No other sector better exemplifies the risk/reward inherent in share market investing than biotechnology/life sciences. The reward potential of a company successfully jumping through the substantial hurdles involved in securing regulatory approval for distribution to a sizable percentage of a population is immense. The road to final approval can be rocky with multiple ups on news of progress along the way and downs on setbacks.

Common sense suggests no other sector requires the kind of due diligence needed to assess a biotech stock, with the exception of some of the highest of high tech stocks. Understanding the medical jargon alone is challenging enough, not to mention the effort involved in identifying the presence of the affliction targeted by the treatment in the population and the competitive landscape. Perhaps the most challenging issue of all is tracking the company’s cash position, as the “burn” rate hemorrhages more and more money on the journey towards approval.

Investors with very high levels of risk tolerance are often prepared to weather the storm until the date of final approval for distribution dawns. Failing to gain necessary regulatory approval can lead to devastating losses.

In 2004, physician/scientist Silviu Itescu started a company focusing on regenerative medicine called Mesoblast (MSB). Itescu remains the CEO of Mesoblast to this day, leading the company through a series of starts and stops rivaling the performance of any biotech on the ASX.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

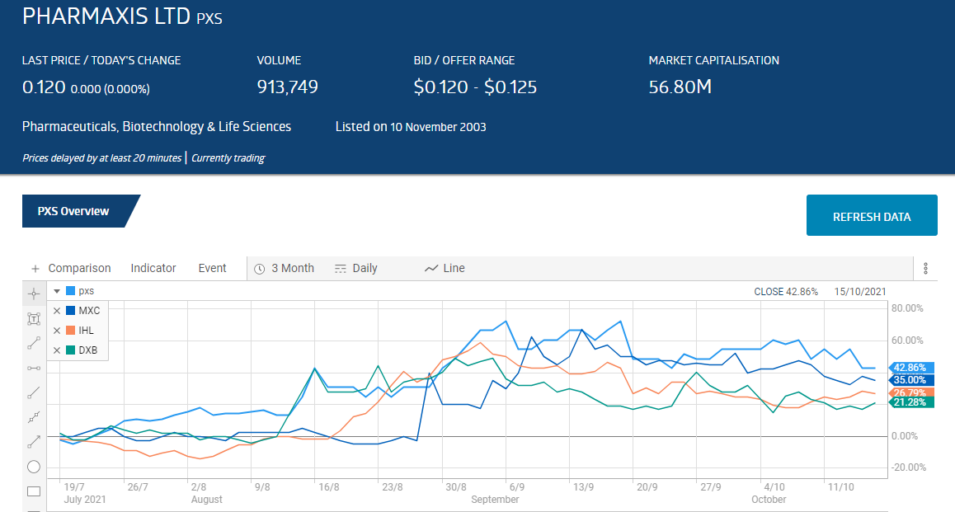

In the past three months four ASX biotechs in search of regulatory approvals for their treatments saw share price appreciation ranging from gains of 21% to 43%.

The following three month price movement chart from the ASX website shows the rise and modest declines of leader of the pack, Pharmaxis Limited (PXS) followed by MGC Pharmaceuticals (MXC), Incannex Healthcare (IHL), and Dimerix Limited (DXB).

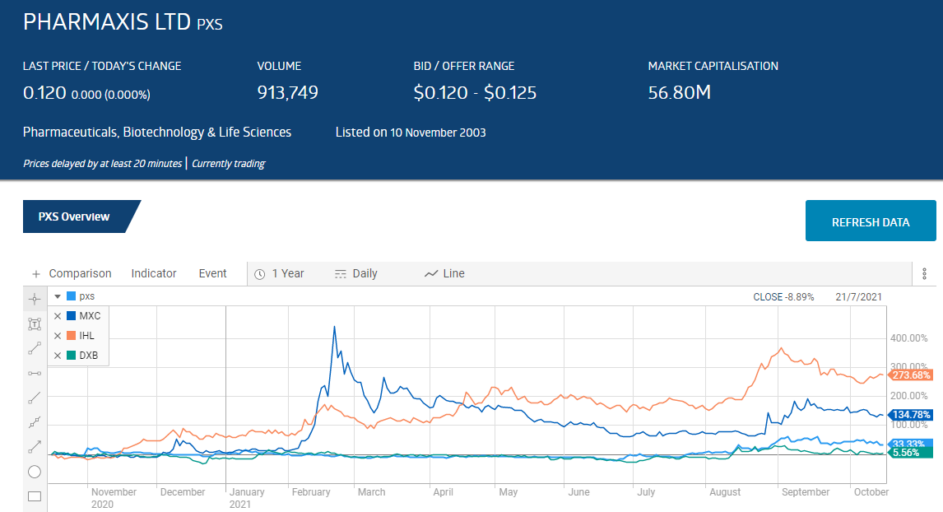

Although most have cooled off some, three of the four have year over year share price increases from 33% to 274%.

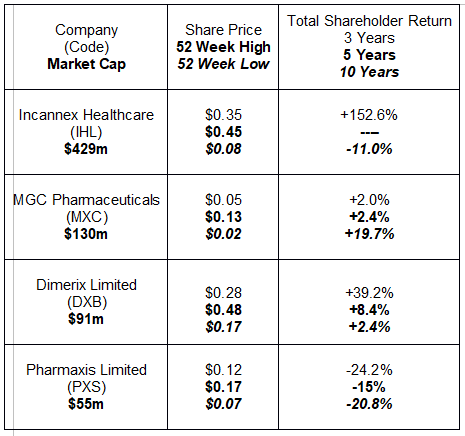

The following table includes share price information and historical performance for total shareholder returns.

Pharmaxis is a research and development company with a history of focusing on treatments for inflammatory and fibrotic (excess fibrous tissue) diseases globally.

The company’s Mannitol Respiratory business has two revenue generating products – Bronchitol® for the treatment of cystic fibrosis – and Aridol® for the diagnosis and management of asthma.

It is the New Drug Development segment at Pharmaxis that is attracting increasing investor attention. Among the new drugs under development is a treatment for a form of bone marrow cancer called myelofibrosis. The Pharmaxis share price began an upward climb in early June when the company reported the completion of the first three dosage phases of its Phase 1c clinical trials. On 5 October, the company announced positive results from the Phase 1c trial, allowing Pharmaxis to proceed with Phase 2 clinical trials. On 12 October, the company announced the first dosage of patients in the Phase 2 clinical trial.

MGC Pharmaceuticals is a provider of phytocannabinoid (derivative of cannabis plants), and plant derived medicines here in Australia, New Zealand, and in Slovenia with plans to expand into Brazil. The company’s broader focus is on Phytomedicines, or herbally extracted compounds with healing and therapeutic properties.

The share price took off at the end of August when MGC Pharmaceuticals announced its entry into the largest healthcare market in the world – the United States – via a binding 3 year Supply and Distribution Agreement with AMC Holdings in the US. The agreement calls for minimum orders of $24 million dollars of MGC products including CannEpil®, CogniCann®, and CimetrA™.

AMC Holdings is a non-governmental organisation (NGO) founded by former government regulatory and healthcare executives to expedite the process of bringing promising pharmaceutical products into the US.

AMC assists in establishing US clinical trials and is focusing on bringing phytomedicines into the US. The AMC website now lists MGC Pharmaceuticals as a “trusted partner” and leader in the sector. Aussie investors can expect AMC to assist MGC with pushing the flagship products through the US FDA (Food and Drug Administration) regulatory approval process.

CannEpil® is a phytocannabinoidal treatment for epilepsy with a Phase 2b clinical trial for use of the drug in children about to get underway in Israel.

CogniCann® is a potential treatment for symptoms of Dementia and Alzheimer’s with a Phase II clinical trial in process in Western Australia.

CimetrA™ has undergone successful early stage trials as an anti-inflammatory treatment for COVID 19 patients.

Developer of medicinal cannabinoid pharmaceutical products Incannex got a big boost to its already upward trending share price in late August when the company announced it was filing for an American Depository Shares listing in the United States via an F-1 filing. Essentially this is the same as an initial public offering for US investors interested in the company.

In addition to its traditional cannabidiol products for ailments like sleep apnea, traumatic brain injury, inflammatory lung conditions, rheumatoid arthritis, and inflammatory bowel disease, one of the company’s subsidiaries is venturing into the field of psychedelic medicine.

Once the plaything of adventurous youth, psychedelic compounds are now being explored as treatment options for afflictions like GAD (generalised anxiety disorder). The proposed treatment from Incannex, Psi-GAD, is under application with the Australian Government HERC (human research ethics committee) for a Phase 2a Clinical Trial at BrainPark in collaboration with a scientific leadership team from Monash University. BrainPark is an independent Australia based neuroscience research clinic.

The upward movement is now in reversal, following a disappointing Full Year 2021 Financial Results Report. Company revenues were up dramatically – increasing 213.7%. Cost increases in production, advertising and promotion, research, and development, and legal and regulatory ate into that revenue, leading to its net loss for the year almost doubling.

Incannex has six of its product candidates in clinical trials here in Australia, with the treatments for sleep apnea and traumatic brain injury in Phase 2a trials and the treatments for rheumatoid arthritis and irritable bowel syndrome in Phase 1 trials. The inflammatory lung disease and the Psi-GAD treatments are in pre-clinical studies.

Dimerix is pursuing treatments for unmet medical needs with multiple products in clinical trials. The company website proudly proclaims the company has “multiple Phase 3 opportunities” with the “innovative new therapies” it is developing.

Prior to the start of the COVID 19 Pandemic the company’s fortunes rested on two products in its pipeline – DMX-200 and DMX-700.

The share price over three years reflects the volatile nature of these stocks as clinical trials do not always progress as planned. Less than expected results in the Dimerix Phase 2 clinical trial for DMX-200 as a treatment for diabetic kidney disease crushed the share price in September of 2020.

The share price has been rising since the company realised its DMX-200 technology could be adapted for treating respiratory complications associated with COVID 19 infections.

The drug is in trials in Europe and India and on 15 October investors learned trials would be starting here in Australia.