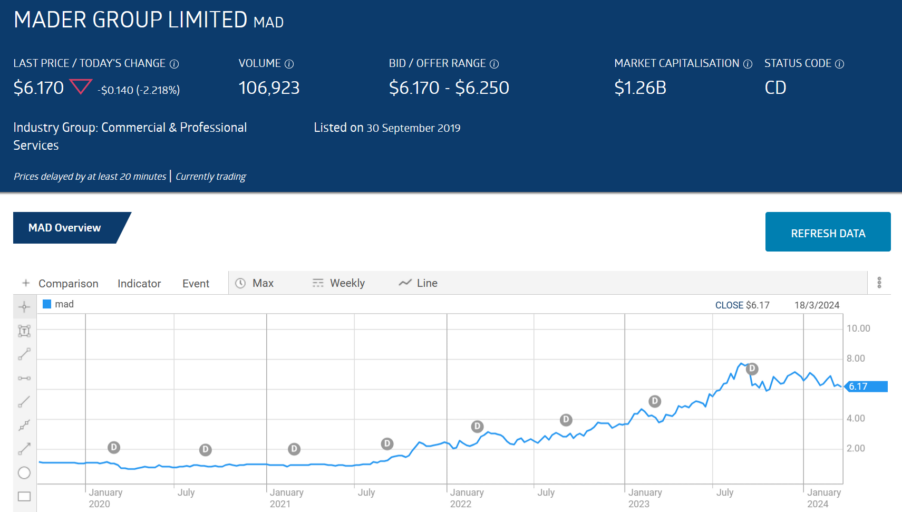

- International mechanical services contractor Mader Group listed on the ASX in September of 2019.

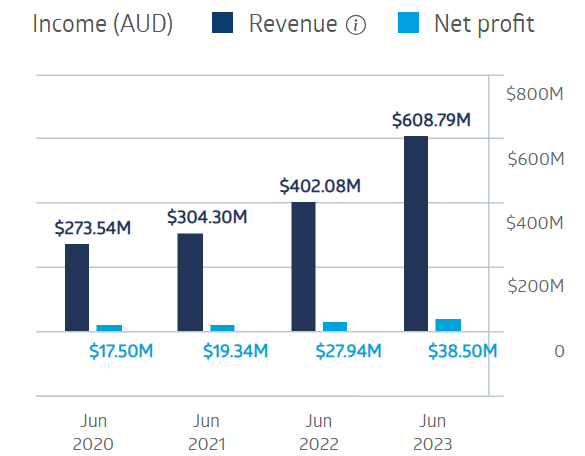

- The company has grown both revenue and net profit every year since listing.

- The share price is up more than 400% since its first day of trading.

The Mader Group provides skilled technicians for equipment and plant maintenance to the mining, industrial, and industrial sectors around the world.

The company listed on the ASX on 30 September of 2019, with its share price on an uninterrupted upward run, rising 476.6%.

Source: ASX

In its first full year of operation as a publicly traded company Mader posted a net profit, which along with the company’s revenues have grown every year since listing.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Mader Group Financial Performance

Source: ASX

Half Year 2024 financial results continued the trend, with revenues up 34%, net profit up 38%, dividend payments up 58%, and net debt down 17%.

Mader Group has set an aspirational target of $1 billion dollars in revenue by FY 2026. The company reaffirmed its full year 2024 guidance for revenues of 770 million dollars and net profit of $50 million dollars, significantly increasing its financial performance over FY 2023.

The company has paid dividends every year since listing, with a five-year average dividend yield of 1.35%, paying a dividend of $0.08 per share in FY 2023

An analyst at Baker Young has a HOLD recommendation on Mader Group shares, citing the mechanical services contractor strong revenue growth in US markets, net profit increase, and net debt reductions.

Marketscreener.com has an analyst consensus recommendation of BUY on MAD shares, with three of the four analysts reporting at BUY and one at HOLD.

The Wall Street Journal has an analyst consensus rating at OVERWEIGHT, with four of the six analysts reporting at BUY, one at OVERWEIGHT, and one at HOLD.

Over the past three months the share price is down 13.8%.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2024.

We’re giving away this valuable research for FREE.

Click below to secure your copy

Related Articles:

- Eight Top ASX Stocks for 2024

- 18 Share Tips: 18th March 2024

- ASX200 Up Marginally Monday, What Will Central Banks Bring?

- AUB Group (ASX:AUB) Shares Drop On The Day, But Huge Gains On The Year

- Proteomics International’s (ASX:PIQ) Delays the Launch of Kidney Disease Test in US

- Car Group (ASX: CAR) – Should Investors Take Profits, Hold, or Buy?