- One-stop nursery retailer Baby Bunting Group is Australia’s largest.

- The company is cited by multiple analysts as a top income stock.

- Company metrics are showing signs of recovery from a profit plunge.

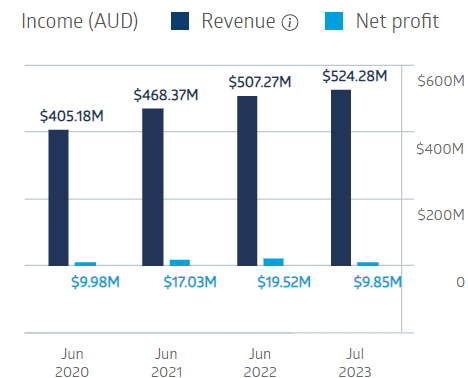

Baby Bunting Group was one of the few Aussie retailers whose stores remained open despite lockdowns during COVID, with both revenue and profit growth continuing throughout before flagging in FY 2023.

Baby Bunting Group Financial Performance

Source: ASX

Revenue increases could not handle the impacts of the cost of doing business, competitor, and challenging economic conditions on net profit, which dropped 51%. Half Year 2024 results continued with profit declines and adding revenue drops. Sales and customer acquisition metrics showed signs of improvement.

The dismal FY 2023 financials included 2022 dividend payments of $0.16 per share cut in half to $0.08 per share, fully franked. The five-year average payment is $0.11 per share with a five-year average yield of 3.39%.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Analyst firm Morgans lists BBN as a dividend stock to buy, joined by Citi and others.

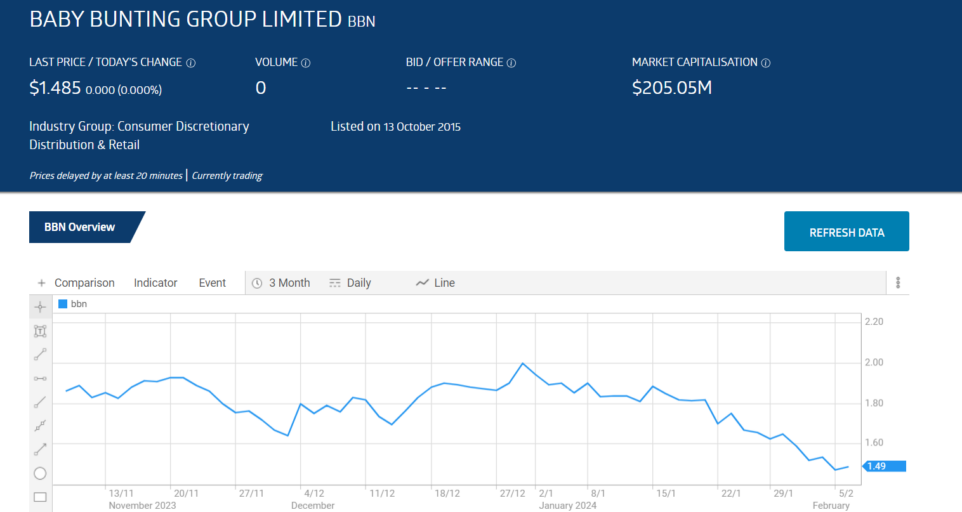

Year over year the stock price has dropped 49.5%.

Source: ASX

An analyst at Sequoia Wealth Management has a HOLD recommendation on Baby Bunting Group, cautioning investors to continue to monitor the news flow on the company’s modestly improving performance.

Marketscreener.com has an analyst consensus rating at OUTPERFORM, with three of the six analysts reporting at BUY, one at OUTPERFORM, and two at HOLD.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2024.

We’re giving away this valuable research for FREE.

Click below to secure your copy