In the midst of the Pandemic, a 16 July 2020 article appearing on finder.com.au dubbed 2020 as the “Year of the Pet.”

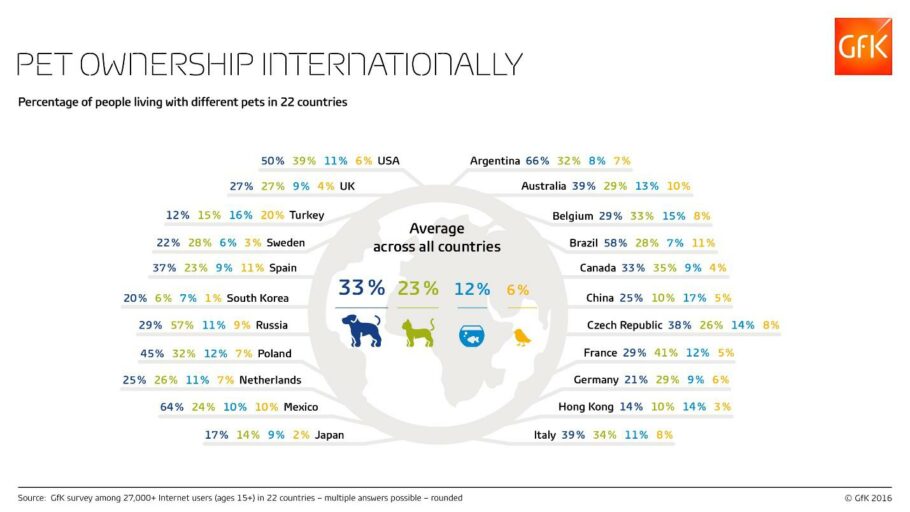

Australians are among the most pet-loving people in the world, ranking third in pet ownership.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Finder is a free research site providing access to resources that help users navigate a wide variety of financial and related products in Australia.

Pet adoptions surged here in Australia as a result of home isolation and along with that so did spending on pet-related products and services. According to finder.com.au in a six week period from early March to mid-April of 2019 a group called PetRescue flagged 12,534 pet adoptions, close to doubling the expected rate.

Back in 2016 an article appearing in the Australian pointed to spending levels on pet care as evidence the pet care industry is one of the major growth hot spots of the country’s business sector.

Finder.com app data reinforces that claim:

- In June of 2019 only 621 users out of the 7,000 in the sample paid for pet care or pet products. As of June 2020 the number of paid purchases rose to 1,055.

- In June of 2019, the average pet care transaction amount was $90 from a pool of 1,001 transactions. By June of 2020, the average spend rose to $100 while the number of transactions skyrocketed, more than doubling to 2,334.

While news out of the US reports many pets are being returned now that the Pandemic is ebbing, that does not appear to be the case in Australia.

An 11 May of 2021 article appearing on abc.net.au/news pointed to the Lost Dogs Home in Melbourne where there is no evidence of adopted dogs being returned, although that claim is disputed by a PETA (People for the Ethical Treatment of Animals) article, without citing any sources. The abc.net.au article included this quote from a spokesperson for Lost Dogs:

- “We were fearful we would see a high return rate when people transitioned back to work but thankfully that hasn’t been the case,”

Established in 1910, today Lost Dogs Home is Australia’s largest animal shelter, caring for “more than twenty-one thousand lost, stray, injured and abandoned dogs and cats every year.”

The rise in pet ownership is anticipated to encourage greater overall investment in pet food, accessories, and pet care services.

A report from international research and consulting firm, US based Global Markets Insights, points to the over 5 million households in Australia owning more than 25 million pets as an indicator of a booming market here in Australia for pet care products and services.

In 2020 our pet care market was valued at more than USD$13.3 billion, with an expected CAGR (Compound Annual Growth Rage) of 3.9% to 2027.

Traditionally the market has been segmented into the following groups”

- Retail (pet food, treats, toys, accessories)

- Veterinary Services

- Animal Health pharmaceuticals

- Pet Insurance

- Bookings and other services.

Older investors can remember the days when domestic animals were thought of more as animal companions than as family members. In today’s market an ever increasing number of consumers are willing to pay premium prices for premium products for their beloved animal members of their families.

The ASX is home to a miniscule number of pure players in the pet care market. Former ASX listings Greencross Limited (GXL) and National Veterinary Care Ltd (NVL) were both acquired, leaving a single veterinary company publicly traded on the ASX – Apiam Animal Health (AHX).

Apiam caters to both companion and production animals with other services offered.

The only other ASX entry whose offerings are limited to animals is newcomer Mad Paws Limited (MPA), listing on the ASX in March of 2021.

Creso Pharma (CPH) and AusCann Holdings (AC8) both are producing cannabinoid pharmaceuticals for animal treatments.

Blackmores (BLK) also offers animal health treatments.

Kogan (KGN) and Invocare (IVC) are offering ancillary services – pet insurance and crematory burial services.

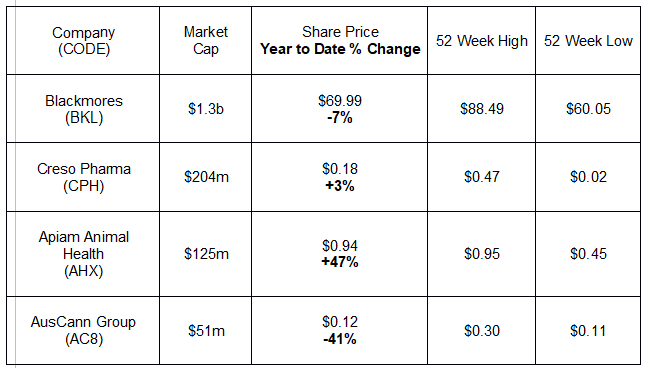

The following table includes Apiam and the other three stocks with animal health products.

Although Apiam’s name implies its business model is restricted to animal health, the company provides additional products and services. Although the company listed on the ASX in December of 2015, the disparate businesses it brought together have been around for decades in some cases. The company’s 42 existing vet clinics, staffed by more than 150 experienced veterinarians, are spread across Australia’s dairy, beef, sheep, and pig regions. Apiam also provides consulting and business services to animal producers as well as a dedicated diagnostic laboratory. Apiam Genetic Services offers artificial breeding technology, semen services, livestock identification systems and computer software packages to its own clinics and independent clinics as well.

The company operates four wharehouses for dry and climate controlled storage and a logistics service for time-sensitive delivery. Apiam operates eCommerce platforms for animal health products.

Companion animals are treated at the company’s Fur Life Vet centres. Fur Life Vet offers a subscription based wellness program for companion animals called BestMates. Membership in BestMates provides a variety of services, including unlimited health checkups.

In early June of 2021 Apiam completed the acquisition of three Vet Clinics in the Queensland area, expected to add $10 million in revenue in FY 2021. Apiam pays a dividend with a current yield of 2.1%. Revenues have increased in each of the last three fiscal years and the company is profitable. Half Year 2021 Financial Results showed an 8.9% revenue increase and a 543.8% rise in net profit after tax (NPAT.) Apiam remains committed to an aggressive acquisition strategy.

The remaining three stocks can benefit from growth in animal health products, but their main focus remains with products for humans.

Blackmores provides a wide variety of natural health supplements and the PAW (Pure Animal Wellbeing) product line for pets. The company saw revenue, profit, and share price decline in FY 2020.

AusCann has been pursuing medical marijuana applications with a powder based capsule for pain relief in clinical trials. Based on the company’s proprietary Neuvis® platform, the capsule form is intended to address concerns raised by healthcare professionals over other delivery methods. Oils open the door for inconsistent dosing and dexterity issues among users.

AusCann entered the animal health market by acquiring another ASX stock focusing on cannabinoid uses in animals – CannPal Animal Therapeutics (CP1).

CannPal and its new parent have no products in the market and remain unprofitable. CannPal does have two cannabinoid treatments for dogs in the testing phase. CPAT-01D is a pain control treatment for dogs and DermaCann is focused on the health of canine skin.

Creso Pharma is developing therapeutics, nutraceuticals, and cosmetics for human use and a line of animal health products – anibidiol, anibidiol 80, anibidiol Oil 500 and anibidiol EQUI.

The company has operations in Canada, Switzerland, Latin America, and here in Australia. As 2020 drew to a close, the share price got a boost from successive favorable regulatory announcements reclassifying the kinds of cannabinoid treatments Creso produces.

The good news continued with Creso announcing on 2 December three new purchase orders for its anibidiol® line of animal health products. The AUD$414,000 revenues raised Creso’s total purchase orders from its animal health operations to AUD$917,000 for FY 2020, year to date as of 2 December.

The company expanded its animal health product line, introducing anibidiol® swine, “a new and innovative hemp flour and oat bran based complementary feed product to support stress reduction and wellbeing of pigs reared indoors and outdoors.”

Creso is preparing to enter the US market and rocked the market with the announcement. Potential legal changes in the US state of California bodes well for Creso’s acquisition of Halucenex Life Sciences.

Halucenex is a Canada-based Psychedelic-Assisted Psychotherapy (PAP) company, focusing on novel psychedelic molecules for the treatment of post-traumatic stress disorder (PTSD), depression and other mental illnesses.

On 25 March, a newcomer entered the ASX with a digital business model featuring an online marketplace website and accompanying apps for both iOS and Android phones.

Mad Paws (MPA) launched as a marketplace for pet services that in a bygone era would have been challenging to find. The company was founded in 2014 and today features a proprietary platform that facilitates the process of finding a service from start to finish.

Pet owners planning a vacation can read reviews of the company’s service providers, either acting as host and taking the pet in their own homes or as a pet sitter, coming into the owners’ home. Mad Paws has over 19,000 providers registered on the site, offering dog walking, grooming, day care, and short-term house visits. The site handles booking, scheduling, and payment.

The company has ambitious growth plans, already launching an ancillary service prior to listing – a subscription based food provider called the Dinner Bowel. The IPO Prospectus also announced its efforts to build a pet insurance offering to add to the platform.

The Prospectus clearly stated the company’s intent to explore for further opportunities in the pet space and as of 7 June has notched its first acquisition – a “toys and treats” subscription based retailer, the Waggly Club. Mad Paws’ latest trading update introduced its next growth expansion – pet health products focusing on supplements and recurring medications like flea and tick preventatives and treatments as well as worm treatments.

According to the Prospectus, the company currently has about over 450,000 registered users (pet owners) across Australia. Another 8,000 signed on in the month following the listing on the ASX.