A Junior Gold Miner for the Risk-Inclined Investor

Central bankers are playing catch-up on inflation, leaving room for gold to run. Gold producers have performed well of late; can Gascoyne Resources cash in? Sitting on the promising Never Never deposit, Gascoyne is looking to make a run. Gascoyne Resources Limited ASX: GCY (GCY) has been recapitalised of late, selling off equity on the…

Independent Oil and Gas Company Carving a Path in WA

Refined petroleum is the largest import market in Australia. Triangle Energy (Global) Ltd ASX: TEG (TEG) is a small West Australian explorer and producer. Finding a home for any barrels of oil won’t be difficult; getting it out of the ground is the hard part. A diverse range of opportunities and companies will aid in…

A New Player Enters the Lithium Fray

The global lithium market is projected an annual increase of 20%. Patagonia Lithium Ltd has been set up to cash in on some of that demand. Focussing on the abundant lithium brines in Patagonia, this newly-minted company is scouring Patagonia, Argentina for opportunities. For those that are looking for maximum multiple returns, the earlier you…

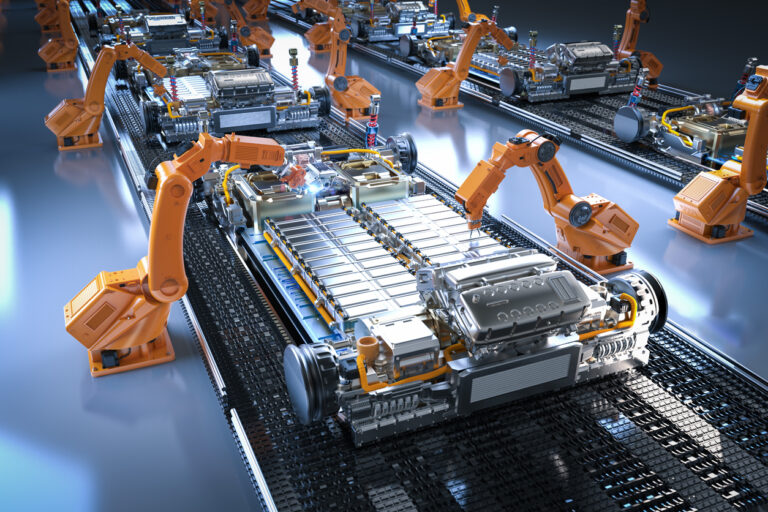

A Miner Capitalising On Surging Battery Chemical Demand

The global battery market is projected to grow at 14% pa through Avenira Limited is an Australian miner producing critical battery minerals and components. With a groundswell of international demand, the Bull.com.au projects that this miner could capture some of that growth. Avenira Limited ASX:AEV (AEV) is a mineral exploration and development company that operates…

Flight Centre Travel Group Could Beat the Short Sellers

The initial wave of COVID-19 and the subsequent variants crushed the stock price of companies operating in the global and domestic travel sector. The Flight Centre Travel Group (ASX: FLT) has been a favourite target of short sellers. The travel industry in general, and Flight Centre, in particular, are showing solid signs of recovery. The…

Wesfarmers Making Moves

Already the largest conglomerate in Australia/New Zealand, Wesfarmers (ASX : WES) continues to expand into new growth areas The company’s retail division includes the top hardware chain in the country – Bunnings – along with the top five discount department stores – K-Mart and Target – and the leading purveyor of office supplies in Australia…

Copper miner looking to bounce back with global sentiment

The world’s largest copper importer is China. China’s economy has faltered taking the strength out of global copper prices. Copper miners will be looking to a China economic rebound to see an improvement in their bottom line. Sandfire Resources Limited ASX: SFR (SFR), is a mining company, primarily engaged in the business of copper ore…

Rare Earths back in the Spotlight

Rare earth elements are a critical component of complicated modern electronic components. China is the largest supplier of rare earths. Rare earth production is growing rapidly in line with demand, and Australia is poised to benefit Lynas Rare Earths Limited (ASX: LYC) is primarily involved in the extraction of rare earth elements and their processing…

Betting on Infrastructure in Australia & New Zealand

Infrastructure company covering Australia and New Zealand Budget surpluses and a renewed mining boom are driving employment and infrastructure spending across the region. Ventia Services Group Limited ASX: VNT (VNT), founded in 1956 and based in North Sydney, services Australia and New Zealand with its broad basket of infrastructure services. Having recently booked a 10%…

Broadening horizons of an Australian real estate conglomerate.

LLC is looking overseas to provide pre-pandemic returns on its assets. With an already sizeable US portfolio, LLC is considering alternative footings outside Australia to beef up its top-line revenue, already beaten down by COVID-19. Lendlease Group Stapled Securities ASX: LLC (LLC) is a favoured pick because of its history in Australian and international real…