King Coal Refuses to Die

For hundreds of years coal dominated energy markets, leading to the accolade – King Coal. By 2012 the falling price of natural gas began a stampede of US coal producers into bankruptcy courts, with more than fifty disappearing by 2020.

Although the demise of King Coal has been a subject of much expert analysis, events like the war in Ukraine bring coal back into sharp focus.

Coal produced is named according to its use, with thermal coal for energy generation and metallurgical or coking coal for use in the production of steel.

Of the two, it is thermal coal destined for the dustbin of history in the exceptionally long term. S&P Global Commodity Insights sees demand for thermal coal declining in countries with growing sources of renewable energy and natural gas. The picture in countries with massive growth in demand for electricity will continue to rely on coal for the foreseeable future . China and India will continue to drive demand.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

The energy supply disruption threat from the war in Ukraine caused European countries to delay retirement of coal powered electricity generation stations.

With more producers of thermal coal shedding their assets, the outlook for the remaining producers may not be as bleak as some assume.

Metallurgical coal is a different animal entirely. While thermal coal has viable competitive energy sources, metallurgical coal has no major competition for use in steel production.

Electric Arc Furnaces, powered by electricity, not coal, may be viable longer term but adoption of them remains slow. Green hydrogen to power blast furnaces is another possibility in the long term.

The ASX has many coal miners, but only four qualify as large cap stocks with market caps in excess of a billion dollars. Larger companies can better sustain downturns in demand for the commodities they produce, even at lower prices.

- Yancoal Australia (ASX: YAL)

- Whitehaven Coal (ASX: WHC)

- New Hope Corporation (ASX: NHC)

- Stanmore Resources (ASX: SMR)

Yancoal Australia (ASX: YAL)

Yancoal Australia is the largest pure play coal producer in Australia with operations in both thermal and metallurgical (coking) coal. The company has nine operating mines, with five in New South Wales, three in Queensland, and one in Western Australia. Yancoal’s market spans the Asia Pacific Region.

A five year share price performance chart capture’s the boom in coal demand spurred by the war in Ukraine. Over the period Yancoal’s stock rose 98%.

Source: ASX 27 June 2024

Year to date in 2024 YAL stock is up 29.29%.

Investors may be climbing onboard Yancoal stock because of its stunning dividend performance. The company’s $0.21 dividend payment per share in FY 2020 was cut in FY 2021 before returning in FY 2022 at $1.03 per share and $1.07 per share in FY 2023, fully franked. The trailing twelve month dividend yield is 10.86% with a five year average yield of 12.58%.

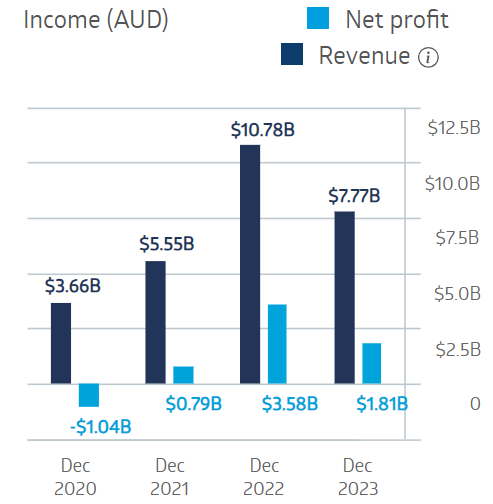

The company’s financial performance reflects the 2022 boom followed by the moderate bust commencing in 2023.

Yancoal Australia Financial Performance

Source: ASX 27 June 2024

Results for the first quarter of 2024 saw total sales of thermal coal up 55% with sales of metallurgical coal falling 17%.

The Wall Street Journal has a consensus analyst BUY rating on Yancoal shares, with 2 analysts at BUY.

Yancoal has bargain level five year average valuation measures with an average P/E of 3.29 and a price to book ratio of 0.68.

Whitehaven Coal (ASX: WHC)

Whitehaven Coal also saw is share price begin an upward trend with the energy crisis created by the war in Ukraine at its back. Over five years the stock price is up 94.1%.

Source: ASX 27 June 2024

Year to date the price is up 2.5% while year over year WHC shares are up 16.3%. The share price hit a 52 week high on 4 June.

The company has made acquisitions moving the company towards majority production of metallurgical coal – 70% – versus 30% production of thermal coal. Whitehaven currently operates six mines with two development projects of “high quality,” large scale, and near term completion underway.

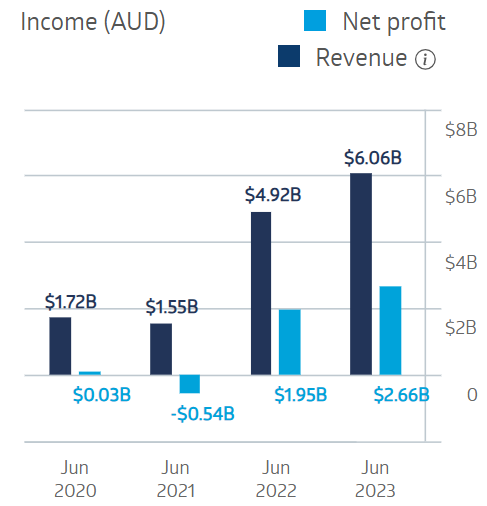

Whitehaven dodged the FY 2023 profit drop, increasing both revenues and profit compared to FY 2022.

Whitehaven Coal Financial Performance

Source: ASX 27 June 2024

Half Year 2024 results were disastrous, with a 58% fall in revenue and a 79% drop in underlying net profit after tax. Results for the first quarter of FY 2024 showed a 35% increase in coal production and a 9% rise in sales of produced coal.

The total dividend for FY 2023 was $0.74 per share, fully franked, up from $0.48 per share in FY 2022. The current dividend yield in 6.42% with a five year average of 3.48%.

The Wall Street Journal has a consensus analyst OVERWEIGHT rating on Whitehaven shares, with 8 analysts at BUY, 3 at OVERWEIGHT, and 3 at HOLD.

Marketscreener.com has an analyst consensus BUY rating on Whitehaven shares, with 8 analysts at BUY, 3 at OUTPERFORM, and 3 at HOLD.

Whitehaven has some attractive valuation measures with a P/E (price to earnings) ratio of 5.49 and a P/EG (price to earnings growth) of 0.28.

New Hope Corporation (ASX: NHC)

New Hope Corporation share price appreciation trails its larger rivals, up 86.6% over five years and basically flat year over year – up 0.41%. Year to date the share price has turned negative, down 4.8%.

Source: ASX 27 June 2024

New Hope is a pure play thermal coal producer, with two operating mines. The company is diversified, with nine oil- producing projects in the Cooper-Eromanga Basin and farming , grazing, and land management operations. In addition, New Hope engages in logistics, port operations, and bulk handling.

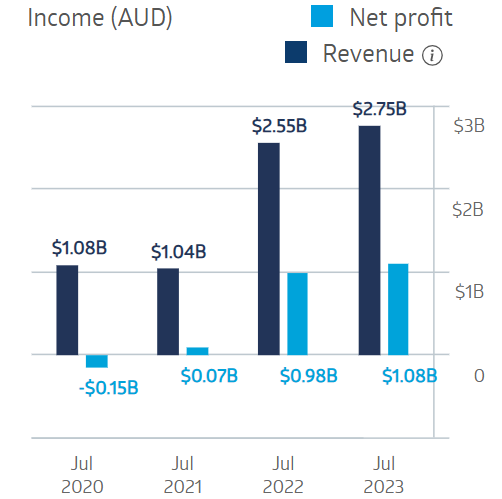

The company swung from an FY 2020 loss to three successive years of revenue growth and profitability.

New Hope Corporation Financial Performance

Source: ASX 27 June 2024

Half Year 2024 results reflected the retreat of record high prices of thermal coal. Revenues dropped 45.9%, net profit after tax fell 62.4%, and dividends were cut 57%,

The Wall Street Journal has a consensus analyst HOLD rating on New Hope shares, with 1 analyst at BUY, 6 at HOLD, and 1 at SELL.

Marketscreener.com has an analyst consensus HOLD rating on New Hope shares, with 1 analyst at BUY, 1 at OUTPERFORM, 4 at HOLD, and 1 at UNDERPERFORM.

Goldman Sachs is bearish on New Hope, with a SELL rating anticipating “further softening of demand for thermal coal in 2024.”

New Hope has a low P/E of 6.36 and a low P/EG of 0.19.

Stanmore Resources (ASX: SMR)

Stanmore Resources posted the best share price appreciation over five years of the four top ASX coal stocks – up 200.7%.

Source: ASX 27 June 2024

Year over year the share price appreciated 39.4% but has fallen year to date in 2024 – down 10.9%.

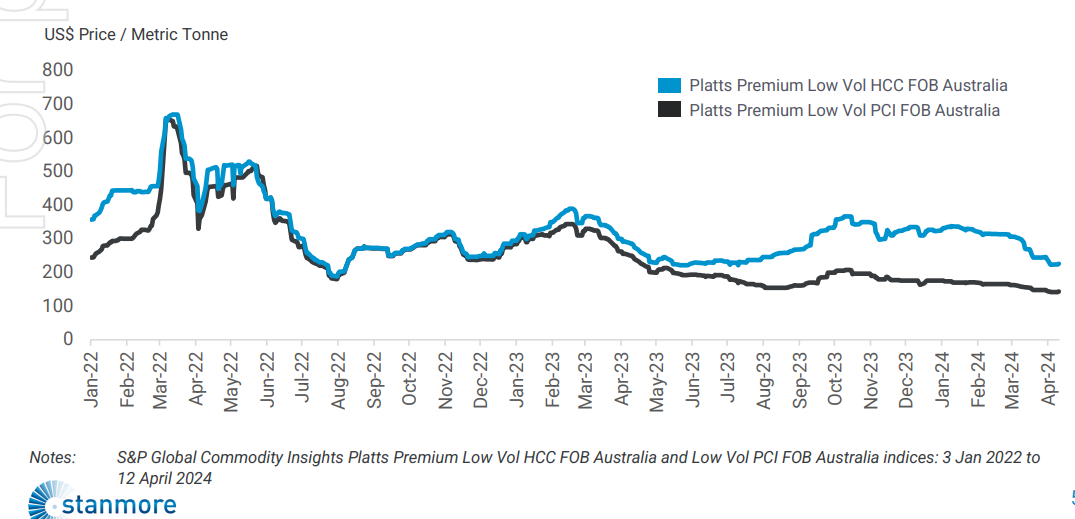

Stanmore produces metallurgical coal exclusively, with four major coal-producing assets across Australia and eight development projects in varying stages with Stanmore holding a majority interest in seven and a joint exploration agreement in one.

Stanmore completed acquisitions of the Eagles Downs metallurgical coal project and was added to the ASX 200. The inclusion in the ASX 200 is significant as Australian fund managers are limited to investing in ASX 200 or higher indices.

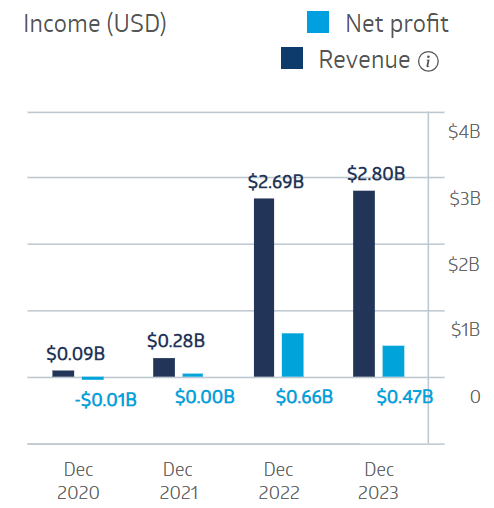

Although the company increased revenues in FY 2023, falling coal prices and weakening demand led a drop in profit reported from FY 2022.

Stanmore Resources Financial Performance

Source: ASX 27 June 2024

On 29 November Stanmore announced the payment of a fully franked special dividend of US$0.52 per share, following the elimination of dividend payments in FY 2020 through FY 2023. In the Full Year release the dividend declared was US$0.84 per share, bringing the dividend yield to 3.61%.

The company’s latest reporting to the market came on 22 April with the Quarterly Activities Report for the first quarter of FY 2024.

During the quarter Stanmore’s total coal sales increased from 2.8 million tonnes in the first quarter of 2023 to 3.4 million tonnes. Stanmore management reaffirmed its earlier full year 2024 guidance, despite weakening demand and falling coal prices. From the Stanmore announcement:

The Wall Street Journal has a consensus analyst BUY rating on Stanmore shares, with 3 at BUY and 1 at OVERWEIGHT.

Marketscreener.com has an analyst consensus BUY rating on Stanmore shares, with all four analysts reporting at BUY.

Coal no longer rules global energy markets, but the commodity is a long way from disappearing. Thermal coal to generate electricity is threatened by solar and wind powered generation. Metallurgical for producing steel has electric arc furnaces and green hydrogen in the rear view mirror, with no real threat in the foreseeable future.

As more miners exit coal production, the outlook for those who remain may have more demand to fill than some experts, analysts, and investors assume.