- Global supplier of small kitchen appliances has grown revenue and profit in each of the last four fiscal years.

- Half-Year 2024 results were positive, but below expectations.

- Management warned of continuing macroeconomic headwinds.

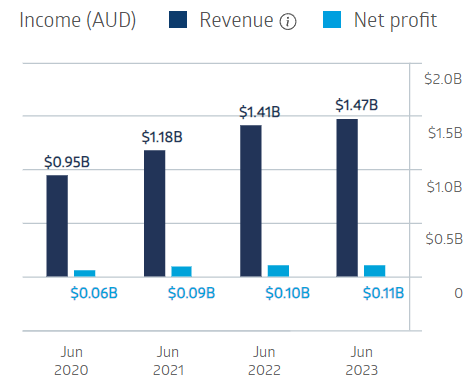

Despite the COVID 19 pandemic and rising interest rates and inflationary conditions threatening consumer spending worldwide, Breville Group has experienced slow and steady revenue and profit growth over the last four fiscal years.

Breville Group Financial Performance

Source: ASX

While the share price is up 28.2% year over year, year to date the share price is essentially flat following a sell-off attributed to the company’s missed expectations and cautious outlook in the Half Year 2024 results announcement.

Breville’s FY 2023 dividend payment of $0.32 per share is down from the ten year high payment of $0.41, paid in FY 2020. The current yield is 1.12% with a five year average of 1.42%.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Source: ASX

An analyst at Novus Capital has a HOLD recommendation on Breville Group shares, citing half year 2024 results that fell below market expectations, although positive, and commenting on an “inventory reduction supporting a forecast to continue moving forward.”

Marketscreener.com has an analyst consensus recommendation of HOLD, with two of the fifteen analysts reporting at BUY, three at OUTPERFORM, seven at HOLD, one at UNDERPERFORM, and two at SELL.

The Wall Street Journal also has an analyst consensus rating at HOLD, with three of the fifteen analysts reporting at BUY, two at OVERWEIGHT, seven at HOLD, one at UNDERWEIGHT, and two at SELL.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2024.

We’re giving away this valuable research for FREE.

Click below to secure your copy