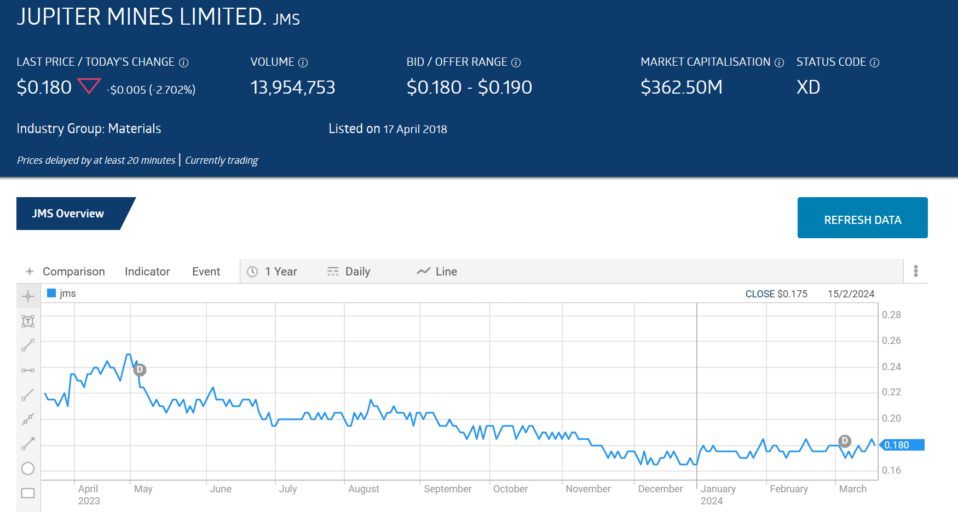

- Jupiter Mines listed on the ASX in 2018.

- The share price has moved downward since listing.

- The company generates both revenue and profit, featuring low P/E, P/EG, and P/B ratios.

Jupiter mines has a 49.8% interest in the Tshipi Manganese Mine in South Africa. The mine has been in production since 2012 and is considered one of the largest and lowest cost producers and exporters in the world.

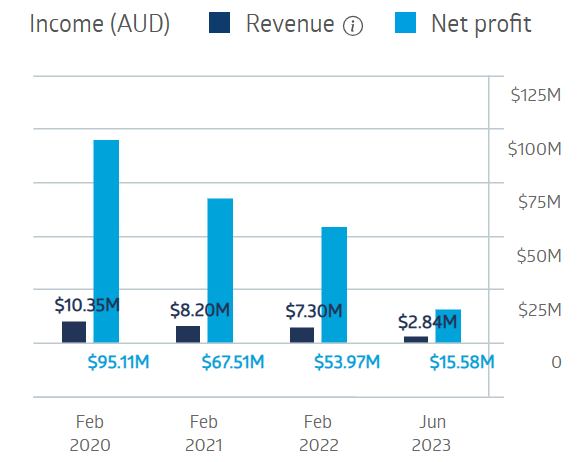

Jupiter’s revenues and profit have been in decline over the past four fiscal years.

Jupiter Mines Financial Performance

Source: ASX

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Half Year 2024 result saw revenues falling from half year 2023’s $4.6 million dollars to $3.3 million while profit declined from $1.0 million to $394,526 thousand.

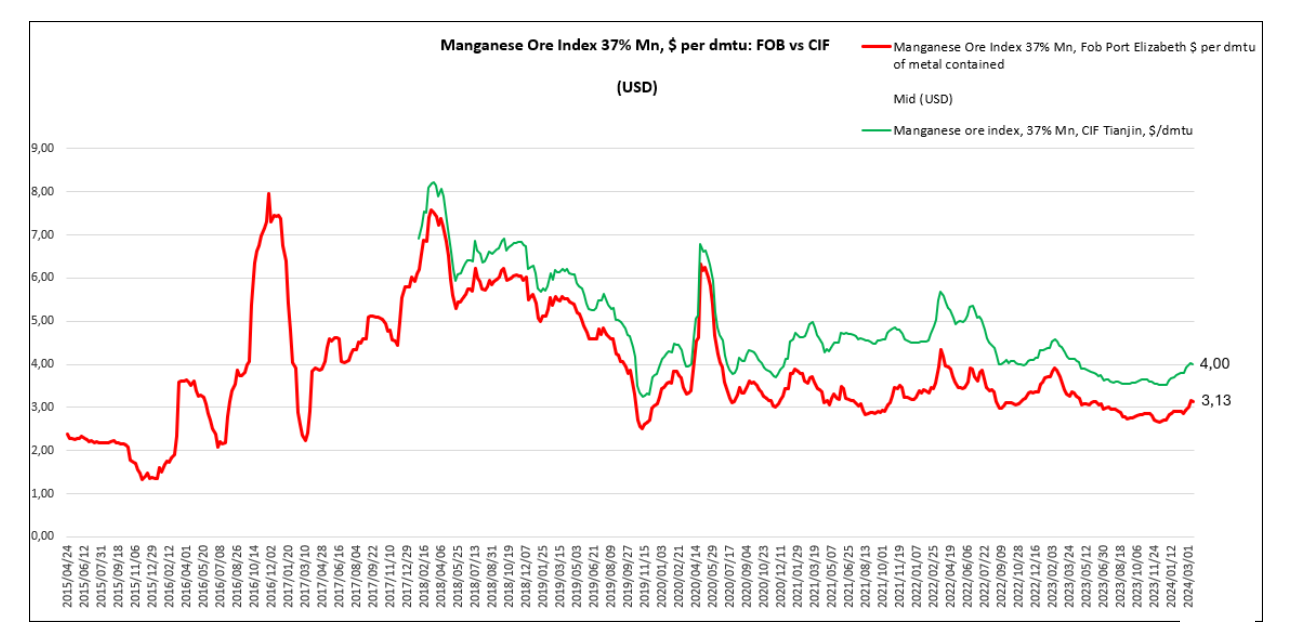

The company’s financial performance has been impacted by a variety of macroeconomic factors, the most prominent among them the volatile movements of the price of manganese. From the Jupiter Mines website:

Jupiter’s five-year strategy is to move from a pure-play miner into a supplier of High Purity Manganese Sulphate Monohydrate (HPMSM) for the battery market. On 13 March, the company released the results of a Scoping Study on successful laboratory production, positioning the company to move to a full-scale operating production facility.

Year over year the share price is down 21.7%.

Source: ASX

For investors with an appetite for risk, an analyst at Sequoia Wealth Management has a BUY recommendation on Jupiter shares, citing the company’s Half Year 2024 fiscal results, its long-life, open pit mine and processing plant, and its five-year strategic plan.

A sole analyst reporting on marketscreener.com has a BUY recommendation on Jupiter shares.

The Wall Street Journal has an analyst consensus rating of BUY on JMS shares, with all three of the analysts reporting at BUY.

Jupiter has a P/E ratio of 4.05; a P/EG of 0.25; and a P/B of 0.74. The book value per share is $0.24, with the share price at $0.18.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2024.

We’re giving away this valuable research for FREE.

Click below to secure your copy

Related Articles:

- Eight Top ASX Stocks for 2024

- 18 Share Tips: 18th March 2024

- ASX 200 & XAO Gained Tuesday on Central Bank Moves and Commodity Strength

- Can Mader Group (ASX: MAD) Keep Growing

- ASX200 Up Marginally Monday, What Will Central Banks Bring?

- AUB Group (ASX:AUB) Shares Drop On The Day, But Huge Gains On The Year