In share markets across the world the COVID 19 pandemic sent stocks tumbling through no fault of their own. Of the sectors hardest hit, none could compare to the havoc created in the travel and tourism sector.

Patient investors eagerly awaited the day COVID would ease its vise-like grip and the best of breed ASX travel and tourism stocks would return to pre-COVID performance. Then came a new roadblock – challenging macroeconomic conditions spurred on by inflation, high interest rates, and growing fears of a global recession.

The travel and tourism sector covers a broad range of businesses from transportation to accommodations and tourist attractions and entertainment. When searching the Internet in 2024 looking for the best stocks investors find heavy emphasis on transportation and accommodation stocks, with many worthy tourism stocks and newcomers to the travel and accommodation sector falling under the radar.

Under the radar stocks offer investors some advantages over stocks constantly in the news. Ignored by the investment community at large, under the radar stocks can mean early entry into hidden, undiscovered gems. In addition, under the radar stocks are less likely to fall victim to panic selling.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Top ASX Travel & Tourism Shares

Three of the top travel and accommodation stocks on the ASX are on the Top 100 Most Shorted Shares – Flight Centre (ASX FLT) at #4; Webjet (ASX: WEB) at #25; and Corporate Travel Management at #55 – trail our first under the radar stock – Serko Limited (ASX: SK0) by wide margins.

Source: ASX

5 Best ASX Travel and Tourism Shares

- Serko Limited (ASX: SKO)

- Tourism Holdings Limited (ASX: THL)

- Experience Co Limited (ASX: EXP)

- Kelsian Group Limited (ASX: KLS)

- SiteMinder Limited (ASX: SDR)

Serko Limited (ASX: SKO)

New Zealand based Serko Limited offers its business customers travel booking and expense management services, both online and via a mobile app. Operating as a SaaS (software as a service) company, Serko’s Zeno software-based platform allows business travelers to make flight and accommodation bookings as well as ground transport. Intelligence-based Zeno Expense manages corporate card and out of pocket expenses and reimbursements in line with company policy.

Serko signed a partnership agreement with Booking.com in 2019, incorporating Zeno into the Booking.com for Business platform. Serko operates internationally with offices in Australia, the United States, and China.

Since listing in 2018 the stock price is up 15.6%. Year over year SKO has risen 59.8%. The company has yet to show a profit but is generating revenue.

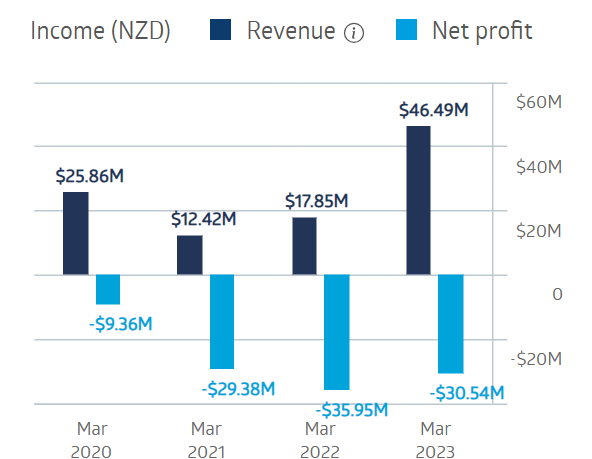

Serko Limited Financial Performance

Source: ASX

Half Year 2024 results showed major improvements in cash burn – down 84% – and total loss – down 64% from Half Year 2023. Net income was up 87%, with total bookings up 26%. Room bookings from Booking.com for Business rose 192%.

Serko’s ninety-day average trading volume is a miniscule 11,913 shares traded per day.

Tourism Holdings Limited (ASX: THL)

Tourism Holdings is another New Zealand-based company listed on the ASX flying well under the radar of the ASX investing community, with a ninety-day trading volume of 40,700 shares per day.

The company designs, builds, sells, and rents RVs (recreational vehicles) directly in New Zealand, Australia, United Kingdom, Europe, the USA, and Canada, and via franchise operations in Japan and South Africa.

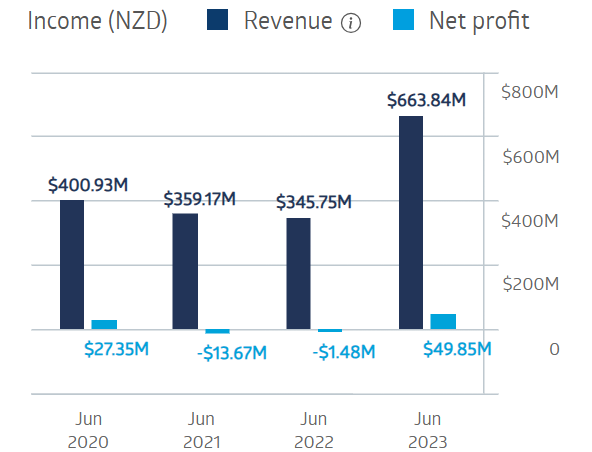

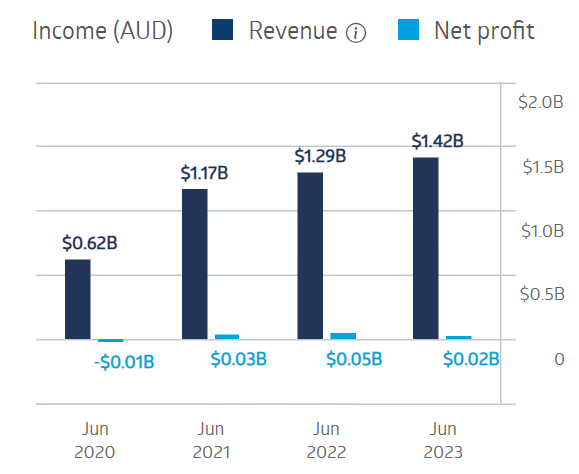

Tourism Holdings revenues declined and profits turned into losses in the COVID impacted Fiscal Years of 2021 and 2022 but rebounded strongly in FY 2023.

Tourism Holdings Financial Performance

Source: ASX

Half Year 2024 results continued the powerful performance, with underlying net profit up 51% and revenues up 72%. Tourism Holdings began paying dividends in FY 2023 and declared an interim dividend payment of $0.045 per share.

Year over year the share price is down 33.1%, as of 22 April of 2024. Since listing in 2022 the share price has fallen 22.3%.

Experience Co Limited (ASX: EXP)

Operating in New Zealand and Australia, Experience Co offers risk tolerant travelers the ultimate in adventure experiences – skydiving. The company’s second revenue producing segment is Adventure Experiences, ranging from the challenging tree top climbing to the leisurely day-trip tours of islands, reefs, and rain forests. More rigorous multi-day trips are available with walking tours of more remote areas, including wild bush, plains, and homesteading areas.

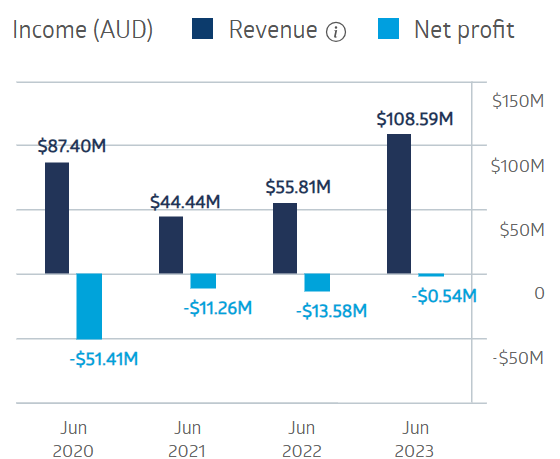

COVID came close to shutting this company down, but Aussie and Kiwi adventurers are returning, with analysts projecting an uptick in visitors from India and China. FY 2023 revenues came close to doubling the FY 2022 results and the company dramatically reduced its loss.

Experience Co Financial Performance

Source: ASX

Half Year 2024 results were impacted by Cyclone Jasper and the cost-of-living pressures on domestic adventure seekers, but the company is seeing improved demand domestically and from Indian, South Korean, US, and UK travelers. Revenues increased 20.8% and Experience Co continued reducing its posted loss – this time by 16.2%.

Year over year the share price is down 45.2%. Since listing in 2015 the share price has fallen 53%. The company has a ninety-day average trading volume of 337,735 shares per day, far below the “in the spotlight” Flight Centre’s more than 800k shares traded per day.

Kelsian Group Limited (ASX: KLS)

Kelsian operates in both transportation and tourism. The company changed its name from Sealink to reflect its growing presence in both public and private transportation systems. Kelsian designs and delivers public transportation systems here in Australia, Singapore, the UK, and the US. The Sealink operations continues to provide marine transport to the Channel islands, along with offering resorts and accommodations and a variety of single and multi-day tours, leisure cruises, and packaged holidays.

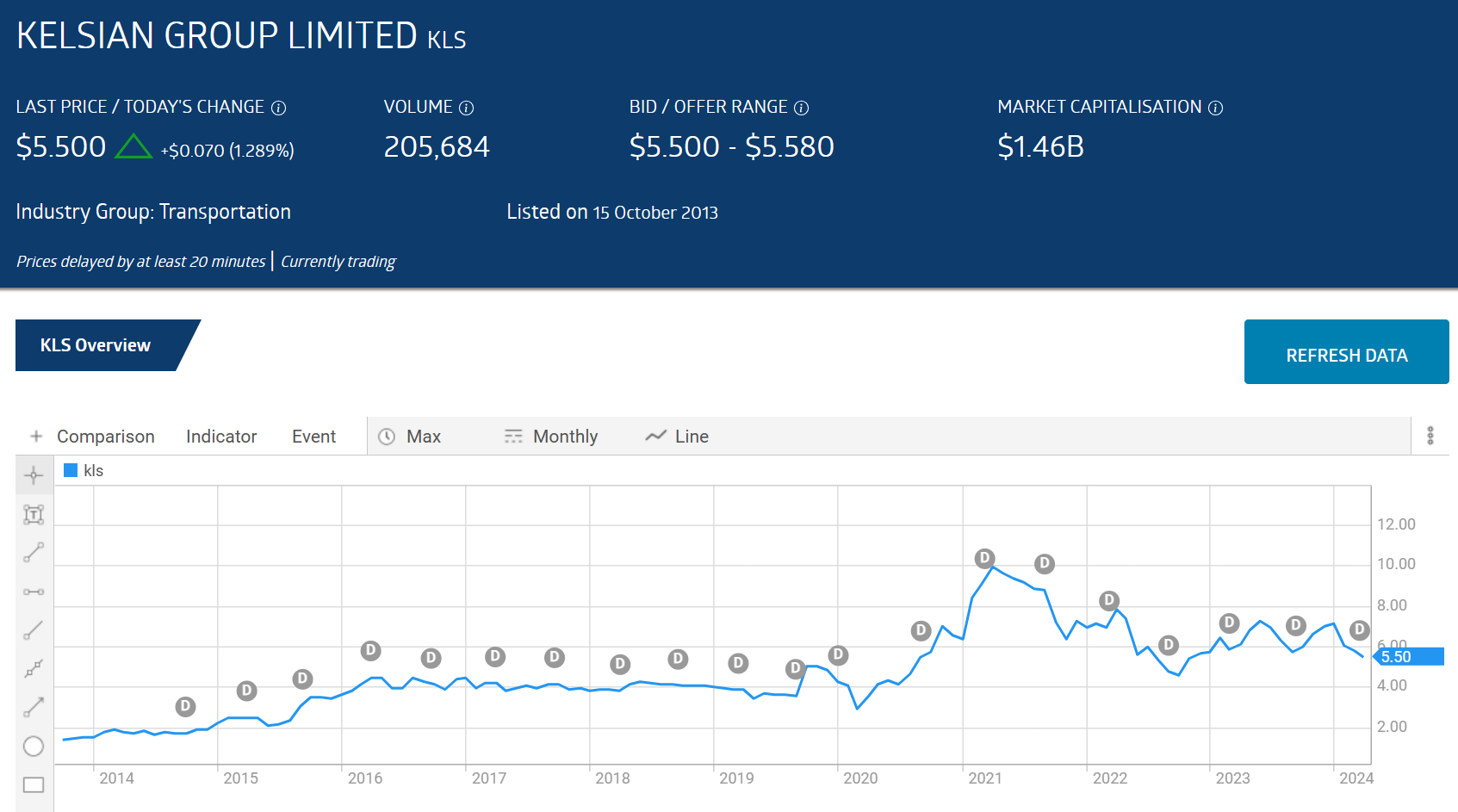

Since listing in 2023 the Kelsian share price has risen 295.3%. Year to date the share price is down 21.4%.

Source: ASX

Kelsian’s share price hit an all-time high as the impact of COVID widened. The company maintained its dividend payments throughout the COVID pandemic but did cut the payments back from $0.21 per share in FY 2021 to $0.04 in FY 2020 before rebounding to $0.16 per share, with a five-year average dividend yield of 2.29%.

Revenues and profit rebounded from the pain of FY 2020 in FY 2021 and 2022, but the challenging conditions of 2023 slowed the recovery.

Kelsian Group Financial Performance

Source: ASX

Half Year 2024 financial performance showed revenues growing 44.9% with statutory net profit up 44.1%, adjusted net profit (NPATA) up 20.4% and underlying net profit down 0.8%.

Over ninety days KLS shares have averaged 396,581 shares per day, as of 22 April of 2024.

SiteMinder Limited (ASX: SDR)

As the business world continues to transition to more digitisation many boutique hotels and resorts struggle to keep up. The SiteMinder Hotel Commerce Platform empowers its commercial hotel and resort users to market, sell, and manage their business operations. Platform components include a Hotel channel manager; a Hotel booking engine; a Hotel website builder as well as Hotel business intelligence and insight support and access to more than 450 of the largest booking channels in the world.

The platform is available in eight languages serving customers in 150 countries. Office locations span the globe – Sydney, London, Bangkok, Dallas, Galway, Berlin, Manilla, Barcelona, and Banalore.

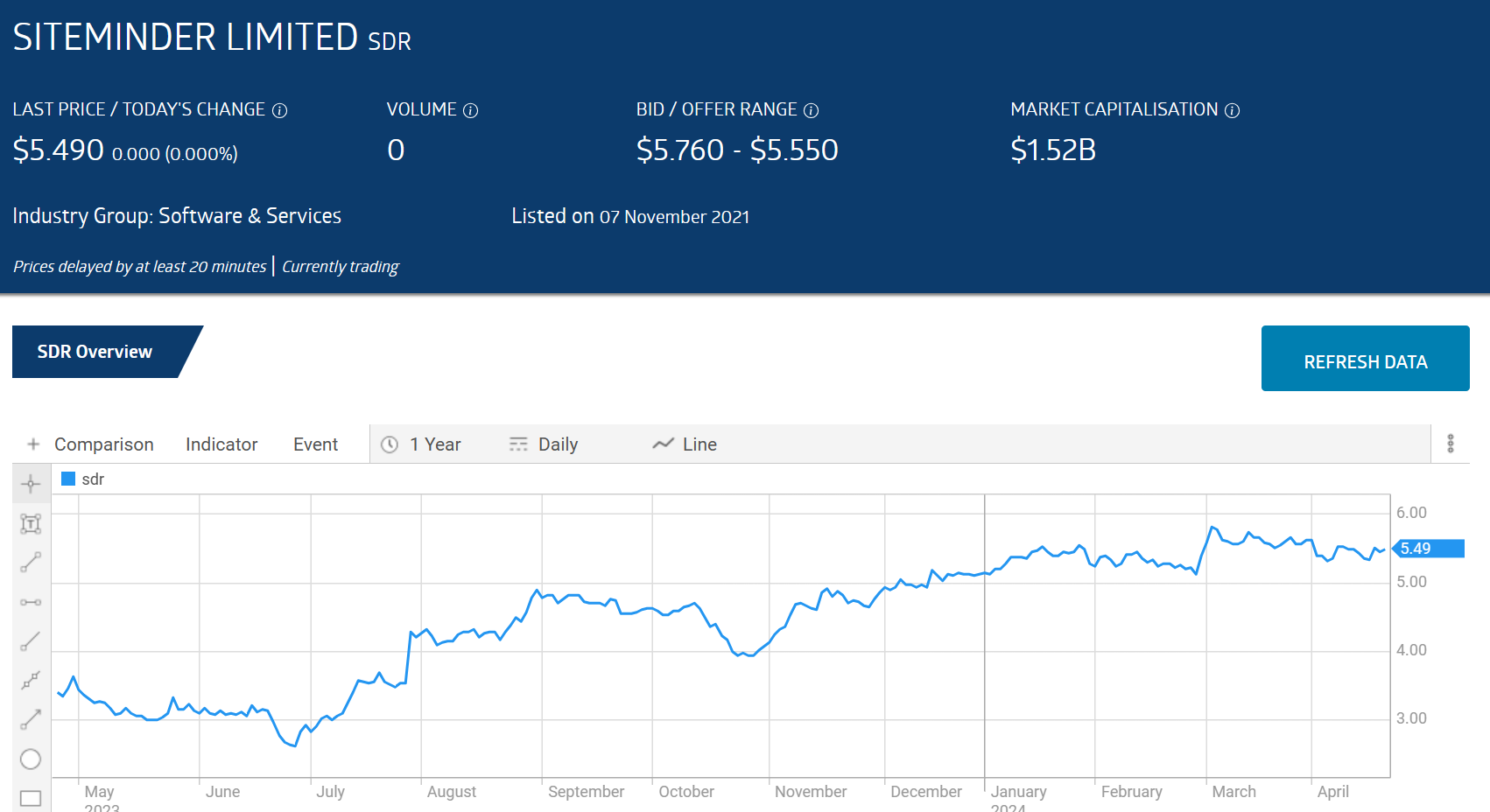

The company listed on the ASX in 2021 with the share price falling from a first trading day opening of $7.11 to the current $5.49, as of 22 April of 2024. Year to date the stock is up 54.7%.

Source: ASX

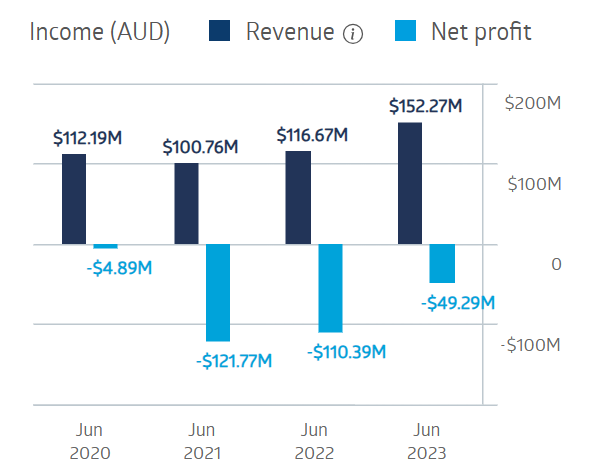

The company has yet to show a profit but has narrowed its loss in each of the last three fiscal years, with a massive improvement between FY 2021 and FY 2022.

SiteMinder Financial Performance

Source: ASX

Half Year 2024 results showed a 27.9% revenue increase and another reduction in losses – dropping from the Half Year 2023 loss of $24.7 million dollars to $14.9 million.

In March of 2024 SiteMinder was added to the ASX 200 index. The average daily trading volume over the last ninety days has been 852,429 shares per day.

Decimated by the COVID 19 Pandemic, the resurrection of the travel and tourism sector experienced a brief spurt before the economic woes of high interest rates and inflation hit consumer wallets. Some of the biggest ASX travel and tourism stocks remain on the ASX Top Shorted Stocks list, suggesting some travel and tourism stocks failing to generate much investor enthusiasm or interest may offer higher rewards when the hidden gems among them pop into focus.