Diversifying Your Portfolio with Japanese Stocks

Many newcomers to share market investing are tempted to restrict their initial investments to the “hot stocks” of the moment, but many experienced traders choose to invest in Japanese stocks as a way to diversify their portfolios. At the turn of the century, .com stocks were the place to be, until the bubble burst. Today, the “hot stock” moniker belongs to any company involved in AI (artificial intelligence.)

Stock market investing is inherently risky. Some stocks are riskier than others and some do better in challenging times. Some economic conditions favour select business sectors while punishing others. In 1952, US economist Harry Markowitz introduced the what would become known as modern portfolio theory in his landmark book – Portfolio Selection. Diversification is the core principle of the theory.

Investors are urged to avoid fixating on individual companies in favour of considering their portfolio of holdings in relation to each other. The idea is to include assets that behave differently from each other under certain circumstances, providing a counter balance. While strict adherence to the approach calls for investing in different asset classes like bonds and real estate, equity investments over time have outperformed fixed income assets, leading many investors to seek diversification restricted to stocks.

Diversification goes beyond business sectors into geographic regions, allowing investors access to companies not available on the stock markets in their country. This is especially true for Aussie investors with limited opportunities on the finance and resource heavy ASX.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

While the world’s top companies are dominated by US stocks, there are seven Japanese companies in the Forbes 2004 Global 2000 List of the world’s largest publicly traded companies by market capitalisation:

- Toyota

- Mitsubishi UFJ Financial

- Sumitomo Mitsui Financial

- Sony

- Nippon Telegraph & Telephone

- Mitsubishi

- Honda Motor

In today’s digitally connected trading environment, Australian investors have relatively easy access to diversifying their portfolios with these and other Japanese stocks.

How to Invest In Japanese Stocks

Australian brokerage houses and online trading platforms allow the purchase of individual Japanese stocks trading on the Tokyo Stock Exchange (TSE) and exchange traded funds (ETFs) available directly on the ASX tracking the top Japanese index, the Nikkei 225. Commissions, fees and research capabilities vary.

While most investors might focus on fees and commissions, research capabilities of foreign stocks is one of the biggest challenges of adding individual stocks to a portfolio of holdings. Keeping up with what is going on the Japanese economy at large and specific Japanese companies is far more challenging and time consuming than keeping up with ASX listed companies.

Exchange traded funds limit the research task to the Japanese economy as a whole and provide an easier path to diversification. Building a portfolio of individually selected Japanese stocks is a task best left to Aussie investors with both the time and temperament required to select and manage.

Japanese ETFs

Australian investors have a choice between these two ETFs trading on the ASX:

- iShares MSCI Japan ETF (ASX: IJP) from BlackRock and

- Betashares Japan ETF – Currency Hedged (ASX: HJPN).

Both track the performance of the performance of the MSCI Japan Index. The index includes Japanese large-cap and mid -caps representing about 85% of Japanese stocks with total holdings of 191 companies.

Investors who prefer investing in US ETFs with a trading platform that has access to US stocks can buy the iShares MSCI Japan ETF (NYSE Arca: EWJ). This fund represents the sum total of holdings included in the Australian Japanese ETFs from BlackRock.

Over five years both Australian funds have outperformed the ASX 200.

Source: ASX 20 February 2025

For bargain hunters, both funds have started off 2025 on the dip, with IJP up 1.29% and HJPN down 2.0%.

iShares MSCI Japan ETF (ASX: IJP) offers exposure to notable Japanese companies not included in the Forbes 2004 Global 2000 List , including:

- Hitachi

- Nintendo

- Fujitsu

- Canon

- Panasonic

- Fuji Film

- Bridgestone

- Nippon Steel

- Suzuki Motor

- Olympus, and

- Rakuten

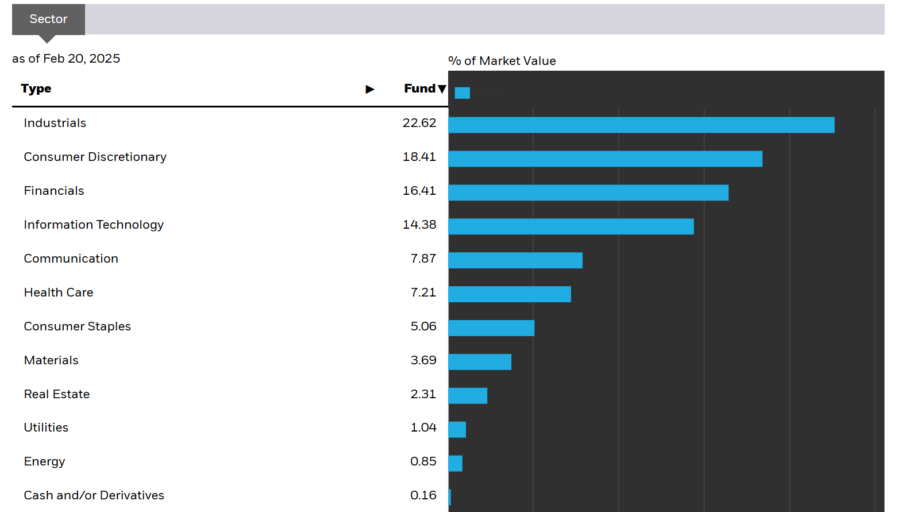

From the BlackRock website here is the breakdown of holdings by business sector:

Source: BlackRock

BetaShares ETFs are provided by an Australia-based fund manger specialising in ETFs. The Betashares Japan ETF – Currency Hedged (ASX: HJPN) restricts its holdings to the largest Japanese companies, with the fund hedged into Australian dollars.

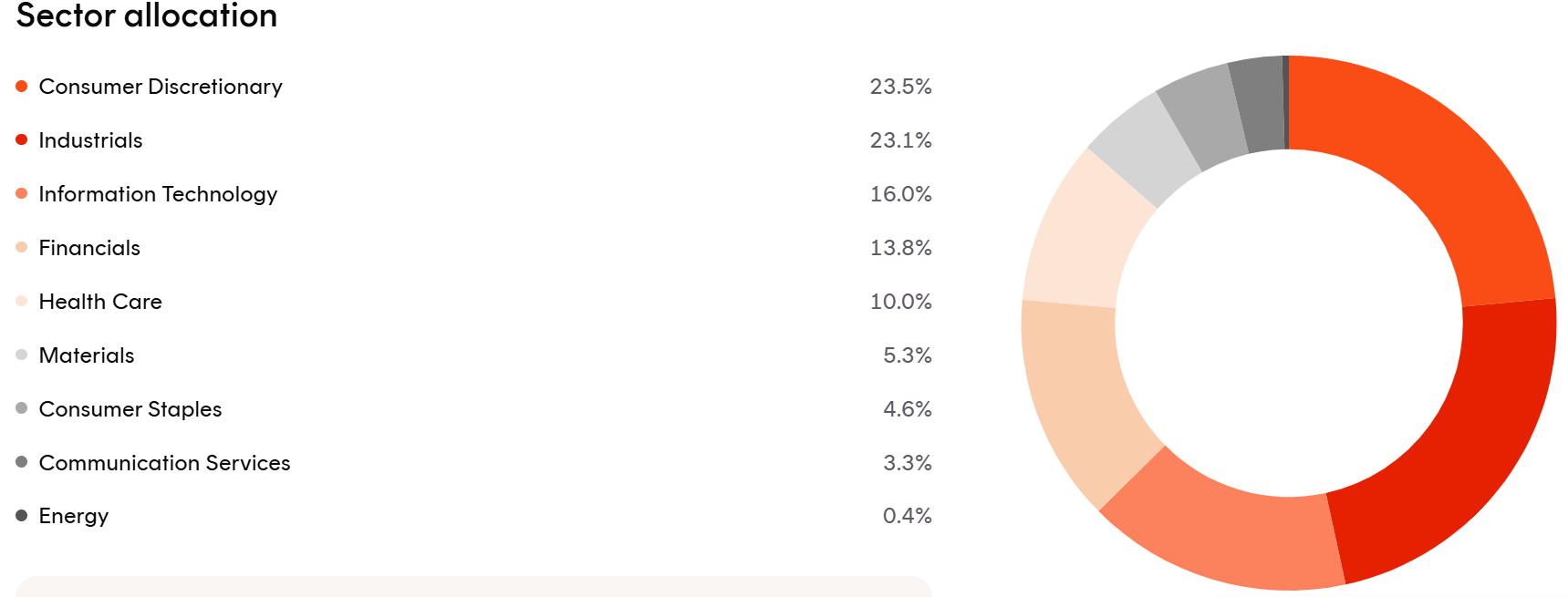

The fund flips the top sectors in the breakdown, with Consumer Discretionary at the top followed by industrials. From the BetaShares website here is the sector breakdown, as of 31 January of 2025:

Source: BetaShares

One year total returns from HJPN came to 15.84% while IJP’s total returns came to 11.84%.

The Best Japanese Stocks

For investors bold enough to consider diversifying with individual stocks, here are the top ten Japanese stocks from 2024:

- Toyota Motor Corporation

- ‘Sony Group

- Tokyo Electron

- Fast Retailing

- Hitachi

- Mitsubishi UFJ Financial

- Shin-Etsu Chemical

- Nintendo

- SoftBank Group

- Nomura Holdings

Bargain hunters could look to Toyota, down about 11% year to date. Investors who believe “high flying” stocks will keep flying, might be interested in Sony Group, up about 14% year to date, and Tokyo Electron, up about 16.4% year to date.

Other targets for bargain hunters include Fast Retailing, Hitachi down about 45% year to date, and Shin-Etsu down about 18.7%.

Toyota, Sony, Hitachi. Mitsubishi, and Nintendo are well-known Japanese companies.

Tokyo Electron is an electronics and semiconductor manufacturer serving Southeast Asian countries, Europe, and North America.

Fast Retailing is a designer, manufacture, and distributor of casual clothing for men, women, and children. The company offers a range of branded products in Japan and internationally.

Shin-Etsu is Japan’s largest chemical company. The company leads the world in market share for PVC (polyvinyl chloride), silicon for semiconductors, and photomasks used for photolithography.

SoftBank Group is a multinational conglomerate focusing on investment management of companies providing a wide range of technology products serving multiple markets around the world.

Nomura Holdings, up about 7.4% year to date, is a global financial services company serving over 30 countries around the world.

The Japanese economy includes some of the world’s largest companies. Investors looking to diversify their portfolio of ASX holdings with international stocks can go directly to the ASX. There are two ETFs on the ASX that provide diversification through Japan’s largest companies.

Both the iShares MSCI Japan ETF (ASX: IJP) and the Betashares Japan ETF – Currency Hedged (ASX: HJPN) track the performance of the MSCI Japan Index. The index includes Japanese large-cap and mid -caps representing about 85% of Japanese stocks with total holdings of 191 companies.

Japanese Stocks FAQs

Can I Invest in Japanese Stocks From Australia?

Yes. It is very possible for Australian investors to buy Japanese stocks. The simplest way is to buy ASX-listed ETFs that include Japanese shares, such as the iShares MSCI Japan ETF and the Betashares Japan ETF. Investors can also purchase shares in individual Japanese companies via their broker.

Are Japanese Stocks a Good Investment?

Investing in Japanese stocks can be a good way for Australian investors to diversify their portfolios. The Nikkei 225, Japan’s leading stock index hit a high of just over 41,000 in July 2024, up from just over 20,000 in 2020. The index has traded largely sideways since then dropping back to 37,160 at the time of writing, a gain of 82.26%.

What are the Five Biggest Japanese Companies?

The five biggest Japanese companies by market cap are Toyota, Mitsubishi UFJ Financial, Sony, Hitachi and Keyence. Toyota is by far the largest company with a market cap of $236.58B. Mitsubishi UFJ Financial is the second largest with a market cap of $155.23B, closely followed by Sony at $153.78B. Hitachi is fourth largest with a $121.80B market cap and Keyence is fifth largest with $101.14B.