Everyone loves a bargain, and they can be found in the stock market. Bargain stocks often emerge in troubled times when the market takes a dip; however, there are bargain stocks available at any time.

For investors looking for a bargain, we have picked some of the best ASX penny stocks and small-caps to buy. Penny stocks sound like a good source of bargains, but what about small-caps? What are they? What is the difference between a small-cap and a penny stock?

The US markets have elevated their penny stocks to mean any company whose shares are trading for less than $5. Here in Australia, we remain true to the original meaning – a stock trading for under $1.00 AUD per share. However, some commentators here define small-cap stocks as any stock that trades on the ASX for under $5.00.

Both have low market caps – the current share price divided by the number of outstanding shares – but small-cap stocks are not defined by their stock price but by market capitalisation.

Penny stocks have both low market caps and stock prices under $1.00 AUD in Australia. The low price lures some new investors looking for potential returns from a large cache of stocks rather than the fewer higher-priced stocks they can afford. No financial expert will recommend investors buy stocks based solely on share price without investigating whether the stock is worth buying.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Penny stocks are penny stocks for a reason – too few investors think they are worth buying, considering their risk. Penny stocks are, in almost all cases, start-up companies with low revenue generation and substantial cash outlays to keep the company going. That leaves some penny stock businesses in a constant cycle of borrowing or capital raisings. In effect, these companies are in a race against the clock to generate revenue before the ability to raise capital evaporates.

Small-cap stocks in the early stages of the business life cycle share some of the same risk factors as their penny brethren. Research is the key to finding the best small-cap or penny stocks on the ASX.

The primary focus of such research should be how close the company is to the start of revenue generation, which leads to profitability In addition, stocks beaten down due to market conditions that are likely to improve may be worthy “best” targets.

At the close of the first quarter of FY 2024 we looked at four penny stocks and four small-cap stocks to consider as ‘best buys” at that time. Now we look at their performance at the close of calendar year 2024 into the first month of trading in 2025.

- The Best ASX Penny Stocks

- Byron Energy (ASX: BYE)

- Prescient Therapeutics (ASX: PTX)

- MinRex Resources (ASX: MRR)

- Castle Minerals Limited (ASX: CDT)

- The Best ASX Small-cap Stocks

- Patriot Battery Minerals (ASX: PMT)

- Frontier Energy Limited (ASX: FHE)

- Argosy Minerals (ASX: AGY)

- City Chic Collective (ASX: CCX)

- FAQs

- The Best ASX Penny Stocks

- Byron Energy (ASX: BYE)

- Prescient Therapeutics (ASX: PTX)

- MinRex Resources (ASX: MRR)

- Castle Minerals Limited (ASX: CDT)

- The Best ASX Small-cap Stocks

- Patriot Battery Minerals (ASX: PMT)

- Frontier Energy Limited (ASX: FHE)

- Argosy Minerals (ASX: AGY)

- City Chic Collective (ASX: CCX)

- FAQs

The Best ASX Penny Stocks

Byron Energy (ASX: BYE)

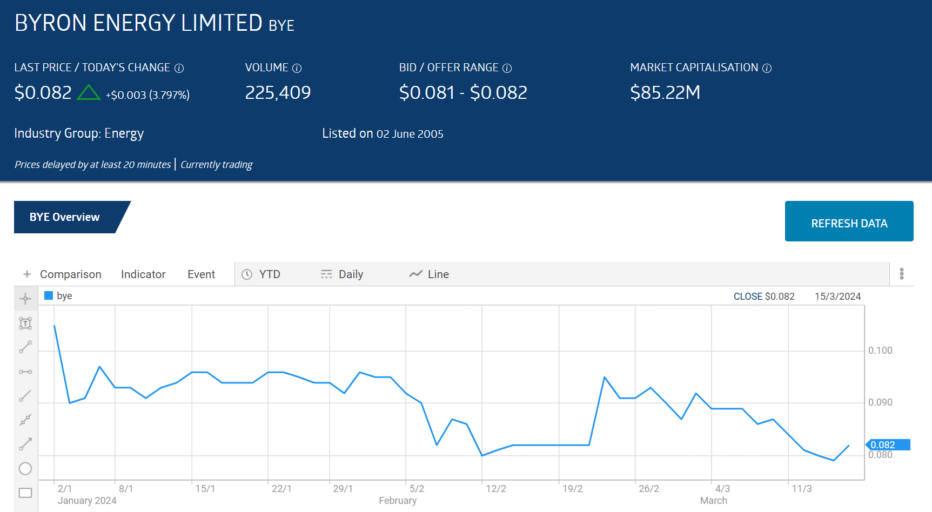

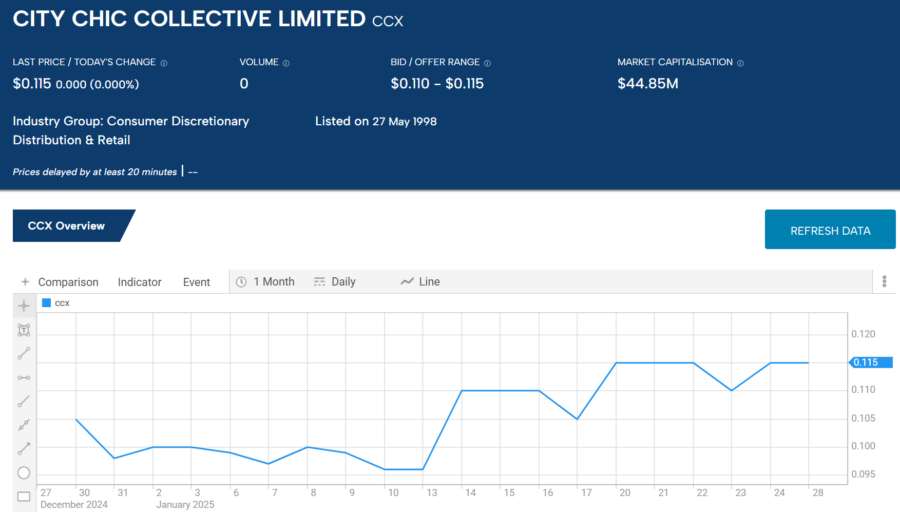

With a market cap dropping from close to $100 million dollars in mid-2023 to $85.2 million dollars on 15 March of 2024, Byron Energy was an example of a stock bordering on blurring the distinction between a penny stock and a small-cap business. The price of a share and a market cap under $100m still says, “penny stock” The current market cap and share price of $0.082 8 per share left the company in penny stock status.

Byron serves as an example of the significant risk of investing in penny and small-cap stocks. The company’s stock price performance did not reflect the value of the company, based both on its assets and its financial performance, in the eyes of Byron’s board of directors. Byron Energy delisted from the ASX in June of 2021 and remains in business as a private entity.

Byron has oil and gas assets in the shallow waters of the Gulf of Mexico off the coast of the US state of Louisiana. Some are 50% owned, and others 100%. Year over year as of mid-March of 2024 the share price was essentially flat – up 1.23% — but year to date the price had dropped 18%.

Source: ASX 15 March 2024

Byron breaks the mould of most penny stocks as the company generates revenue from its oil and gas operations and posts profits. Revenues and profit took a big leap between FY 21 and FY 2022, continuing into the Half Year 2023 Financial Results. Profit for the first half jumped from $7,039 USD to $17,662 million dollars USD, an increase of 150%. Revenue and profit plateaued in the Full Year 2023 results during volatile oil prices accentuated by the war in Ukraine and recession fears.

This kind of financial performance is rare for a penny/small-cap stock.

Byron Energy Financial Performance

Source: ASX Website

Prescient Therapeutics (ASX: PTX)

A biotechnology company working on cancer treatments, Prescient Therapeutics, made a case for penny stocks when its lead candidate, PTX100, received orphan drug approval from the US Food and Drug Administration in March of 2023. That sent the stock price on an upward trajectory as investors decided in large numbers that this penny stock was worth buying, but the trend reversed.

In December of 2023, the announcement of positive results from clinical trials of PTX100 ignited another rally Neither rally lasted, with the share price now down 71% over three years and but finished a volatile 2024 trading year, up 1.7% as of 28 January of 2025.

Source: ASX 28 January 2025

The company has another treatment in clinical trials and two in pre-clinical developmental stages. In December of 2024, the US FDA (Food and Drug Administration) approved further clinical trials of PTX-100.

MinRex Resources (ASX: MRR)

Gold miner MinRex Resources saw its share price rise 60% during the last week of November 2021. The catalyst was not positive news about one of its many gold assets but the announcement the company had acquired multiple exploration and minerals licenses for lithium projects in the Pilbara mining region of Western Australia. Management commented the company was pursuing lithium exploration.

The share price continued its upward trend until the price of lithium began to soften and then collapse, driving the share price down A positive Quarterly Update released on 31 October of 2023 on progress on the company’s lithium assets sparked another transitory rally. As is often the case with pennies and small caps, the investor euphoria evaporated, with the share price now down13% over five years and 42.8% year over year, as of 28 January of 2025.

Source: ASX 28 January of 2025

The company continues to target three of the lithium projects, with rock sampling, geological mapping, and drilling. MinRex is also developing a rare earth elements (REE) asset in the region, but primary focus appears to have shifted towards the company’s copper/gold assets.

Castle Minerals Limited (ASX: CDT)

Castle is another gold miner whose share price was boosted by news on lithium prospects. On 20 January 2022, the company’s gold exploration at its Beasley Creek project in the Pilbara found lithium deposits in two of the four targeted gold prospects based on geological soil sampling. Investors rallied to the stock, with a series of positive announcements on multiple exploration activities, including Castle’s graphite project in Ghana, continuing the share price on an upward trajectory at the start of the trading year 2022. Interest began waning in mid-2022, accelerating as the price of lithium fell with the stock price continuing in free fall.

Over five years the share price is down 62.5% and 57% year over year.

Source: ASX 28 January of 2024

Like MinRex, Castle Minerals Is focusing on gold assets, releasing positive announcements in early January of 2025 on the company’s Kpali and Kandia gold projects in Ghana.

The Best ASX Small-cap Stocks

Commonwealth Bank sets a standard for categorising stocks as “small-cap” – a market cap as low as a few hundred million dollars but less than two million dollarsSmall-cap stocks have more room for growth than their large-cap counterparts. Peter Lynch achieved legendary status as one of history’s greatest investors due to his management of the Fidelity Magellan Fund. One of his many valuable observations on market activity was his belief that “big companies don’t make big moves.”

Here are the four best ASX small-cap stocks with the potential to make big moves from a beaten-down share price or operations in a high-growth sector highlighted in March of 2024 closed out the calendar year 2024 and started the new year.

Patriot Battery Minerals (ASX: PMT)

Canada-based Patriot Battery Minerals is an exploration stage company targeting properties containing minerals needed for battery use and precious and base metals. Patriot’s wholly owned Corvette Project in Quebec contains significant lithium potential. Patriot is also the sole owner of a gold asset in the US and a 40% owner of two additional lithium assets.

The company’s exposure to lithium assets in North America is attracting investor interest, with a share price boost at the close of 2024 as the company announced Volkswagen had taken a 9.9% interest in the company and the signing of a 10 year offtake agreement.

The company listed on the ASX in December of 2022, with the share price up 34.6% in March of 2-24, but now down 69.2% since listing, following the declines in lithium pricing. Year over year, the share price is down 56.8%.

Source: ASX 28 January of 2025

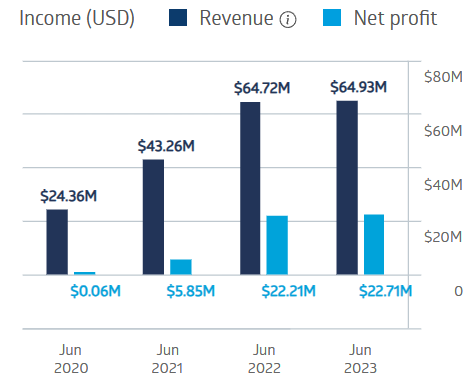

Frontier Energy Limited (ASX: FHE)

Frontier focuses on a renewable fuel source for large vehicles, from trucks to aeroplanes. The source is hydrogen produced using renewable solar energy, earning the moniker of green hydrogen.

Hydrogen fuel is colour-coded by the source used to create it. Brown or black hydrogen is made from coal. Blue hydrogen uses natural gas.

Frontier’s project is at Bristol Springs in Western Australia. A 2022 pre-feasibility study showed potential hydrogen production of 4.4 million tonnes per year at the cost of just $2.83 per kilogram.

On 14 March 2023, Frontier announced a binding agreement with Water Corporation for the water supply needed to run the Bristol Springs Renewal Energy Project. The following day, the Western Australian government stepped in with a statement of support, pointing to Frontier’s potential to become the lowest-cost producer in the country. Following the December of 2023 acquisition of Waroona Energy, the project was renamed the Waroona Renewable Energy Project.

Frontier is joined in the pursuit of green hydrogen by Fortescue Metals from a new subsidiary company, Fortescue Futures Industries.

The share price had been in an upward trend since Frontier announced the acquisition of the Bristol Springs Renewable Energy Project in February of 2022, until mid-2024 when an announcement of a new debt facility to fund the project followed by the announcement of a capital raise crashed the share price. Over five years the share price is up 9%and year over year the share price is down 60.6%.

Source: ASX 28 January of 2025

On 27 February of 2024 Frontier announced the completion of its DFS (definitive feasibility study for the Waroona Project. The study confirmed the mine as long-life and highly profitable with low operating cost. A final investment decision (FiD) was expected in mid-2024 with Frontier now actively seeking strategic partner.

Argosy Minerals (ASX: AGY)

Argosy’s sole focus is on the company’s Rincon Lithium Project in the Lithium Triangle region in South America, famed for its abundance of lithium from salt brine production. The company currently owns 77.5% of the project with a 90% ownership following the company’s funding of the production capacity estimated at 10,000 tonnes per annum.

In early 2021, investors got the welcome news that the Argosy pilot plant had already produced high-grade lithium carbonate, with 20 tonnes of the 30 tonnes produced sold to Asian customers. The commissioning and increases to full production are on track to begin in 2024. cording to the company announcement, Argosy is set to become only the second ASX-listed producer of lithium carbonate,

In 2019 Argosy acquired the Tonopah Lithium Project in the lithium valley in the US state of Nevada. This is a lithium from brine prospect, within sight of global lithium production giant Albemarle’s lithium from brine project and two hundred kilometres from the Tesla giga battery factory. Argosy is conducting geophysical analysis and interpretation at the site.

The announcements started a rally commencing in mid-2021 with the share price hitting all-time highs powered by continual positive company announcements and the rising price of lithium, until lithium collapsed in early 2023. Over five years the share price has dropped 61% and 71.5% year over year.

Source: ASX 28 January of 2025

Argosy and Frontier are worthy targets as both are rapidly approaching production. Many analysts remain convinced the price of lithium will rise again.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2025.

We’re giving away this valuable research for FREE.

Click below to secure your copy

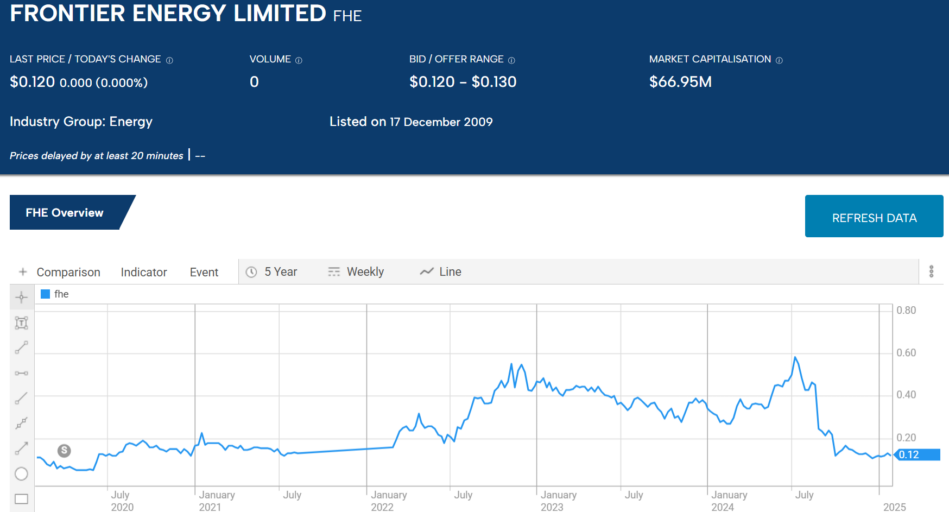

City Chic Collective (ASX: CCX)

City Chic qualifies as a beaten down stock stemming from the COVID-19 Pandemic in its early and late stages, coupled with some self-inflicted wounds with inventory management.

A trading update for the closing weeks of December 2021 released on 14 January 2022 contained the news that was to bring chaos to the company and propel it onto a lengthy stay on the ASX Top Ten Short List. Group revenues were up 49.8%. What investors should have paid more attention to was inventory. The update proclaimed the company’s revenue growth was supported by its “strategic investment in inventory.”

City Chic was not the only ASX retailer to go on a buying spree to combat supply issues, and over time it paid for that mistake.

The share price has dropped 95.5% over five years and 68.6% year over year. A positive unaudited trading update on the company’s Half Year 202 financial performance released on 14 January jolted the stock price up 9.2%.

Source: ASX 28 January of 2025

The company is a multi-channel, multi-national clothing, footwear, and accessories provider for plus-size women. The trading update was for 26-week period ending on 29 December of 2024, showing total revenue growth in the holiday period of 3.2%, along with positive EBITDA (earnings before interest taxes depreciation and amortisation) between $3 and $4 million dollars (unaudited), up from an EBITDA loss of 44.4 million in the first half of 2024.

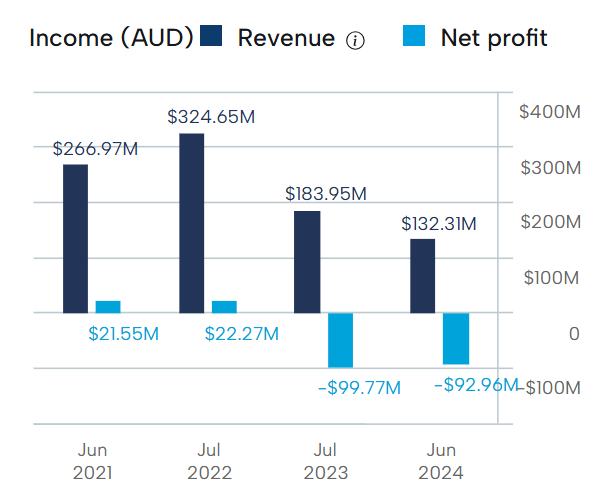

The company’s losses in the last two fiscal years suggest massive room for improvement.

City Chic Collective Financial Performance

Source: ASX

ASX penny and small-cap stocks have more significant growth potential than large caps on the /ASX, but they come with more risk. Penny stocks and most small caps have yet to generate revenue and can be haemorrhaging cash in the race to commence production. Large caps are stable, established companies.

Penny stocks in Australia are stocks with share prices under $1.00 AUD and market caps of around $100 million AUD. Small caps have no standards for share price, but market caps of $100 million or more up to $2 billion dollars, according to Commonwealth Bank.

The need for rigorous research with penny and small-cap stocks is significantly higher than for established large caps. Many investors gravitate towards companies nearing production.

Related Articles:

- The Best CFD Trading Platform in Australia

- A Guide to Day Trading ASX Shares

- ASX Dividend Stocks to buy

FAQs

What Are Penny and Small-Cap Stocks?

Penny stocks are stocks that typically trade for under 5 USD per share. In Australia it is any stock trading for less than 1 AUD per share. Small-cap stocks are shares in companies that have a market capitalisation between about $250m and $2bn.

How to Buy Penny and Small-Cap Stocks

Penny and small-cap stocks can be traded through an Australian broker. Once you’ve chosen a broker and opened an account you will need to research which stocks are a good investment for you. Penny and small-cap stocks are a risky investment as the companies tend to be small and have not yet proven themselves over the long term.

How to Find Penny and Small-Cap Stocks

Choosing penny and small cap stocks that will go on to drastically increase in price is not easy. Spending time doing your own research into the company and gathering as much information as you can will increase your chances of success. Stock screeners are a good place to start looking for penny and small cap stocks.

Does the ASX Have Penny Stocks?

Yes. At the time of writing there are over 2500 companies listed on the ASX with a share price of less than $1.