- Diversified property group Stockland Corporation has assets in residential communities, town centres, and land lease and workplace properties.

- The company has a high P/E ratio but also a low P/B ratio

- Analysts are bullish on the stock for the dividends.

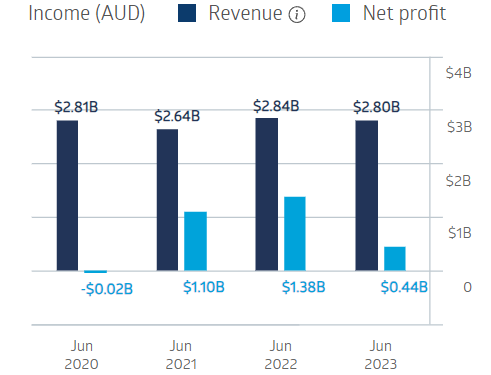

Real Estate Investment Trust (REIT) Stockland Corporation collided with “challenging market conditions” in FY 2023 resulting in a substantial decline in net profit after tax.

Stockland Corporation Financial Performance

Source: ASX

The trend continued with the Half Year 2024 results, with statutory profit dropping to AUD$102 million dollars, down from $301 million in the first half of 2023. The company outlook again cautioned on challenging conditions.

Despite the profit drop the share price remains in an upward trend, rising 27.6%. over the past three months. The company has a lofty Price to Earnings Ratio of 25.42, with an attractive Price to Book Ratio of 1.09, which translates to $4.23 per share. The five year average P/B is 0.98.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Stockalnd has a five year average dividend yield of 6.15%.

An analyst at Stockopedia has a BUY recommendation on Stockland shares (SGP), citing the company’s “diversified asset portfolio, strong occupancy rates, and recurring revenue streams coming from Stockland’s recent acquisition of 12 MPC (master planned communities) at a cost of more than $1 billion.”

Marketscreener.com has an OUTPERFORM rating on Stockland shares, with three of ten analysts reporting at BUY, two at OUTPERFORM, three at HOLD, and two at UNDERPERFORM.

Yahoo finance Australia has a BUY recommendation on SGP shares, with one of thirteen analysts reporting at STRONG BUY, seven at BUY, and five at HOLD.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2024.

We’re giving away this valuable research for FREE.

Click below to secure your copy