Peter Lynch managed the Fidelity Magellan Mutual Fund from 1977 to 1999. Along the way, his average annual rate of return was 29.2%, more than doubling the average returns of the US flagship index — the S&P 500 — in six of those years and outperforming the index in 11 years. When he inherited management of the fund, its assets stood at $18 million dollars. When he left, the assets of the fund had ballooned to $14 billion dollars.

His strategy was simple and should provide a starting point for all beginners in the world of share market investing – invest in what you know.

This strategy does not absolve the newcomer from the need to fully research a prospective investment in a sector he or she knows. This leads to a corollary bit of advice – invest in what you can understand by putting in the effort to learn.

A company like ASX listed global wine producer Treasury Wine Estates (ASX: TWE) has a relatively simple business model even non-wine drinkers can understand – grow grapes, produce different wines, and distribute them around the world.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

In contrast, many biotechs are engaged in medical technologies beyond the comprehension of beginning investors, although with more experience analyzing potential markets and competition investors can take the risk with these and other high-tech shares,

Best ASX Stocks for Newcomers

Regardless of their experience in share market investing, all investors need to research potential buys. Starting with stocks in which the investor has pre-existing familiarity is a sound strategy for beginning investors.

- Car Group (ASX: CAR)

- REA Group (ASX: REA)

- Treasury Wine Estates (ASX: TWE)

- Wesfarmers Limited (ASX: WES)

- JB HiFi Limited (ASX: JBH)

Car Group (ASX: CAR)

In 1994 Amazon began selling books over the internet, followed by the opening of the eBay auction site in 1995.

In 1997, two Australian entrepreneurs revolutionised the way cars were sold, replacing classified ads as the conventional way of listing and buying cars, with the creation of a digital platform for vehicle advertising and consumer searches.

Today the company has expanded its online listing and sales sites to include multiple forms of vehicular transportation in countries around the world. Car group has ancillary sites as well, ranging from parts to marketing and data research.

In addition to its Australian market dominating position, Car has digital marketing platforms in South Korea, the United States, Brazil, Malaysia, Indonesia, Thailand, Chile, China, and Mexico.

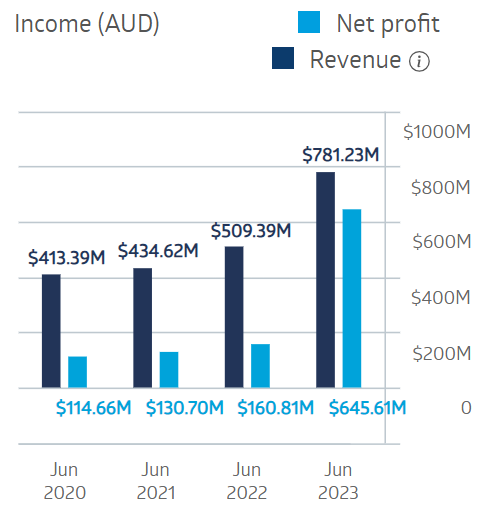

The company has grown revenue and profit in each of the last four fiscal years.

Car Group Financial Performance

Source: ASX

Half Year 2024 results continued the outstanding performance, with revenues and profit excluding abnormal items up 60% and 34%, respectively. The company has been a consistent dividend payer over the last decade, with an FY 2023 payment of $0.69 per share and a five-year trailing dividend yield of 2.29%.

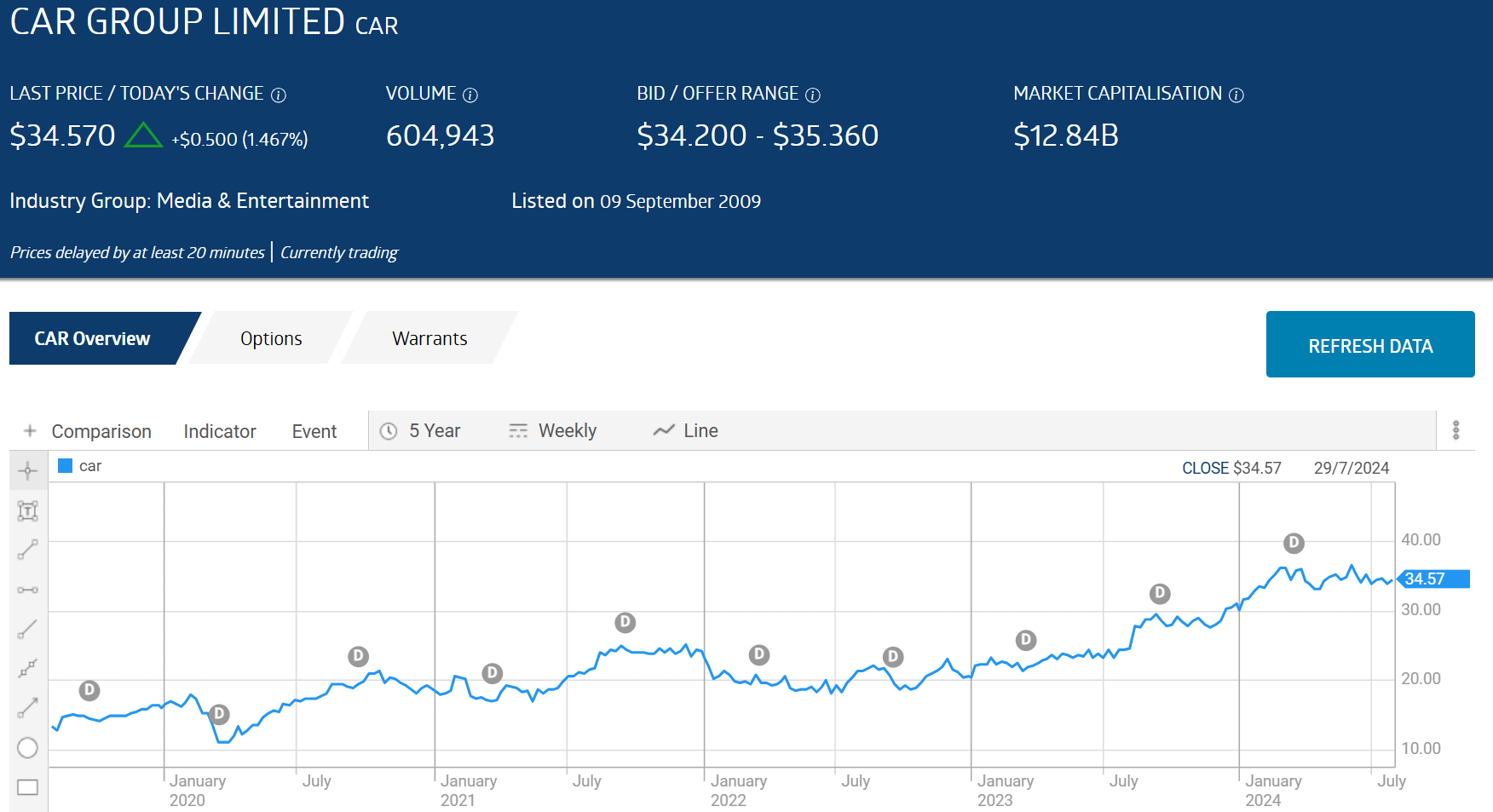

Over five years the CAR share price has risen 169.3%. Year over year the price is up 41.6%.

Source: ASX

The Wall Street Journal is reporting an OVERWEIGHT rating on CAR shares, with 5 analysts at BUY, 1 at OVERWEIGHT, 5 at HOLD, and 2 at UNDERWEIGHT.

REA Group (ASX: REA)

REA Group also revolutionized the conventional way of listing and buying property. Formed in 1995 REA began what was to become the standard way of doing business in the property sector. The company has expanded into commercial real estate, mortgage brokering, and home financing. REA Group boasts more than 20 digital property advertising sites around the world.

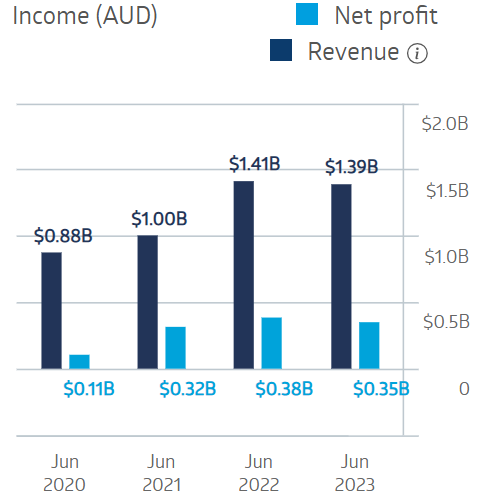

The company’s financial performance saw modest dips in revenue and profit in FY 2023.

REA Group Financial Performance

Source: ASX

Half Year 2024 results saw revenues up 18% and net profit up 22%. REA is another prolific dividend payer, with an FY 2023 payment of $1.19 per share and a five-year trailing dividend yield of 0.99%.

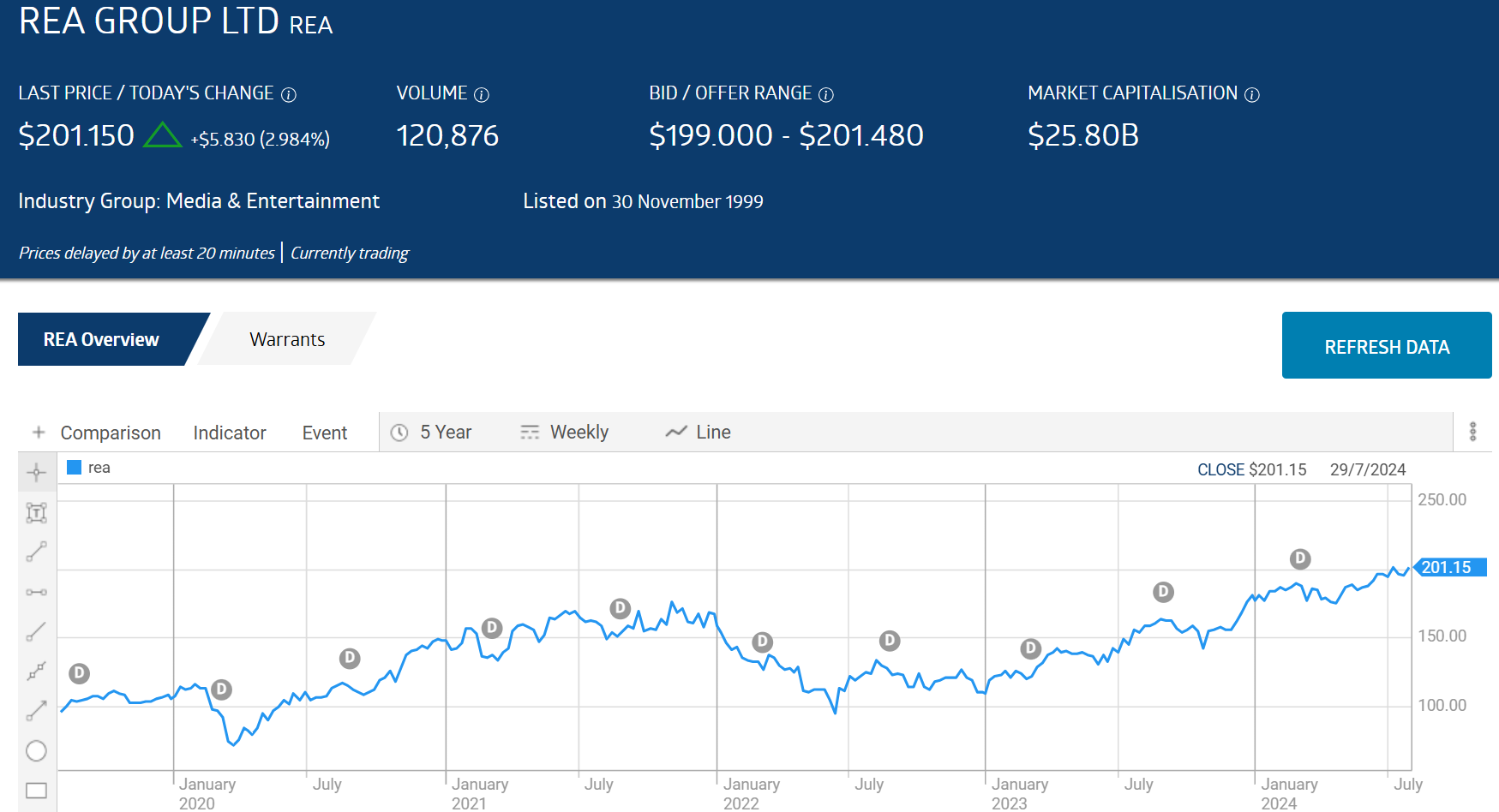

Over five years REA shares are up 109.4%. Year over year the share price is up 28.6%.

Source: ASX

The Wall Street Journal is reporting an OVERWEIGHT rating on REA shares, with 6 analysts at BUY, 8 at HOLD, 1 at UNDERWEIGHT, and 1 at SELL.

Treasury Wine Estates (ASX: TWE)

Inn 2021 China levied tariffs on imported Australian wine, devastating the TWE share price, but the financial performance remained resilient. The company has vineyards here in Australia as well as in the wine-growing regions of the US, Italy, and France.

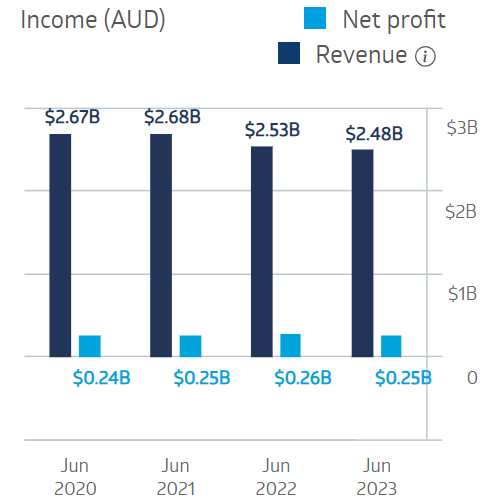

Treasury Wine Estates Financial Performance

Source: ASX

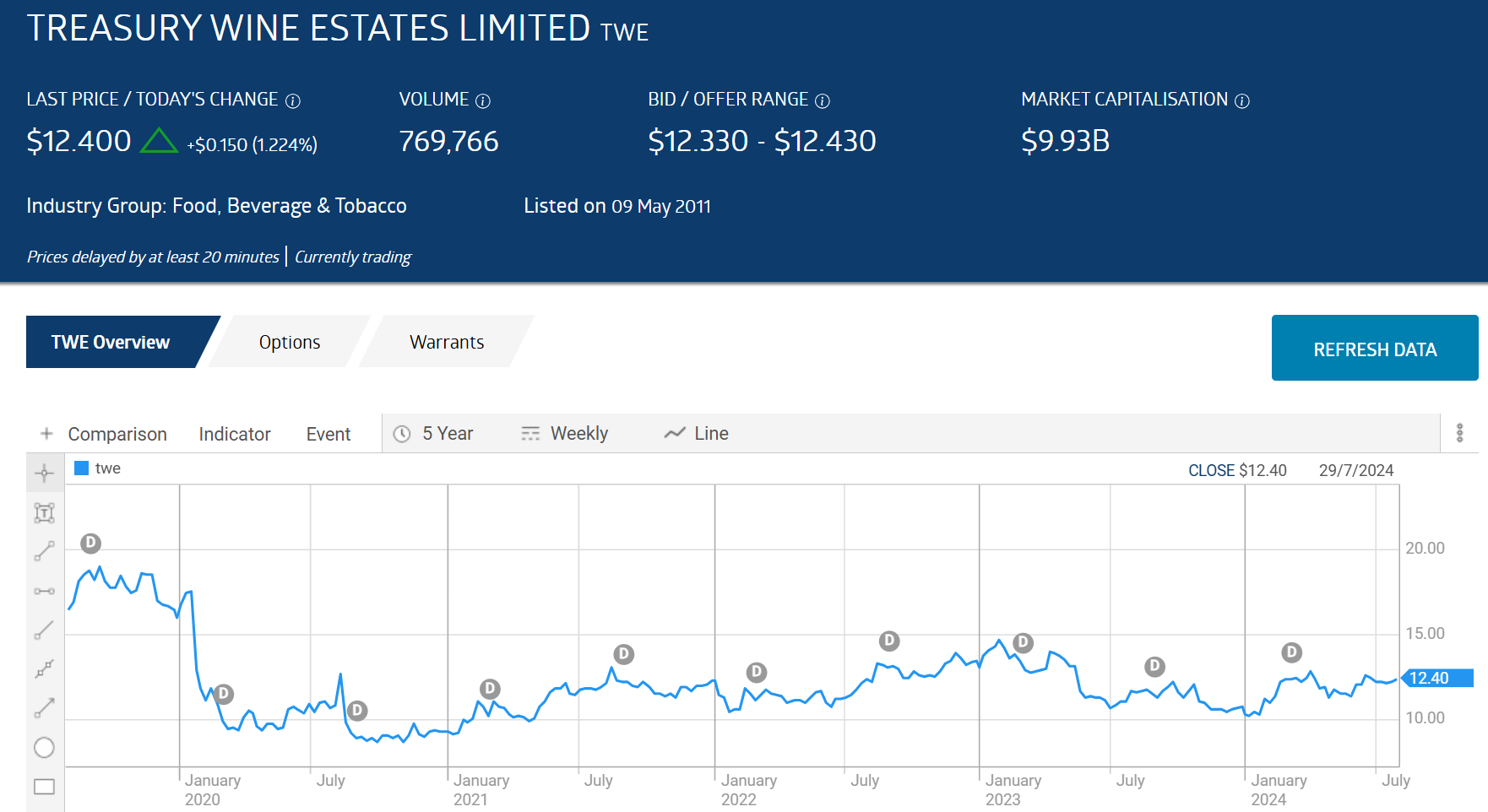

Over five years the TWE share price dropped 16%. Year over year the share price is up 12.2%.

Source: ASX

On 28 March China lifted the tariffs. TWE’s Half Year 2024 results showed flat revenues and a 16.9% drop in net profit. In FY 2023 the company continued its decade long record of dividends with a payment of $0.34 per share with a five year trailing dividend yield of 2.59%.

The Wall Street Journal is reporting an OVERWEIGHT rating on Treasury Wine Estate shares, with 11 analysts at BUY, 2 at OVERWEIGHT, and 3 at HOLD.

Wesfarmers Limited (ASX: WES)

Wesfarmers Limited presents more of a challenge to beginner investor due to its diversified holding, essentially making the stock like owning three companies instead of one. Wesfarmers owns noted Australian branded retail outlets Bunnings Hardware, Kmart Discount Stores, and Officeworks. Newcomers quickly learn of the benefits of diversification, with Wesfarmers offering that advantage. The products included in the company’s businesses span the gamut of consumer needs, from discretionary items to stable items.

The company’s other businesses include industrial and safety products, health and digital products, chemicals, fertilizers, and energy products.

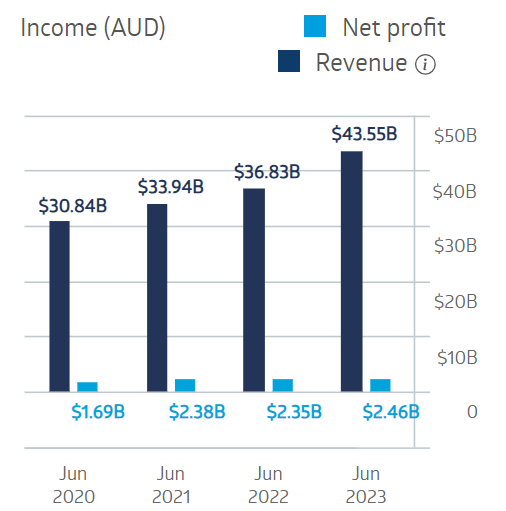

Wesfarmers Financial Performance

Source: ASX

Half Year 2024 results were essentially flat, with revenues up 0.5% and net profit up 3%.

Wesfarmers has a five-year trailing average dividend yield of 3.45% with a dividend payment in FY 2023 of $1.94.

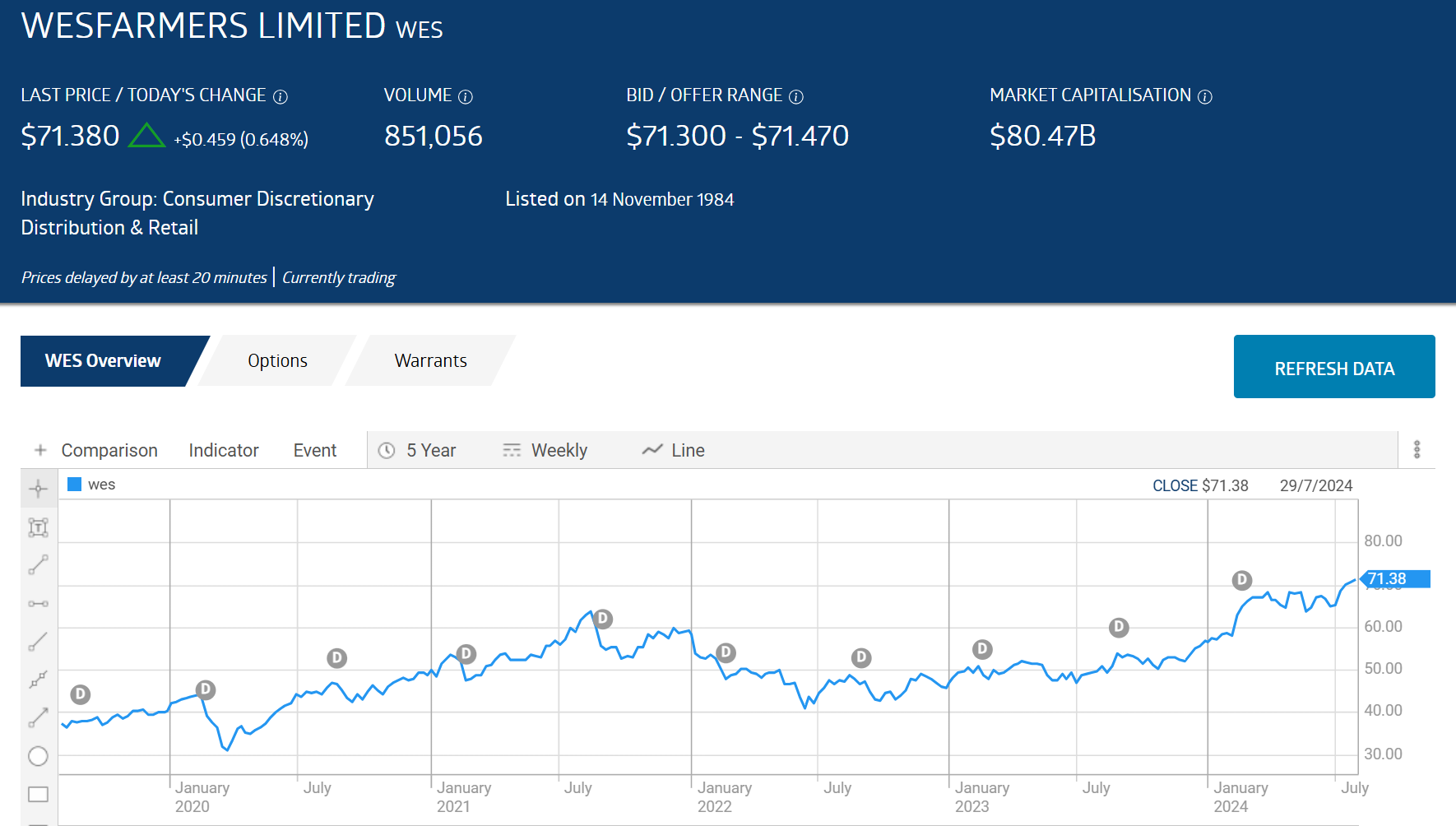

Over five years the WES share price has gone up 97.4%, while year over year the price has risen 43.8%. On 23 July, the share price hit an all-time high.

Source: ASX

The Wall Street Journal is reporting a HOLD rating on Wesfarmers shares, with 1 analyst at BUY, 7 at HOLD, 2 at UNDERWEIGHT, and 3 at SELL.

JB HiFi Limited (ASX: JBH)

Online and brick-and-mortar retailer JB HiFi offers a broad array of consumer electronics, hoe entertainment, and appliances. Despite intense competition from offshore online discount sites, JB HiFi has maintained its reputation as a low-price leader. The company’s business divisions are JB HiFi Australia, JB HiFi New Zealand, and the Good Guys (home appliances.)

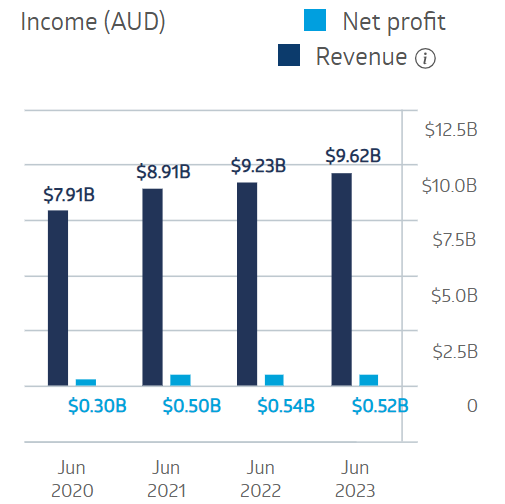

JB HiFi Financial Performance

Source: ASX

Half Year 2024 results showed the cost of living increases plaguing Australian consumers weighing on the company’s finances, with total sales down 2.2% and net profit down 19.9%.

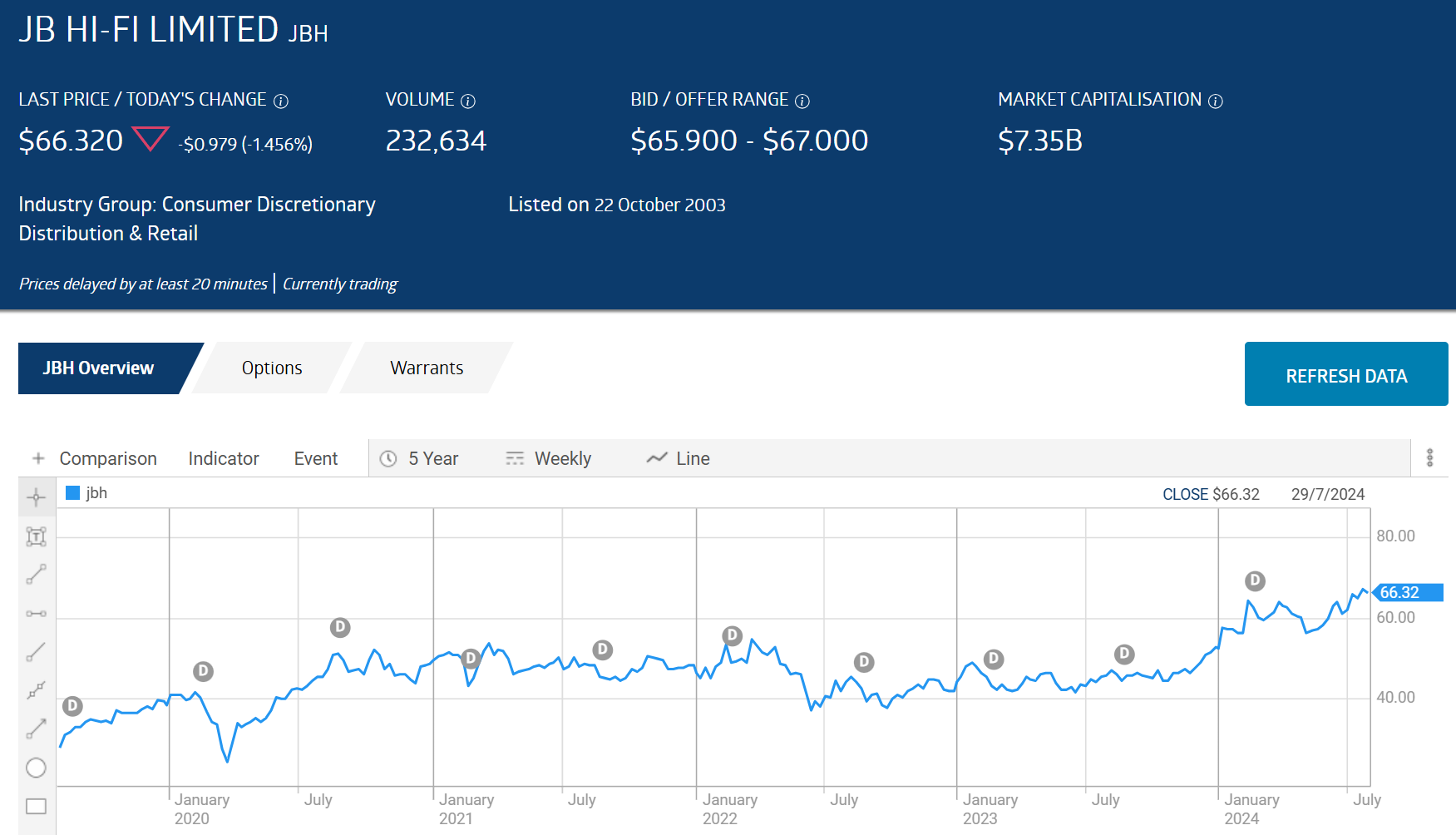

Over five years JBH has risen 156.5%. Year over year the share price is up 45.4%, reaching a 52 week high on 23 July.

Source: ASX

ASX retail stocks continue to surprise despite challenges confronting Australian consumers. In particular, JBH was downgraded to sell at global investment banker Goldman Sachs, yet the share price continued to rise, up 9.58% over the last three months.

The Wall Street Journal is reporting a HOLD rating on JB HiFi shares, with 4 analyst at BUY, 1 at OVERWEIGHT, 3 at HOLD,3 at UNDERWEIGHT, and 3 at SELL.

First-time investors in the ASX would be well advised to stick with stocks working in business sectors they know, or in stocks of businesses with business models that are relatively simple and easy to comprehend. Retailers are typical targets along with online digital advertising platforms like Car Group and REA Group are also potential start-up investments.