One of Australia’s independent financial news websites, the Finance News Network (FNN) regularly partners with wealth manager Shaw and Partners to sponsor investor presentation events.

The events, now online due to COVID 19, allow CEO’s of up and coming companies the opportunity to present their case to interested investors. Attendees have the opportunity to question the business leaders as well.

The full text of each presentation is available online at the FNN website for interested investors to look for prospective investments. Although well-known ASX stocks occasionally make presentations, the more typical participants are companies in the earlier stages of development taking advantage of the opportunity to make their investment case. They have stories to tell, with some more compelling than others.

Companies whose stories center on innovative approaches to the way traditional business is done in the sectors in which they operate are often most attractive to investors with tolerance for risk. Few of these companies are generating substantial revenues and fewer still have reached profitability.

The following price movement chart from the ASX website tracks the year over year share price movement of four interesting companies from the November investor presentation events at FNN. These are the companies:

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

- Knosys Limited (KNO) Software

- Etherstack PLC (ESK) Software

- BARD1 Life Sciences Limited (BD1) Healthcare

- Carbonxt Group Limited (CG1) Materials

- Galian Lithium (GLN) Resources

And here is their year over year share price movement.

Investors with the patience to endure the doldrums resulting from declining lithium prices have been rewarded as lithium stocks have once again returned to earlier form. Oversupply of lithium drove down the prices and investors fled. Developments in the future of Electric Vehicles (EVs), with most coming from Tesla, the largest EV manufacturer in the world, have propelled lithium stocks back into the forefront of investor interest. Every major automobile manufacturer on the planet is ramping up production of EV models. A recently passed infrastructure bill in the US, the largest market in the world, includes major investments in recharging stations across the country.

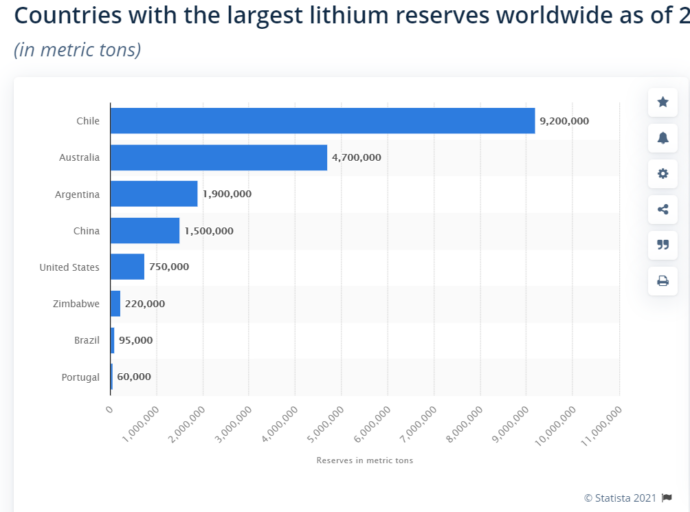

Galan brings the promise of an improved process for extracting lithium from salt brines. Lithium is found in hard rock deposits, with Australia holding the largest hard rock deposits in the world at the Greenbush mine in Western Australia. Australia ranks second in the world in lithium reserves, trailing Chile. From the Statista ( a research firm for business data) website:

South American countries like Chile, Argentina, and Bolivia extract lithium from the extensive salt flats in the region.

Galan has multiple lithium brine projects in the Argentina’s Hombre Muerto Basin at Humberto Muerto West and Candelas. The company also has a licence application for a project near the Greenbushes mine. In January of 2021Galan acquired an 80% interest in Lithium Australia’s (LIT) Greenbushes South lithium project.

Galan is at the forefront of employing high-tech methods of exploration and production. At Greenbush, the company recently completed a deep ground penetrating radar (DGPR) study to identify high potential targets. Galan plans soil sampling and drilling at the identified locations.

The company is also experimenting with different chemical compounds for extracting lithium from brine to optimise both the design of the extraction ponds and the attendant lithium carbonate processing plants. Galan is after extraction and processing techniques that will yield high purity lithium carbonate at lower cost.

The share price has been rising for most of the year following a series of positive announcements. In mid-July, the share price hit what was then an all-time high following the news of the successful testing of the company’s extraction process with purity levels of 99.88%, higher than the minimum level of 99.5%. In addition, the consulting firm conducting the test believed there was room for further improvement.

The share price slid as investors learned Galan planned a $50 million dollar share placement to fund exploration and drilling progress along with finalising feasibility studies at Humberto Muerto West and Candelas.

Galan has a market cap of $443 million dollars and last traded at $1.53 per share.

Etherstack claims to be the “world’s leading licensor of wireless technologies for the public safety and mission critical radio industries.”

The company’s customers include a variety of sectors, from defense to resources to public safety. Etherstack technologies are used to encrypt critical communications over “push to talk” radio systems, using “stack software,” as well as in other applications

Located in the UK, Etherstack has a subsidiary company in Australia, Auria Wireless, that uses Etherstack technology to manufacture complete digital radio network systems.

In the past year, the company has achieved several product wins. The Australian government signed a $4.1 million dollar deal to receive Etherstack technology and associated delivery systems, with the potential for additional business pending the successful completion of performance-based targets.

Additional contracts signed during late 2020 through 2021 to date include RCS Communications for a major Western Australian iron ore producer (the second deal with this client); an AUD$500,000 subcontract with Electro Optics Systems (EOS) to provide supply services to the Australian Department of Defense; an AUD$11.6 million dollar deal with Samsung of Korea for networking elements; and the Etherstack American subsidiary company signed a USD$420,000 contract with US communications conglomerate AT&T for software licences and equipment and needed services to integrate the equipment.

Additional contracts were signed with the UK Ministry of Defence and the Australian Department of Home Affairs.

On 23 November, the company issued new guidance for FY 2020, raising both revenue and profit expectations. Etherstack has a market cap of $67 million dollars and last traded at $0.51 per share.

Bard Life Sciences is developing testing for the diagnosis of a variety of cancers, including ovarian, breast, lung, prostate, bladder, and pancreatic cancer. The company’s focus is on non-invasive diagnostic methods for early detection of cancers. Many currently used diagnostic measures cannot detect cancers until later stages.

The company has two diagnostic products in place – the hTERT test to supplement cytology testing for bladder cancers, and the EXO-NET® pan-exosome capture tool for research purposes. Bard’s cancer diagnostic pipeline includes tests in development for ovarian and breast cancers, and research-stage projects for prostate and pancreatic cancers.

The share price exploded upwards following the release of successful test results on a Bard compound for early diagnosis of ovarian cancer. The share price got another boost back in March when a collaborative research study with Minomic International found EXO-NET® successfully isolated exosomes in a study of a Minomic pancreatic cancer treatment, before returning to earth.

In August, the company announced successful “proof of concept” results for a treatment for ovarian cancer – ELISA (enzyme-linked immunosorbent assay). A proof of concept (POC) test demonstrates the potential viability of the concept, or idea.

On 11 November, the company was granted a US patent for its BARD1 autoantibody treatment for the diagnosis of lung cancer. Bard Life Sciences has a market cap of $96 million dollars and last traded at $1.04 per share.

Of all the presenting companies, Carbonxt operates in a sector that could catch fire – reducing environmental pollutants.

The world appears to be coming together in joint efforts to reduce carbon emissions and other pollutants, with coal being one of the leader sources of carbon and other emissions. Companies have been working for decades on “clean” coal. There are methods of carbon capture and sequestration (CCS) in place but as yet none has made a large scale impact.

Carbonxt makes Activate Carbon (AC) powders and pellets for the removal of pollutants generated from industrial processes. The company’s principal market is the US and its clients include coal-fired electricity generating plants, cement factories, and other applications with polluting byproducts. The company has successfully reduced mercury and sulfur emissions from coal-fired generating plants and has expanded its focus to pollutant sources in wastewater treatment, potable water, and phosphate removal.

The company has manufacturing facilities in the US states of Minnesota, Georgia, and Ohio. On 2 February, the company announced an agreement with a US coal producer, Kentucky Coal Processing, to produce pellets at high volume by opening a new manufacturing facility for Carbonxt. The new plant will be funded by an investment group at no cost to Carbonxt and is expected to be completed in the second quarter of FY 2022. Carbonxt has a market cap of $51 million dollars and last traded at $0.30 per share.