Publicly traded insurance companies have regularly been acclaimed for long term stability. But for risk tolerant investors, does the observation from legendary investor Peter Lynch that “big companies don’t make big moves” apply to insurance companies?

It may be true that ASX insurance stocks with huge market caps and long histories of solid financial performance may no longer be candidates for another investing “holy grail” touted by Peter Lynch, – the ten bagger. Some eager newcomers to share market investing gravitate towards smaller biotech companies in search of the ten-bagger. While it is true these startups can make big moves upwards, the reverse is equally true, and no investor wants to see a big move in the wrong direction.

On a variety of measures a strong case can be made that when it comes to insurance companies, bigger is in fact better. Of course this applies more to investors looking for longer-term gains, which the best of the biggest deliver via consistent dividend payments, share price appreciation, and the financial means to weather economic storms.

The big players are highly diversified in the range of insurance products they sell and the customers to whom they sell them – from average retail customers to high-net-worth individuals to a host of commercial businesses both large and small. Publicly traded health insurance companies do not fit the mold perfectly, but the biggest still offer a range of choices and serve both the retail and commercial/industrial sectors.

Although the top ASX listed insurance companies cannot compare to the market caps of the major players in the US, they are identical in the risk mitigation measures – diversified product lines, customers, and cash.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

QBE Insurance (ASX: QBE)

With a market cap in excess of $26 billion dollars as of 22 May of 2024, QBE Insurance is the largest by market cap and the most geographically diversified, with operations in the Asia Pacific region, North America, Europe, and other international locations – twenty-seven countries in all.

The company offers standard insurance products for consumers – homeowners and renters’ insurance, auto insurance, and accident and health insurance. To the business/commercial sectors QBE offers agriculture and marine insurance, casualty insurance, liability and indemnity insurance, workers’ compensation and business accident and health insurance. The company also underwrites general insurance and reinsurance for other insurers.

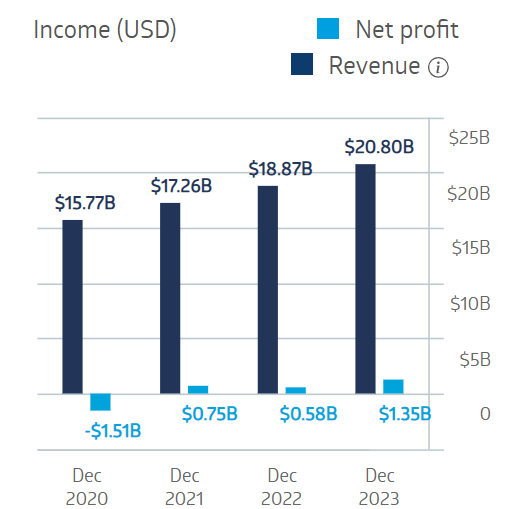

For three of the last four fiscal years the company has shown a profit and grown revenues in each year.

QBE Insurance Group Financial Performance

Source: ASX

The share price got a boost from the company’s update for Q1 of 2024, posting a 2% year on year increase in gross written premium and a 7.3% year on year increase in renewal rates. Higher interest rates favor insurance company’s investments from policy premiums, but QBE did see a 2% fall in total premiums, excluding rate increases.

Year over year the share price is up 22.4% and 38.1% over five years, as of 22 May of 2024.

Source: ASX

QBE has been a consistent dividend payer but did cut its dividend payment from $0.37 per share in FY 2019 to $0.21 in FY 2020 and again in FY 2021 to $0.08 per share before climbing back to $0.62 per share in FY 2023, more than doubling the FY 2022 payment of $0.30 per share. The five-year average dividend yield is 1.86%. Goldman Sachs is forecasting a 5.8% dividend yield for FY 2024 and 5.5% in FY 2026.

The Wall Street Journal has an OVERWEIGHT rating on QBE shares, with 10 of the fifteen analysts reporting at BUY, 2 at OVERWEIGHT, 2 at HOLD, and 1 at UNDERWEIGHT.

Marketscreener.com is reporting an analyst consensus BUY rating on QBE, with 8 of the fifteen analysts reporting at BUY, 4 at OUTPERFORM, 2 at HOLD, and 1 at UNDERWEIGHT.

Insurance Australia Group (ASX: IAG)

Insurance Australia Group (ASX: IAG) is the second largest insurance company by market cap, at $15.1 billion dollars. The company is a parent group of leading branded insurance companies serving consumers and businesses in Australia and New Zealand.

The company offers a nearly identical range of insurance products, but also offers a variety of investment offerings.

The IAG share price reached a three year high in mid-May on the announcement of a new product offering – Cylo – a hybrid product for small business protection against cyber attacks combining insurance and protection.

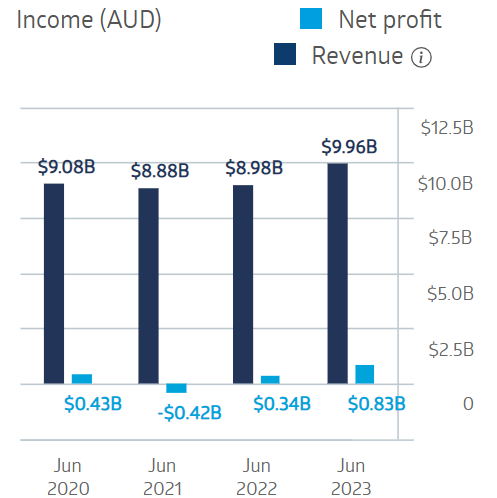

The company swung to a loss in the first year of the COVID 19 pandemic but rebounded, with FY 2023’s performance exceeding pre-COVID levels.

Insurance Australia Group Financial Performance

Source: ASX

Half Year 2024 results were solid, with a 12.5% increase in gross written premium; a 39.9% increase in underlying insurance profit; a 13% rise in net profit after tax; and a 66.7% increase in dividend payments.

While the company’s financials have recovered from COVID, the share price has not, with a five-year decline of 18%. Year over year the share price is up 24.4%.

Source: ASX

The company’s current dividend yield is 4.75% with a five-year average yield of 3.16%. IAG cut its FY 2019 dividend payment of $0.32 per share to $0.10 per share in FY 2020. The company’s FY 2023 dividend payment was $0.20 per share.

The Wall Street Journal has an analyst consensus HOLD rating on IAG shares, with 3 of the thirteen analysts reporting at BUY, 9 at HOLD, and 1 at UNDERWEIGHT.

Marketscreener.com is reporting an analyst consensus OUTPERFORM rating on IAG, with 3 of the fourteen analysts reporting at BUY, 1 at OUTPERFORM, 9 at HOLD, and 1 at UNDERPERFORM.

Medibank Private (ASX: MPL)

Medibank Private (ASX: MPL) is a health insurance provider with the third largest market capitalization of ASX listed insurance companies at $10 billion dollars. The company provides health insurance for the more than five million Australians who need or prefer private health insurance. The company now offers preventive healthcare and other services through its Amplar Health business, in line with Medibank’s intent to be more than a health insurance company, with a stated goal of providing “the best health and wellbeing experience for people across Australia.”

Medibank offers health insurance to overseas students and visitors as well as corporate health coverage. Medibank has expanded its offerings to include home and travel insurance, auto and home insurance, as well as pet insurance. Finally, the company offers health services within retirement and aged care homes as well as in home.

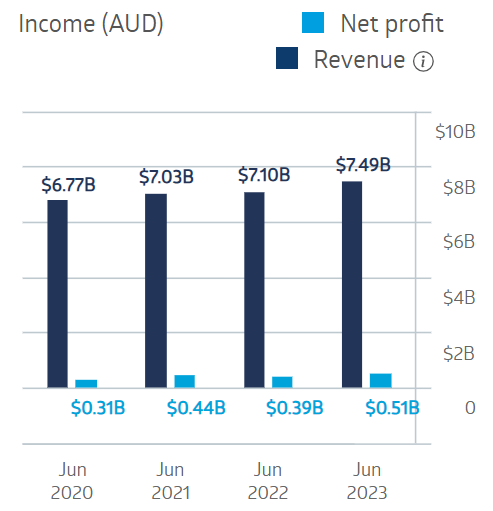

In a validation of the belief that healthcare is resistant to economic downturns, the company’s financial performance did not slip due to COVID.

Medibank Private Financial Performance

Source: ASX

Half Year 2024 results showed group revenues from external customers up 4.2%, underlying net profit after tax up 16.3%, and dividend payments up 14.3%.

Medibank listed on the ASX in 2015 with the share price up 68.2% since it switched from government control to a publicly owned company.

Source: ASX

The company’s current dividend yield is 4.25% with a five-year average yield of 4.06%. Medibank cut its FY 2019 dividend payment of $0.13 per share to $0.12 per share in FY 2020. The company’s FY 2023 dividend payment was $0.15 per share.

The Wall Street Journal has an analyst consensus OVERWEIGHT rating on MPL shares, with 5 of the fourteen analysts reporting at BUY, 1 at OVERWEIGHT, and 8 at HOLD.

Marketscreener.com is reporting an analyst consensus OUTPERFORM rating on Medibank shares, with 4 of the thirteen analysts reporting at BUY, 1 at OUTPERFORM, and 8 at HOLD.

Steadfast Group (ASX: SDF)

Steadfast Group (ASX: SDF) boldly proclaims its 425 insurance brokerages across Australasia make the company the largest general insurance brokerage network on the ASX.

The company offers a variety of both business and personal insurance products. In addition, Steadfast offers underwriting and related services.

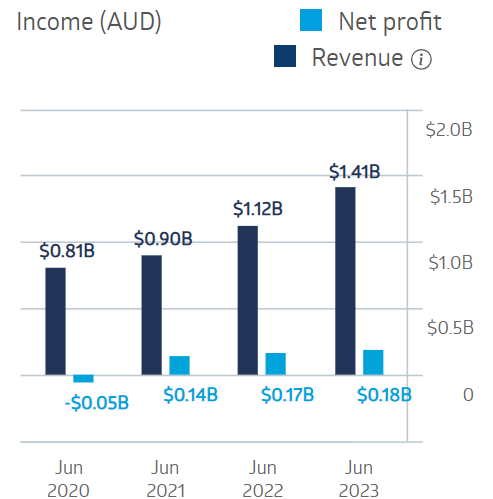

The company’s financial performance has been rock solid since posting a loss in FY 2020 at the onset of the COVID 19 pandemic.

Steadfast Group Financial Performance

Source: ASX

Half Year 2024 results continued the company’s strong financial performance, with underlying revenues up 19.3% and underlying net profit after tax up 17.5%.

With a market cap of $6.1 billion dollars, Steadfast is smaller than the major ASX insurance companies but it comes with an advantage – the stock seems to be trading well under the radar of Aussie investors when compared to QBE, IAG, and MPL, Steadfast’s 90-day average trading volume is 2.5 million shares traded per day. Medibank’s 90-day average trading volume is 6.6 million shares traded per day while IAG comes in at 5.5 million shares and QBE averages 3.2 million shares.

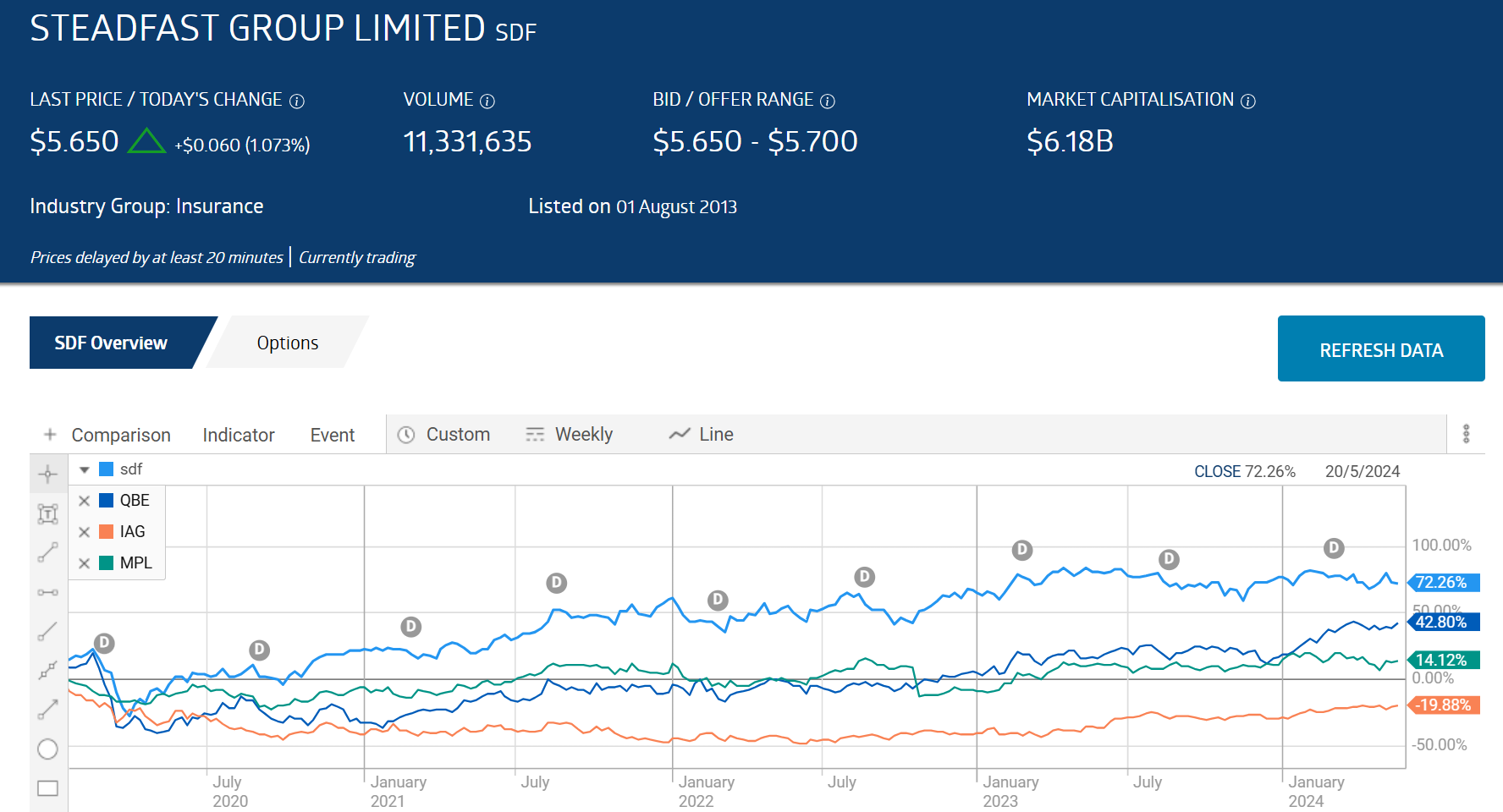

Year over year the Steadfast share price is down 5.3%, but over five years, SDF share price appreciation outperforms the major players.

Source: ASX

Steadfast has a five-year average dividend yield of 2.49% with the FY 2023 dividend payment at $0.15 per share. The company did not cut dividends during COVID.

The Wall Street Journal has an analyst consensus OVERWEIGHT rating on Steadfast shares, with 8 of the fourteen analysts reporting at BUY, 1 at OVERWEIGHT, and 4 at HOLD.

Marketscreener.com is reporting an analyst consensus OUTPERFORM rating on SDF shares, with 6 of the eleven analysts reporting at BUY and 5 at HOLD.

Insurance companies generally provide a safety net during hard times, with “the bigger the better” applying when looking for the best insurance companies. The major players are often broadly diversified in product lines, customers served, and market penetration. Banked insurance premiums in fixed income investments provide the financial strength to survive severe economic downturns.

While healthcare insurance companies are narrower in focus on product lines, but demand for healthcare in the worst of times makes them especially attractive for the most risk averse investors.