In recent months, Medibank Private Limited stock price (ASX:MPL) has witnessed a solid surge, with shares ascending by 7.5% YTD. This rally has encapsulated investor confidence and sparked a wave of optimistic discourse among market analysts observing the health insurer. In comparison, the ASX200 has risen by 0.56% over the same period, so this is not just a case of a rising tide floating all boats.

Medibank Private’s financial prowess, evidenced by its Return on Equity (ROE) of 26.8% through 2023 (growing from 20.2 & 23.2 in the preceding 2 years), sits as a testament to the company’s ability to effectively allocate capital and generate profits. The significance of ROE as an indicator of financial health cannot be understated, and Medibank’s figure suggests robust managerial efficiency and a potentially attractive investment for shareholders.

However, the path to its current standing has not been without its challenges. Some might say that Medibank’s five-year trajectory shows that net income growth has largely remained flat in comparison to the market but both margin and revenue have been increasing. This lack of significant growth comparatively could prompt potential investors to question the company’s capacity to expand its earnings moving forward. Despite this concern, investors have, thus far, not been deterred, possibly due to other aspects of the company’s financial health.

A notable feature of Medibank’s financial strategy has been its approach to dividend payouts. The company has established a practice of allocating a high portion of its earnings back to shareholders, which could be observed as a double-edged sword. While this enhances immediate returns for investors craving stable income from their holdings, it may also raise eyebrows regarding the company’s re-investment strategies and long-term growth prospects.

Looking ahead, analysts seem to maintain an upbeat outlook on Medibank Private’s performance, forecasting that the company’s ROE will climb, even though the payout ratio is projected to remain stable. This expected improvement in ROE might imply that analysts anticipate the company to either generate higher profits from the same level of equity or to optimize its equity usage more effectively.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Medibank Price Targets Have Analysts Not Far Off Current Mark

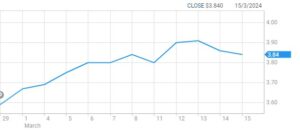

Investors currently engaged or considering a stake in Medibank Private Limited are advised to view these mixed signals with a balanced perspective. The consensus price target amongst analysts at the moment is $3.87, just a slither above the current price of $3.84. At the high end sits a price target of $4.20 against a low of $3.60. Picking out one that has recently revised forecasts we have Morgan Stanley with a price target now at the current live price of $3.84. Having raised early in March from a mark of $3.66 (when the stock was hovering around that mark), it remains to be seen whether any further revisions will be upcoming.

There may be better value opportunities in the market, but there certainly will be worse. Having put Medibank on our shortlist of financial shares toward the end of last year, we will be watching with interest to see how things continue to develop. As is stands, Medibank Private’s adaptability and strategic financial decisions will be pivotal in maintaining confidence and ensuring that its stock performance sustains its current upward momentum.