Navigating the Biotechnology Sector

Investors around the world are attracted to biotechnology stocks because they offer the opportunity to grab onto a “tenbagger” – a term coined by legendary US investor Peter Lynch for a stock appreciating ten times its initial purchase price.

Biotechnology in its strictest sense is the application of biological processes to produce products that improve our lives. As applied to healthcare, it involves the application of cellular and other biological materials to produce medical diagnostic and treatment products, although there are some companies classified as biotechnology stocks that do not fit that mold.

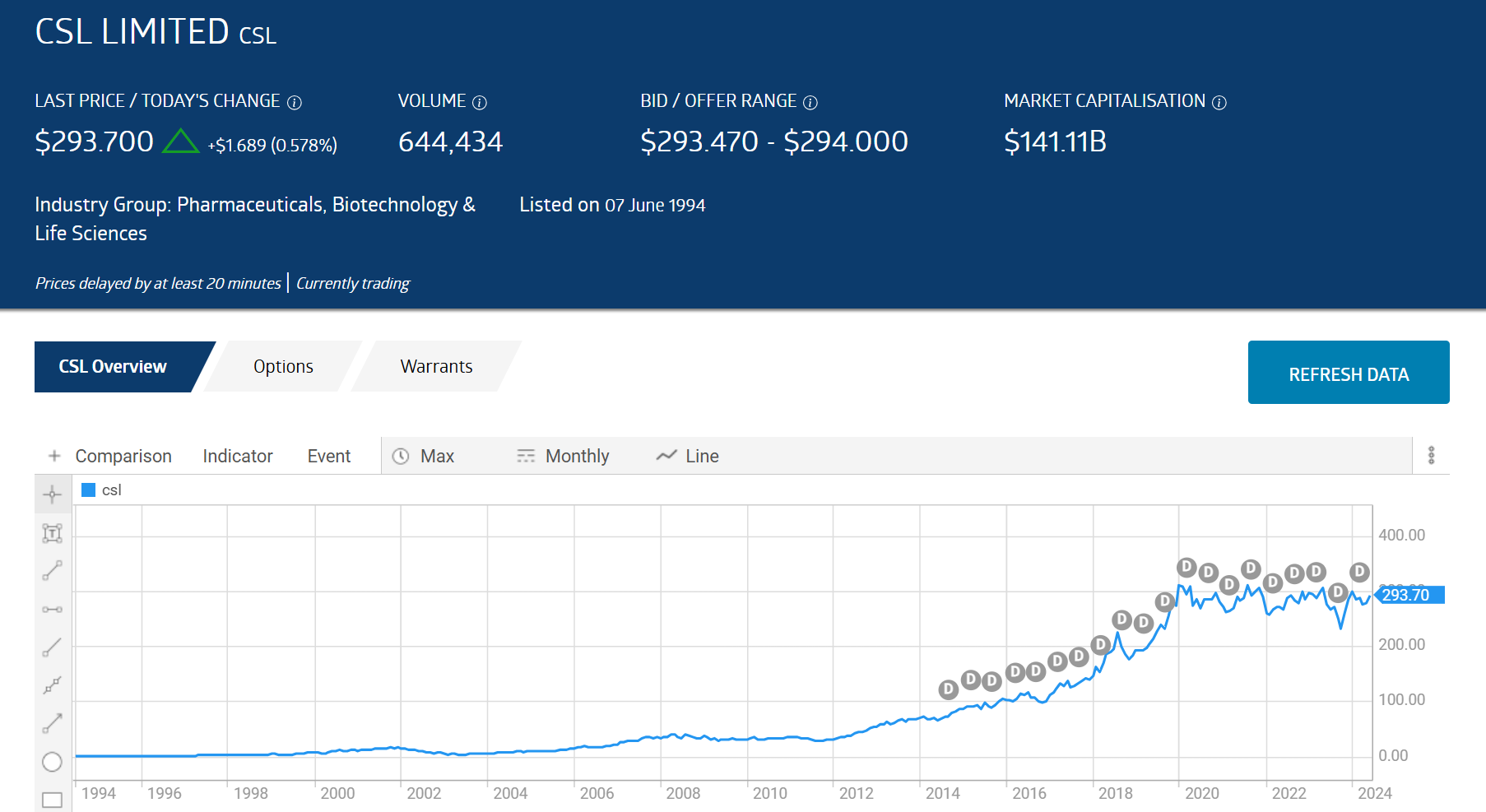

The quintessential example of an ASX listed biotechnology stock is blood plasma and vaccine provider CSL (ASX: CSL). CSL’s days of explosive growth are passed, now attracting risk averse long-term investors.

Source: ASX 25 June 2024

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Rabid investors thirsting for companies whose explosive growth is ahead of them are willing to take the risk with start-ups and early stage biotechs.

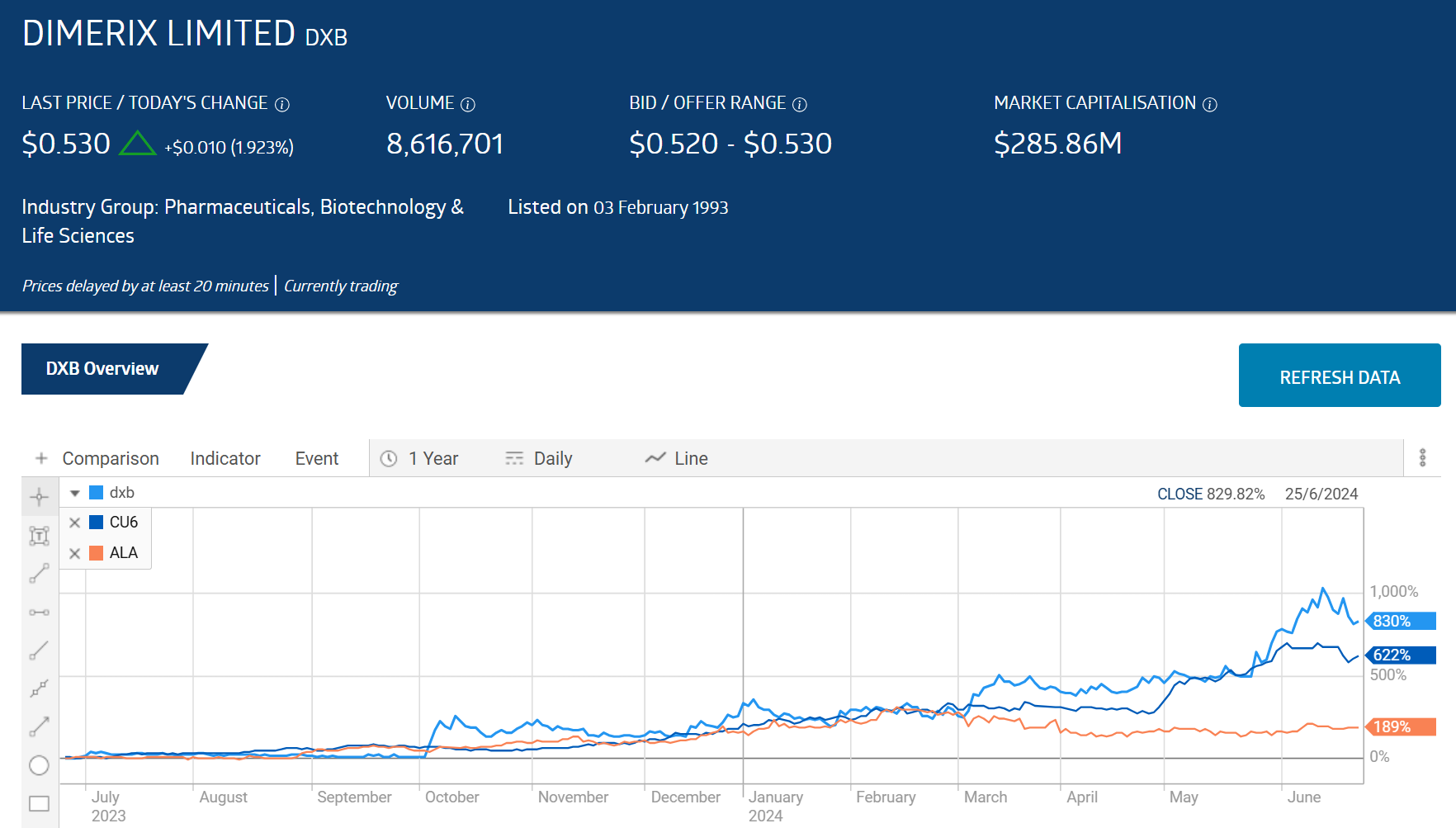

Right now the ASX features three biotechs far exceeding tenbagger status for investors buying shares a year ago. All three are up triple digits year over year. The companies are Dimerix Limited (ASX: DSB), Clarity Pharmaceuticals (ASX: CU6), and Arovella Therapeutics (ASX: ALA).

Source: ASX 25 June 2024

In the majority of cases, investors who are bidding up biotechnology stocks like these ignore a cardinal rule of investing, also from Peter Lynch – Buy What You Know. Momentum traders inflate the share price of biotech startups, timing an exit to maximise profit. News of clinical trials drive the momentum in both directions.

Most serious investors take the time to thoroughly research a stock before investing, but no market sector presents the multiple challenges found in biotechs.

The technology employed can be difficult to comprehend for even those investors with some background in science.

- Dimerix is working on “segmental glomerulosclerosis disease.”

- Clarity Pharmaceuticals is working on “theranostic radiopharmaceuticals.”

- Arovella was working on “zolpidem tartrate” treatments.

Instead of struggling to reach a basic understanding of incomprehensible technologies, biotech investors should focus on the presence of the conditions to be treated in the general population.

Even the most revolutionary treatment needs an addressable market massive enough to achieve tenbagger status and beyond. Even with that addressable market, biotech startups need cash to sustain the arduous journey from initial clinical trials to regulatory approvals and introduction to the market. Funding often comes from a seemingly never-ending string of debt or capital raises, or both.

Beyond addressable markets and financial stability, biotech investors should consider the company’s treatment pipeline, with those with multiple treatments under development superior to those concentrating on a single entry.

Biotechnology stocks do have a significant upside as they are resistant to economic downturns.

Telix Pharmaceuticals (ASX: TLX)

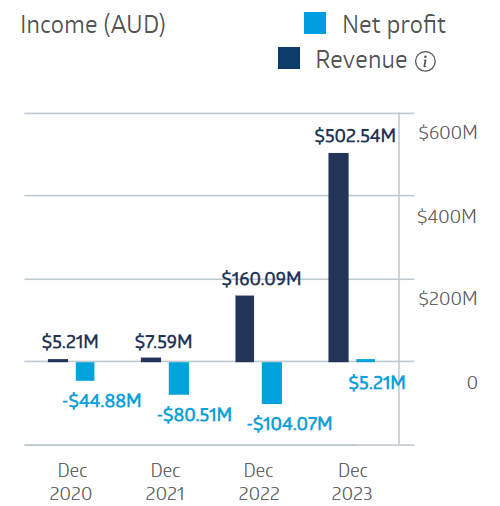

Telix provides an example of a biotech that has arrived – the company has a product in the market, more than doubling revenue and turning profitable.

Telix Pharmaceuticals Financial Performance

Source: ASX

The company’s technology is “theranostic” in that it can both diagnose and treat a condition through radiation therapy. Telix’s lead candidates are targeting multiple forms of cancer conditions – prostrate, kidney, and brain. The therapy is “radiopharmaceutical” in that it injects radioactive isotopes directly into the affected tissue, allowing the kind of precise targeting of cancers not possible in traditional forms of imaging and treatments that can damage healthy surrounding tissue. The company’s Illucix® prostate cancer imaging/treatment is now available in Australia, New Zealand, Canada, and the United States.

Telix expects to roll out two more imaging agents in 2024. The company has seven more diagnostic/treatment candidates in clinical trials.

Year over year the Telix share price is up 60% but in the last five years as investors flocked to this promising biotech the share price is up 1,687%!

Source: ASX 25 June 2024

Clarity Pharmaceuticals (ASX: CU6)

Clarity Pharmaceuticals is being hailed as possibly the “next Telix” due to similarities in the company’s technology –radiopharmaceuticals. The company’s SAR technology is targeting brain, breast, and prostate cancers.

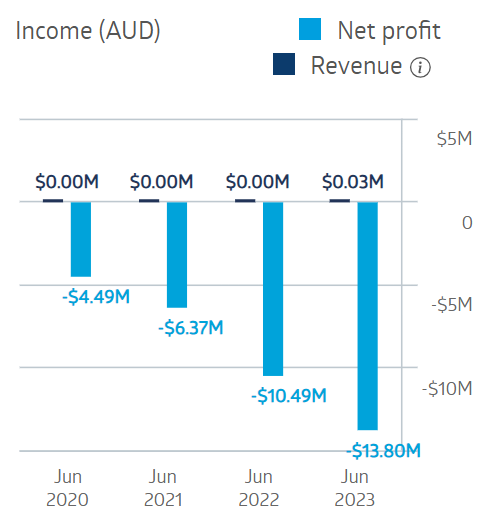

The company’s financial performance should serve as a stark reminder of one of the risks inherent in biotech stocks.

Clarity Pharmaceuticals Financial Performance

Source: ASX

The company’s losses have grown in each of the last four fiscal years without a dime of revenue generated.

Clarity has a prostrate cancer theranostic ready to begin Phase III clinical trials, with an additional five in earlier stages of clinical trials. The company has $37.9 million dollars in cash on hand as of the most recent quarter (MRQ) with no debt and a healthy current ratio of 11.76. The current ratio measures a company’s ability to meet its short-term obligations.

On 24 June, the company received a $10 million dollar tax incentive refund from the federal government recognizing Clarity’s research and development expenditures in FY 2023.

On 23 April, the company announced the successful completion of a Retail Entitlement Offer, raising $10.8 million dollars.

In March, the company raised $115 million dollars in a capital raise.

Management states these funding efforts ensure the company has the cash needed to operate through 2026.

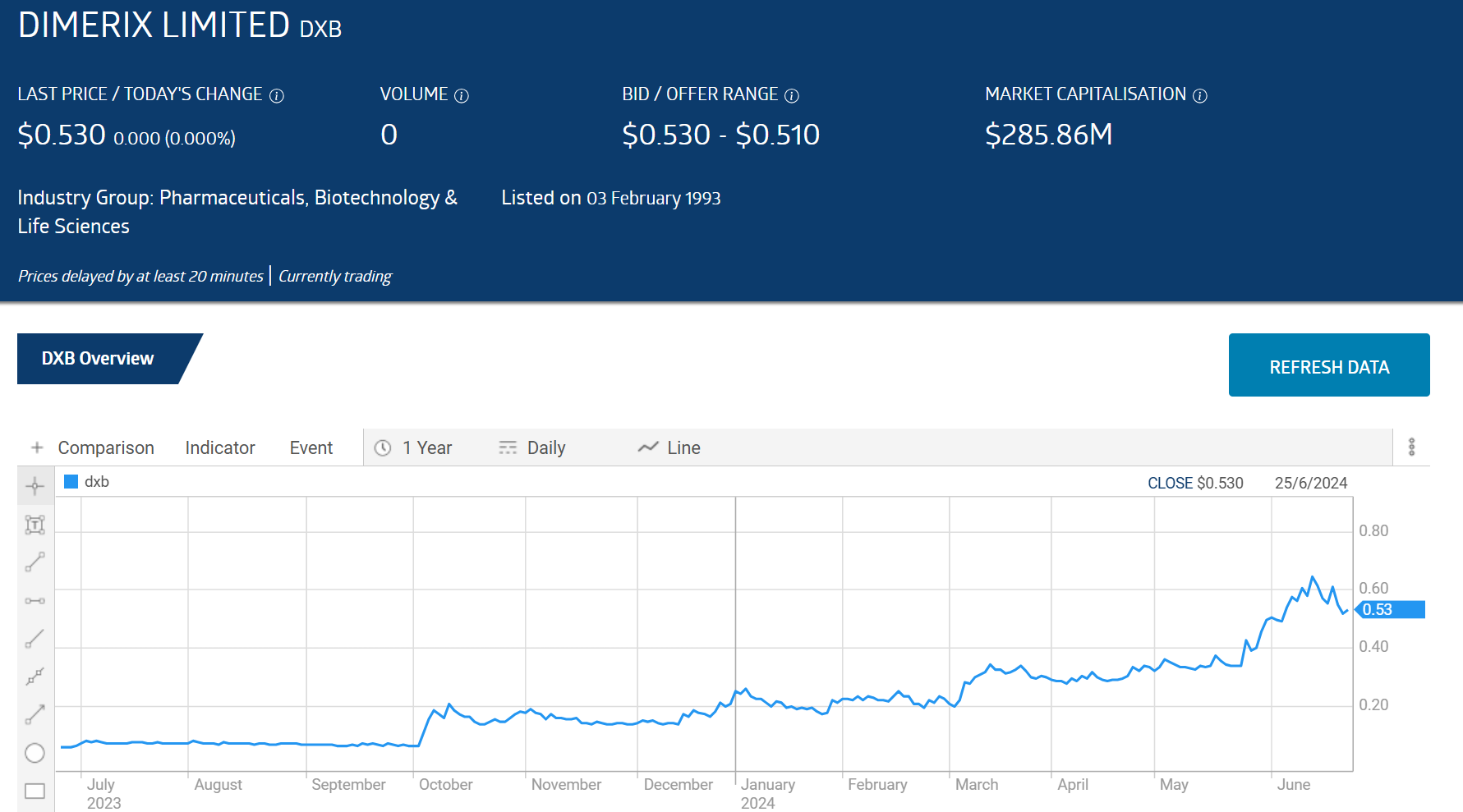

Dimerix Limited (ASX: DSB)

Dimerix Limited is developing a treatment – DMX-200 – for a scar tissue disease that can cause kidney failure – focal segmental glomerulosclerosis disease – now in Phase III clinical trials. The company also has a treatment for diabetic kidney disease in Phase II clinical trials and a treatment for COPD (chronic obstructive pulmonary disease) nearing a Phase I clinical trial.

A licensing agreement with Advanz Pharma for DMX-200 distribution in Australia, New Zealand, Canada, and Europe announced on 5 October of 2023 started the buying frenzy that drove the share price up more than 800% year over year.

Source: ASX 25 June 2024

The Advanz agreement calls for AU$11.5 million dollars upfront with milestone payments potentially reaching AU$340 million along with royalties when DMX-200 reaches the market. Preliminary results of the Phase III study released in March were positive, with another release of interim results expected in mid-2025.

The company also had its treatments for respiratory complications and pneumonia in COVID 19 patients participating in a global study of nineteen different treatments.

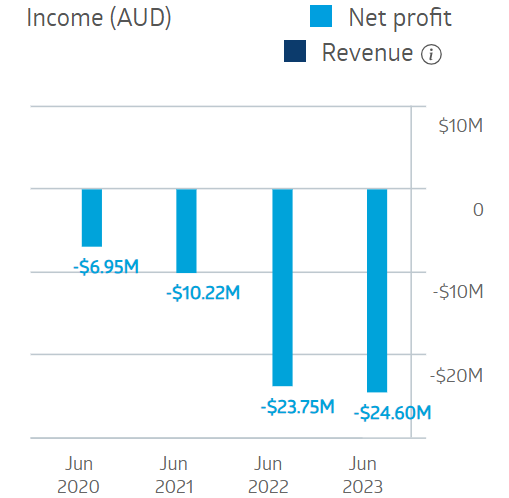

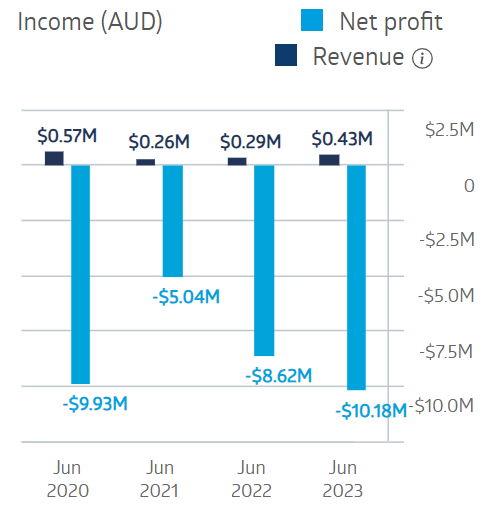

The company’s financials follow the typical pattern of startup biotechs – ever-increasing losses.

Dimerix Limited Financial Performance

Source: ASX

Dimerix has $14 million in total cash and $1.43 million in debt, MRQ. The debt to equity ratio of 83.1% is somewhat high but the company has had successful capital raises in the past.

Arovella Therapeutics (ASX: ALA)

Arovella Therapeutics is one of the few biotechs around the world working on CAR-iNKT cells for cancer treatment. CAR stands for chimeric antigen receptors and iNKT stands for invariant natural killer T cells. This seems to be a genetically engineered cell therapy treatment platform for treating blood cancers and solid tumours. Arovella is developing CAR-iNKT in a collaborative research arrangement with Imperial College London. In 2021, then Suda Pharmaceuticals changed its name to Arovella Therapeutics. The lead product is ALA-101 (CAR19 iNKT)-, nearing Phase I clinical trials.

Another product in pre-clinical stages – ALA-105 (CLDN18.2-iNKT) –is under development with a global licensing agreement with SparX Group for the treatment of gastric and pancreatic cancers. SparX Group is a US based biotech with a complimentary technology. The cancers targeted register over a million new cases per year, causing 770,000 fatalities, according to a joint press release appearing on PR Newswire.

On 5 June Arovella announced the company had “completed process development for its patent protected manufacturing process for ALA-101.” The process is modular and semi-automated, developed by privately held Cell Therapeutics. The process will facilitate large scale manufacturing of ALA-101 and all future CAR-iNKT cell products.

As of 30 April the company had completed a successful capital raise, leaving a pro forma cash balance of $15.3 million dollars.

Arovella’s finances show minimal revenues and maximal losses.

Arovella Therapeutics Financial Performance

Source: ASX 25 June 2024

Investors are drawn to biotechnology stocks for the potential of massive share price appreciation as the company moves through the process of achieving regulatory approval for the treatment they offer. Biotechs are high risk since the potential for massive share price appreciation is matched by the potential for massive losses as negative news of clinical trial results can crush a company’s stock price.

Risk tolerant investors should focus on startups with treatments in clinical trials, preferably more than one treatment and some in late stage trials. Financial stability is another must. Risk averse investors should focus on biotechs with existing products in the market, with a history of profitability and a pipeline of products under development.