At the close of the first quarter of 2024, an article appeared here on thebull.com.au highlighting five of the best dividend stocks on the ASX at that time. At year’s end, their fortunes have changed, but the mechanics of qualifying a stock as a best in breed dividend stock. Here are the mechanics, unchanged.

An unanticipated and somewhat surprising development came out of the COVID 19 pandemic.

The Australian edition of the global financial website investing.com joined with US based keyword research firm SEMrush to release research results strongly suggesting a new generation of first-time investors in global stock markets, based on internet search terms.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Here in Australia, the research found a 419% increase in the keyword search query “Stocks to Buy” year over year from 2019 to 2020, and a 238% increase in the March to April period of 2020 when global markets crashed and then recovered in startling speed, compared to the January to February period of 2020.

Moderately less dramatic was the increases in the keyword search query “How to Invest in The Stock Market,” up 241% year over year and 179% comparing the period from March to April against queries in January to February.

Among the myriad of questions facing these newcomers was the issue of buying Australian dividend stocks or stocks that do not pay dividends. Regardless of investing philosophy, all investors have the same ultimate goal – return on their initial investment.

Investment returns from non-dividend payers are determined by share price appreciation alone, while dividends are included in total shareholder return for investments in dividend payers.

On the surface, Australian dividend stocks seem the obvious choice, but there are differences of which newcomers should be made aware.

ASX listed stocks report financial results twice a year. The ASX website includes all company financial reporting and other relevant announcements. Companies that have had a banner year with revenue and profit increases along with solid future outlook have a decision to make with what is in essence extra cash. Do they return some of it to their shareholders or do they reinvest the excess in growing the company in the future?

Perhaps a more significant difference is risk avoidance. The new field of behavioral finance tells us loss aversion is more important to investors than equivalent gains. Investopaedia.com is an excellent resource for information on behavioral finance. Dividend paying companies tend to be older, bigger, and more established than non-dividend paying counterparts in earlier stages of the life cycle of a business. Dividend payments are a sign of a financially healthy company. The goal of many non-dividend payers is to grow large enough and financially strong enough to attract more investors by offering dividends.

There are a variety of issues to consider when searching for the best dividend stocks on the ASX.

The first, and arguably the most important is understanding the dividend yield investors find in researching stocks on internet financial websites.

Dividend yield is separate from the annual dividends paid. Instead, it is a function of the ratio between total dividends and current share price. While the first impulse of many newcomers is to find a pre-defined stock screener of ASX dividend stocks and gravitate towards those with the highest yields. This approach is fraught with risk. As a stock price falls, the dividend yield increases, meaning many stocks with yields in excess of 10% are there because the stock price is in decline. Yield is calculated by taking the total dividends paid over the last twelve months and dividing it by the current share price. The calculation virtually guarantees daily fluctuation as the dividend yield quoted on all financial websites will rise and fall with the movement of the stock price.

Another critical issue for newcomers is the temporary nature of dividend payments. Dividends are not guaranteed and if a dividend payer sees trouble ahead, last year’s juicy dividend may be reduced or eliminated entirely.

There are measures available on financial websites that provide warning signs. The first is the payout ratio. This essential financial metric expresses the relationship between dividends paid and net income, with lower payout ratios indicating the company has the flexibility to maintain dividend payments in the event of declining income. Payout ratios in excess of 100% are a warning sign – the company’s income does not support the amount paid out in dividends.

The debt-to-equity ratio is another barometer for assessing a company’s ability to maintain current levels of dividend payments. The ratio measures the company’s use of debt to finance operations rather than utilizing existing resources. Debt to equity ratios above 60% are a sign of potential trouble.

Some financial websites include a company’s five-year dividend payment history, expressed as a yield percentage.

Younger investors can reinvest dividend payments into more stock to benefit from compound interest over time. All Austrian investors have a major advantage when investing in Australian dividend stocks. Many companies are listed as fully franked, meaning the company pays taxes on the profits, sparing the investor. In the US markets both the company and the individual investor are liable for those taxes.

Here then are five of the best ASX dividend stocks to buy.

Fortescue Metals Group (ASX:FMG)

at the close of the first quarter of 2024 Fortescue’s trailing twelve-month dividend yield was 8.44%with a five-year average yield of 7.86%, with fully franked dividends.

At the end of 2024, the trailing twelve month dividend yield stands at 10.79, with the five year average yield at 9.43.The yield’s all-time high is still 18.64% from2021.

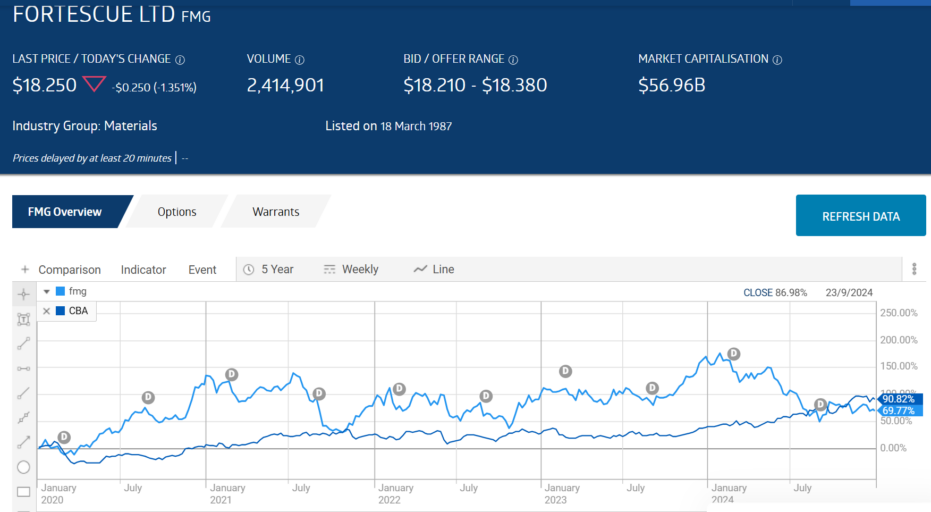

What happened? The Fortescue share price was up 17.1% year over year from first quarter of 2023 to the first quarter of 2024.

At year end, the Fortescue share price dropped 37.1% year over year, driven down by a fall in the price of iron ore in excess of 15%..

In addition, Fortescue’s share price appreciation over five years – up 300.6% – dropped to 69,77% from the 2024 decline, leaving Fortescue share price performance trailing that of Australia’s largest bank – Commonwealth Bank of Australia (ASX: CBA)

Source: ASX Website

In FY 2023 Fortescue’s payout ratio was acceptable at 62.1%, now rising to 74..14% in 2024 but still at acceptable levels. . Debt to equity remains low at 0.28, up from 0.27 still meeting the preferred under 2.0 standard. The company’s low trailing price to earnings ratio of 6.49 (down from 8.7) along with a five-year average P/E of 6.45 keeps the stock in bargain basement territory.

History is no guarantee of future performance and Fortescue is embarking on climate change initiatives that could split the company’s personality into a stable iron ore producer and a clean energy start-up.

Start-ups cost money and analysts are already predicting drastic drops in the company’s ability to maintain its stellar dividend record as money formerly paid out its dividends is devoted to development of the newly formed clean energy company, Fortescue Futures Industries.

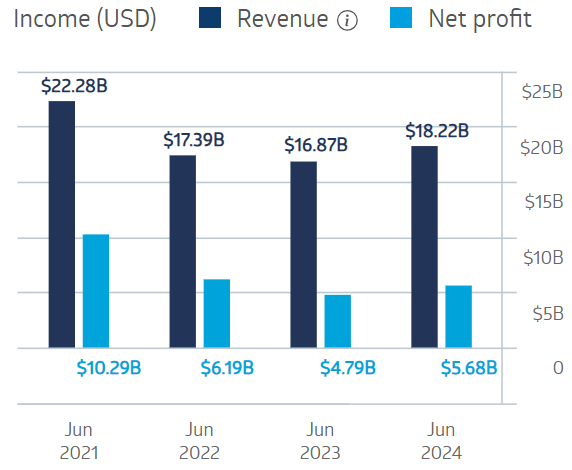

The company’s Full Year 2023 Financial Results supported the bear view – revenues fell 3% , profit dropped 23% and Fortescue cut its dividend payment by 17%.Fortescue bounced back in the Half Year 2024, with revenues up 21% , net profit up 41%, with dividend payments up 44%. Full Year 2024 financial results continued the positive trend, with both revenues and profit increasing.

Source: ASX Website

Goldman Sachs and other major analysts are predicting dire consequences for the company, largely due to significant capital expenditures to place the company in the clean energy space..

Goldman has cut its forecast for the price of iron ore in 2025 to $95 US per tonne, down from 2024’s forecast of $110 US per tonne, with a slight improvement going into 2026 with a forecast of $96 US per tonne. . Fortescue has a 72% interest in the Belinga iron ore project in the African country of Gabon, which had been expected to start production in the second half of 2023. Fortescue claims the project is still underway, despite having produced only a “token” first shipment of iron ore and reports of some project staff having been relieved.

Rio Tinto Group (RIO)

Rio Tinto may have a slight competitive advantage over Fortescue due to its diversified asset base, with copper and other metals supplementing the company’s iron ore production. Some analysts are skeptical about Rio’s dividend payments in the future for similar reasons for concern about Fortescue. Rio is expanding into the lithium space, which will require significant capital expenditures. The company is reportedly the only global diversified miner looking to enter the lithium space and has called on investment banks to help find potential targets.

The Serbian government ended Rio’s attempt to permit a lithium project there, but Rio has purchased the Argentina based Rincon lithium from brine project and is producing lithium from waste rock using a new process developed at the company’s boron mine in California. The latest development is a demonstration plant for lithium spodumene concentrate in Quebec.

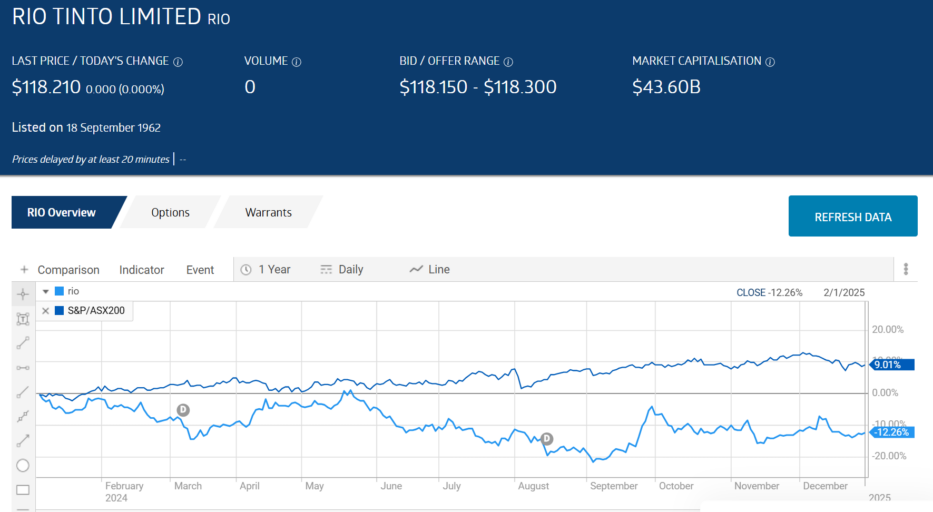

The end of year 2024 dividend yield remains at its end of the first quarter yield – 5.54% with the five year average increasing from 5.97% to 6.16%.

Rio’s diversified asset base spared the stock some of the pain experienced at Fortescue, down 12.26% year over year as of 2 January of 2025. The Rio share price significantly underperformed the ASX 200 index.

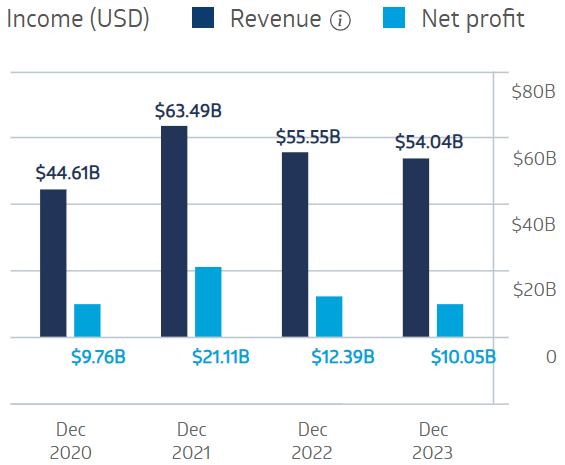

Source: ASX website

The lowest yield of the last decade of 3.52% came in 2016., with the highest in 2021 – 9.06%. Payout ratio ballooned from FY 2021’s 52.59%to 90.3% in FY 2022, reflecting the company’s poor Full Year 2022 results where revenues fell 13% and net profit dropped 41%. In FY 2023 the payout ratio fell back to 63.75%. and stands at 65.38 for 2024 with a five-year average payout ratio of 69.47%. Dividends are fully franked. Debt to equity ratio rose slightly at year up finishing at 0.26, up from Q1’s 0.25. Over ten years the Rio share price is up 105.3%.

Full Year 2023 financial results reflected challenging conditions , with revenues dropping 3%, net profit down 19%, and dividend payments slipping 11%.

Source: ASX website

JB HiFi (ASX:JBH)

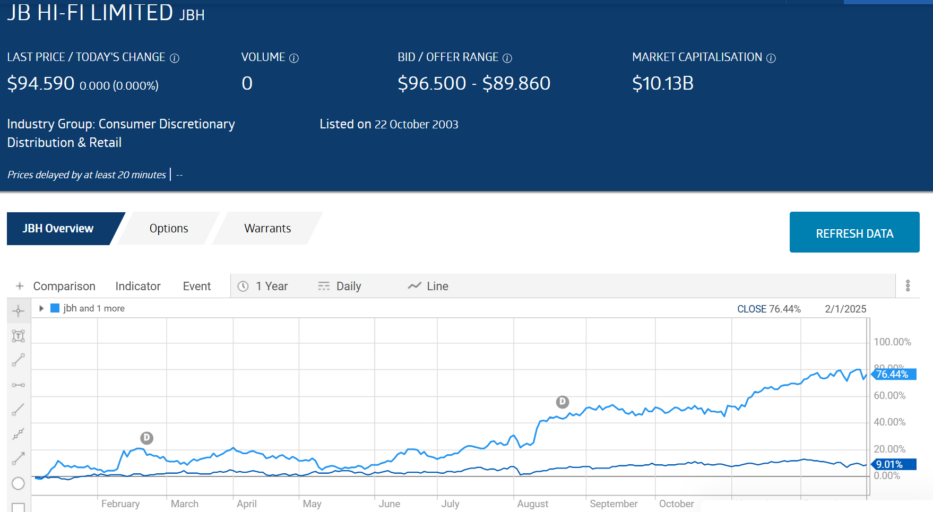

Unencumbered by declining commodity prices, JB HiFi posted a stellar year in 2024 – up 76.44%, trouncing the performance of the ASX 200.

Source: ASX Website

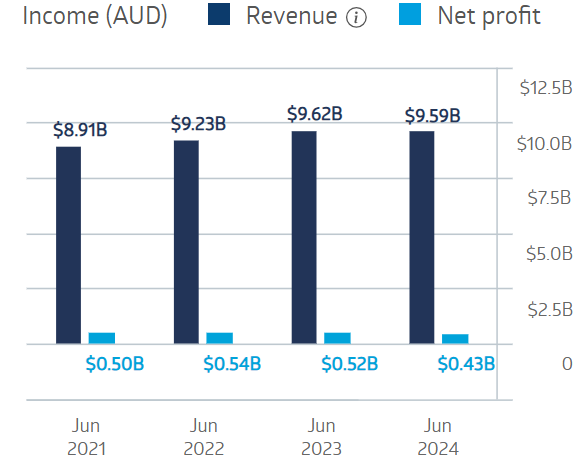

JB HiFi is an example of a solid dividend payer over the last decade that some analysts expected to see some slippage in dividend yields. At year’s end, the company’s five-year average dividend yield dropped from 5.83% to 4.99%, dragged down by the year end trailing twelve month yield of 2.61% down from 4.44% at the end of Q1 of 2024. Over the last decade the yield has seen a low of 3.35% with a high of 12.98% in 2022. The payout ratio in FY 2023 was 74.6%, dropping to 68.31% with a five-year average payout ratio of 63.32%. . . Debt to equity at year end rose to 0.42, up from 0.40.

The company’s Half Year 2024 Financial Results reflected the inflation/high interest rate environment, with total sales down 2.2%, net profit down 19.9%, and dividend payments reduced by 19.8%. Full Year 2024 results bounced back close to 2023 levels.

Source: ASX Website

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2024.

We’re giving away this valuable research for FREE.

Click below to secure your copy

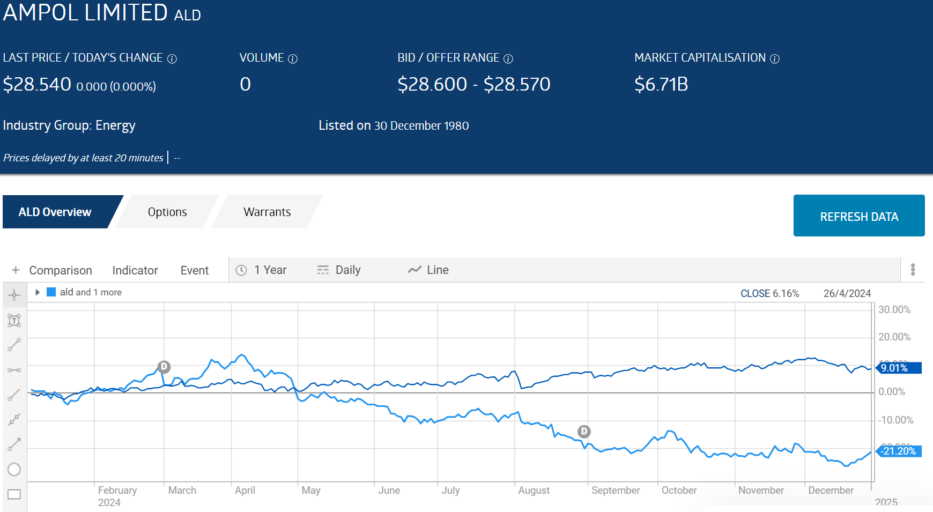

Ampol Limited (ASX:ALD)

In a step back in time, well known Caltex Australia returned to its original name of Ampol Limited (Australian Motorists Petrol Company) following the decision by Chevron to end the licensing arrangement allowing the use of the Caltex name.

Ampol is both refiner and distributor of petroleum products primarily in Australia and New Zealand where . New Zealand’s Z Energy was acquired in 2022.

The year end 2024 6.31% with a five-year average of 3.48%, up from the end of Q! levels of 5.34% and 3.31%. The lowest yield over the last decade was 1.04% in 2014.

The payout ratio jumped from 53.01% in FY 2022 to 86.99% in FY 2023 but fell back to 68.2% in 2024, with a five year average above standard at 107.6%. The debt-to-equity ratio is up from 0.92 to 1.12 at year end..

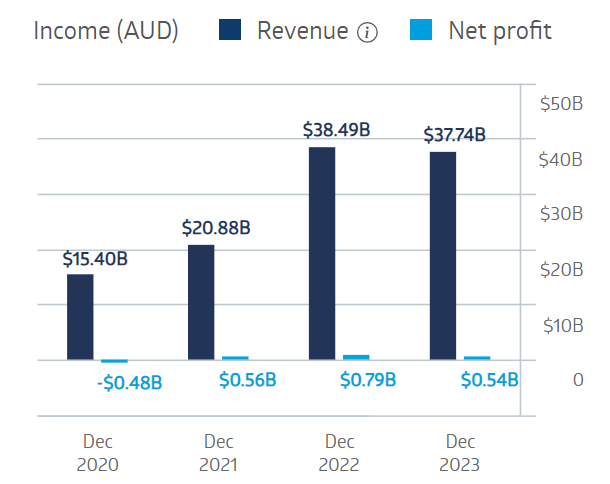

Full Year 2023 Financial Results announced in February of 2024 showed total sales dropping slightly from FY 2022, while statutory net profit dropped 25% . Ampol added a special dividend of $0.60 per share to the fully franked ordinary dividend of $2.15 per share.

Source: ASX Website

The share price plunged following a solid start, finishing the year down 21.2%.

Source: ASX Website

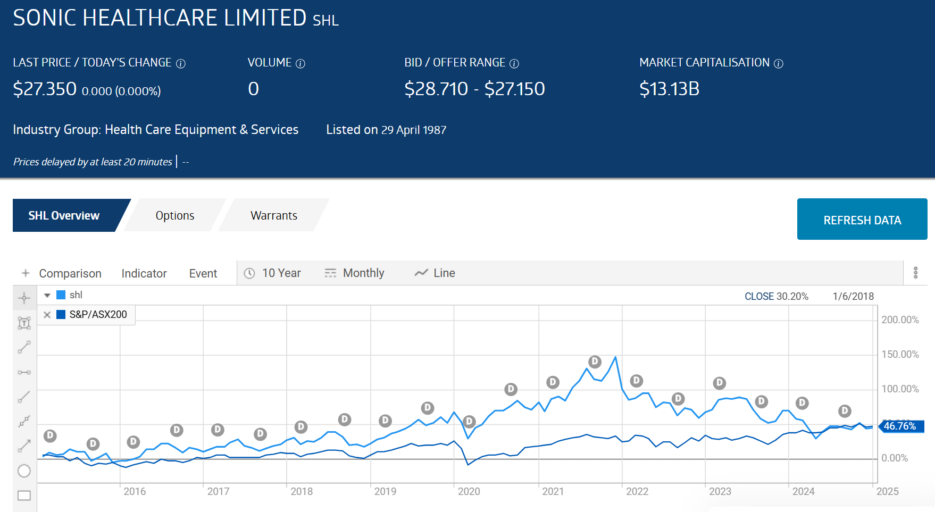

Sonic Healthcare Limited (ASX:SHL)

Sonic provides a full range of medical diagnostic, laboratory medicine, and pathology services to medical practitioners of all stripes. The company is a market leader here in Australasia, Europe, and North America.

The GFC (great financial crisis) proved that in the worst of times, there may be no such thing as a recession proof stock, but common sense suggests a company like Sonic comes close. Regardless of economic conditions, people still get sick and diagnostic imaging and laboratory medicine are at the forefront of determining what is wrong and what treatment is appropriate. The COVID 19 pandemic challenged that bit of common sense, as diagnostic procedures were put on hold with the exception of the most serious cases.

The Sonic stock price had been in a non-stop upward trend before COVID caught up with the stock, pushing down the price to an increase of 46.76%m still matching the performance of the AWSX 200 over that time period. Year over year, the Sonic share price is down 12.5%.

Source: ASX Website

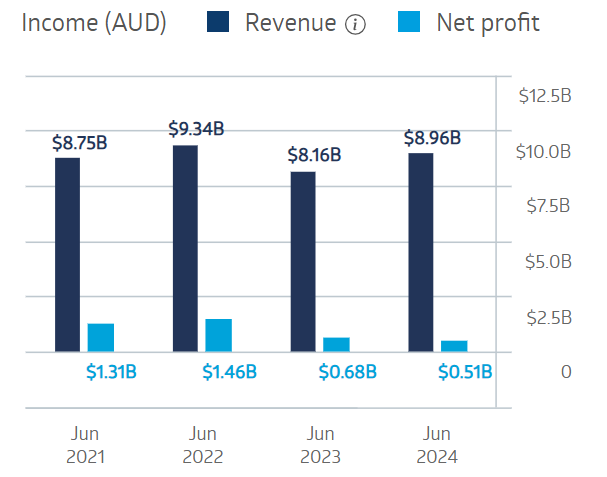

Full Year 2023 financial results were heavily impacted by the reduction of revenues related to COVID 19, with revenues down 13%, and net profit down 52%. COVID-related revenues fell 80%.

Half Year 2024 financial results released on 20 February showed revenues rose 5% but net profit fell 47%. Sonic did increase the interim dividend by 2.4%. Management stood by its Full Year 2024 guidance. Full Year financial results saw revenues rise 9.8% while net profit slid 25%.

Source: ASX Website

Sonic’s year end 2024 dividend yield is 385% with a five-year average of 2.88%. The low point for the company’s dividend yield came in 2021 at 1.95%. The high point came in 2015, with a yield of 3.92%.

The payout ratio is high, at 97.95%with a five-year average payout of 59.38%. Debt to equity is 0.57%.

Just as it is unrealistic to assume the share price of a favoured stock will continue to climb upward and onward, it is unrealistic to assume a dividend-paying stock will continue to pay dividends into the distant future.

Dividend-paying stocks add an additional dimension to equity market investing for older and younger investors. Older investors benefit from passive income, and the younger ones benefit from the compounding that comes with reinvesting the dividends. Companies that have generated cash in excess of operational expenditures can either pay out some of the money to shareholders or reinvest in initiatives to grow the company.

Australian dividend-paying stocks are not without risk, as when conditions change, a company could reduce or eliminate dividend payments. Debt to equity, along with dividend yields and payout ratios over ten years, are valuable warning signs of potential risk.

FAQs

What Are Dividend Stocks?

Dividend stocks are shares in companies that distribute corporate earnings to shareholders in the form of a dividend payment. The dividend payments are determined by the company’s board of directors and are usually paid quarterly. Payments can be made in the form of cash or as a reinvestment in additional stock.

How to Buy Dividend Stocks

Buying dividend stocks is as simple as buying any other type of stock. You will need to open an account with a broker then research and select the stocks you wish to buy. You will need to own the stocks for a certain period of time before you are eligible to receive a dividend (the ex-dividend date).

How Do Dividend Stocks Work?

Dividend stocks work by sharing a portion of the company’s profits with it’s shareholders. This is paid via your brokerage account in the form of a dividend. There are four key dates to be aware of when trading dividend stocks: The announcement date when the dividend amounts are announced, the record date when the number of investors eligible to receive the dividend is recorded, the ex-dividend date when new investors will no longer receive the dividend and the payment date when eligible investors receive the dividend payment.

How to Evaluate Dividend Stocks

There are several factors to consider when evaluating dividend stocks. Investors should look for companies that are profitable over the long term with healthy cash flow to ensure they can sustain a dividend payment program. It is also wise to avoid companies with excessive debt, as any profits will likely go towards paying down debt rather than paying dividends.