Is It Time to Buy ASX Airline Stocks?

Airline stocks are notoriously dependent on economic cycles with both consumers and corporations cutting back on all but essential travel during economic downturns. In addition, airlines are expensive to operate and at the mercy of volatile fuel prices.

Yet there are some investors skilled in the art of juggling who buy into Airline stocks at low points, waiting for the return of economic boom times to take profits. Whale watchers (investors who follow the investments of the world’s most successful investors) were shocked when long-time airline stock skeptic Warren Buffet began taking positions in US airline stocks in 2016. Buffet surprised both market analysts and whale watchers when he exited those airline positions by the end of 2020.

Of all business sectors negatively impacted by the COVID 19 Pandemic, the travel industry was one of the few forced to face a near-complete shutdown of all operations. Borders were closed, businesses were locked down and consumers remained in their homes.

While few doubted demand would return at some point, few also anticipated the onset of COVID variants, stretching out the pain. The winding down of the pandemic was followed by high inflation and high interest rates to cool rising prices with wars added to the mix. Hardly a recipe for booming economic times, but ASX listed airlines have returned to profitability while not yet regaining investor enthusiasm.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

ASX Consumer Airlines

Qantas Airways (ASX: QAN)

The ASX has airline stocks serving both the consumer and commercial markets, with iconic Qantas Airways (ASX: QAN) leading the pack.

Older investors may fondly recall the airline’s wildly popular ad campaign featuring a Koala, at first bemoaning and later celebrating the influx of visitors traveling on Qantas.

Source: mumbrella.om.au

Qantas dominates Australian skies with about two thirds of the domestic market. The company operates both a fleet of full-service Qantas flights and the Jetstar fleet, a low cost carrier. Qantas is aggressively signing up new partnership arrangements for the company’s Frequent-Flyers Loyalty Program.

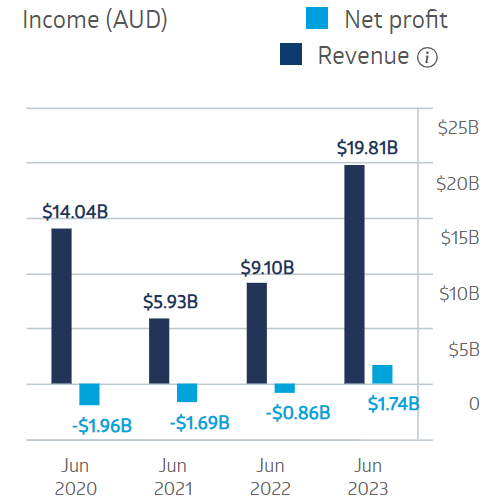

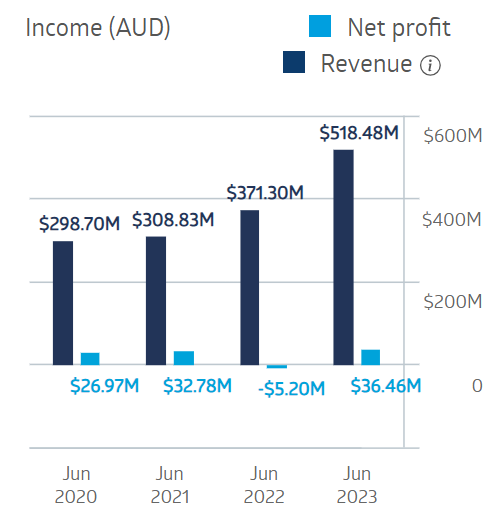

COVID crushed the company’s financials but FY 2023 saw a big boost in revenues with a return to profitability.

Qantas Airways Financial Performance

Source: ASX

Half Year 2024 financial results pleased investors despite a 12.8% drop in profit. Management attributed the drop to lower consumer fares and freight yields. Revenues were up 12.3% and multiple other rising metrics supported the view the turnaround is here.

Qantas has bargain valuation metrics, with a P/E (price to earnings) ratio of 6.66 and a P/EG (price to earnings growth) ratio of 0.55.

The Wall Street Journal has an OVERWEIGHT rating on QAN shares, with 9 analysts at BUY, 2 at OVERWEIGHT, and 3 at HOLD.

Over a five-year period including the entirety of the COVID impact the Qantas share price managed a 9.7% rise, although year over year the stock has fallen 7.4%.

Source: ASX 21 June 2024

Year to date the share price is up 17.5%, following the company’s announcement of a massive expansion in the Qantas Frequent Flyer Program.

Air New Zealand (ASX: AIZ)

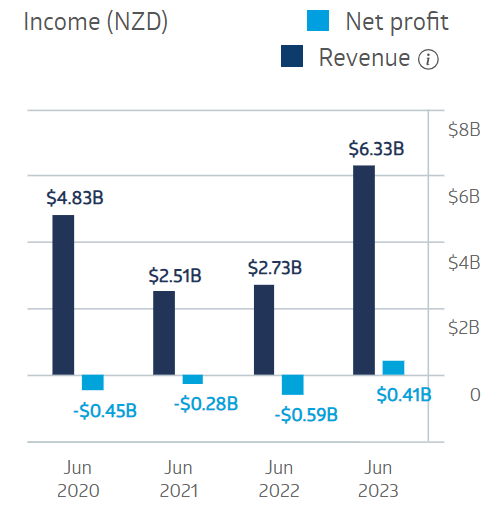

Air New Zealand, like Qantas, returned to profitability in FY 2023. New Zealand had among the most stringent border policies in the world, exacerbating the COVID impact on Air New Zealand. The company controls 80% of the domestic New Zealand market and operates internationally.

Air New Zealand Financial Performance

Source: ASX

Half Year 2024 results saw revenues increase 13% with net profit dropping 39% coupled with a bleak outlook for the second half of the year.

On 21 April Air New Zealand surprised the market by lowering its Full Year 2024 guidance, already lowered in the half year release in February. The company continues to experience domestic weakness in both corporate and government demand, in addition to competitive pressures from US carriers in the company’s North American markets. North American carriers are not yet fully returning to the China market, directing that capacity towards New Zealand. Finally, inflation is elevating the company’s cost base.

The Wall Street Journal has a HOLD rating on AIZ shares, with 1 analyst at BUY, 2 at HOLD, and 1 at SELL.

Unlike Qantas, the Air New Zealand share price has remained in a downward trend since the COVID outbreak, now down 67.7% over five years.

Source: ASX 21 June 2024

Year over year AIZ has dropped 30%. The company’s P/E ratio is 4.38 and the P/B is 0.99. The book value of the shares selling for $0.50 per share is $0.59 per share.

ASX Commercial Airlines

There are two airlines listed on the ASX that serve multiple markets – Regional Express Holdings (ASX: REX) and Alliance Aviation Services (ASWX: AQD).

Regional Express Holdings (ASX: REX)

As its name implies, Regional Express is an Australian regional airline transporting serving the bush and elsewhere around the country with both public passenger and charter group along with freight. In addition, the company operates a flight training academy.

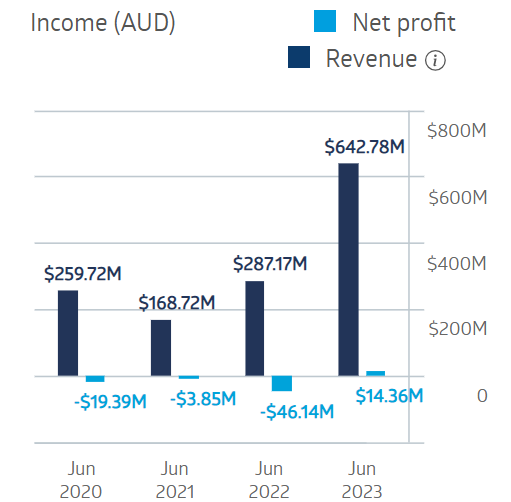

Regional Express also has returned to solid earnings and profitability in FY 2023.

Regional Express Holdings Financial Performance

Source: ASX

Half Year 2024 results saw passenger revenues up 6.3% and total revenues up 32.3% with the posted loss of $2.1 million dollars improving 86.6% over the $15.7 million dollar drop in the first half of 2023.

The company’s outlook for the full year is positive, citing the addition of 3 Boeing 737s to its fleet and the launch of Rex Flyer, a frequent flyer program. Also in the outlook was more foreign trainees at the company’s flight academy with international demand surging and an uptick in charter bookings. REX has a P/E ratio of 3.5 and a price to book of (P/B) ratio of 0.47. Yahoo finance Australia lists the company’s book value per share at $1.35 while the shares last traded at $0.64 per share.

Over five years the stock price is down 55.6% and 47.7% year-over-year.

Source: ASX 21 June 2024

REX also has bargain basement valuation metrics. The P/E is 3.44 and the P/B is 0.46. For $0.63 per share investors can buy a stock with a book value of $1.35 per share.

Alliance Aviation Services (ASWX: AQD)

Alliance Aviation Services managed to escape much of the wrath of COVID largely due to the company’s business model as a charter company for the Australian resources sector, along with charter customers from government, tourism, and sporting events. Full Year 2023 results exceed pre-COVID levels by substantial margins.

Alliance Aviation Services Financial Performance

Source: ASX

Half Year 2024 results continued the resurgence with revenues increasing 28% and net profit after tax up 298%.

On 29 May the company issued a bold trading update, informing investors management was confident the company would set a record profit before tax, exceeding its $83.9 million dollar forecast for a 60% increase over FY 2023.

Alliance also has enticing valuation ratios, with a P/E of 9.08, a P/B of 1.35, and a P/EG ratio of 0.57.

Marketscreener.com has a BUY rating on AQZ shares with 4 analysts at BUY.

Over five years the Alliance Aviation share price is up 15.3%

Source: ASX 21 June 2024

Airline stocks are historically volatile, seesawing back and forth from economic boom times to economic downturns along with high labor costs and volatile fuel prices.

The beginning of the COVID 19 pandemic through the ups and downs of the variants and promises of a vaccine right around the corner have rocked Airline stocks arguably more than any other business sector.

Air travel is back and ASX airline stocks returned to profitability in FY 2023, but the share prices have not reflected any sustained full blown economic recovery. Consumers and businesses alike are suffering from high inflation and interest rates.

For risk tolerant investors, the ASX has four airline stocks from which to choose, most with valuation metrics suggesting the stocks are undervalued.