- In late 2021 hotel and casino operator Star Entertainment Group came under regulatory scrutiny over alleged money laundering at its facilities.

- The share price collapsed, with a second inquiry now in progress.

- Despite weak Half-Year 2024 financial results, the share price rose, and analysts remain bullish on the stock.

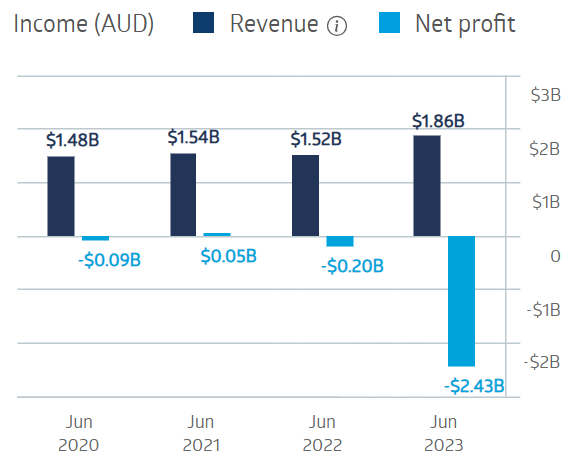

COVID 19 lockdowns and border closures impacted the financial performance of the hotels and casinos operated by the Star Entertainment Group, followed by softening consumer demand and fines and fees associated with regulatory inquiries.

Star Entertainment Group Financial Performance

Source: ASX

The $2.43 billion dollar posted loss in FY 2023 was statutory, with net profit after tax for the year before significant items up 41%. Half Year 2024 results showed declines across the board – revenues dropped 14.6% and net profit after tax before significant items fell 42.7%. Without the burden of significant item impairments in Half Year 2023, Star posted a statutory net profit of $9 million, a massive improvement over Half Year 2023’s $1.2 billion dollar loss.

Over five years SGR shares have dropped 86.3%, but investors reacted positively to the half year results, sending the share price up 14.4% over the last month.

Top Australian Brokers

- Pepperstone - Trading education - Read our review

- IC Markets - Experienced and highly regulated - Read our review

- eToro - Social and copy trading platform - Read our review

Source: ASX

An analyst at Sequoia Wealth Management has a BUY recommendation on Star Entertainment shares, citing the company’s recent uptick in the share price following dramatic losses year over year.

Marketscreener.com has an analyst consensus rating of OUTPERFORM rating on Star shares, with three of the nine analysts reporting at BUY, two at OUTPERFORM , three at HOLD, and one at SELL.

Yahoo Finance Australia has a consensus BUY recommendation on Star, with one of ten analysts reporting a STRONG BUY, seven at BUY, one at HOLD, and one at UNDERPERFORM.

Don’t Buy Just Yet

You will want to see this before you make any decisions.

Before you decide which shares to add to your portfolio you might want to take a look at this special report we recently published.

Our experts picked out The 5 best ASX shares to buy in 2024.

We’re giving away this valuable research for FREE.

Click below to secure your copy

Related Articles:

- Eight Top ASX Stocks for 2024

- 18 Share Tips: 18th March 2024

- IC Markets extends collaboration with Bloomberg Media Studios for IC Your Trade 4

- IPO News – Reddit Shares Listing Today Under NYSE:RDDT At $6.4BN Valuation

- The US Fed Keeps Rates On Hold : Markets React With A Bounce

- Are Investors and Analysts Missing Jupiter Mines (ASX: JMS) Bargain Level Valuation?