Commodities are the raw materials that go into making what the global economy needs to thrive. There are hard commodities like iron ore, copper, gold, crude oil and lithium, and soft commodities of livestock, fruit, wheat, sugar, and corn. There are others in both categories, with the separation point being a resource extracted from the earth versus a resource grown from the soil.

The price of commodities is highly volatile, whipsawed by a range of events, such as global economic downturns, technological advances, wars and weather.

While the risk is high, commodities offer investors a unique opportunity – the cyclical nature of commodity pricing historically has virtually guaranteed a boom to bust to boom cycle.

A commodity cycle starts with a rise in demand, often from an unexpected source, such as a weather-related event, a new market opening, or rising use of the commodity in a country.

As demand goes up, available supply declines, driving up the price. As the price increases, producers invest in expanding production operations to meet the demand, flooding the market with supply.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Skyrocketing prices in the boom phase can reduce demand, with excess supply driving prices downward. As supply overwhelms diminishing demand, the cycle is complete as the commodity’s price hits bottom.

As demand hits bottom, producers pull back, and supply dwindles below demand, causing the cycle to repeat.

Two prominent examples of the commodities cycle in recent times are worth mentioning. The first was the rise and fall of iron ore in the early years of the last decade. The second was lithium’s rise and fall in the last decade’s closing years. Both repeated the cycle following the shifts in the balance between supply and demand.

Aussie investors looking to invest in ASX commodities will find less risk in buying stock in the producer than in the commodity itself. Australia is blessed with some of the world’s outstanding hard commodity resources – iron ore, copper, diamonds, nickel silver, lithium and coal. In 2022, exports of Australian agricultural products hit a record $78.1 AUD billion dollars.

A commodities list of ASX stocks provides ample opportunities for investors of all types, but how does one determine the best ASX commodities stocks to buy in 2023?

The criteria investors use to screen an ASX commodities list will vary according to investing strategy. Given that investing in ASX commodities stocks present a significant risk, a criterion for many investors would be the company’s position in global markets. A commodity producer that exports to the world can benefit in localised economic downturns and is in a better position to sustain itself during global downturns.

Here are some of the top ASX commodities stocks that rank in the top tier of global producers.

BHP Group (ASX: BHP)

With multiple hard commodities in its operating mines, BHP is the world’s largest commodities producer. An investment in BHP provides diversified exposure to commodities in a single stock. The company mines iron ore, copper, metallurgical coal, petroleum, and nickel. BHP has added a soft commodity to its holdings – the Jansen Potash operation in Canada. Potash is a stand-alone fertiliser and a component of other nutrient-enhanced fertilisers. BHP is confident demand for potash could double in size towards the end of the 2040s, hitting a $50 USD billion-dollar market size.

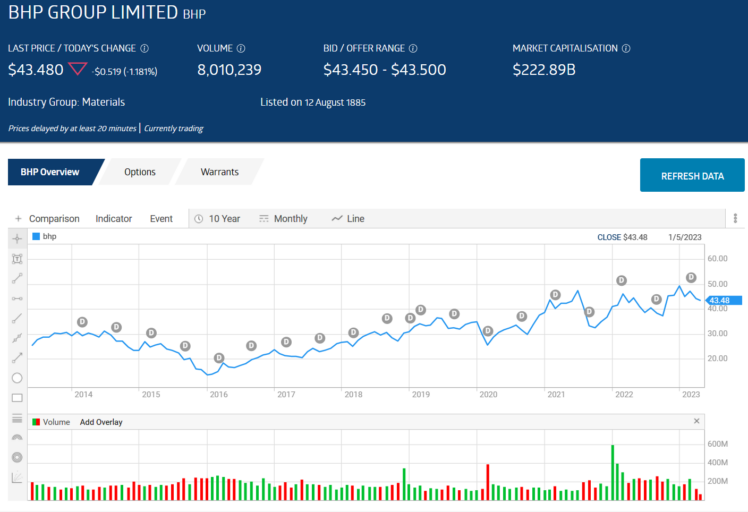

Over ten years, the stock price is up 73.7%, with consistent dividend payments over the decade.

Source ASX 1/5 2023

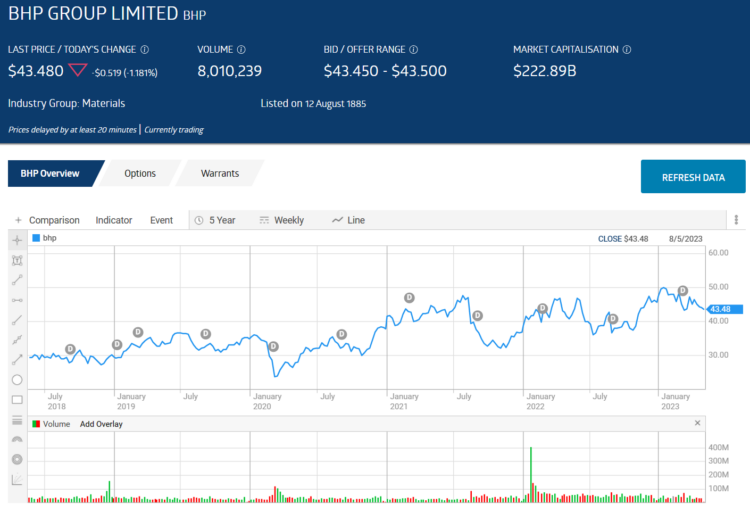

A five-year share price movement chart better illustrates the share price volatility in this commodities powerhouse.

Source ASX 8/5 2023

Over five years, the share price is up 40.48%, with the company’s current Price to Earnings ratio (P/E) of 8.20p, placing BHP in bargain territory, well below the five-year average of 15.94.

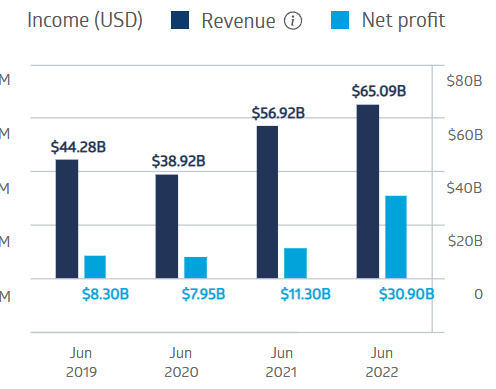

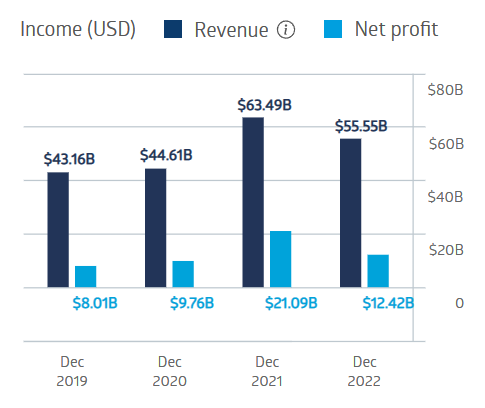

BHP’s financial performance has been admirable during the pandemic period. Both revenue and profit declined in the early stages but recovered in FY 2021 and soared in FY 2022. Shareholders may see even better performance as BHP acquired one of the top copper producers in Australia – Oz Minerals – in April of 2023. BHP also merged its petroleum assets into Woodside Energy Group, with BHP shareholders getting a 48% stake in the new entity.

BHP Financial Performance

Source: ASX 12/5 2023

In FY 2021, BHP derived 57% of its revenue from iron ore and 26% from copper. In FY 2022, Oz generated $1.9 AUD billion dollars in revenue.

The OZ deal was part of BHP’s strategy of entering the “green economy”. The OZ revenues should help the company if the projections for falling iron ore prices over the next five years come true. The decline may be more a normal part of the commodity cycle, given the expectation is for lower demand in the face of increased supply.

Rio Tinto (ASX: RIO)

Like BHP, RIO mines multiple commodities, with iron ore its top revenue generator. The company has now shed all of its coal assets. Rio also produces aluminium, copper, scandium, titanium dioxide, borates, diamonds, and salt. While both Rio Tinto and BHP are evolving with the decarbonisation economy, Rio decided to add lithium assets to its portfolio, while BHP did not.

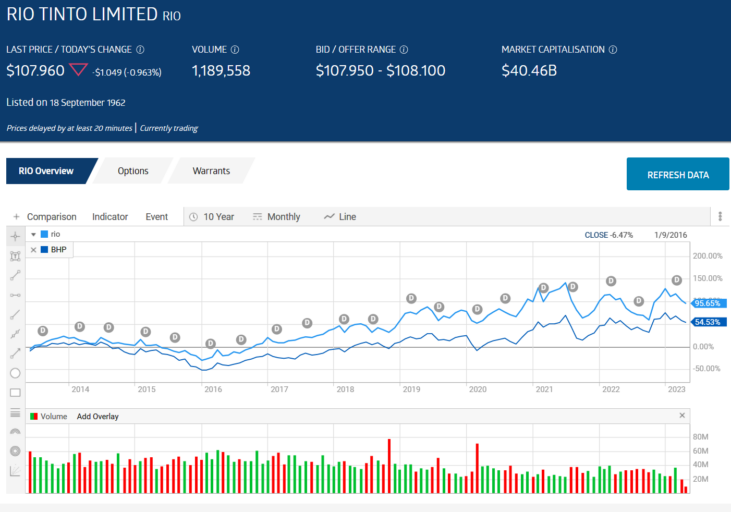

Rio’s brand value ranked fifth among the world’s largest iron ore miners in 2022. Over ten years, Rio’s share price has outperformed BHP’s.

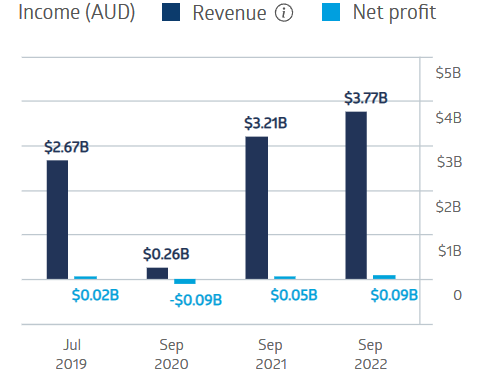

The company had stellar financial performance in FY 2021 but tailed off in FY 2022 as the price of iron ore declined.

Rio Tinto Financial Performance

Rio’s five-year average dividend yield of 6.45% should appeal to income investors, while the company’s low P/E of 9.61 should appeal to bargain hunters.

Allkem Limited ()ASX: AKE)

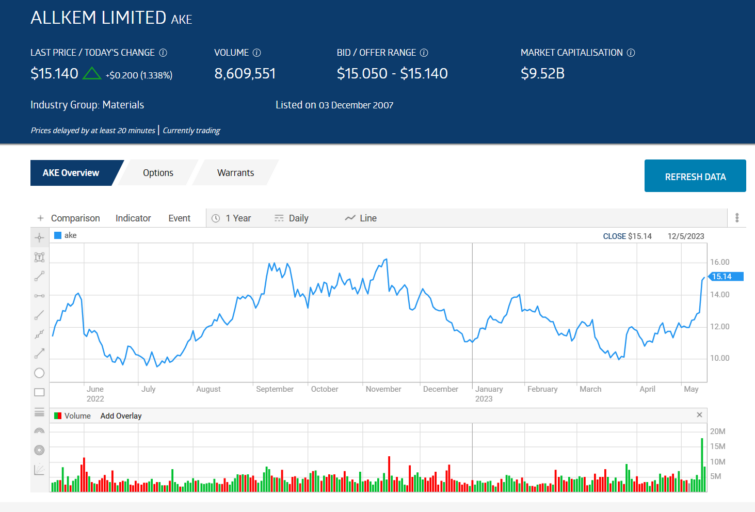

Allkem was already one of the largest lithium producers in the world following the marriage of Orocobre and Galaxy Resources. That left Allkem with lithium brine assets in South America and hard rock assets in Australia. The company got much bigger with the proposed merger joining Allkem with US-based lithium technology provider Livent (NYSE: LTHM). Goldman Sachs points to the resultant entity launching as a global “top tier lithium producer,” making Allkem a worthy entry on any ASX commodities list.

Allkem began trading on the ASX at the end of August 2021. Over the past year, the share price is up 34.6%, with a big boost following the May 5 positive announcement of increased resources at the company’s James Bay hard rock development project in Canada.

Source: ASX 12 May 2023

Nufarm Limited (ASX: NUF)

Nufarm is an agricultural chemical company focused on crop protection and seed technology. In FY 2020 and again in FY 2021, Nufarm was ranked ninth among the top agrochemical companies in the world.

Crop protection products include herbicides, insecticides and fungicides. Nufarm also offers treated, high-yielding sunflower, sorghum and canola seed to customers in more than 30 countries.

Year over year, the share price is down 16.7%, spurred on by a surprising reaction to the company’s Half Year 2022 Financial Results, released on May 19 2022.

Source: ASX 12/5 2023

For that period, the company reported a 31% increase in revenue, a 61% increase in statutory net profit, and a 112% increase in underlying net profit.

Full Year Results in FY 2021 and FYH 2022 improved on FY 2019 and FY 2020 results.

Nufarm Financial Performance

Source: ASX 12/5 2023

Whitehaven Coal (ASX: WHC)

Given the global stampede towards a decarbonised world, Whitehaven seems an odd choice for a best ASX commodities investment list. Although analysts and experts have been predicting the death of King Coal, its demise looks to be delayed considerably. In 2022, coal was alive and well, driven by rising natural gas prices and the war in Ukraine.

The International Energy Agency (IEA) forecast a slight percentage increase in coal consumption for 2022 of 1.2%, following a 6% jump in 2021. The US Energy Information Administration (EIA) is projecting a continued increase in coal prices to 2050, assuming demand forecasts for industrial and electricity markets hold.

The largest coal miner in the US – Peabody Energy – has a market cap of around $3.2 USD billion, while Whitehaven’s market cap is $4.1 USD billion

Over three years, the share price is up 308%.

Source: ASX 12/5 2023

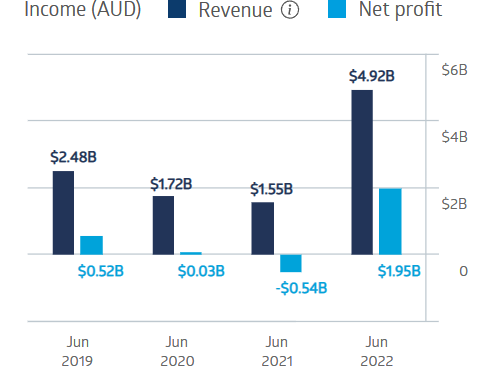

Whitehaven’s 2022 financials reflect the global increase in coal consumption.

Whitehaven Coal Financial Performance

Source: ASX 12/5 2023

Both the hard commodities from mining operations and the soft commodities from agriculture are cyclical, controlled by the balance between demand for the commodity and available supply.

Rising demand can outpace available supply, increasing prices and production, while higher prices can dampen demand creating an imbalance with supply. Producers then cut back on production, causing supply to fall below demand, and the cycle repeats itself.

Choosing the best commodity stocks will vary depending on an individual investor’s strategy.