australia was published under the title “Coal Transition in Australia.”

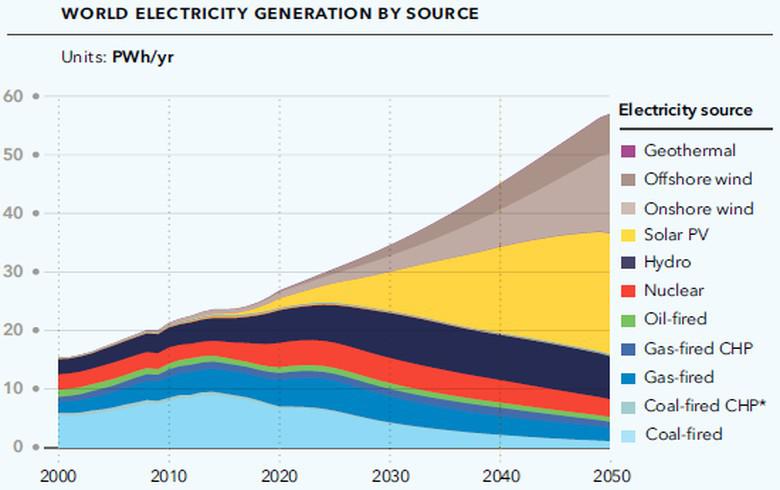

The following chart from the report was intended to support the paper’s general conclusion, highlighted in a later article on The Conversation.com, that coal does not have an economic future in Australia.

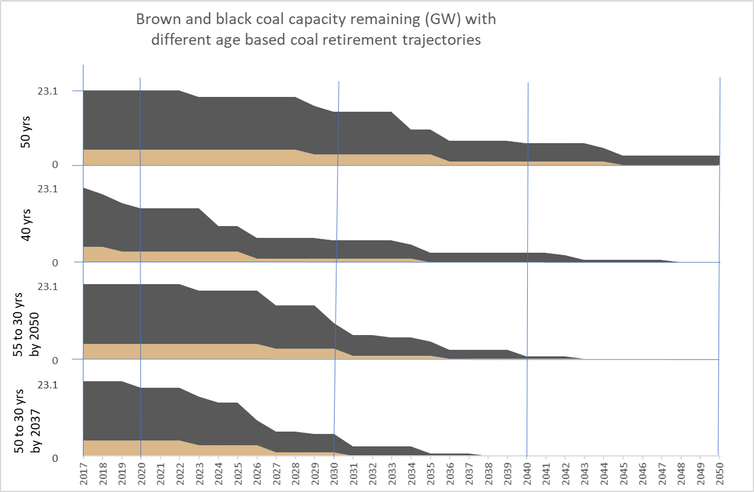

According to the report it is the cost of maintaining aging plants, not the demand for thermal coal, that will slowly eat away at our thermal coal production. The BlackRock decision could make equity capital raises for coal miners more challenging.

However, the report does not cover metallurgical coal and investors looking for shorter term opportunities should note the retirement data’s extended trajectories.